doi: 10.58763/rc20229

Research Article Review

The franchise: from investment to entrepreneurship

La franquicia: de la inversión al emprendimiento

Oscar

Mauricio Gómez Miranda1 ![]() *

*

ABSTRACT

Keywords: business creation, entrepreneur, franchise, investor

JEL Classification: L22, L26

RESUMEN

La franquicia es un modelo de negocio que no se ha investigado lo suficiente en Colombia, aun cuando tiene un gran potencial de crecimiento. Por esta razón, la franquicia pareciera un modelo organizacional y de relación contractual estático, sin embargo, es un sistema de negocio que ha presentado cambios en la forma como se proyecta y se entiende. Así, la franquicia se percibe como un sistema dinámico y en constante evolución, cuyo objetivo es identificar el cambio de enfoque de la franquicia como un modelo de inversión a un sistema de emprendimiento. Los resultados más importantes indican que la motivación del individuo, el tiempo dedicado a la gestión de la franquicia, los recursos económicos disponibles y la gestión que realizara sobre la empresa, son los aspectos más valorados por el franquiciador para elegir el franquiciado. En consonancia, los franquiciadores buscan personas con enfoque emprendedor, interesadas en invertir y en operar la empresa.

Palabras clave: creación de empresa, emprendedor, franquicia, inversor.

Clasificación JEL: L22, L26

Received: 15-03-2022 Revised: 18-06-2022 Accepted: 01-07-2022 Published: 27-07-2022

Editor:

Carlos Alberto Gómez Cano ![]()

1Corporación Unificada Nacional de Educación Superior – CUN, Bogotá, Colombia.

Cite as: Gómez, O. (2022). The franchise: from investment to entrepreneurship. Región Científica, 1(1), 69-82. https://doi.org/10.58763/rc20229

INTRODUCTION

Entrepreneurship is "the action and effect of undertaking" (Real Academia Española, s.f.). To undertake is to initiate an activity filled with risk and uncertainty stemming from human willpower, commitment, and desire to create and evolve. According to Fiol (2013), from an economic standpoint, undertaking relates to creating a company. This action has a transformative impact on society, as businesses generate employment, contribute to the development of a region, stimulate innovation, and fulfill people's needs by providing goods or services (Romero & Restrepo, 2016). However, companies not only meet needs but, in many ways, create and foster desires that alter cultures, attitudes, and traditions; essentially, they become actors that reshape reality (Sánchez et al., 2017). Thus, business organizations are influential and participative institutions on a global scale.

Due to the significance of businesses, their creation, development, and management have been studied from various perspectives (Camargo & Ehrenhard, 2021). These approaches encompass economic, political, administrative, technological, social, philosophical, motivational, and educational viewpoints (Forero & Durán, 2019; Rodríguez, 2009). Moreover, there has been theoretical interest, and businesses have evolved in practice to offer profitable management and business models for all stakeholders (Fernández & Sanjuán, 2012; Chirinos et al., 2018). This continuous advancement has driven the need to create organizational classifications that help understand businesses generally and, specifically, intending to enhance the production system (Vinante et al., 2021). Among these classifications are organizations based on size, economic sector, involved partners, purpose, and business model. Under this last category, franchising emerges as a business development and initiation option.

Franchising is about replicating a proven and successful business model so that others can exploit it in exchange for payment and under a series of agreements made between the involved parties (Mosquera, 2010). As franchising is formalized through a contract, terms are set between the party accessing the model (franchisee) and the business idea creator (franchisor), who offers it for the brand's exploitation and expansion (Porchas et al., 2013). Each country regulates this contract. In the Colombian context, the model has no unique and specific regulation. Consequently, the Civil, Commercial, and Ethics Codes stipulations are followed (Navarro & Miranda, 2018).

Among the most common conditions agreed upon are commercial and financial agreements, such as the permission and right to produce a good or provide a service, confidentiality agreements, location advice, launch support, and the obligation to follow established processes and procedures to ensure brand unity (Scott & Spell, 1998; Bui et al., 2021). Similarly, ongoing training and support are established, as well as a commitment to reduce the risk of the economic investment made. Therefore, the contract must specify the exploitation permit period (Rata et al., 2009). The advantages or disadvantages of franchising can be analyzed from the franchisor's perspective, who grants the right to exploit the franchise in exchange for financial compensation, and from the franchisee's, who accesses the established business model (Duarte, 2003).

The franchisor benefits from brand growth, improved market position, and additional income per the agreed contract. Generally, income arises from the initial fee to access the franchise, a percentage of the franchisee's sales, associated funds (such as advertising), and additional fees to reaffirm the brand use after the stipulated time have passed (Navarro & Miranda, 2018). Disadvantages include conflicts with franchisees over communication issues or desired model modifications, resistance to changes, and reduced income from potentially opening a new sales point (Gillis et al., 2020). On the other hand, the franchisee benefits from reduced risk, support, access to structured processes, and decreased uncertainty about their investment. Their disadvantages include limited strategic power over the company, the substantial initial investment to access the model, and not owning the brand (Navarrete, 2010).

The unique conditions proposed by the franchise model promote knowledge management and its externalization (Iddy & Alon, 2019), as a business's success is standardized, documented, and shared to grow for the benefit of all stakeholders (Duarte, 2003). This sharing opportunity creates a collaborative and growth-oriented relationship for all parties. These features are crucial for individuals interested in long-term alliances and relationships and for attracting those who see it as an investment opportunity. Investment uses resources to achieve goals (González et al., 2017). This process involves committing current resources to gain future benefits, which are directly related to savings and resource prioritization and optimization.

In this sense, Betancourt et al. (2013) summarize key factors in investment options through three aspects: profitability, liquidity, and risk. Profitability encompasses returns on investment over a set period, i.e., expected benefits and time, which could be short, medium, or long-term; liquidity refers to the ability of assets to become cash and be ready for use; and risk involves uncertainty and the success odds in obtaining benefits, associated with concepts like volatility, understood as the variability affecting a sector's profitability. Greater uncertainty and risk anticipate higher rewards; conversely, lower risk projects lesser profitability (Cooper et al., 2017). Thus, the investor's profile, perception, and risk acceptance concerning a specified period influences the investment decision.

Generally, there are three investor profiles: low, medium or moderate, and high. All stem from an individual's subjective analysis against environmental conditions, available knowledge, technological tools for analysis, and past experiences leading to cognitive biases (Barón & Rotundo, 2018; Galán et al., 2017). Depending on these profiles, the perception of value creation varies, affecting the investor's decision-making process. This analysis is influenced by perceptions of the risk of loss or gain, investment opportunities, and resource management (Cabrera et al., 2017). Consequently, investors undertake rational and subjective processes to analyze options and direct their resources toward them (Chick, 2019). Emotions play a significant role in the final choice and future success of anticipated outcomes (Kaufmann et al., 2017).

Traditionally, franchises are viewed as an investment form since they involve a present-time commitment of resources, either capital and/or labor. However, new franchise business models are starting to prioritize partners who wish to become entrepreneurs rather than just investors. Against this backdrop, this paper aims to identify the shift in focus from franchising as an investment model to an entrepreneurship system based on the author's reflection and experience. The document is structured in three sections: the first pertains to the context, serving as an introduction and conceptual basis for the analysis; the second includes the methodology and research process; and the third presents the results as reflections alongside the most pertinent conclusions from the reflection process.

METHODOLOGY

Following the approaches of Gómez et al. (2019), this article is the result of a documentary review process. For its development, a literature review was conducted, which allowed the construction of a theoretical framework underpinning the work. This study explored main themes, such as franchising and investment, in journals and books available in academic databases like Dialnet, Google Scholar, Redalyc, SciELO, ScienceResearch, and ScienceDirect.

The second part involved analyzing the discourse present in the literature review. This analysis sought to understand and explain the evolution of the franchise system in the country from a reflective perspective while also addressing its challenges.

RESULTS

Historically, the resources for production through investment are based on three factors: land, capital, and labor (Kay, 2016). Individuals can offer their labor to obtain a benefit and economic capital or physical resources, such as infrastructure or facilities (Infante, 2016). In this sense, to establish a business, one must contribute at least one of the three factors, depending on the availability of resources and the willingness to commit to the venture in the medium and long term.

Every entrepreneur can be considered an investor when committing current resources to receive future returns without neglecting the possibility of inherent risk (Bolton et al., 2020). However, not every investor can be considered an entrepreneur (Bustamante & Fernández, 2005). Investment requires a process of analysis of the various options, aiming to weigh both the chance of success and the appropriateness of a project for allocating capital (González et al., 2017). As the ultimate goal of investment is profitability, the utmost rationality, and objectivity are sought in the decision-making process, using tools and analyzing financial indicators such as Net Present Value (NPV), Internal Rate of Return (IRR), and Return on Investment (ROI) (Sapag & Sapag, 2008). This is supported by returns from past experiences that influence perception and the accepted level of risk.

This situation can lead to a detachment in asset management if the investment does not require constant monitoring but only intermittent oversight. Therefore, the investor will prioritize both the most profitable option and the one that allows them to manage their time resource most efficiently, regardless of the type of investment (Brealey et al., 2010; Hirshleifer, 1958). In this regard, they might also consider alternatives to starting a business, such as investing in stocks, bonds, or real estate.

The entrepreneur, driven by opportunity or necessity (Amorós et al., 2019), is motivated not only by financial gain but also by personal growth and the desire to create and face unknown challenges. These challenges present an opportunity for personal achievement and the possibility of fulfilling a dream, which might offer labor or financial independence (Valencia et al., 2019). Accordingly, entrepreneurs must be willing and committed to investing their time and resources without detaching from asset management. Despite these differences, both the entrepreneur and the investor share certain similarities. Table 1 provides a comparison of the main characteristics of the discussed actors.

|

Table 1. Comparison of entrepreneur versus investor characteristics. |

|||

|

|

Variable |

Entrepreneur |

Inverter |

|

Similarities |

Resources |

-Land, capital and labor. -Own and/or third party resources. |

|

|

|

Decision-making process |

-Rational process: business plan or project analysis, use of financial analysis tools. -Irrational process based on experience, knowledge of the environment and cognitive biases. |

|

|

Differences |

Motivation |

Profitability, fulfilling dreams, independence, facing challenges, satisfying needs in the environment. |

Profitability. |

|

|

Purpose of the investment |

Creation of a company. |

Business start-ups, bonds, stocks, real estate, investment funds, angel investors, loans, and binary options (currencies). |

|

|

Skills |

Innovation, creativity, recursion, managerial management, high tolerance for failure, achievement orientation, optimism, and resource management. |

Critical analysis, achievement orientation, optimism, complex problem solving, environmental adaptation, planning, foresight, emotional management, and intuition. |

|

|

Payback time |

Medium and long term. |

Short, medium and long term. |

Source: own elaboration based on Abubakar et al. (2019); Alcalá (2014); Bustamante and Fernández (2005).

This way, franchising emerges as a viable and low-risk option, merging interests and motivations for investing and starting a business. It allows the commercial use of a successful organizational model recognized by the market, thereby reducing uncertainty (Medina et al., 2019). Other benefits make franchising attractive, such as initial support and training to understand the business model, market research, and selecting a strategic location, enhancing the chances of profitability and survival for new businesses (Medina et al., 2019).

These features create favorable conditions for the inexperienced entrepreneur, as franchising provides a system with clear guidelines, offering guidance and advice during the initial stages (Parker et al., 2019). This suggests that micro-franchising, which doesn't demand high investment rates, is an opportunity to start a business with medium/low risk (Lanchimba et al., 2018). This risk is even lower than traditional entrepreneurship, which requires a learning curve to develop know-how.

In this context, this business model is also attractive as an investment option through one or several franchises allowing for capital diversification (Gorovaia & Windsperger, 2013). Indeed, the traditional perception of franchising (Anderson et al., 1992) is not an entrepreneurial venture but a low-risk way to achieve moderate returns. However, a review of websites addressing the franchising model in the country, such as COLFRANQUICIAS, Franquicias Colombia, 100 franchises, and Franquicias LATAM, along with discussions with business representatives offering franchising models, suggests a shift in entry requirements.

Access conditions to the franchising model have evolved since their inception (Varotto & Silva, 2017) and are transitioning from an investor or traditional focus to an entrepreneurial one. Investors aim for profitability, irrespective of the type of business or their understanding of it (De Bondt, 1998). In the traditional approach, the franchisor seeks financial solvency in potential partners, and the investor expects a return on their capital. Thus, requirements revolve around available investment capital, the desired region for implementing the franchise, and availability to start the business. These criteria relate to assessing the brand's growth and rapid impact through a subsidiary network covering territories and establishing a quick presence (Herrera & Moreno, 2009). Communication and negotiation typically flow one way, with directives from the franchisor to the franchisee.

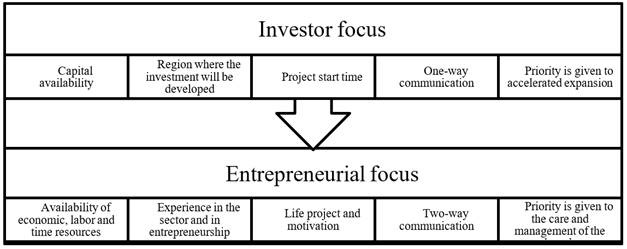

The perceived change regarding the profiles of individuals they aim to attract to the franchising model now includes, in addition to previous economic and readiness aspects, current occupation, career experience, and trajectory, relational experience with the franchise sector and with startups, as well as attitude (Calderón et al., 2021). Consequently, motivational factors, prior knowledge, and life goals become crucial in selecting franchisees to facilitate the transfer process (Brookes, 2014) and ensure brand success interest. The aim is also to share clear and common goals and move towards models that operate bi-directionally. Figure 1 summarizes the main characteristics of this shift in focus.

Figure 1.

Characteristics of the shift from an investor to an entrepreneurial approach.

Source: Own elaboration.

This shift in the model's focus, defined as the motivation to access and exercise control and autonomy over the business (Kellner et al., 2014), safeguards the franchisor from the investor disengaging from the brand, ensuring their commitment remains steadfast to reduce the chances of bankruptcy (Buchan et al., 2015). A franchisor's apprehension hinges on concerns that its brand might need to be managed appropriately or that there might be a lack of commitment to drive growth and expansion of the new franchise location. Such situations can culminate in the termination of the contract (Wulandari, 2021). To prevent this, franchisors implement a rigorous selection process, prioritizing individuals keen on engaging with the business model (Calderón et al., 2021), particularly those inclined towards hands-on business operation.

From this revamped perspective and shift in approach, franchisors no longer perceive investors as potential long-term partners. Instead, they see them as individuals who, besides being entrepreneurial, aim to optimize their financial returns through a thorough analysis of current market opportunities (Villada et al., 2018). This situation presents challenges for the franchise model, as the franchisor may forgo potential growth by distancing from the investor, thus introducing a barrier to entry into the model (Lofstrom et al., 2014). This can redirect financial resources toward other investment opportunities (Brookes, 2014) that are more receptive to the market landscape.

Moreover, a franchisor does not guarantee profitability but provides estimates. This means that the initial payment obliges the franchisor to transfer knowledge, expertise, and experience and provide guidelines and training in business and resource management (Brookes, 2014). In light of this, the individual assumes the entrepreneur's role, striving for the projected profitability (Herrera & Moreno, 2009), and franchising evolves as a more accommodating option for those looking to allocate capital resources and operate directly.

CONCLUSIONS

The potential to offer the model as both an entrepreneurial endeavor and an investment is a pivotal factor in an individual's decision-making process when committing their financial, temporal, and effort-based resources. This is mainly due to the accessibility of crucial experience and knowledge necessary for business management.

The contemporary franchise model shuns the purely financial investor, favoring the entrepreneur with aptitude in resource allocation and business management. In this context, franchisors are increasingly exhibiting an aversion to capital-only investors, preferring those who invest both capital and effort and operate within the guidelines set by the franchise. Accordingly, to access the franchise model, more than mere investment interest is needed; entrepreneurial aspiration is paramount. Typically, the investor focuses on capital optimization, while the entrepreneur aims for business success. These two focuses, though similar, exert different influences at motivational and attitudinal levels.

Thus, franchisors increasingly value relationships with individuals committed to the franchised business model, where the entrepreneur's approach is beginning to be recognized for its importance, both by the franchise marketer and the franchisor themselves. Key aspects in this valuation include an individual's motivation to select that particular business model, the hours they can commit weekly to its management, available financial resources, and their management strategy for the business; essentially, individuals keen on both investing and operating.

In conclusion, a deeper exploration of the implications of this paradigm shift for the stakeholders is required. Consequently, it's recommended that further studies be conducted that address both the perceived change and its impacts on franchisors, franchisees, and franchise marketers.

REFERENCES

Abubakar, A., Elrehail, H., Alatailat, M. y Elci, A. (2019). Knowledge management, decision-making style and organizational performance. Journal of Innovation & Knowledge, 4(2), 104-114. https://doi.org/10.1016/j.jik.2017.07.003

Alcalá, J. (2014). Análisis de los factores cognitivos que inciden en la toma de decisiones de inversión de los administradores financieros de la ciudad de Barranquilla. Sotavento MBA, (24), 8-22. https://ssrn.com/abstract=2625671

Amorós, J., Ciravegna, L., Mandakovic, V., y Stenholm, P. (2019). Necessity or opportunity? The effects of state fragility and economic development on entrepreneurial efforts. Entrepreneurship Theory and Practice, 43(4), 725-750. https://doi.org/10.1177/1042258717736857

Anderson, R., Condon, C., y Dunkelberg, J. (1992). Are franchisees" real" entrepreneurs?. Journal of Business and Entrepreneurship, 4(1), 97-105. https://cutt.ly/tCTs1EF

Barón, L., y Rotundo, G. (2018). Los sesgos cognitivos: de la psicología cognitiva a la perspectiva cognitiva de la organización y su relación con los procesos de toma de decisiones gerenciales. Ciencia y Sociedad, 43(1), 31-48. http://dx.doi.org/10.22206/cys.2018.v43i1.pp31-48

Betancourt, B., García, D., y Lozano, R. (2013). Teoría de Markowitz con metodología EWMA para la toma de decisión sobre cómo invertir su dinero. Atlantic Review of Economics, 1. https://cutt.ly/sCTft9L

Bolton, P., Li, T., Ravina, E. y Rosenthal, H. (2020). Investor ideology. Journal of Financial Economics, 137(2), 320-352. https://doi.org/10.1016/j.jfineco.2020.03.004

Brealey, R., Myers, S., y Allen, F. (2010). Principios de Finanzas Corporativas (Novena Ed.). México D.F.: McGraw-Hill.

Brookes, M. (2014). The dynamics and evolution of knowledge transfer in international master franchise agreements. International Journal of Hospitality Management, 36, 52-62. https://doi.org/10.1016/j.ijhm.2013.07.005

Buchan, J., Frazer, L., Zhen, C., y Nicholls, R. (2015). Franchisor insolvency in Australia: Profiles, factors, and impacts. Journal of Marketing Channels, 22(4), 311-332. https://doi.org/10.1080/1046669X.2015.1113487

Bui, T., Jambulingam, M., Amin, M., y Hung, N. (2021). Impact of COVID-19 pandemic on franchise performance from franchisee perspectives: the role of entrepreneurial orientation, market orientation and franchisor support. Journal of Sustainable Finance & Investment, 1-19. https://doi.org/10.1080/20430795.2021.1891787

Bustamante, V., y Fernández, A. (2005). Emprendedores e inversionistas: convergencias y divergencias. Cuadernos de Administración, 18(29), 131-155. https://cutt.ly/pCTgPPa

Cabrera, C., Fuentes, M., y Cerezo, G. (2017). La gestión financiera aplicada a las organizaciones. Dominio de las ciencias, 3(4), 220-232. https://doi.org/10.23857/dom.cien.pocaip.2017.3.4.oct.220-232

Calderón-Monge, E., Pastor-Sanz, I., y Sendra-García, J. (2021). How to select franchisees: A model proposal. Journal of Business Research, 135, 676-684. https://doi.org/10.1016/j.jbusres.2021.07.003

Camargo, B. y Ehrenhard, M. (2021). Rediscovering the Cooperative Enterprise: A Systematic Review of Current Topics and Avenues for Future Research. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations, 32(5), 964-978. https://doi.org/10.1007/s11266-021-00328-8

Chick, C. (2019). Cooperative versus competitive influences of emotion and cognition on decision making: A primer for psychiatry research. Psychiatry Research, 273, 493-500. https://doi.org/10.1016/j.psychres.2019.01.048

Chirinos, Y., Meriño, V., y Martínez, C. (2018). Emprendimiento sostenible: una opción para el crecimiento local. I+D Revista de Investigaciones, 11(1), 116-128. https://doi.org/10.33304/revinv.v11n1-2018009

Cooper, K., Schneider, H. y Waldman, M. (2017). Limited rationality and the strategic environment: Further theory and experimental evidence. Games and Economic Behavior, 106, 188-208. https://doi.org/10.1016/j.geb.2017.09.014

De Bondt, W. (1998). A portrait of the individual investor. European economic review, 42(3-5), 831-844. https://doi.org/10.1016/S0014-2921(98)00009-9

Duarte, J. (2003). Franquicias. Una alternativa para emprendedores. Revista Escuela de Administración de negocios, 47, 116-121. https://cutt.ly/QCTht9x

Fernández, F. y Sanjuán, A. (2012). La teoría del stakeholder o de los grupos de interés, pieza clave de RSE, del éxito empresarial y de la sostenibilidad. aDResearch ESIC: Revista Internacional de Investigación en Comunicación, 6, 130-143. https://doi.org/10.7263/ADR.RSC.006.07

Fiol, E. (2013). Emprendedor/Inversor, los intereses comunes. TicLaude, el reto de emprender, 79. Universidad Autónoma de Barcelona. https://cutt.ly/ZCThYJ6

Forero, L., y Durán, L. (2019). Aportes a la construcción del estado de arte del emprendimiento femenino en Colombia. Revista Escuela de Administración de Negocios, (86), 77-92. https://doi.org/10.21158/01208160.n86.2019.2291

Galán, Y., Baquero, Y. y Ascanio, J. (2017). Los roles gerenciales de Mintzberg: una evidencia empírica en la universidad. I+D Revista de Investigaciones, 10(2), 102-111. https://doi.org/10.33304/revinv.v10n2-2017009

Gillis, W., Combs, J. y Yin, X. (2020). Franchise management capabilities and franchisor performance under alternative franchise ownership strategies. Journal of Business Venturing, 35(1), 105899. https://doi.org/10.1016/j.jbusvent.2018.09.004

Gómez, C., Sánchez, V., & Valbuena, G. (2019). Corrupción y administración pública: una relación antagónica. Revista FACCEA, 9(1), 58–68. https://doi.org/10.47874/faccea.v9n1a7

González, C., Valarezo, J., Montero, V., y Sarmiento, C. (2017). Perspectivas de los criterios de evaluación financiera, una selfie al presupuesto de proyectos de inversión. INNOVA research journal, 2(8.1), 139-158. https://doi.org/10.33890/innova.v2.n8.1.2017.357

Gorovaia, N. y Windsperger, J. (2013). Real options, intangible resources and performance of franchise networks. Managerial and Decision Economics, 34(3-5), 183-194. https://doi.org/10.1002/mde.2582

Herrera, M. y Moreno, A. (2009). El contrato de franquicia: aportes y tendencias en el derecho comparado sobre la responsabilidad del franquiciador. Vniversitas, 119, 279-304. https://cutt.ly/XCTjvWY

Hirshleifer, J. (1958). On the Theory of Optimal Investment Decision. Journal of Political Economy, 66(4), 329–352. https://www.journals.uchicago.edu/doi/abs/10.1086/258057

Iddy, J., y Alon, I. (2019). Knowledge management in franchising: a research agenda. Journal of Knowledge Management. 23(4), 763-785. https://doi.org/10.1108/JKM-07-2018-0441

Infante, F. (2016). La importancia de los factores productivos y su impacto en las organizaciones agrícolas en león Guanajuato México. Revista El Agora USB, 16(2), 393-406. https://cutt.ly/5CTjM56

Kaufmann, L., Wagner, C. y Carter, C. (2017). Individual modes and patterns of rational and intuitive decision-making by purchasing managers. Journal of purchasing & supply management, 23(2), 82-93. https://doi.org/10.1016/j.pursup.2016.09.001

Kay, C. (2016). La transformación neoliberal del mundo rural: procesos de concentración de la tierra y del capital y la intensificación de la precariedad del trabajo. Revista Latinoamericana de estudios rurales, 1(1)1-26. https://cutt.ly/gCTkwdu

Kellner, A., Townsend, K., Wilkinson, A., y Peetz, D. (2014). Decaf or double shot? The strength of franchisor control over HRM in coffee franchises. Human resource management journal, 24(3), 323-338. https://doi.org/10.1111/1748-8583.12020

Lanchimba, C., Windsperger, J., y Fadairo, M. (2018). Entrepreneurial orientation, risk and incentives: the case of franchising. Small business economics, 50(1), 163-180. https://doi.org/10.1007/s11187-017-9885-3

Lofstrom, M., Bates, T., y Parker, S. (2014). Why are some people more likely to become small-businesses owners than others: Entrepreneurship entry and industry-specific barriers. Journal of Business Venturing, 29(2), 232-251. https://doi.org/10.1016/j.jbusvent.2013.01.004

Medina, G., Anido, R., y Pinda, G. (2019). Franquicias: de modelo exitoso de negocios a alternativa viable para el emprendimiento en la actualidad. Dilemas Contemporáneos: Educación, Política y Valores, 7, 1-27. http://dx.doi.org/10.46377/dilemas.v31i1.1085

Mosquera, M. (2010). La franquicia una estrategia de crecimiento empresarial. Revista MBA EAFIT, 70-85. https://cutt.ly/XCTkbAG

Navarrete, V. (2010). La franquicia, estrategia competitiva de desarrollo empresarial. Libre empresa, 7(1), 23-33. https://cutt.ly/3CTkAIV

Navarro, M., y Miranda, V. (2018). El contrato de franquicia: la dimensión jurídica de una realidad económica. Derectum, 3(1), 61-85. https://doi.org/10.18041/2538-9505/derectum.1.2018.4710

Parker, S., Cutts, S., Nathan, G. y Zacher, H. (2019). Understanding franchisee performance: The role of personal and contextual resources. Journal of Business and Psychology, 34(5), 603-620. https://doi.org/10.1007/s10869-018-9558-5

Porchas, J., Villegas, M., Pérez, B. y Vega, G. (2013). El Modelo Organizacional como Fuente de Competitividad: Análisis de la Franquicia vs Microempresa Tradicional. Un Lenguaje Natural Tecnológico, 3(2), 45. https://acortar.link/i4CAJK

Rata, B., Benavides, M., y Sánchez, J. (2009). Características del conocimiento transferido como determinantes del rendimiento de los sistemas de franquicia. Pecunia: Revista de la Facultad de Ciencias Económicas y Empresariales, Universidad de León, 8, 235-262. https://cutt.ly/8CTk49R

Real Academia Española. (s,f.). Emprendimiento. Recuperado en octubre de 2021, de https://dle.rae.es/emprendimiento

Rodríguez, A. (2009). Nuevas perspectivas para entender el emprendimiento empresarial. Pensamiento & gestión, (26), 94-119. https://cutt.ly/gCTle1D

Romero, X., y Restrepo, S. (2016). Emprendimiento e innovación: Una aproximación teórica. Dominio de las Ciencias, 2(4), 346-369. https://cutt.ly/nCTlfAu

Sánchez, G., Ward, A., Hernández, B., y Flórez, J. (2017). Educación emprendedora: Estado del arte. Propósitos y Representaciones, 5(2), 401-473. http://dx.doi.org/10.20511/pyr2017.v5n2.190

Sapag, N., y Sapag, R. (2008). Preparación y evaluación de proyectos (Quinta Ed.). Bogotá D.C.: McGraw-Hill.

Scott, S., y Spell, C. (1998). Factors for new franchise success. MIT Sloan Management Review, 39(3), 43-50. https://cutt.ly/3CTlmLo

Valencia, F., Restrepo, I., y Restrepo, J. (2019). El individuo y sus motivaciones en el proceso emprendedor. Universidad & Empresa, 21(36), 149-174. https://doi.org/10.12804/revistas.urosario.edu.co/empresa/a.6197

Varotto, L., y Silva, L. (2017). Evolution in franchising: Trends and new perspectives. Revista Eletrônica de Negócios Internacionais: Internext, 12(3), 31-42. https://doi.org/10.18568/1980-4865.12331-42

Villada, F., López-Lezama, J., y Muñoz-Galeano, N. (2018). Análisis de la Relación entre Rentabilidad y Riesgo en la Planeación de las Finanzas Personales. Formación universitaria, 11(6), 41-52. http://dx.doi.org/10.4067/S0718-50062018000600041

Vinante, C., Sacco, P., Orzes, G., y Borgianni, Y. (2021). Circular economy metrics: Literature review and company-level classification framework. Journal of Cleaner Production, 288, 125090. https://doi.org/10.1016/j.jclepro.2020.125090

Wulandari, R. (2021). Legal Protection of Franchisee in Franchise Contract Which Franchisor Unilaterally Terminates. NORMA, 18(1), 1-8. https://doi.org/10.30742/nlj.v18i1.1288

FINANCING

No external financing.

CONFLICT OF INTEREST STATEMENT

The author declares no conflict of interest.

ACKNOWLEDGMENTS

The Corporación Unificada Nacional de Educación Superior - CUN is thanked for the support received.

AUTHORSHIP CONTRIBUTION:

Conceptualization: Oscar Mauricio Gómez Miranda.

Research: Oscar Mauricio Gómez Miranda.

Methodology: Oscar Mauricio Gómez Miranda.

Writing - original draft: Oscar Mauricio Gómez Miranda.

Writing - revision and editing: Oscar Mauricio Gómez Miranda.