Scientific and Technological Research Article

Business growth and its relationship with the profitability of a commercial MSE in Arequipa, Peru

El crecimiento empresarial y su relación en la rentabilidad de una MYPE del rubro comercial en Arequipa, Perú

Jafet

Moisés Gonzales Centon1 ![]() *, Wuilmer Chávez Cubas1

*, Wuilmer Chávez Cubas1 ![]() *, Jeanette Berrio Huillcacuri1

*, Jeanette Berrio Huillcacuri1 ![]() *, Abrahan Braulio Santos Maldonado1

*, Abrahan Braulio Santos Maldonado1 ![]() *

*

ABSTRACT

Business growth is crucial for the long-term sustainability of a company. Such growth enables the acquisition of new customers as well as significant financing. In turn, it generates favorable profits for the company and contributes to the organization's prosperity and development. Therefore, the objective was aimed at determining the business growth in relation to the profitability of a commercial MSE in Arequipa, during the period 2018-2022. The research was structured as a quantitative, basic, descriptive, non-experimental, correlational, and cross-sectional study. Thus, the relationship is evidenced by the Pearson's statistic through business development and economic profitability, under a 0.02 error. This achieved a high correlation of 0.845, indicating that if business development increases exponentially or is high, economic profitability also increases directly. Meanwhile, the internal factor shows a medium correlation of 0.596, with an error level of 0.040 regarding financial profitability. Similarly, concerning the external factor, a high correlation of 0.901 is shown in terms of financial profitability, and medium, of 0.666, regarding economic profitability.

Keywords: business, finance and trade, profit, organization, economic profitability.

JEL Classification: D24; O14

RESUMEN

El crecimiento empresarial es determinante para la conservación a largo plazo de una empresa. De esta manera, dicho crecimiento hace posible la adquisición tanto de nuevos clientes como de financiaciones importantes. A su vez, genera beneficios favorables para la empresa y contribuye a que la organización prospere y se desarrolle. Por lo tanto, el objetivo estuvo orientado a determinar el crecimiento empresarial con relación a la rentabilidad de una MYPE del rubro comercial de Arequipa, en el periodo 2018-2022. Se estructuró bajo un estudio cuantitativo, básico, descriptivo, no experimental, correlacional y de corte transversal. Así, se evidencia la relación mediante el estadígrafo de Pearson a través del desarrollo empresarial y la rentabilidad económica, bajo un error de 0.02. Esto alcanzó una correlación elevada de 0.845, indicando que, si el desarrollo empresarial aumenta de forma exponencial o es alto, la rentabilidad económica también aumenta de forma directa. Por su parte, el factor interno deja en evidencia una correlación media de 0.596, con un nivel de error de 0.040 en cuanto a rentabilidad financiera. Asimismo, acerca del factor externo, se muestra una correlación alta de 0.901 en cuanto a la rentabilidad financiera, y media, de 0.666, respecto a la rentabilidad económica.

Palabras clave: empresa, finanzas y comercio, ganancia, organización, rentabilidad económica.

Clasificación JEL: D24; O14

Received: 25-02-2023 Revised: 04-04-2023 Accepted: 15-06-2023 Published: 04-07-2023

Editor: Carlos Alberto Gómez Cano ![]()

1Universidad Peruana Unión. Lima, Perú.

Cite as: Gonzales, J., Chávez, W., Berrio, J. y Santos, A. (2023). El crecimiento empresarial y su relación en la rentabilidad de una MYPE del rubro comercial en Arequipa, Perú. Región Científica, 2(2), 202387. https://doi.org/10.58763/rc202387

INTRODUCTION

There is much empirical evidence from around the world that explains why some companies achieve success while others cannot. For example, Perez et al. (2019), Fonseca et al. (2019), and Adan et al. (2022) mention that the most significant product suppliers in the world's most developed nations have achieved high returns on their investments and have proven to be stable market leaders. Companies worldwide have been hurt by rapid social globalization; even in countries with fewer resources, profits have declined, and new companies have had difficulty getting off the ground. However, the performance of individual firms has varied widely, even within the same nation or industry (Demuner et al., 2022; Palacios et al., 2020).

Considering the above, micro and small enterprises (MSEs) reconcile the interest in developing economic skills to improve their financial situation and get investments in a market where large and small companies are increasingly interested in technological, operational, and accounting positioning necessary for organizational growth (Ramón & Bañón, 2022). Thus, making the right decisions drives companies' growth and profitability. In such virtue, under the consultation of the literature, it has been argued that the profitability increase is unrelated to business expansion. However, having a large company (with good profits and many assets) does not guarantee high profitability since aspects such as production and management must also be considered (Núñez, 2018).

In turn, the European Parliament approved specific policies in favor of MSEs. It stressed that they should obtain the necessary support to promote competitiveness and highlight their importance in the economy of the European Union. These policies were aimed at safeguarding companies and contributing to the construction of a continent that promotes and highlights sustainable small and medium-sized enterprises over time; it was also noted that there are around 21 million MSEs. Likewise, during the last few years, this premise has been transposed to Latin American regimes to position the continent's economy through small businesses (Adam et al., 2022; Vidal, 2020). Thus, firms are the engine of the recent economic expansion in Latin America. However, more is needed to balance the field regarding productivity, stability, and working conditions among firms of dissimilar volumes. Although expansion is essential, it is not enough to guarantee long-term development success (Hernández et al., 2021; Laguía et al., 2019; Ibarra et al., 2017).

Consequently, an analysis in Peru by the Instituto de Desarrollo Económico Empresarial (IEDEP) showed that the medium and small industries had contributed significantly to the country's gross domestic product (GDP) regarding commercial items in 2018. Added to this, the latest reports about the GDP establish that the transportation, telecommunications, and commerce sectors have been the ones that have contributed the most to this expansion. As can be seen, these sectors have boosted the country's economy, which translates into constant development and an elemental source of income for the nation's progress (Vásquez, 2021).

Likewise, it has been verified that MSEs in Arequipa lack the necessary policies to carry out formal analyses of business growth indicators since, instead, there are only the speculations of the managers themselves about the expansion and profitability of their companies. In addition, the poor financial overview by organizational managers and the absence of administrative and accounting reviews are the most significant challenges facing modern companies. The scarce budgetary projections between costs, mission, and vision clarify that there is no objective, strategy, or value; additionally, from an administrative perspective, there are no manual procedures for manipulating business management, so there is no formative alignment for employees. That is why the progress of companies is slowed down by these deficiencies (Durand et al., 2021; Párraga et al., 2021; Salamzadeh et al., 2019).

Concerning the study variables, Larrinaga et al. (2019), Dulitzky (2020), and Ortega et al. (2021) have stated that, recently, empirical research on the correlation between profitability and business development has increased considerably in regions of the world with a high concentration of micro and small enterprises (MSEs). An explanatory study conducted with 80 traders found that business expansion affects the profitability of MSEs and that traders' understanding of expansion and profitability depends on the economic context of their businesses rather than on any particular knowledge that salespeople may possess. This is because such studies are usually conducted in more complex economic sectors; this research explores new insights into understanding these factors in Peruvian MSEs.

Similarly, Morales et al. (2018) aimed - for a particular case - to determine the connection between profit margins, business development, and profitability. The Herfindhal-Hirshman index was calculated for non-perfect market structure states, and liquidity and solvency ratios were obtained to adjust the financial performance of consolidated companies. In addition, four economic models were developed, and statistical tests of the adequacy of the estimators in these models were performed. Using Ordinary Least Squares, a linear regression analysis was run on several different experiments. Of the nine firms in the oligopoly, four are particularly dominant; between them, they hold 73.12% of the market and an approximate profitability of 0.1391 % on average between 2011 and 2015, representing the study's time frame.

For his part, Daza (2016) mentioned that, since a few years ago, the growth standards of developing countries had been significantly surpassed by developing countries, so the latter lag behind the former globally. These countries, particularly Brazil, have immense business opportunities by providing high profitability rates and business expansion not available in developed nations. Their research examined the connection between development and profitability in Brazil's manufacturing industry from 2002 to 2012. A set of estimated linear and nonlinear panel data models was proposed to achieve this objective, using the most appropriate methods for each environment to provide efficient and robust estimators. In addition, the behavior of persistent growth and profitability was contrasted, as well as the independence of development in proportion to firm size. The results showed the existence of a connection between expansion and profitability.

Finally, Zambrano et al. (2021) note that the success of the Ecuadorian microenterprise sector contributes to the country's overall economic development. The analysis used a quantitative approach of the descriptive design type. A t-study was conducted for independent prototypes with different variants to establish comparisons between the two data sets. The findings of this study suggest, with a 95 % degree of certainty, that debts and average liquidity are more significant in Guayas province than in the rest of Ecuador, where microenterprises report higher average profits. However, the province of Guayas has the country's highest percentage of microenterprises. This is more evidence that the province's financial indicators are generally more favorable than those of the rest of Ecuador.

In this context, profitability is the sum of a company's economic inflows and capital outflows. Consequently, there are several tools to analyze the profitability generated by the company throughout its economic activity. Based on the above premise, this article aimed to determine the business growth of the profitability of an MSE in the commercial sector in Arequipa in the period 2018-2022.

METHODS

The study was based on a positivist paradigm with a quantitative approach since, using numerical values, it was possible to respond to the study objectives, and it was classified as essential. According to Ramos et al. (2021), research is essential because it is an abstract science that studies a subject and seeks information from it. The laws of nature must be studied to understand and explain the phenomena studied; for this reason, it was considered essential.

Likewise, the study responded to a non-experimental, descriptive, cross-sectional correlational design. Zurita et al. (2018) describe that studies using a non-experimental design focus on observing and analyzing pre-existing variables and problematic phenomena or unmodifiable events rather than creating their own. Data are also collected on a point-in-time and concurrent basis. Standard longitudinal designs usually include both conditions, where variables are analyzed from different time intervals to establish a behavioral factor (Diaz & Calzadilla, 2018). Thus, Cienfuegos and Cienfuegos (2016) point out that quantitative research involves the collection and statistical analysis of numerical data on study parameters. Such a research approach aims to quantify the relationships between variables, systematize and objectively evaluate the consequences of the entire sample analyzed, and draw conclusions about the population from which the samples were drawn (Cadena et al., 2017).

Additionally, Barnet et al. (2017) mention that descriptive correlational research is conducted on a phenomenon, using systematic discernments that enact the establishment of the behavior of the study phenomenon and provide information that can be systematically compared with other sources. This paper offers an explanation of the phenomenon of global homogeneity and its most fundamental characteristics. Furthermore, in this study, researchers can choose to have participants act as total observers, half-observers, half-participants, or full-participants.

Finally, using a sample of objects, descriptive and correlational studies aim to determine the degree to which two or more variables of interest are related or the degree to which two events or occurrences may be linked. Explanatory research that provides a sense of knowledge and high organization is often based on descriptive studies that serve as the basis for correlational queries. Several phases of research may require the use of additional layers. It is possible for a survey to act as a finding at first, then describe and correlate, and finally explain (Martinez et al., 2016).

According to Otzen and Manterola (2017), a sample or population is formed by all the individuals or things that share some characteristic, determined by the sampling criteria used by the researcher. As such, 325 MSEs in the commercial sector in the city of Arequipa were taken into consideration as a population. Thus, under convenience sampling (Otzen & Manterola, 2017), the study sample consisted of 35 MYPES of the commercial sector within the jurisdiction and free active exercise of Arequipa from 2018-2021.

The information-gathering instrument was a survey that was helpful to the organization under study. Questionnaires were applied with prior informed consent after requesting and receiving informed consent from the company to initiate the research. Data from all these fiscal years 2018-2021 sources were entered into an electronic spreadsheet. Subsequently, the requested financial data were digitized; the complete values of the company's income and expenses, assets and liabilities over a long period, and net worth were estimated to calculate financial ratios that will help to analyze growth and profitability. Consequently, a correlation matrix was used to meet the correlation objective.

RESULTS

Descriptive analysis of the business growth variable

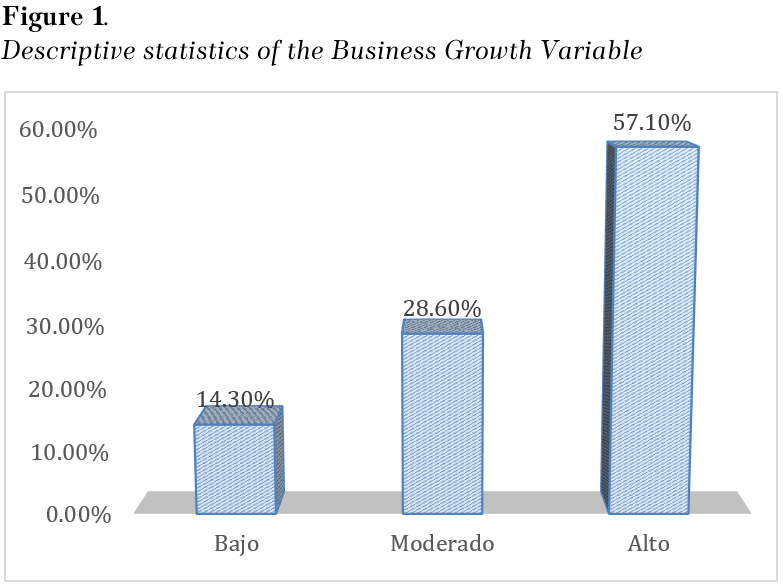

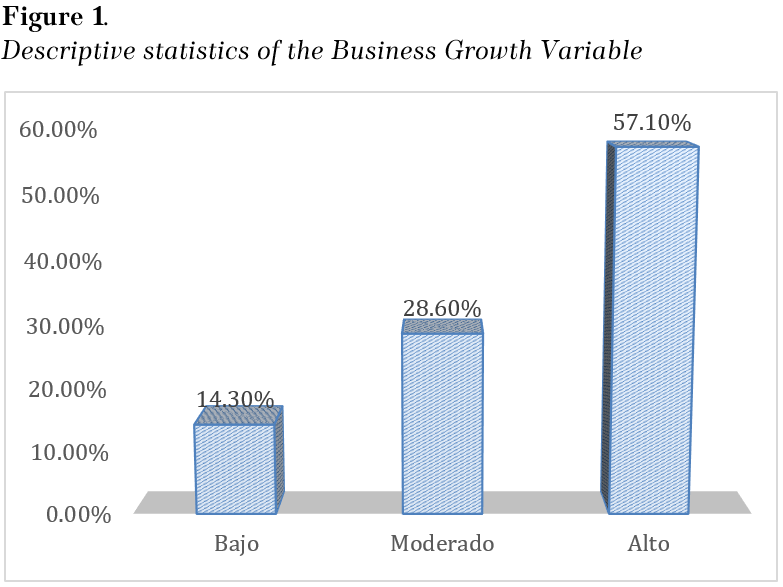

As described in both table 1 and figure 1, the descriptive behaviors of the variable “business growth” made it evident that there was a predominance of the valid response level on the part of the high respondents, represented by 57.1% (20 of the participants); A valid moderate response level was evident in 28.6% (10 of the participants). Finally, it was proven that 14.3% (5) were positioned at a low level of response, regarding the variable in question.

|

Table 1. Descriptive analysis of the variable Business Growth |

||||

|

Range |

Frequency

|

Percentage

|

Valid percentage |

Cumulative percentage |

|

Low |

5 |

14.3 |

14.3 |

14.3 |

|

Moderate |

10 |

28.6 |

28.6 |

42.8 |

|

High |

20 |

57.1 |

57.1 |

100 |

|

Total |

35 |

100 |

100 |

|

Source: Own elaboration.

Source: Own elaboration.

Note: the figure appears in its original language.

Descriptive analysis of the profitability variable

Table 2 and figure 2 show the descriptive behavior of the "economic profitability" variable. Thus, it was established that 65.7% (23 of the sample surveyed) were positioned at a low valid level regarding the questions addressed in this variable. In addition, 13.3% (5) were positioned at a moderate level of response. Subsequently, 20% (7 of the participants) were found to have a high level of response.

|

Table 2. Descriptive analysis of the variable Profitability |

||||

|

Range |

Frequency

|

Percentage

|

Valid percentage |

Cumulative percentage |

|

Low |

23 |

65.7 |

65.7 |

65.7 |

|

Moderate |

5 |

14.3 |

14.3 |

80 |

|

High |

7 |

20 |

20 |

100 |

|

Total |

35 |

100 |

100 |

|

Source: Own elaboration.

Source: Own elaboration.

Note: the figure appears in its original language.

Normality test for correlation

|

Table 3. Normality Test |

||||||

|

|

Kolmogorov-Smirnov |

Shapiro-Wilk |

||||

|

|

Statistician |

Gl |

Sig. |

Statistician |

Gl |

Sig. |

|

Business growth |

.203 |

35 |

.076 |

.912 |

35 |

.080 |

|

Profitability |

.210 |

35 |

.015 |

.798 |

35 |

.034 |

Source: Own elaboration.

The significance of business growth and economic profitability for paired samples less than 50 were tested with the Shapiro-Wilk column; therefore, with the help of the analysis yielded 0.080 and 0.034, respectively. These bilateral significances were higher than the theoretical significance (of 0.01), so the variables possessed parametric or expected behavior, according to Pearson's correlational inferential statistic.

|

Table 4. Correlations |

|||||||

|

|

Internal factors |

External factors |

Business growth |

Economic profitability |

Financial profitability |

Profitability

|

|

|

Internal factors

|

Pearson correlation |

1 |

-.051 |

-.352 |

.290 |

.652** |

-.029 |

|

Sig. (bilateral) |

|

.969 |

.294 |

.243 |

.008 |

.912 |

|

|

N |

35 |

35 |

35 |

35 |

35 |

35 |

|

|

External factors

|

Pearson correlation |

-.051 |

1 |

.287 |

.666** |

.843** |

.565** |

|

Sig. (bilateral) |

.866 |

|

.266 |

.022 |

.000 |

030 |

|

|

N |

35 |

35 |

35 |

35 |

35 |

35 |

|

|

Business growth

|

Pearson correlation |

-.254 |

.234 |

1 |

.178 |

.080 |

.890** |

|

Sig. (bilateral) |

.222 |

.266 |

|

,567 |

.790 |

.000 |

|

|

N |

35 |

35 |

35 |

35 |

35 |

35 |

|

|

Economic profitability |

Pearson correlation |

.234 |

.666** |

.161 |

1 |

.637** |

.721** |

|

Sig. (bilateral) |

.222 |

.022 |

.612 |

|

.001 |

.001 |

|

|

N |

35 |

35 |

35 |

35 |

35 |

35 |

|

|

Financial profitability

|

Pearson correlation |

.596** |

.901** |

.080 |

.645** |

1 |

.420 |

|

Sig. (bilateral) |

.008 |

.000 |

.88’ |

.004 |

|

.083 |

|

|

N |

35 |

35 |

35 |

35 |

35 |

35 |

|

|

Profitability

|

Pearson correlation |

-.035 |

.536* |

.845** |

.623** |

.450 |

1 |

|

Sig. (bilateral) |

.954 |

.040 |

.000 |

.002 |

.083 |

|

|

|

N |

35 |

35 |

35 |

35 |

35 |

35 |

|

Source: Own elaboration.

This result showed a Pearson relationship between business growth and economic profitability with an error of 0.02, which reached a high correlation (0.845), suggesting that if business growth increased exponentially or were high, economic profitability would also increase directly. The internal factor showed a medium correlation (0.596) with an error level of 0.040 with financial profitability. The external factor showed a high correlation (0.901) with financial profitability and a medium correlation (0.666) with economic profitability.

|

Table 5. Linear regression |

||||

|

Variables entered/deleteda |

||||

|

Model |

Variables inputs Business growth b |

Variables eliminated |

Method |

|

|

1 |

|

|

Enter |

|

|

Summary of the model |

||||

|

Model |

R |

R square

|

Adjusted R-squared |

Standard error of the estimate |

|

1 |

.834a |

.681 |

.671 |

1.910231 |

Source: Own elaboration.

Table 5 shows a. is a dependent variable: profitability; b. relates to all the requested variables entered. Then, in the model summary, a. refers to predictors (constants) and business growth (model summary).

|

Table 6. Anova |

||||||

|

Model |

|

Sum of squares |

Gl |

Root mean square |

F |

Sig. |

|

1 |

Regression |

124.777 |

2 |

122.765 |

37.116 |

.000b |

|

Residual |

57.555 |

17 |

3.333 |

|

|

|

|

Total |

178.300 |

18 |

|

|

|

|

Source: Own elaboration.

|

Table 7. Coefficients |

||||||||

|

Model |

|

Unstandardized coefficients

|

Standardized coefficients

|

|

99.0% confidence interval for B |

|||

|

B |

Error deviation |

Beta |

t |

Sig. |

Lower limit |

Upper limit |

||

|

1 |

(Constants) |

12,889 |

2.088 |

|

4.412 |

.001 |

4.221 |

22.810 |

|

Business growth |

1,221 |

.180 |

.930 |

6.265 |

.000 |

.598 |

1.702 |

|

Source: Own elaboration.

These results showed in the inferential analysis, using the linear regression Anova and coefficients in tables 5, 6, and 7, that the statistical significance was 0.000 and, since it was positioned within a character of less than 0.01, it was established that there was a significant relationship between the variable "business growth" and "economic profitability." In addition, since the R-squared was positioned within the model summary at 0.681, it was concluded that business growth defined or influenced economic profitability by 68.1%.

Therefore, the results addressed within the present study clarify a Pearson relationship between business growth and economic profitability under an error of 0.02. This achieves a high correlation (of 0.845), showing that economic profitability also increases directly if business growth increases exponentially or is high. The internal factor shows a medium correlation (0.596) with an error level of 0.040 concerning financial profitability. In addition, the external factor shows a high correlation (0.901) concerning financial profitability and a medium correlation (0.666) concerning economic profitability, respectively.

Likewise, it is evident within the inferential analysis using linear regression, Anova (and coefficients in tables 5, 6, and 7) that the statistical significance is 0.000 and, as it is positioned within a character lower than 0.01, it is established that there is a significant relationship between the variable "business growth" and "economic profitability." In addition, as the R-squared is positioned within the summary of the model at 0.681, it is concluded that business growth defines or influences economic profitability by 68.1%.

In this sense, according to Moyano (2020), who researched the connection between expansion and business profitability based in Chimborazo-Ecuador, the findings of this study are consistent with what he reported. A total of 27 companies were used in this study, and the methodology employed included a thorough review of financial documents to determine metrics such as return on assets (ROA), return on equity (ROE), and gross profit margin (GPM). At the same time, a linear regression test was used for statistical analysis. The results indicated a Pearson correlation of = 0.932 and a coefficient of determination of 0.869.

Another source consulted, Nieto (2017), conducted a thesis project in a survey of 136 small business owners, finding that the availability of credit, product diversification, lack of market information, and the use of technological aids played an essential role in the growth capacity of the firms. The evidence showed that the three growth factors affected the profitability of MSEs in the Commercial Sector of the Villa El Salvador Industrial Park. Regarding credit availability, the country has one of the highest rates of informality in the world, close to 80%, and the vast majority of MSEs still need to be formally constituted. As a result, they still need to implement accounting practices, contribute to social security, and issue invoices.

In another study, the documentary work conducted by Daza (2015) used a sample of 1246 active Brazilian companies, both domestic and international, where their growth and profitability between 2002 and 2012 were analyzed. It sought to establish a correlation between the two. In addition to a document-based analysis, the methodology also used a least squares test. The results showed a correlation between company growth and profitability for 1246 companies from 2002 to 2012, with a correlation coefficient of 0.033, a sensitivity coefficient of 0.034, a standard deviation of 0.04, a standard error of 0.05 and a coefficient of determination of 0.1709 and 0.2078 for Brazilian and international companies, respectively.

Profitability is directly correlated with growth for Brazilian companies; the coefficient of determination indicates that profitability accounts for 17% of growth. In contrast, for foreign companies, more profitability means slower growth and the coefficient of determination shows that profitability accounts for 20.78% of growth for foreign companies. This is a significant figure that foreign investors should take into account. Correlation coefficients of -0.482 and -0.171 for firm size and debt, respectively, at the 5% significance level, and a single-factor coefficient of determination of 0.0575% suggest that larger firms with lower debt and higher growth rates also generate higher profits. This study ultimately concludes that size has a direct effect on firm expansion.

For his part, Vicente (2015) established that the asset structure is a particularly significant internal dimension of business growth since it is pledged as collateral when applying for working capital loans. In addition, financial management plays a crucial role in business expansion by enabling firms to achieve optimal financial health. The research demonstrated a positive and significant relationship between effective financial management and the profitability of Mexican firms (r = 0.93). This high correlation coefficient indicated that both factors were highly correlated. Therefore, proper management allows the development of a financial strategy that boosts liquidity and, by extension, profitability; this, in turn, translates into the generation of capital that enables the purchase of inputs and the timely payment of suppliers, avoiding interruptions in the supply chain, severance payments, and other costs, which allows the Mexican business sector to grow sustainably.

Finally, the research conducted by Viteri and López (2019) in Tungurahua, Ecuador, sought to establish the connection between business expansion and the profitability of textile manufacturers in the region. The research methodology consisted of a documentary analysis covering the years 2007-2017; the correlation test was used to establish a link between the variables of return on assets, return on equity, and gross margin of return on investment, as well as the growth rates of the companies and the percentage variation of net sales in the sector. The study found a Pearson correlation coefficient of 0.930 between business development and profitability of Tungurahua textile producers, as well as positive correlations between ROA, ROE, and gross profit margin (ROP), with r-squared values of 0.828, 0.705, and 0.836, respectively. Thus, the profitability of Tungurahua's textile business will increase to the maximum as the business expands, thanks to the hard work of its employees and managers in all areas of operation. This includes production, sales, and purchasing.

CONCLUSIONS

A Pearson's relationship was found between business development and economic profitability under an error of 0.02. This reached a high correlation of 0.845, indicating that economic profitability also increases directly if business growth increases exponentially or is high. The internal factor shows a medium correlation (of 0.596) with an error level of 0.040 regarding financial profitability. Likewise, the external factor shows a high correlation (0.901) for financial profitability and a medium correlation (0.666) for economic profitability.

Likewise, within the inferential analysis carried out through linear regression, taking into consideration Anova and coefficients in Tables 5, 6, and 7, it is shown that the statistical significance is 0.000 and, since it is positioned within a character lower than 0.01, it is established that there is a significant relationship between the variable "business growth" and that of "economic profitability." Finally, since the R-squared is positioned within the summary of the model at 0.681, it is concluded that business development defines or influences economic profitability by 68.1 %.

REFERENCES

Adan, J., Munar, L., Romero, G. y Gordillo, A. (2022). Nuevos desafíos de las pequeñas y medianas empresas en tiempos de pandemia. Tecnura, 26(72), 185-202. https://doi.org/10.14483/22487638.17879

Barnet, S., Arbónes, M., Pérez, S. y Guerra, M. (2017). Construcción del registro de observación para el análisis del movimiento fundamentado en la teoría de Laban. Pensar en Movimiento, 15(2), 1-21. http://dx.doi.org/10.15517/pensarmov.v15i2.27334

Cadena, P., Rendón, R., Aguilar, J., Salinas, J., De la Cruz, F. y Sangerman, D. (2017). Métodos cuantitativos, métodos cualitativos o su combinación en la investigación: un acercamiento en las ciencias sociales. Revista Mexicana de Ciencias Agrícolas, 8(7), 1603-1617. https://www.redalyc.org/pdf/2631/263153520009.pdf

Cienfuegos, M. y Cienfuegos, A. (2016). Lo cuantitativo y cualitativo en la investigación. Un apoyo a su enseñanza. Revista iberoamericana para la Investigación y el Desarrollo Educativo, 7(13), 15-36. https://n9.cl/rereci

Daza, J. (2015). Análisis de la interrelación crecimiento-rentabilidad en Brasil. Tourism & Management Studies, 11(2), 182-188. www.redalyc.org/articulo.oa?id=388743884021

Daza, J. (2016). Crecimiento y rentabilidad empresarial en el sector industrial brasileño. Contaduría y Administración, 61(2), 266-282. https://doi.org/10.1016/j.cya.2015.12.001

Demuner, M., Saavedra, M. y Cortes, M. (2022). Rendimiento empresarial, resiliencia e innovación en PYMES. Investigación Administrativa, 51(130), 00001. https://doi.org/10.35426/iav51n130.01

Díaz, V. y Calzadilla, A. (2018). Metodología de la Investigación, procesos de investigación y estudiantes de Medicina. Revista Salud Uninorte, 34(1), 251-252. https://doi.org/10.14482/sun.34.1.1036 7

Dulitzky, A. (2020). Entre el pasillo y la tribuna. La acción política de las empresas multinacionales en Argentina (2003–2015). Canadian Journal of Latin American and Caribbean Studies, 45(3), 318-337. https://doi.org/10.1080/08263663.2020.1769460

Durand, K., Vilches, L. y Rayo, N. (2021). Análisis de la gestión municipal provincial 2011-2014 en el sector SG-1 (núcleo del centro histórico del Cusco). Devenir, 8(15), 95-116. http://dx.doi.org/10.21754/devenir.v8i15.983

Fonseca, A., Fernández, E. y Martínez, A. (2019). Factores empresariales e institucionales condicionantes de la presión fiscal a nivel internacional. Spanish Journal of Finance and Accounting, 48(2), 224-253. https://doi.org/10.1080/02102412.2018.1524221

Hernández, R., Kellermanns, F. y López, M. (2021). Dynamic capabilities and SME performance: The moderating effect of market orientation. Journal of Small Business Management, 59(1), 162-195. https://doi.org/10.1111/jsbm.12474

Ibarra, M., González, L. y Demuner, M. (2017). Competitividad empresarial de las pequeñas y medianas empresas manufactureras de Baja California. Estudios Fronterizos, 18(35), 107-130. https://doi.org/10.21670/ref.2017.35.a06

Laguía, A., Jaén, I., Topa, G. y Moriano, J. (2019). University environment and entrepreneurial intention: the mediating role of the components of the theory of planned behaviour. Revista de Psicologia Social, 34(1), 137-167. https://doi.org/10.1080/02134748.2018.1542789

Larrinaga, C., Moneva, J. M. y Ortas, E. (2019). Veinticinco años de Contabilidad Social y Medioambiental en España: Pasado, presente y futuro. Spanish Journal of Finance and Accounting, 48(4), 387-405. https://doi.org/10.1080/02102412.2019.1632020

Martínez, G., Cortés, M. y Pérez, A. (2016). Metodología para el análisis de correlación y concordancia en equipos de mediciones similares. Revista Universidad y Sociedad, 8(4). http://scielo.sld.cu/scielo.php?script=sci_abstract&pid=S2218-36202016000400008

Morales, L., Córdova, A., Altamirano, L. y Lema E. (2018). ¿Son rentables las empresas concentradas? El caso del sector de curtido de pieles en el Ecuador. Revista de Ciencias de la Administración y Economía, 8(15), 153-166. https://doi.org/10.17163/ret.n15.2018.10

Moyano, S. (2020). La rentabilidad financiera de las empresas industriales privadas de la provincia de Chimborazo, como factor de crecimiento económico de la provincial, periodo 2016-2017. [Tesis de maestría, Universidad Técnica de Ambato]. Repositorio UTA. http://repositorio.uta.edu.ec/bitstream/123456789/31909/1/4905M.pdf

Nieto, M. (2017). Factores de crecimiento y rentabilidad de las MYPES del sector comercial del parque industrial de Villa el Salvador-Lima, 2016. [Tesis de pregrado, Universidad Inca Garcilaso de la Vega]. Repositorio UIGV. https://n9.cl/n26xw6

Núñez, G. (2018). Elementos para una estrategia de desarrollo económico de México. Análisis Económico, 33(84), 9-31. https://www.scielo.org.mx/pdf/ane/v33n84/2448-6655-ane-33-84-9.pdf

Ortega, C., Vásquez, S. y Vásquez, S. (2021). Crecimiento empresarial y su influencia sobre la rentabilidad en las empresas de una cámara de industria de Huaycán Perú. Diagnóstico Fácil Empresarial, 16, 20-26. https://doi.org/10.32870/dfe.vi16.98

Otzen, T. y Manterola, C. (2017). Técnicas de Muestreo sobre una Población a Estudio. International journal of morphology, 35(1), 227-232. http://dx.doi.org/10.4067/S0717-95022017000100037

Palacios, P., Saavedra, M. y Cortés, M. (2020). Estudio comparativo de rendimientos empresariales de hombres y mujeres en México: una aproximación empírica. Revista Finanzas y Política Económica, 12(2), 431-459. https://doi.org/10.14718/revfinanzpolitecon.v12.n2.2020.3375

Párraga, S., Pinargote, N., García, C. y Zamora, J. (2021). Indicadores de gestión financiera en pequeñas y medianas empresas en Iberoamérica: una revisión sistemática. Dilemas Contemporáneos: educación, política y valores, Edición especial, 00026. https://doi.org/10.46377/dilemas.v8i.2610

Pérez, A., García, R., y Aguaded, I. (2019). Dimensions of digital literacy based on five models of development. Cultura y educación, 31(2), 232-266. https://doi.org/10.1080/11356405.2019.1603274

Ramón, R. y Bañón, C. (2022). Stock de activos intangibles y rentabilidad empresarial. El caso de la industria hotelera española (2008-2019). Innovar, 32(84), 25-39. https://doi.org/10.15446/innovar.v32n84.100544

Ramos, R., Viña, M. y Gutiérrez, F. (2021). Investigación aplicada en tiempos de COVID-19. Revista de la OFIL, 30(2), 93. https://dx.doi.org/10.4321/s1699-714x2020000200003

Salamzadeh, A., Radovic, M., y Masjed, S. (2019). The effect of media convergence on exploitation of entrepreneurial opportunities. AD-minister, 34, 59-76. https://doi.org/10.17230/ad-minister.34.3.

Vásquez, E. (2021). Factores críticos para la adopción de las TIC en micro y pequeñas empresas industriales. Industria Data, 24(2), 273-292. http://dx.doi.org/10.15381/idata.v24i2.20736

Vicente, A. (2015). Impacto de la gestión financiera en la rentabilidad empresarial. Revista Administración y Finanzas, 2(2), 278-287. https://n9.cl/agf97

Vidal, V. (2020). Estudio del estrés laboral en las PYMES (pequeña y mediana empresa) en la provincia de Zaragoza. Revista de la Asociación Española de Especialistas en Medicina del Trabajo, 28(4), 254-267. https://n9.cl/z3v8b

Viteri, J. y López, A. (2019). Crecimiento y rentabilidad empresarial del sector de fabricación de productos textiles y prendas de vestir en la provincia de Tugurahua. [Tesis de pregrado, Universidad Técnica de Ambato]. Repositorio UTA. https://repositorio.uta.edu.ec/jspui/handle/123456789/30527

Zambrano, F., Sánchez, M., y Correa, S. (2021). Análisis de rentabilidad, endeudamiento y liquidez de microempresas en Ecuador. Revista de Ciencias de la Administración y Economía, 11(22), 235-249. https://doi.org/10.17163/ret.n22.2021.03

Zurita, J., Márquez, H., Miranda, G. y Villasis, M. (2018). Estudios experimentales: diseños de investigación para la evaluación de intervenciones en la clínica. Revista Alergia México, 65(2), 178-186. https://doi.org/10.29262/ram.v65i2.376

FINANCING

No external financing.

DECLARATION OF CONFLICT OF INTEREST

None.

ACKNOWLEDGMENTS (ORIGINAL SPANISH VERSION)

Se agradece a la Universidad Peruana Unión por el apoyo recibido para el desarrollo de la investigación.

AUTHORSHIP CONTRIBUTION

Conceptualization: Jafet Moisés Gonzales Centon, Wuilmer Chávez Cubas, Jeanette Berrio Huillcacuri and Abrahan Braulio Santos Maldonado.

Research: Jafet Moisés Gonzales Centon, Wuilmer Chávez Cubas, Jeanette Berrio Huillcacuri and Abrahan Braulio Santos Maldonado.

Methodology: Jafet Moisés Gonzales Centon, Wuilmer Chávez Cubas, Jeanette Berrio Huillcacuri and Abrahan Braulio Santos Maldonado.

Validation: Jafet Moisés Gonzales Centon, Wuilmer Chávez Cubas, Jeanette Berrio Huillcacuri and Abrahan Braulio Santos Maldonado.

Writing - original draft: Jafet Moisés Gonzales Centon, Wuilmer Chávez Cubas, Jeanette Berrio Huillcacuri and Abrahan Braulio Santos Maldonado.

Writing - revision and editing: Jafet Moisés Gonzales Centon, Wuilmer Chávez Cubas, Jeanette Berrio Huillcacuri and Abrahan Braulio Santos Maldonado.