doi: 10.58763/rc2026532

Scientific and Technological Research

Analysis of working capital management and its impact on the profitability of tourism companies

Análisis de la gestión del capital de trabajo y su impacto en la rentabilidad de las empresas del sector turismo

Oscar José Pedraza-Sarabia1 ![]() *, Rolando Eslava-Zapata1

*, Rolando Eslava-Zapata1 ![]() *, Nubia Isabel Díaz-Ortega1

*, Nubia Isabel Díaz-Ortega1 ![]() *

*

ABSTRACT

Introduction: Capital must be planned, managed, organized, coordinated, feedbacked, and constantly controlled so that the necessary current assets can be maintained and exceed current liabilities, thus guaranteeing business continuity.

Objective: The article aims to analyze the impact of working capital management on profitability in Colombia’s tourism sector companies.

Method: A quantitative research study with a cross-sectional design was carried out, where financial instruments were applied to understand the trend in working capital and profitability variables in five companies in the Colombian tourism sector.

Result: The results revealed that the tourism sector has grown after the impact of the COVID-19 pandemic. However, this growth has demanded working capital. Although it increases every year, it is still a challenge for companies to manage it in a specific way that significantly impacts financial profitability. The equity and financial structure reveal that current assets and liabilities comprise accounts receivable and accounts payable.

Conclusions: The influence of working capital on the profitability of the Colombian tourism sector is of utmost importance, as it generates the working capital needed to meet daily financial obligations, maintain its productive apparatus at its peak by providing better service, take advantage of future growth opportunities, and reserve a portion of capital that will be used for possible future eventualities or catastrophes.

Keywords: Capital, enterprises, profitability, tourism

JEL Classification: G12, G13.

RESUMEN

Introducción: El capital debe planearse, dirigirse, organizarse, coordinarse, retroalimentarse y controlarse constantemente de forma que se puedan tener los activos corrientes necesarios y superen los pasivos corrientes, y de esta forma garantizar la continuidad de las empresas.

Objetivo: El articulo tiene por objetivo analizar el impacto que tiene la gestión del capital de trabajo en relación con la rentabilidad en las empresas del sector turismo en Colombia.

Método: Se llevó a cabo una investigación cuantitativa con diseño trasversal donde se aplicaron instrumentos financieros a fin de conocer la tendencia de variables de capital de trabajo y rentabilidad en cinco empresas del sector turismo colombiano.

Resultado: Los resultados revelaron que el sector turismo ha crecido después de la afectación por la pandemia del COVID-19, pero este crecimiento ha demandado capital de trabajo y aunque éste cada año es mayor, todavía sigue siendo un reto para las empresas gestionarlo de terminada forma que ejerza un impacto importante en la rentabilidad financiera. La estructura patrimonial y financiera revela que el activo y pasivo corriente se componen en su gran mayoría por cuentas por cobrar y cuentas por pagar respectivamente.

Conclusiones: La influencia del capital de trabajo en la rentabilidad del sector turismo colombiano es de suma importancia, ya que genera el capital circulante necesario para responder a las obligaciones financieras diarias, para mantener su aparato productivo al máximo prestando un mejor servicio, para aprovechar futuras oportunidades de crecimiento y para guardar una parte de capital que servirá para posibles eventualidades o catástrofes futuras.

Palabras clave: capital, empresa, rentabilidad, turismo

Clasificación JEL: D24, F32.

Received: 28-06-2025 Revised: 16-08-2025 Accepted: 06-11-2025 Published: 01-01-2026

Editor:

Alfredo Javier Pérez Gamboa ![]()

1Universidad Libre de Colombia. Cúcuta, Colombia.

Cite as: Pedraza-Sarabia, O. J., Eslava-Zapata, R. y Díaz-Ortega, N. I. (2026). Análisis de la gestión del capital de trabajo y su impacto en la rentabilidad de las empresas del sector turismo. Región Científica, 5(1), 2026532. https://doi.org/10.58763/rc2026532

INTRODUCTION

In recent years, global technological advancement has led to countries becoming increasingly interconnected. With easier access to information, higher incomes, and greater availability of time, more and more people are choosing to travel around the world. This has led to growth in the tourism sector, which has become a source of economic development for countries around the world, contributing 9.80% of the world's Gross Domestic Product (GDP) and representing 7.00% of total global exports (Brouder, 2017; Modi, 2024). Among these, Colombia, a country rich in diversity (natural, cultural, and ethnic), is among the ten countries with the greatest natural biodiversity in the world (Batlle-Cardona, 2024; Echeverri et al., 2023).

However, following the COVID-19 coronavirus pandemic, businesses are facing many challenges, as its spread has significantly impacted economic and productive systems in a context where several governments have attempted to mitigate its effects with new lockdown measures (Delardas et al., 2022; Jones, Palumbo & Brown, 2020). Colombia has been no exception to these difficulties, and in an effort to counteract the potential damage caused by COVID-19, the current government has taken measures that have impacted the country's productive sectors, especially tourism (Cabello-Beltrán & Pulido-Arbeláez, 2020).

In this sense, tourism is a highly vulnerable sector to various factors, such as natural disasters, wars, internal unrest, diseases, and pandemics, such as the recent COVID-19 pandemic (Botero-Guzmán et al., 2023; Duan et al., 2022). These problems threaten the liquidity or lack of working capital available to these companies and, consequently, their continued existence. In fact, during the COVID-19 pandemic and the subsequent return to normalcy, limited cash flow was a decisive factor in the liquidation of many of these companies (Superintendencia de Sociedades, 2023).

Capital management requires systematic planning, organization, and control, supported by cyclical monitoring and feedback processes, to ensure adequate levels of current assets that exceed short-term liabilities, guaranteeing organizations' operational and financial sustainability (Peñafiel, 2016). Without this preparation, any company's financial difficulties will threaten its liquidation. This was the reason why many companies were unable to continue after the coronavirus pandemic, as their working capital was insufficient to meet their obligations (Wang, 2024).

Small and medium-sized businesses are those with the least working capital due to short-term obligations (Higuita-González, 2019). This characteristic means that they are the first companies to see their liquidity affected by problems such as natural disasters, wars, internal unrest, diseases, and pandemics (Miklian & Hoelscher, 2022). According to a press report, more than half a million small businesses closed between January and October 2020 (Acosta-Fonseca, 2021).

Regarding the regulations related to the study, it was possible to identify Law 300 of 1996 as the first law to treat the tourism sector as a primary activity for the economic, cultural, and social development of the country's regions. Article 13 of this Law clearly illustrates its priority by stating that this sector should be decentralized and that its management and coordination would be the responsibility of territorial authorities, which would be supported through programs and advisory services (Article 13, Ley 300, 1996).

Therefore, Law 300 of 1996 encourages coordinated and participatory development among the various territorial institutions to treat the tourism sector as an industry. Furthermore, it treats the tourism sector as a matter of public responsibility and establishes its development through the representation of municipalities, key entities in the administrative structure, and territorial planning.

Thus, Law 300 of 1996 constitutes a fundamental pillar for the tourism sector, as it places greater importance on the territorial sector in its development, promoting the participation of various municipal and departmental institutions in creating public policies for the development of this sector. Subsequently, Law 1101 of 2006, Law 1558 of 2012, and Law 2068 of 2020 created a parafiscal contribution aimed at promoting, developing, and enhancing the tourism sector's competitiveness through companies that carry out the economic activity itself. Furthermore, this legislation sought to ensure that the funds raised in this contribution would be invested solely in tourism projects, primarily in key areas such as infrastructure, competitiveness, promotion, and marketing.

Another strength of this regulatory framework is that it creates incentives to attract investors to this sector. These aid measures took the form of an increase in a special 9.00% income tax for the construction of new hotels, theme parks, and renovations, along with an extended construction period of four to six years. In addition, new services were included to serve elderly visitors at the new facilities. Finally, these regulations also entail important reactivation measures to promote the development of the tourism sector and include other initiatives related to sustainability and quality to position Colombia as an excellent tourist destination.

However, these legislative efforts were affected by the impact of the coronavirus pandemic, as a significant number of the companies that went bankrupt during the period belonged to the tourism sector. Regarding this, the Superintendency of Companies (2023) said that the decrease in cash flow and the low demand for products and services are considered the main factors that affected the operations and profitability of companies in the tourism sector in 2020 (Gómez-Ortiz & Durán, 2023).

Based on the above, the following research question is posed: How does working capital management influence the profitability indicators of companies in the tourism sector in Colombia during the 2021-2022 period? Therefore, through empirical analysis, this study aimed to analyze the causal relationship between working capital management practices and financial performance measured through profitability metrics in Colombian companies in the tourism sector for the indicated period.

The research was based on a quantitative approach with a cross-sectional design, using financial analysis tools to evaluate the relationship between working capital variables and profitability. The sample included five representative companies from the Colombian tourism sector, and the methodological process was structured in three phases:

1. Exploratory Phase: Analysis of secondary sources to characterize the economic and financial context of the sector.

2. Descriptive Phase: Calculation of working capital and profitability ratios, followed by correlational analysis to identify significant patterns.

3. Propositional Phase: Comparative documentary analysis with international financial management standards aimed at formulating recommendations to optimize profitability in the sector.

METHODOLOGY

The research was quantitative, as instruments were applied to determine the trends in variables over time to measure the correlation between working capital and profitability in companies in the tourism sector in Colombia.

The study was based on a cross-sectional design (Hernández-Sampieri & Mendoza, 2020), a non-experimental methodological approach aimed at describing variables and analyzing their impact and interrelationships at a specific time. This type of design allows phenomena to be characterized in a defined context through synchronous data collection, which facilitates a structural analysis of the relationships between variables without inferring causality.

To achieve the first objective, an exploratory phase was conducted, in which documents related to the economic and financial activity of the companies studied were reviewed. A descriptive phase was conducted to develop the second objective, which included determining or calculating the working capital of the companies studied. For the third objective, a document review was conducted to propose actions to improve the profitability of companies in the Colombian tourism sector.

The research population is defined as the universe of elements that meet specific criteria linked to the study objectives (Hernández-Sampieri & Mendoza, 2020). For this study, the target population was defined as active companies in the Colombian tourism sector registered on the EMIS platform, a specialized source of market intelligence, that met three conditions: (1) public availability of audited financial statements for 2021-2022, (2) continuous operation during the study period, and (3) CIIU 79 classification (tourism service activities). After applying these filters, the final population consisted of 30 companies. Finally, the sample was purposive and non-probabilistic, considering the ease of obtaining data and the estimated timeframe in which the study was conducted (Hernández-Sampieri & Mendoza, 2020). Therefore, the sample consisted of 5 companies:

1. Hoteles Estelar S.A.

2. Hoteles Decameron Colombia S.A.S.

3. Grupo Empresarial en Línea S.A.

4. Winner Group S.A.

5. Corredor Empresarial S.A.

The company's financial information was used to calculate working capital using the following formula: Current assets – current liabilities = working capital. The data was analyzed using Microsoft Excel based on the indicators shown in table 1.

|

Table 1. Economic-financial indicators |

||

|

Indicator |

Definition |

Formula |

|

ROA |

Return on Assets |

Net Income/Total Assets |

|

ROE |

Return on Equity |

Net Income/Equity |

|

EBIT |

Earnings Before Interest and Taxes |

Total Revenue - Operating Costs |

|

KT |

Working Capital |

Current Assets - Current Liabilities |

|

CE |

Capital Employed |

Assets - Current Liabilities |

Source: own elaboration.

RESULTS

The influence of working capital on the profitability of tourism companies in Colombia

Below are the results obtained from the financial analysis conducted on tourism sector companies to understand the relationship between liquidity, profitability, current asset maturity, and equity and financial structure. Equity balance for tourism sector companies is determined by considering working capital and capital employed. While the former is determined by subtracting current liabilities from current assets, the latter is total assets less current liabilities.

Table 2 presents the averages for working capital and capital employed in the selected companies for 2021 and 2022. It then shows the funds the companies require to cover their cash needs in their daily operations, whether with long-term financing or with their own resources. As can be seen, both working capital and capital employed increased for 2022 compared to 2021. In the case of working capital, the increase is reflected in a 10.22% decrease from the negative balance recorded in 2021, while for capital employed, the increase was 16.36%. This difference of 660.458,48 between capital employed and working capital for 2021 and 746.266,34 for 2022 reflected that companies did have sufficient assets to meet their obligations (CE) but not assets readily convertible into cash (KT).

|

Table 2. Working Capital and Employed Capital of companies in the tourism sector |

||

|

Years |

Ce |

Kt |

|

2021 |

576.690,43 |

-83.768,05 |

|

2022 |

671.056,87 |

-75.209,47 |

Source: own elaboration.

To gain a clear picture of the tourism sector's liquidity, Table 3 shows the amount of sales generated by its assets in a year (Net Sales/Assets), the efficiency with which current assets are used to generate revenue in a year (Net Sales/Current Assets), and finally, the efficiency of working capital in generating revenue in a year (Net Sales/Working Capital). It can be seen, then, that the amount of sales generated by assets decreased by 3.07% for 2022 compared to 2021. Current assets performed similarly, decreasing by 2.06%, although working capital did experience a notable drop of 82.22%. This shows that more assets, current assets, and working capital were used to generate net sales and, therefore, revenue.

|

Table 3. Total asset turnover, current assets and working capital |

|||

|

Years |

Total Assets |

Current Assets |

Working Capital |

|

2021 |

2.28 |

3.89 |

19.85 |

|

2022 |

2.21 |

3.81 |

3.53 |

Source: own elaboration.

Regarding the relationship between working capital and business profitability for the years 2021 and 2022, it can be seen in Table 4 that the Corredor Empresarial company has an increase of 44.66% in working capital in 2022 compared to 2021, while the increase in its profitability is 312.90%, in the case of Winner Group S.A. in working capital it has a drop of -230.88% in 2022, while the increase in its profitability is 105.24%, in the case of Grupo Empresarial en Línea S.A. the variation in its working capital, is an increase of 163.16% for 2022 while the increase in its profitability is 117.33%, in the case of Hoteles Decameron Colombia S.A.S. Its working capital started with a negative in 2021 and by 2022 it had a reduction of 1.00% while its profitability increased by 530.00% and in the case of Hoteles Estelar S.A. its working capital has a growth of 108.00% while its business profitability 319.35% in 2022 compared to 2021.

|

Table 4. Working capital-financial profit ratio |

||||

|

|

Kt 2021 |

Kt 2022 |

Utility 2021 |

Utility 2022 |

|

Corredor Empresarial S.A. |

29.632 |

42.865 |

4.517 |

18.649 |

|

Winner Group S.A. |

16.274 |

- 21.299 |

72.220 |

148.223 |

|

Grupo Empresarial en Línea S.A. |

14.405 |

37.910 |

29.285 |

63.646 |

|

Hoteles Decameron Colombia S.A.S. |

- 514.783 |

- 509.637 |

- 35.675 |

153.401 |

|

Hoteles Estelar S.A. |

35.632 |

74.114 |

- 11.053 |

24.245 |

Source: own elaboration.

The descriptive analysis concluded with an assessment of business profitability, analyzing indicators such as ROA, ROE, and EBIT/Total Assets, which can be seen in Table 5. All indicators increased in 2022 compared to 2021; in the case of ROA, it increased by more than 100%; in the case of ROE, it increased by 200%; and in EBIT/Total Assets, it increased by less, at 80%. In the case of ROA and RAE, it can be seen that the sector has generated higher net profits while assets or equity have continued to grow.

|

Table 5. Economic and financial profitability for companies in the tourism sector |

|||

|

Years |

Ebit/total assets % |

Roa % |

Roe % |

|

2021 |

14.08 |

7.62 |

13.61 |

|

2022 |

25.33 |

16.69 |

40.85 |

Source: own elaboration.

Impact of current assets and current liabilities on working capital management of tourism sector companies in Colombia for the period 2021 and 2022.

Regarding the equity structure, Table 6 shows the main indicators for 2021 in terms of total assets obtained from the financial statements of these companies. Current assets represent an average of 42.57% of total assets, followed by current liabilities, which represent an average of 37.77%. Total liabilities represent 62.15%, and equity represents 37.85% of total assets. It can be observed that the largest source of financing used by companies in the Colombian tourism sector is external debt.

|

Table 6. Descriptive statistics of asset structure (2021) |

||||

|

Indicator |

Minimum |

Average |

Median |

Maximum |

|

Current Assets/Total Assets |

0.11 |

0.43 |

0.26 |

0.88 |

|

Current Liabilities/Total Assets |

0.13 |

0.38 |

0.30 |

0.63 |

|

Total Liabilities/Total Assets |

0.36 |

0.62 |

0.63 |

0.92 |

|

Equity/Total Assets |

0.08 |

0.38 |

0.37 |

0.64 |

Source: own elaboration.

Table 7 shows the equity structure for 2022. Current assets represent an average of 45.86% of total assets, which shows that almost half of a company's total assets are current assets. This is followed by current liabilities, representing an average of 39.96% of total assets. Total liabilities then represent an average of 62.15% of total assets, and finally, equity represents 37.85% of total assets. The same distribution of funding sources between total liabilities and equity continues to be maintained.

|

Table 7. Descriptive statistics of asset structure (2022) |

||||

|

Indicator |

Minimum |

Average |

Median |

Maximum |

|

Current Assets/Total Assets |

0.12 |

0.46 |

0.32 |

0.88 |

|

Current Liabilities/Total Assets |

0.15 |

0.40 |

0.37 |

0.63 |

|

Total Liabilities/Total Assets |

0.50 |

0.62 |

0.59 |

0.81 |

|

Equity/Total Assets |

0.19 |

0.38 |

0.41 |

0.50 |

Source: own elaboration.

Regarding the financial structure, Table 8 shows the main indicators for 2021 regarding the composition of liabilities. Current liabilities represent an average of 62.52%, which shows that more than half of companies' total liabilities are current liabilities. Next comes current assets, which represent an average of 73.22% of total liabilities; then total assets represent an average of 175.87% of total liabilities; and finally, equity represents 75.87% of total liabilities.

|

Table 8. Descriptive statistics financial situation (2021) |

||||

|

Indicator |

Minimum |

Average |

Median |

Maximum |

|

Current Assets/Total Assets |

0.23 |

0.63 |

0.61 |

0.99 |

|

Current Liabilities/Total Assets |

0.12 |

0.73 |

0.73 |

1.39 |

|

Total Liabilities/Total Assets |

1.07 |

1.76 |

1.60 |

2.76 |

|

Equity/Total Assets |

0.09 |

0.76 |

0.60 |

1.76 |

Source: own elaboration.

Table 9 presents the financial structure for 2022. The indicators show that current liabilities represent an average of 66.10%; this shows that more than half of companies' total liabilities are current liabilities. Following this, current assets represent an average of 76.82% of total liabilities; then, total assets represent an average of 165.08% of total liabilities; and finally, equity represents 65.08% of total liabilities.

|

Table 9. Descriptive statistics financial situation (2022) |

||||

|

Indicator |

Minimum |

Average |

Median |

Maximum |

|

Current Assets/Total Assets |

0.26 |

0.66 |

0.74 |

1.00 |

|

Current Liabilities/Total Assets |

0.14 |

0.77 |

0.64 |

1.40 |

|

Total Liabilities/Total Assets |

1.23 |

1.65 |

1.70 |

1.99 |

|

Equity/Total Assets |

0.23 |

0.65 |

0.70 |

0.99 |

Source: own elaboration.

Data analysis and triangulation

Once the results have been obtained and analyzed, a series of actions are proposed to manage working capital in a way that allows companies in the Colombian tourism sector to generate the greatest economic and financial benefits. This management involves a meticulous application of the strategies described below; effective negotiation, agreements, incentives, and policies are essential to maximize the use of all strategies (Ruíz-Molina & Carnevali-García, 2021). Therefore, management must be comprehensive in all aspects affecting current assets and their ability to generate working capital (Noguera-López, 2023).

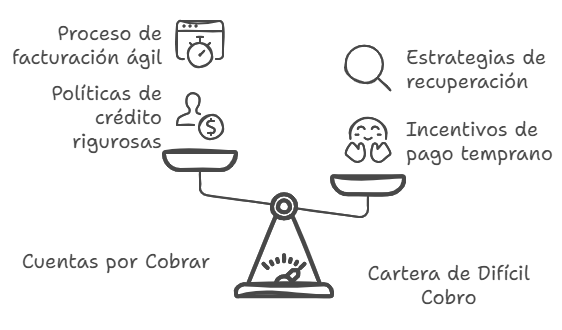

Table 3 shows that increasing working capital is needed to generate more sales, which will continue to provide more working capital. Accounts receivable accounts for a significant portion of current assets, as is the case with Hoteles Decameron Colombia S.A.S., where accounts receivable represent 88% of current assets (López-Díaz et al., 2024). Therefore, the first step should be to address accounts receivable to shorten their payment terms (Figure 1). Some avenues include implementing more rigorous credit policies, streamlining the invoicing process, and using incentives for early payment. For bad debt portfolios, incentives like those for early payment can be used (Landaverde, 2023).

|

Figure 1. Strategies for managing accounts receivable |

|

|

Source: own elaboration.

Note: the figure appears in its original language.

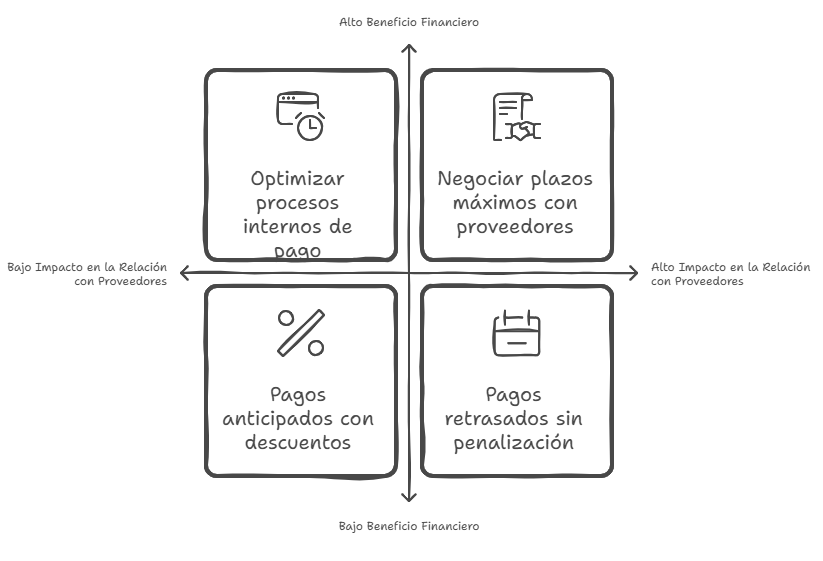

Second, in most of the companies studied, current liabilities are largely comprised of short-term debt, as is the case with Hoteles Estelar S.A., whose accounts payable represent 88.32% of its current liabilities. Therefore, the second strategy focuses on accounts payable (Figure 2). In this regard, the maximum terms for payment of these payments must be agreed with the suppliers. This way, the company can maximize the available time to pay them without incurring penalties or losing important users for the company, such as suppliers (Eslava-Zapata & Guerrero-Cristancho, 2024).´

|

Figure 2. Strategies for managing accounts payable |

|

|

Source: own elaboration.

Note: the figure appears in its original language.

Table 4 shows that the sector's net profits have grown; however, the need for working capital remains latent, as its production is capital-intensive. To achieve this, it is necessary to turn to financing sources that adapt to the sector and its business, finding the best option between costs, interest rates, payment terms, and financial restrictions imposed by the capital provider (Gómez Ortiz et al., 2020). Considering their operating context, companies must strategically select between instruments such as government aid, bank loans, or factoring. According to Eslava-Zapata et al. (2024a), sector growth validates these options and ensures liquidity to meet future financial obligations. Finally, it should be noted that contingencies, such as the COVID-19 pandemic, are disasters that do not occur very often, but when they do, they have a significant impact on companies that were not prepared for them, especially the tourism sector, which is sensitive to these catastrophes (Karunarathne et al., 2021; Škare et al., 2021). Therefore, a reserve should always be set aside to deal with large-scale unforeseen events; although this may involve sacrificing part of the company's funds, it is crucial to do so in order to protect the company's continuity. The amount to be set aside will depend on the size and location of the company's tourism services (Gómez-Chaves et al., 2024).

DISCUSSION

The influence of working capital on the profitability of the Colombian tourism sector is of utmost importance, as it generates the working capital necessary to meet daily financial obligations. As observed, the sector has grown its net profits but also required working capital to maintain its growing profitability. Therefore, proper working capital management will ensure business profitability and, therefore, business continuity (Eslava-Zapata et al., 2024b).

The effect of current assets and current liabilities on working capital management is decisive since the higher the current assets and the lower the current liabilities, the greater the working capital available (Addin Al-Mawsheki, 2022). Consequently, appropriate decisions must be made to increase current assets, for example, by reducing accounts receivable and to reduce current liabilities by extending payment terms and agreeing on flexible payment methods with suppliers (Díaz-Ortega et al., 2022).

It was found that working capital, like capital employed, increased in 2022 compared to 2021. In the case of working capital, the increase is reflected in a 10.22% decrease from the negative balance recorded in 2021, and for capital employed, the increase was 16.36%.

Regarding the relationship of working capital with business profitability for the years 2021 and 2022 it was evidenced that the company Corredor Empresarial has an increase of 44.66% of working capital in the year 2022 with respect to 2021 while the increase of its profitability is 312.90%, for the case of Winner Group S.A. in the working capital has a drop of -230.88% in the year 2022 while the increase of its profitability is 105.24%, for the case of Grupo Empresarial en Línea S.A. the variation of its working capital is an increase of 163.16% for the year 2022 while the increase of its profitability is 117.33%, for the case of Hoteles Decameron Colombia S.A.S. its working capital started with a negative in the year 2021 and by 2022 it had a reduction of the negative by 1.00% while its profitability increases by 530.00% and in the case of Hoteles Estelar S.A. its working capital has a growth of 108.00% while its business profitability 319.35% in the year 2022 with respect to the year 2021.

Based on the above, it is evident that companies increasingly need more working capital to continue generating more sales, which in turn will continue to provide more working capital (Pant et al., 2024). Accounts receivable accounts for a significant portion of current assets, as is the case with Hoteles Decameron Colombia S.A.S., whose accounts receivable represent 88% of its current assets. Therefore, the first step to address should be receivables; their receivables terms must be shortened. Some ways to address these issues include implementing more rigorous credit policies, streamlining the invoicing process, and using incentives for early payment (Flores-Anaya et al., 2023).

In the case of bad debts, incentives similar to those for early payment can be used. Likewise, the importance of liquidity, asset turnover, and corporate profitability was confirmed; therefore, companies must study financial indicators, enabling them to make financial decisions based on current asset management and business profitability knowledge. They must be prepared for eventualities such as the COVID-19 pandemic, keeping in mind that the tourism sector is one of the main sectors affected by a similar catastrophe; therefore, a financial reserve must be in place.

CONCLUSIONS

The findings of this study demonstrate that working capital plays a decisive role in the profitability of companies in the tourism sector in Colombia, acting as a connecting link between operating liquidity and profit generation. While a 16.36% increase in capital employed was observed (2021-2022), the persistence of negative working capital (-75.209,47 in 2022) highlights a critical imbalance: companies rely on illiquid assets to cover long-term obligations while facing limitations in converting current assets into cash. This duality is reflected in the 82.22% drop in working capital turnover, an indicator that highlights inefficiencies in accounts receivable management, particularly in cases like Hoteles Decameron Colombia S.A.S., where these accounts represent 88% of current assets. The sector's financial structure, characterized by a high dependence on current liabilities (66.10% of total liabilities in 2022), increases vulnerability to economic fluctuations despite growth in profitability indicators (ROE: +200%). This scenario requires dual strategies: optimizing collection periods through rigorous credit policies and renegotiating terms with suppliers to balance liquidity without compromising strategic alliances. Additionally, preparation for systemic crises—such as the COVID-19 pandemic—emerges as a priority, requiring the creation of financial reserves proportional to the size and geographic exposure of each company.

Finally, the analysis confirms that profitability does not depend exclusively on sales volume but on comprehensive management that links financial indicators (ROA, turnover) with operational decisions. The implementation of continuous monitoring models would allow for anticipating risks, aligning financing strategies (e.g., lines of credit, venture capital) with production cycles, and ensuring sustainability in a sector highly sensitive to external shocks. These results provide a framework for action to strengthen the financial resilience of Colombian tourism, underscoring the need to balance economic growth with liquidity stability.

REFERENCES

Acosta-Fonseca, V. (21 de febrero de 2021). En medio de la pandemia por covid-19, cerraron 509.370 micronegocios en Colombia. La República. https://www.larepublica.co/economia/en-medio-de-la-pandemia-por-covid-19-cerraron-509-370-micronegocios-en-colombia-3130382

Addin Al-Mawsheki, R. M. S. (2022). Effect of working capital policies on firms’ financial performance. Cogent Economics & Finance, 10(1), 2087289. https://doi.org/10.1080/23322039.2022.2087289

Batlle-Cardona, M. (31 de enero de 2024). Estos son los países más biodiversos del mundo. Viajes National Geographic. https://viajes.nationalgeographic.com.es/a/pura-naturaleza-los-paises-mas-biodiversos-del-mundo_15317#google_vignette

Botero-Guzmán, D., Vecino-Arenas, C. E., Viana-Barceló, R. A., & Vargas-Villamizar, A. J.(2023). Integración bursátil en los países miembros del Mercado Integrado Latinoamericano (MILA). Revista Gestión y Desarrollo Libre, 8(16), 1-22. https://doi.org/10.18041/2539-3669/gestionlibre.16.2023.10227

Brouder, P. (2017). Evolucionará economice geography: reflections forma a sustainable tourism perspective. Tourism Geographies, 19(3), 438–447. https://doi.org/10.1080/14616688.2016.1274774

Cabello-Beltrán, E. & Pulido-Arbeláez, L. (2020). Análisis del impacto económico del coronavirus en el sector turismo en Colombia. https://hdl.handle.net/10983/24709

Delardas, O., Kechagias, K. S., Pontikos, P. N., & Giannos, P. (2022). Socio-Economic Impacts and Challenges of the Coronavirus Pandemic (COVID-19): An Updated Review. Sustainability, 14(15), 9699. https://doi.org/10.3390/su14159699

Díaz-Ortega, C. H., Maestre-Delgado, M., & Díaz-Ortega, N. I. (2022). Liquidezy endeudamiento de las pymes y microempresas del sector cerámico Norte de Santander. Revista Gestión y Desarrollo Libre, 7(13),1-11. https://doi.org/10.18041/2539-3669/gestionlibre.13.2022.8785

Duan, J., Xie, C., & Morrison, A. M. (2022). Tourism Crises and Impacts on Destinations: A Systematic Review of the Tourism and Hospitality Literature. Journal of Hospitality & Tourism Research, 46(4), 667–695. https://doi.org/10.1177/1096348021994194

Echeverri, A., Furumo, P. R., Moss, S., Figot Kuthy, A. G., García Aguirre, D., Mandle, L., Valencia, I. D., Ruckelshaus, M., Daily, G. C., & Lambin, E. F. (2023). Colombian biodiversity is governed by a rich and diverse policy mix. Nature Ecology & Evolution, 7(3), 382–392. https://doi.org/10.1038/s41559-023-01983-4

Eslava-Zapata, R., & Guerrero-Cristancho, C. F. (2024). Production order costing system management: an empirical study. FACE: Revista De La Facultad De Ciencias Económicas Y Empresariales, 24(1), 111–123. https://doi.org/10.24054/face.v24i1.2946

Eslava-Zapata, R., Arenas-Ochoa, N. R., & Rojas-Ortega, D. L. (2024b). Papeles de Trabajo. Estudio empírico con las Norma Internacional de Control de Calidad 1. Región Científica, 3(1), 2024243. https://doi.org/10.58763/rc2024243

Eslava-Zapata, R., Ferney-Archila, A., Mogrovejo-Andrade, J. M., Chacón-Guerrero, E., & Esteban-Montilla, R. (2024a). Planeación estratégica en empresas comercializadoras de textiles. Universidad Y Sociedad, 16(1), 550-560. https://rus.ucf.edu.cu/index.php/rus/article/view/4358

Flores-Anaya, Y. Z., Salinas-Solís, K. I., & Sorzano-Rodríguez, D. M. (2023). Effects of Financial Education Training on the economic wellbeing of social business. Revista Gestión y Desarrollo Libre, 8(15), 1-14. https://doi.org/10.18041/2539-3669/gestionlibre.15.2023.10348

Gómez Ortiz, E. J., Suarez, D., Herrera Martínez, S.V. (2020). Papel de la gestión empresarial en el postconflicto colombiano. Perspectivas sociales, jurídicas y económicas desde la frontera del Norte de Santander Colombia (págs 255 297). Colombia Universidad Simón Bolívar. https://bonga.unisimon.edu.co/handle/20.500.12442/7233

Gómez-Chaves, M. A., Benavides-Chamorro, K. G., & López-Díaz, V. H. (2024). Relación entre el Ciclo de Caja de Efectivo y la Rentabilidad en las grandes empresas del sector comercio en Colombia. Revista Gestión y Desarrollo Libre, 9(18), 1-14. https://doi.org/10.18041/2539-3669/gestionlibre.17.2024.11824

Gómez-Ortiz, E. J., & Durán, J. J. (2023). Sostenibilidad empresarial en Colombia. Revista Gestión y Desarrollo Libre, 8(16), 1-9. https://doi.org/10.18041/2539-3669/gestionlibre.16.2023.10494

Hernández-Sampieri, R., & Mendoza, C. (2020). Metodología de la investigación: Las rutas cuantitativa, cualitativa y mixta. Mcgraw-hill.

Higuita-González, D. (2019). Análisis de factores de riesgo de liquidez en la MIPYMES de Medellín: estudio de caso MIPYME PRIMS. https://dspace.tdea.edu.co/bitstream/handle/tda/547/ANALISIS%20DE%20FACTORES%20DE%20RIESGO%20DE%20LIQUIDEZ.pdf?sequence=1&isAllowed=y#:~:text=De%20acuerdo%20con%20la%20literatura,obligaciones%20en%20el%20corto%20plazo

Jones, L., Brown, D. and Palumbo, D. (03 de abril de 2020) Coronavirus: A Visual Guide to the Economic Impact. BBC News. https://www.unic.ac.cy/da/2020/05/08/coronavirus-a-visual-guide-to-the-economic-impact-bbc-news/

Karunarathne, A. C. I. D., Ranasinghe, J. P. R. C., Sammani, U. G. O., & Perera, K. J. T. (2021). Impact of the COVID-19 pandemic on tourism operations and resilience: Stakeholders’ perspective in Sri Lanka. Worldwide Hospitality and Tourism Themes, 13(3), 369–382. https://doi.org/10.1108/WHATT-01-2021-0009

Landaverde, L. E. (2023). Desafíos de la Inclusión Financiera en El Salvador. Revista Gestión y Desarrollo Libre, 8(15), 1-12. https://doi.org/10.18041/2539-3669/gestionlibre.15.2023.10496

Ley 1101. (2006). Congreso de la República. Por la cual se modifica la Ley 300 de 1996 - Ley General de Turismo y se dictan otras disposiciones. Bogotá, D.C. Diario Oficial No. 46.461 de 23 de noviembre de 2006. https://www.funcionpublica.gov.co/eva/gestornormativo/norma.php?i=22241

Ley 1558. (2012). Congreso de la República. Por la cual se modifica la Ley 300 de 1996 -Ley General de Turismo, la Ley 1101 de 2006 y se dictan otras disposiciones. Bogotá, D.C. Diario Oficial No. 48.487 de 10 de julio de 2012. https://www.funcionpublica.gov.co/eva/gestornormativo/norma.php?i=48321

Ley 2068. (2020). Congreso de la República. Por la cual se modifica la Ley 300 de 1996 - Ley General de Turismo y se dictan otras disposiciones. Bogotá, D.C. Diario Oficial No. 51.544 de 31 de diciembre de 2020. https://www.funcionpublica.gov.co/eva/gestornormativo/norma.php?i=172558

Ley 300. (1996). Congreso de la República Por la cual se expide la Ley General de Turismo y se dictan otras disposiciones. Bogotá, D.C. Diario Oficial No. 42.845, de 30 de Julio de 1996. Obtenido de https://www.funcionpublica.gov.co/eva/gestornormativo/norma.php?i=8634

López-Díaz, V. H., Gómez-Chaves, M. A., Patiño-Folleco, M. C., & Padilla-Ortiz, V. (2024). Relación entre las estructuras de capital de trabajo y la rentabilidad de pequeñas y medianas empresas del sector construcción de Colombia. Revista Gestión y Desarrollo Libre, 9(18), 1-14. https://doi.org/10.18041/2539-3669/gestionlibre.18.2024.11825

Miklian, J., & Hoelscher, K. (2022). SMEs and exogenous shocks: A conceptual literature review and forward research agenda. International Small Business Journal: Researching Entrepreneurship, 40(2), 178–204. https://doi.org/10.1177/02662426211050796

Modi, R. K. (2024). Economic Contribution and Employment Opportunities of Tourism and Hospitality Sectors. En The Emerald Handbook of Tourism Economics and Sustainable Development (pp. 293–306). Emerald Publishing Limited. https://doi.org/10.1108/978-1-83753-708-220241015

Noguera-López, M. Y. (2023). ¿En qué consiste el Impression Management dentro de la información financiera narrativa que están obligadas a presentar las empresas? Revista Gestión y Desarrollo Libre, 8(16), 1-9. https://doi.org/10.18041/2539-3669/gestionlibre.16.2023.10492

Pant, P., Rathore, P., Dadsena, K. K., & Shandilya, B. (2024). Working capital and firm performance: Role of COVID-19 disruption. International Journal of Productivity and Performance Management, 73(4), 1137–1166. https://doi.org/10.1108/IJPPM-07-2022-0328

Peñafiel, J. (2016). Administración del capital de trabajo y su incidencia en la rentabilidad de la fábrica de aluminios hércules. (Tesis de pregrado). Ecuador: Universidad técnica de Ambato. http://repositorio.uta.edu.ec/bitstream/123456789/20813/1/T2744i.pdf

Ruíz-Molina, O. E., & Carnevali-García, J. L. (2021).Valoración a través del Flujo de Caja Descontado empleando el Costo Promedio Ponderado de Capital y el Valor Presente Ajustado, en Apple Inc. Revista Gestión y Desarrollo Libre, 6(12), 1-23. https://doi.org/10.18041/2539-3669/gestionlibre.12.2021.8714

Škare, M., Soriano, D. R., & Porada-Rochoń, M. (2021). Impact of COVID-19 on the travel and tourism industry. Technological Forecasting and Social Change, 163, 120469. https://doi.org/10.1016/j.techfore.2020.120469

Superintendencia de Sociedades. (2023). Informe Económico - Financiero del Sector Turismo 2019-2021. https://www.supersociedades.gov.co/documents/80312/5975642/Informe-Economico-Financiero-del-Sector-Turismo-2019-2021.pdf?t=1680030977132

Wang, R. (2024). Safeguarding Enterprise Prosperity: An In-depth Analysis of Financial Management Strategies. Journal of the Knowledge Economy, 15(4), 17676–17704. https://doi.org/10.1007/s13132-024-01752-z

FINANCING

None.

CONFLICT OF INTEREST STATEMENT

None.

AUTHORSHIP CONTRIBUTION

Conceptualization: Oscar José Pedraza-Sarabia, Rolando Eslava-Zapata and Nubia Isabel Díaz-Ortega.

Data curation: Oscar José Pedraza-Sarabia, Rolando Eslava-Zapata and Nubia Isabel Díaz-Ortega.

Formal analysis: Oscar José Pedraza-Sarabia, Rolando Eslava-Zapata and Nubia Isabel Díaz-Ortega.

Research: Oscar José Pedraza-Sarabia, Rolando Eslava-Zapata and Nubia Isabel Díaz-Ortega.

Methodology: Oscar José Pedraza-Sarabia, Rolando Eslava-Zapata and Nubia Isabel Díaz-Ortega.

Project administration: Oscar José Pedraza-Sarabia, Rolando Eslava-Zapata and Nubia Isabel Díaz-Ortega.

Software: Oscar José Pedraza-Sarabia, Rolando Eslava-Zapata and Nubia Isabel Díaz-Ortega.

Supervision: Oscar José Pedraza-Sarabia, Rolando Eslava-Zapata and Nubia Isabel Díaz-Ortega.

Validation: Oscar José Pedraza-Sarabia, Rolando Eslava-Zapata and Nubia Isabel Díaz-Ortega.

Visualization: Oscar José Pedraza-Sarabia, Rolando Eslava-Zapata and Nubia Isabel Díaz-Ortega.

Drafting - original draft: Oscar José Pedraza-Sarabia, Rolando Eslava-Zapata and Nubia Isabel Díaz-Ortega.

Writing - proofreading and editing: Oscar José Pedraza-Sarabia, Rolando Eslava-Zapata and Nubia Isabel Díaz-Ortega.