doi: 10.58763/rc2025505

Scientific and Technological Research

Certificación kosher en la industria acuícola colombiana: Caso de implementación en la trucha arcoíris (Onchorhynchus mykiss)

Kosher certification in the Colombian aquaculture industry: Case of rainbow trout (Onchorhynchus mykiss)

Liliana Patricia Mancera Rodríguez1 ![]() *, Raul Fernando Gordillo López1

*, Raul Fernando Gordillo López1 ![]() *, Nicolas Albarracín Bohórquez2

*, Nicolas Albarracín Bohórquez2 ![]() *, Andrea Carolina Piza Jerez3

*, Andrea Carolina Piza Jerez3 ![]() *

*

ABSTRACT

Introduction: in Colombia, the fish farming industry has recently achieved a more stable position in international markets, generating greater productivity at the local level in terms of business size and considering aspects such as the strengthening of the production chain, the adoption of technology, and compliance with health, safety, and quality standards. Under these assumptions, quality certifications are essential for gaining access to new international markets.

Methodology: the objective of the study was to identify the trout production environment in relation to the implementation of certification and its implications for the market. To carry out this work, a literature search was conducted on kosher certification in food products from the fish farming sector, and organizations responsible for granting certification were then contacted.

Results: kosher quality certification, which is of religious origin, has become important for different types of consumers who want to eat nutritious and healthy foods due to market factors. In addition, an overview was established of the administrative requirements that a company in the country must meet in order to obtain this validation.

Conclusions: finally, some aspects of the market that must be considered for certification to be economically viable are analyzed.

Keywords: consumer, financial markets, food, foreign trade.

JEL Classification: Q22, Q13

RESUMEN

Introducción: en Colombia, recientemente la industria piscícola ha logrado un posicionamiento más estable en los mercados internacionales, generando a nivel local mayor productividad en dimensiones empresariales y considerando aspectos como el fortalecimiento de la cadena productiva, la apropiación de tecnología y el cumplimiento de estándares sanitarios de inocuidad y calidad. Bajo estos supuestos, las certificaciones de calidad son elementales para lograr acceder a nuevos mercados internacionales.

Metodología: el objetivo del estudio fue identificar el entorno de la producción de trucha frente a la implementación de la certificación y sus implicaciones en el mercado. Para llevar a cabo este trabajo, se realizó la búsqueda de literatura acerca de la certificación kosher en productos alimenticios del sector piscícola, luego fueron contactadas organizaciones que se encargan de otorgar la certificación.

Resultados: la certificación de calidad Kosher, de origen religioso, debido a factores del mercado ha tomado relevancia en distintos tipos de consumidores cuyo objetivo es consumir alimentos nutritivos y saludables. Además, Se estableció un panorama acerca de los requerimientos a nivel administrativo que debe disponer una compañía en el país para obtener esta validación.

Conclusiones: finalmente, se analizan algunos aspectos del mercado que deben ser considerados para que la certificación pueda ser viable económicamente.

Palabras clave: alimento, consumidor, comercio exterior, mercados de valores.

Clasificación JEL: Q22, Q13

Received: 21-02-2025 Revised: 26-05-2025 Accepted: 26-06-2025 Published: 31-07-2025

Editor:

Alfredo Javier Pérez Gamboa ![]()

1Corporación Unificada Nacional de Educación Superior. Bogotá, Colombia.

2Politécnico Grancolombiano. Bogotá, Colombia.

3Federación Colombiana de Acuicultores. Bogotá. Colombia.

Cite as: Mancera Rodríguez, L. P., Gordillo López, R. F., Albarracín Bohórquez, N., y Piza Jerez, A. C. (2025). Certificación kosher en la industria acuícola colombiana: Caso de implementación en la trucha arcoíris (Onchorhynchus mykiss). Región Científica, 4(2), 2025505. https://doi.org/10.58763/rc2025505

INTRODUCTION

Fish and fish products are chosen for human consumption because they have a profile of essential nutrients that contribute to human health and a healthy diet (Devitiis et al., 2018; FAO, 2024a). Current consumption trends point to choosing products that have quality and safety certifications that provide guarantees and confidence to consumers, as well as their willingness to pay a premium when they know the product's traceability (Dey et al., 2024).

Among the quality seals and certifications in the aquaculture chain, the following elements stand out at the national level. Firstly, good aquaculture production practices and, in terms of processing, good manufacturing practices. In addition, certification of the HACCP (Hazard Analysis and Critical Control Points) certification system and, thirdly, the Colombian fish seal awarded by FEDEACUA.

Likewise, with a view to the international market, the following certifications stand out: ASC (Aquaculture Stewardship Council), also known as the responsible aquaculture process; Global GAP, BAP (Best Aquaculture Practices) certification; and some international certifications that designate their product as socially and environmentally responsible (Hammarlund et al., 2025). Certifications such as the following are also implemented: ISO (14001, 9001, 22000, 45001); FSSC 22000; Halal certification and Kosher certification; and Aquaculture Stewardship Council (ASC) (Hayat et al., 2025; Karim & Almira, 2023; Regenstein & Marinova, 2024; Zanatta et al., 2023).

In the region, Chile has certifications that allow it to maintain its production margins and the most significant trout exports in the world, with large companies such as Salmón de Chile and Aquachile (Rodríguez Rodríguez & Mora Sarmiento, 2017). In the case of Peru, exports have enabled this species to rank fifth in terms of sales, considering key aspects such as quality certifications and their role in accessing foreign markets (Martín & Merino, 2021). Other producers, such as Mexico and Ecuador, have been making progress in certification issues for exports to countries in Asia and Europe (Verboonen, 2013; Morán Rosero, 2019).

Currently, one of the fish species produced in Colombia is trout, which represents production dedicated to breeding, production, processing, and marketing. However, only a few of these have certifications such as HACCP, BAP, and Global GAP (Hammarlund et al., 2025). However, it is necessary to establish what this chain could adopt other certifications by the particularities of the production systems and their alignment with the SDGs.

Similarly, the aquaculture production chain in Colombia emphasizes primary production, focusing on relevant aspects such as genetic improvement, nutrition, production methods, reproduction, etc. However, there are marketing gaps that cause disruption and disarticulation of the chain, including low promotion and marketing. Thus, the value chain develops through the design and need for new products, where its success depends mainly on consumer knowledge (Ortega-Salas, 2016).

Based on the above premises, it is necessary to implement quality certifications that consolidate aquaculture companies, taking into account consumer preferences and the coordination of the value chain. To carry out this study, three stages were considered: the first consisted of searching for information and conducting research to determine the characteristics of Kosher certification in fish species, given the commercial importance of rainbow trout (Oncorhynchus mykiss).

Second, an export trout processing plant was established as a case study for the implementation of Kosher certification. To this end, visits were conducted to verify the conditions of the production and processing plant, in order to associate the factors investigated with the national trout production context. Finally, in the third stage, the results of the research are disseminated and strategies are proposed to producers and entrepreneurs of any fish species who may be interested in obtaining Kosher certification and expanding their market niche.

METHODOLOGY

The study was carried out using the following methodology: A review of the literature based on keyword searches using FAO thesauri (FAO, 2024b). The search was conducted in English and Spanish using search engines such as Scopus, Google Scholar, Ebsco Host, and institutional databases. In addition, the timeline for the review was set by the authors from 2017 to 2024.

About the diagnosis and identification of challenges and opportunities, a visit to a trout processing and export plant in the Andean region was used as a basis. Based on this visit and the contextualization of the production chain, DOFA and PESTEL matrices were developed (Sánchez-Alzate et al., 2020), which allowed for the establishment of the environment and factors involved in Kosher certification.

Subsequently, the conditions of a Kosher market in Colombia and its behavior were reviewed through research on social media, Google Maps, and visits to stores specializing in the sale of Kosher products in the city of Bogotá. Next, a search was conducted for Kosher product certification companies in Colombia to establish the conditions for certification. Finally, the North American external market was segmented and the conditions for obtaining international certification were outlined, taking into account the results at the national level.

RESULTS AND DISCUSSION

Aquaculture context

According to the FAO (2024a), fish consumption in 2021 stood at 20,6 kg/person/year. In Colombia, fish protein consumption in 2023 was recorded at 9,5 kg/person/year (MADR, 2024). It is important to consider how the aquaculture sector has been strengthening its structure in terms of capacity, facilities, and regulations to be able to export, generating exports of 64 000 kg of fish worth USD$143,2 million in 2023 (Acuicultores, 2024).

The destination countries for these products are: the United States, the United Kingdom, Peru, Germany, Canada, Ecuador, Spain, and Chile. In addition, according to the Ministry of Agriculture and the National Council for Aquaculture and Fisheries, aquaculture production centers have been grouped in the departments of Huila, Antioquia, Tolima, Meta, and Cundinamarca, which account for 71% of the country's aquaculture production (MADR 2021a). Also, thanks to the strengthening of the agri-food chain, primary production farms and processing plants have been certified, thus contributing to obtaining safe and quality products.

On the other hand, the MADR (2021b) mentions that among the challenges facing the sector are, among others, the promotion and strengthening of advertising and marketing of aquaculture products. It also mentions improving competitiveness and coordination between public and private institutions for the implementation of Good Aquaculture Practices. It should be noted that in Colombia, 46 primary production units have been recertified with international quality standards and 16 processing plants have HACCP certification (MADR, 2024).

Trout production in Colombia

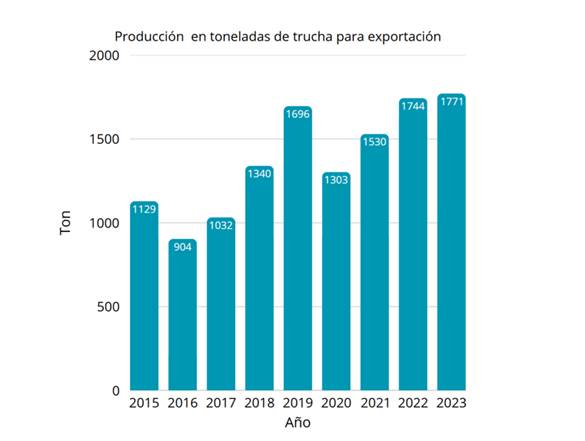

Rainbow trout (Oncorhynchus mykiss) is the third most produced species in the country, but it also stands out in terms of exports. In 2023, 1771 tons were produced, and prices on the domestic market ranged from $15 000 to COP 23 000 per kg (MADR, 2024).

Some challenges facing this production include seed imports, high feed costs, and the cost of setting up the production system. However, Colombia has competitive advantages, as there are no disease risks and therefore no need for antibiotics, resulting in a residue-free product (Beleño, 2017).

Characterization of trout in the international market

According to the FAO (2024a), by 2022, trout and salmon production reached USD 38 billion. Countries such as Norway, Chile, Denmark, Turkey, and Poland led in exports. In terms of production, countries such as Iran, Turkey, Norway, and Chile topped the list of the largest producers, bearing in mind that Iran only supplies its domestic market (FAO, 2020).

According to the Observatory of Economic Complexity (OEC, 2022), the leading exporter is Norway, with a value of $309 million and a 44% share of global exports. Likewise, export growth for the period 2019 to 2020 was 15,3%. Other countries with significant shares are Sweden, Armenia, Turkey, and the United Kingdom.

In South America, the central exporting countries are Colombia, Chile, and Suriname, with shares of 0,46%, 0,37%, and 0,075%, respectively. Among these South American countries, Chile sends 74,7% of its exports to Japan, while 12,3% go to the United States and the remainder to Brazil. Suriname sends 98,3% of its exports to Jamaica and 1,7% to the United States and Canada. In the case of Colombia, 99% of exports go to the United States. Other countries that export trout to the United States are Norway, the United Kingdom, Iceland, Canada, and Australia (OEC, 2022).

According to the annual export and import bulletin (FEDEACUA, 2024), in Colombia, trout exports in 2023 totaled 1771 tons with a FOB (Free on Board) value of $15,7 million, distributed as fresh ($1 856 000), frozen ($253 000), fresh fillets ($5 207 000), and frozen fillets ($7 316 000). Figure 1 shows trout export performance from 2015 to 2023.

|

Figure 1. Colombian trout exports in recent years |

|

|

Source: prepared internally based on the 2024 Annual Export Bulletin. FEDEACUA (2024)

Note: appears in its original language

In the case of Colombia, most exports go to the United States, followed by Canada and Europe (FEDEACUA, 2024). Figure 2 shows the trout products exported by Colombia: whole frozen and fresh (refrigerated), frozen and fresh fillets (FEDEACUA, 2024).

|

Figure 2. Types of products exported from the trout industry |

|

|

Source: prepared internally based on the 2024 Annual Export Bulletin. FEDEACUA (2024)

Note: appears in its original language

Factors such as transport costs, concentrate costs, quality and safety certifications, and lack of introduction into special or segmented markets present a series of threats that could destabilize the chain (FEDEACUA, 2015). Likewise, the main export centers for fresh trout, fresh fillets, and frozen fillets are located in the departments of Cundinamarca, Antioquia, and Risaralda. In the case of frozen trout, the departments with the highest share are Cundinamarca and Valle del Cauca (Ministry of Agriculture and Rural Development, 2021).

Aquaculture quality certifications

According to the FAO (2020), the increase in the marketing, trade, and consumption of fish has led to the creation and adaptation of quality and safety standards and certifications to industry requirements. These are based on the Codex Alimentarius and the implementation of good manufacturing practices and HACCP-certified plants.

Based on the above certifications, in the case of aquaculture products, several certifications are most frequently implemented and have enabled international markets to expand. First, BAP Certification, which includes primary production systems, processing plants, and aquaculture feed mills. In addition, BAP Certification takes into account the environment, social responsibility, animal welfare, food safety, and traceability (Rector et al., 2023).

This certificate is obtained through certifying bodies (Kruk et al., 2024). This certification also allows for market expansion with the support of the Global Seafood Alliance. This certification program is also evaluated and approved by the Global Social Compliance Programme and the Global Sustainable Seafood Initiative. Four links in the chain are certified: primary production (production farms), processing plants, hatcheries (farms dedicated to reproduction), and feed production companies (BAP, 2022a).

The certification is scored with stars to designate the links in which the certification was carried out, with a maximum score of 4 stars and a minimum of 1 star. In the case of Colombia, one producer currently has certification for its production farm and six producers in processing plants, all of which are dedicated to trout production (BAP, 2022b). Along with this certification, in Colombia, the ICA issued Resolution 20186 in 2016, which establishes the sanitary and biosecurity conditions in primary production to receive certification as a biosecure aquaculture establishment (ICA, 2016).

In addition, FEDEACUA awards the Colombian Fish Seal, which aims to highlight products that comply with national regulations and international quality standards. Companies engaged in the processing, transformation, or marketing of aquaculture products can be certified (FEDEACUA, 2021).

In terms of international trade, there is Halal certification: This certification guarantees that products are suitable for consumption by Muslims (Fauzi et al., 2024). It takes into account considerations established by the Koran and Islamic law. This certification is granted by an entity endorsed by the Colombian Arab Chamber of Commerce (CCAC).

Finally, Kosher certification is based on Jewish kashrus laws that underpin the practice of kosher consumption. These laws were initially outlined in the Torah and the Talmud, in accordance with the commandments of Leviticus, one of the books of the Old Testament of the Bible, which establishes the Jewish diet (Gross, 2025). It is based on the term Kosher or Kasher, which means suitable, adequate, clean, or appropriate, while the term treifa is attributed to products that are not kosher. Thus, it considers Kashrut as the basis for compliance.

According to this information, the origin of this seal was initially purely for religious use. Nowadays, there are not only Jewish consumers, but the certification has evolved to include other consumers, such as vegetarians, vegans, or simply people who want to lead a healthier lifestyle and consume products that do not have medium or long-term effects on their health. Kosher certification is gaining strength due to the importance it places on quality, hygiene, and healthiness of its products (Lever et al., 2023).

The integration of quality and safety for global market trends covers a wide range of important issues in kosher foods. These elements include quality, regulatory compliance, safety in the use of food additives, antimicrobial residues and veterinary drugs, aflatoxin in feed, and the application of the HACCP system (Ahmed Osman & Moneim Elhadi Sulieman, 2023).

Kosher certification for fish

Kosher foods play a fundamental role in the diet, economy, and health of Muslims and Jews. This makes the quality, safety, and preservation of kosher foods important issues in these communities and for manufacturers of halal and kosher food products (Ahmed Osman & Moneim Elhadi Sulieman, 2023).

According to Ahmed Osman (2023), harmonizing the requirements for kosher certification would simplify market access, while accurate labeling and traceability are essential for consumer confidence. Logistics and supply chain management are complex, as cultural perceptions and market demand can vary.

According to species from aquaculture, mollusks (e.g., clams, mussels, oysters, squid, and octopus), crustaceans (e.g., shrimp, lobster, and crab), and marine mammals are not kosher species because they lack scales (Blech, 2009). In the case of different fish species, these are suitable for this certification since, as they have scales and rounded, thin fins with smooth edges, the consumption of these species is accepted according to the Torah. The scales and fins on the whole fish must also be perceptible to the consumer (Blech, 2009).

Based on what Blech (2009) mentions, ground fish, canned fish (without skin), fish oil, and skinless fillets are Kosher certified if a Mashgiach (religious supervisor or rabbi) verifies the Kosher status of the fish before processing. The processed product would then be packaged and labeled under the control and supervision of the Mashgiach, which would subsequently bear an appropriate label or mark indicating its Kosher status.

Ground fish or fillets must be properly inspected or, in the case of fillets, contain the skin with scales. Other smoked and processed products require reliable rabbinical inspection (Mohd Shuhaimi et al., 2022). The following is a summary of the process:

· The certification process begins by completing and submitting an application to be certified. Once the application has been made, the institution or synagogue must assign a representative rabbi, who will visit the company's facilities and monitor the entire production process.

· The rabbi will then inform the company of any changes that need to be made in order to obtain certification.

· The rabbi will prepare a report on the status of the company and the annual cost to be borne by the organization. This document will be reviewed by the coordinator, who is responsible for granting or denying certification.

· Once the above steps have been completed, a contract is drawn up with the certification fees for approval so that the certification can be displayed on the product label or packaging (Lytton, 2023).

On the other hand, the term Pareve is defined as a neutral food, that is, a food that does not come from meat or milk. Likewise, the equipment, utensils, and materials used to process Pareve food must not process dairy and meat products on the same production line (Deuraseh, 2022).

Unlike cattle slaughter, the process is more straightforward for fish, as they only need to be supervised during slaughter and processing to ensure that they comply with Kashrut standards. The Mashgiach, or Jewish supervisor, is responsible for ensuring that products such as ground fish, fish oil, fillets, and other products meet the requirements before being processed. Some fillets or products from which the scales have been removed can also be checked for indentations in the skin (Blech, 2009).

It should be noted that the costs of Kosher certification vary depending on the review carried out by the rabbi. Some factors influence this variation, such as the complexity of the processes, the location of the company, the quantity of food to be certified, and the costs of the review (Hossain et al., 2022). Products that have been certified under this scheme include trout, rainbow trout, smoked trout, brook trout, fillets, marinated trout, cold-smoked trout, hot-smoked trout, trout eggs, and butterfly-cut trout (Star-k, 2022).

Diagnosis and identification of challenges and opportunities

Tables 1, 2, 3, and 4 describe the trout supply chain environment in relation to the production and implementation of Kosher quality certification. Similarly, the PESTEL matrix is shown, which was used to create the DOFA matrix to adjust the trout production and export scenario in Colombia.

|

Table 1. Factors related to the impact on trout production companies for export |

||

|

Policies |

Economic |

Cultural partner |

|

1. Land use policies |

1. Inflation |

1. Job creation in the region |

|

2. Imported products |

||

|

3. Production costs |

||

|

4. Exports |

||

|

5. Balanced feed prices |

||

|

Technological |

Ecological - environmental |

Legal regulations |

|

1. Access to the production plant |

1. Waste utilization |

1. BAP compliance |

|

2. Use of equipment that generates operational efficiency |

2. Use of electricity and water |

2. HACCP compliance |

|

3. Transportation |

3. Effluent treatment |

3. Kosher compliance |

|

4. Product lines |

4. Compliance with prerequisites |

4. Health registration for valuable products |

|

Source: own elaboration |

||

|

Table 2. Impact factor for companies in the Andean region |

||||||

|

Aspects |

Impact |

|||||

|

No. |

Very negative |

Negative |

Indiferent |

Positive |

Very positive |

|

|

Political |

1 |

X |

||||

|

Economic |

1 |

X |

||||

|

2 |

X |

|||||

|

3 |

X |

|||||

|

4 |

X |

|||||

|

5 |

X |

|||||

|

1 |

X |

|||||

|

Sociocultural Technological |

1 |

X |

||||

|

2 |

X |

|||||

|

3 |

X |

|||||

|

4 |

X |

|||||

|

|

1 |

X |

||||

|

2 |

X |

|||||

|

3 |

X |

|||||

|

4 |

X |

|||||

|

Ecological |

1 |

X |

||||

|

2 |

X |

|||||

|

3 |

X |

|||||

|

4 |

X |

|||||

|

Source: own elaboration |

||||||

|

Table 4. Strategies obtained from the analysis of the DOFA matrix |

|

|

So strategies |

Wo strategies |

|

Communicate to stakeholders the importance of implementing certification for the expansion of new markets. Trace production processes, guaranteeing the safety and quality of the final product to customers. Identify potential markets both nationally and internationally. |

Develop programs focused on finding and expanding new markets. Stay ahead of trends and customer preferences. Create valuable content about trout that is of interest to hyperconnected and hyperinformed customers. Carry out marketing campaigns to boost trout consumption nationwide. |

|

St strategies |

Wt strategies |

|

Installed capacity would allow for an increase in production volume. Fish consumption could increase as it is considered a healthy product. Price of other animal proteins |

Encourage trout consumption within the country Identify the causes of price variations in the purchase of seeds and inputs and thus establish the best way to optimize production costs. |

|

Source: own elaboration |

|

Strategies to consider for the implementation of Kosher certification include:

· Validity of certifications

· Monitoring and control of production lines established in each procedure to ensure product quality, safety, and purity.

· Segmenting the market in order to identify potential customers.

· Increasing domestic trout production while ensuring compliance with good practices and with a view to strengthening sales growth through the implementation of Kosher certification.

Marketing Plan

Below is an overview of market segmentation, general characteristics of end consumers, advantages of certification, companies that could certify the product, and the behavior of the Kosher product market in Colombia.

Characteristics of Kosher consumers

Consumers are increasingly concerned about the food products they put on their tables. For this reason, Kosher foods provide consumers with confidence about the origin, hygiene, purity, and quality of each certified product (Berry, 2017). In Europe and North America, 50% of products for human consumption are certified Kosher (Cobo Barrios & Díaz Manzano, 2020; Monteblanco, 2017). Different markets can be identified among consumers of Kosher products, including those discussed below.

a) Jewish consumers: in principle, Kosher foods were intended for Jews, as the preparation of their foods is strictly governed by the parameters set forth in the sacred writings of the Old Testament. However, today it is estimated that 80% of Kosher product consumption occurs outside the Jewish market (Berry, 2017).

b) Muslim consumers: this market was also opened up to the millions of practicing Muslims around the world, as their dietary regimes are very similar to Jewish diets and Kosher food certification guarantees that these parameters are met (Regenstein & Marinova, 2024).

c) Consumers of other religions: along the same lines of religion, Seventh-day Adventists and some branches of Christianity are found in smaller proportions, where certain dietary specifications are also part of Judaism, such as the prohibition of pork (Nam, 2023).

d) Health-conscious consumers: this type of consumer includes celiacs and those who have diets that restrict gluten consumption because their bodies cannot digest it. Within this same classification, we find those who are lactose intolerant and for whom certification guarantees that foods have not been mixed with any type of dairy product (Worldwide Kosher Certification, 2017). In the United States, it is estimated that there are two million people with celiac disease and between 30 and 50 million people who are lactose intolerant, including African Americans, Asians, and Americans (Star-K, 2018). Many lactose-intolerant and celiac consumers prefer to look for foods with Kosher seals on their labels, as it is often difficult for consumers to check ingredients and products with these seals make their search easier (OU Kosher Staff, 2017).

e) Millennial consumers: these consumers represent a huge potential market for Kosher foods, as they have increasingly greater access to information, becoming hyperconnected and hyperinformed consumers who are increasingly concerned about what they consume.

These are people who check labels and nutritional tables on products before purchasing them, consumers who explore the internet looking for references for these products, and who like to take care of themselves. Within this classification, we can find vegetarians and vegans (Kadam & Deshmukh, 2020).

CONCLUSIONS

The consumption of Kosher-certified products in Colombia is mainly oriented towards food industries that have certified several products in their portfolio, as the foreign market represents a good niche. Large SMEs have the resources to export Kosher-certified products and guarantee a return on this investment.

About the fish farming industry, it is recommended that Kosher certification be evaluated as an investment to export to foreign markets. In particular, it is suggested that countries be identified where consumers tend to purchase balanced, nutritious foods and avoid industrialized products.

Finally, the implementation of Kosher certification could achieve market diversification, generating competitiveness and opening up new market niches. However, for the Colombian aquaculture industry, it is necessary to consider financially evaluating the investment in aspects such as infrastructure. It is also key to strategically plan prior compliance with Colombian regulations, such as the implementation of good manufacturing practices and prerequisite programs, to consider the possibility of Kosher certification.

REFERENCES

Acuicultores. (2024). Federación Colombiana de Acuicultores. 1(19). https://fedeacua.org/files/acuicultores_19_baja1.pdf

Ahmed Osman, O. (2023). Kosher and Halal Food Dissimilarities and Challenges in Accessing International Markets. En Halal and Kosher Food (pp. 55–65). Springer International Publishing. https://doi.org/10.1007/978-3-031-41459-6_5

Ahmed Osman, O., & Moneim Elhadi Sulieman, A. (2023). Halal and Kosher Food: Integration of Quality and Safety for Global Market Trends. Springer International Publishing. https://doi.org/10.1007/978-3-031-41459-6

BAP. (2022a). BAP Certified Aquaculture Producers. Logo requirements. https://www.bapcertification.org/Standards

BAP. (2022b). BAP Certified Aquaculture Producers. BAP Certified Aquaculture Producers. https://www.bapcertification.org/Producers

Beleño, I. (2017). La trucha, el oro azul de la agroindustria colombiana. Agronegocios. https://www.agronegocios.co/ganaderia/la-trucha-el-oro-azul-de-la-agroindustria-colombiana-2623114#

Berry, D. (2017). The trends fueling kosher certification. Food Business News. https://www.foodbusinessnews.net/articles/9015-the-trends-fueling-kosher-certification

Blech, Z. Y. (2009). Kosher Food Production (1a ed.). Wiley. https://doi.org/10.1002/9780813804750

Cobo Barrios, A., & Díaz Manzano, A. (2020). Sello Kosher: Motivaciones empresariales para su desarrollo en Colombia. https://repository.universidadean.edu.co/entities/publication/c01f2532-517c-4af1-b5c0-252da911d4a8

De Devitiis, B., Carlucci, D., Nocella, G., Viscecchia, R., Bimbo, F., y Nardone, G. (2018). Insights for the Development of a Functional Fish Product: Drivers and Barriers, Acceptance, and Communication of Health Benefits. Journal of Aquatic Food Product Technology,27(4): 430-445. https://doi.org/10.1080/10498850.2018.1447059

Deuraseh, N. (2022). Food safety aspects of cell-based food. World Health Organization. https://www.researchgate.net/profile/Nurdeng-Deuraseh/publication/356628121_The_Ideas_of_Halal_Contemporary_Products/links/62425a825e2f8c7a03466bb3/The-Ideas-of-Halal-Contemporary-Products.pdf

Dey, M. M., Rahman, Md. S., Dewan, Md. F., Sudhakaran, P. O., Deb, U., & Khan, Md. A. (2024). Consumers’ willingness to pay for safer fish: Evidence from experimental auctions in Bangladesh. Aquaculture Economics & Management, 28(3), 460–490. https://doi.org/10.1080/13657305.2024.2353212

FAO. (2020). El estado mundial de la pesca y la acuicultura 2020. La sostenibilidad en acción. https://doi.org/https://doi.org/10.4060/ca9229es

FAO. (2024a). El estado mundial de la pesca y la acuicultura 2024. La transformación azul en acción. JE In El estado mundial de la pesca y la acuicultura 2024. FAO. https://doi.org/10.4060/cd0683es

FAO. (2024b). AGROVOC Multilingual thesaurus. https://agrovoc.fao.org/browse/agrovoc/en/

Fauzi, M. A., Mohd Ali, N. S., Mat Russ, N., Mohamad, F., Battour, M., & Mohd Zaki, N. N. (2024). Halal certification in food products: Science mapping of present and future trends. Journal of Islamic Marketing, 15(12), 3564–3580. https://doi.org/10.1108/jima-12-2023-0407

FEDEACUA. (2015). Plan de negocios sectorial de la piscicultura en Colombia. https://fedeacua.org/files/plannegociopiscicola2015_1.pdf

FEDEACUA. (2021). Fedeacua. Sello de calidad. https://fedeacua.org/page/sellocalidad

FEDEACUA. (2024). Boletín anual de exportaciones e importaciones diciembre de 2024. Federación Colombiana de Acuicultores.

Gross, W. (2025). How the Holy Books became Holy: Their Origin and Function. En W. Gross, Don’t Believe, What You Think (pp. 93–101). Springer Berlin Heidelberg. https://doi.org/10.1007/978-3-662-70878-1_7

Hammarlund, C., Svensson, K., Asche, F., Bronnmann, J., Osmundsen, T., & Nielsen, R. (2025). Eco-Certification in Aquaculture – Economic Incentives and Effects. Reviews in Fisheries Science & Aquaculture, 33(3), 402–415. https://doi.org/10.1080/23308249.2024.2440712

Hayat, N., Mustafa, G., Naeem, M., Alotaibi, B. A., & Traore, A. (2025). Assessing the impact of environmental, occupational health and safety, and food safety management systems on the sustainable performance of food processing companies. Frontiers in Sustainable Food Systems, 9, 1491456. https://doi.org/10.3389/fsufs.2025.1491456

Hossain, M. A. M., Uddin, S. M. K., Sultana, S., Wahab, Y. A., Sagadevan, S., Johan, M. R., & Ali, Md. E. (2022). Authentication of Halal and Kosher meat and meat products: Analytical approaches, current progresses and future prospects. Critical Reviews in Food Science and Nutrition, 62(2), 285–310. https://doi.org/10.1080/10408398.2020.1814691

ICA. (2016). Resolución 20186 de 2016. Por medio de la cual se establecen las condiciones sanitarias y de bioseguridad en la producción primaria de animales acuáticos, para obtener el certificado como establecimiento de acuicultura bioseguro. https://www.ica.gov.co/getattachment/b62ccb80-5075-4f3a-b4f3-4ae983949c17/2016R20186.aspx

Kadam, A., & Deshmukh, R. (2020, febrero). Kosher Food Market by Product Type (Culinary Products, Snacks & Savory, Bakery & Confectionery Products, Meat, and Others), and Distribution Channel (Supermarkets & Hypermarket, Grocery Stores, and Online Stores): Global Opportunity Analysis and Industry Forecast 2019–2026. https://www.alliedmarketresearch.com/Kosher-food-market-A06022

Karim, M. F., & Almira, J. (2023). NGO and Global Voluntary Standards in Sustainable Seafood: The Case of Aquaculture Stewardship Council (ASC) in Indonesia. The Journal of Environment & Development, 32(2), 165–191. https://doi.org/10.1177/10704965231158568

Kruk, S. R. L., Toonen, H. M., & Bush, S. R. (2024). Digital sustainability assurance governing global value chains: The case of aquaculture. Regulation & Governance, 18(4), 1153–1170. https://doi.org/10.1111/rego.12571

Lever, J., Vandeventer, J. S., & Miele, M. (2023). The ontological politics of kosher food: Between strict orthodoxy and global markets. Environment and Planning A: Economy and Space, 55(2), 255–273. https://doi.org/10.1177/0308518X221127025

Lytton, T. D. (2023). Private third-party verification of product claims: Lessons from kosher certification. En Research Handbook on International Food Law (pp. 387–408). Edward Elgar Publishing. https://doi.org/10.4337/9781800374676.00033

MADR. Ministerio de Agricultura y Desarrollo Rural (2021a). Exportaciones piscícolas totalizaron 12.898 toneladas y sumaron US$70,1 millones. https://www.minagricultura.gov.co/noticias/Paginas/Exportaciones-pisc%C3%ADcolas-totalizaron-12-898-toneladas-y-sumaron-US$70,1-millones-.aspx/#:~:text=Bogot%C3%A1%2C%2019%20de%20febrero%20de,sumar%20US%2470%2C1%20millones

MADR. Ministerio de Agricultura y Desarrollo Rural. (2021b). Acuicultura en Colombia. Cadena de la acuicultura. https://sioc.minagricultura.gov.co/Acuicultura/Documentos/2021-06-30%20Cifras%20Sectoriales.pdf

MADR. Ministerio de agricultura y desarrollo rural. (2024). Dirección de Cadenas Pecuarias, Pesqueras y Acuícolas. https://www.minagricultura.gov.co/ministerio/direcciones/Paginas/Direccion-de-Cadenas-Pecuarias.aspx

Ministerio de Agricultura y Desarrollo Rural. (2021). Cifras sectoriales de la acuicultura en Colombia . SIOC - Sistema de Información para la Acuicultura Colombiana. https://sioc.minagricultura.gov.co/Acuicultura/Documentos/2019-06-30%20Cifras%20Sectoriales.pdf

Mohd Shuhaimi, A. A., Ab Karim, M. S., Mohamad, S. F., Ungku Zainal Abidin, U. F., & Arsyad, M. M. (2022). A Review on Halal and Kosher Regulations, Certifications, and Industrial Practices. International Journal of Academic Research in Business and Social Sciences, 12(2). https://doi.org/10.6007/ijarbss/v12-i2/12175

Monteblanco, S. (2017). Certificación Kosher y Halal: Considerando el mercado Kosher y halal en el Perú. https://repositorio.promperu.gob.pe/items/ffcd086f-b288-41bd-95ab-bdf104f3afcc

Morán Rosero, A. Y. (2019). Estudio de factibilidad para la comercialización en los mercados internacionales de trucha congelada de la Asociación acuícola “Integración Santa Rosa” de la comunidad Santa Rosa- Sucumbíos. https://repositorio.upec.edu.ec/items/84c849bd-da6e-48da-a0d2-cddbf113eb63/full

Nam, J. J. (2023). Four distinctive Christian denominations. En World Religions for Healthcare Professionals (pp. 174–190). Routledge. https://doi.org/10.4324/9781003288862-13

OEC. (2022). Observatorio de complejidad económica. Pescado trucha y filete. https://oec.world/es/profile/hs/fish-frozen-trout-salmo-trutta-oncorhynchus-mykiss-oncorhynchus-clarki-oncorhynchus-aguabonita-oncorhynchus-gilae-oncorhynchus-apache-and-oncorhynchus-chrysogaster-excluding-fillets-livers-roes-and-other-fish-meat-of-heading-0304

Ortega-Salas, A. L. (2016). Red empresarial como estrategia asociativa organizacional para producción y comercialización de trucha en el municipio de Pasto, Nariño Colombia. Orinoquia, 20(2), 60-70. https://www.redalyc.org/articulo.oa?id=89659214007

OU Kosher Staff. (2007). The Power of Pareve. OU Kosher. https://ouKosher.org/blog/industrial-Kosher/the-power-of-Pareve/

Rector, M. E., Filgueira, R., Bailey, M., Walker, T. R., & Grant, J. (2023). Sustainability outcomes of aquaculture eco‐certification: Challenges and opportunities. Reviews in Aquaculture, 15(2), 840–852. https://doi.org/10.1111/raq.12763

Regenstein, J. M., & Marinova, D. (2024). The Impact of Kosher and Halal on Consumers. En D. Bogueva (Ed.), Consumer Perceptions and Food (pp. 45–65). Springer Nature Singapore. https://doi.org/10.1007/978-981-97-7870-6_3

Rodríguez Rodríguez, A., & Mora Sarmiento, H. L. (2017). Plan de Marketing internacional para exportar filete de trucha arco iris a Canadá. http://polux.unipiloto.edu.co:8080/00003961.pdf

Sánchez-Alzate, J. A., Viana-Rua, N. E., Pino-Martínez, A. A., & Gómez-Navarro, R. M. (2020). Vigencia de los conceptos, métodos, herramientas y matrices de la planeación estratégica: una revisión bibliográfica. Revista Modum, 2, 189-204. https://revistas.sena.edu.co/index.php/Re_Mo/article/view/3030

Star-K. (2018). THE GLOBAL DEMAND FOR KOSHER. https://www.star-k.org/articles/articles/getting-certified/advantage-Kosher-certification/1373/the-global-demand-for-Kosher/

Star-k. (2022). STAR-K Anisakis Fish Policy. STAR-K Kosher Certification https://www.star-k.org/articles/wp-content/uploads/RST.FISH_POLICY_ANISAKIS_AUG19_2022.pdf

Verboonen, E. (2013). Modelo para la evaluación económica de la producción orgánica de trucha (Oncorhynchus mykiss) en Michoacán. http://bibliotecavirtual.dgb.umich.mx:8083/xmlui/handle/DGB_UMICH/1870

Worldwide Kosher Certification. (2017, junio). KOSHER CERTIFICATION GROWTH AROUND THE WORLD. https://www.klbdKosher.org/news-and-articles/Kosher-certification-growth-around-the-world/

Zanatta, J. A. A. C., Fidelis, R., & Sakanaka, L. S. (2023). Method for selecting certification standards for food safety. Food Security, 15(4), 1071–1085. https://doi.org/10.1007/s12571-023-01370-8

FINANCING

The authors received funding for this project from the Colombian Federation of Aquaculture Producers (FEDEACUA).

CONFLICT OF INTEREST STATEMENT

The authors declare that there is no conflict of interest.

ACKNOWLEDGEMENTS

To the Colombian Federation of Aquaculturists (FEDEACUA) for its unconditional support in data collection and advice in the preparation of this manuscript.

AUTHORSHIP CONTRIBUTION

Conceptualization: Liliana Patricia Mancera Rodríguez, Andrea Carolina Piza Jerez.

Data curation: Raul Fernando Gordillo López.

Formal analysis: Raul Fernando Gordillo López.

Fund acquisition: Andrea Carolina Piza Jerez.

Research: Nicolas Abarracín Bohorquez.

Methodology: Nicolas Abarracín Bohorquez.

Project management: Liliana Patricia Mancera Rodríguez.

Resources: Andrea Carolina Piza Jerez.

Supervision: Liliana Patricia Mancera Rodríguez.

Validation: Liliana Patricia Mancera Rodríguez.

Visualization: Andrea Carolina Piza Jerez.

Writing – original draft: Raul Fernando Gordillo López and Liliana Patricia Mancera Rodríguez.

Writing – proofreading and editing: Nicolas Abarracín Bohorquez.