doi: 10.58763/rc2025497

Scientific and Technological Research

Multiagent simulation to analyze the export behavior of honduran SMEs: a NetLogo-based model

Simulación multiagente para analizar el comportamiento exportador de las PYMES: un modelo basado en NetLogo

Marlene Sarahi Domínguez-Fernández1 ![]() *, Geovina Yamileth Martínez1

*, Geovina Yamileth Martínez1 ![]() *

*

ABSTRACT

Introduction: the study analyzes the export behavior of SMEs (small and medium-sized enterprises) in Honduras using a multi-agent simulation approach with the NetLogo platform. The main objective is to understand how internal and external dynamics influence the export decisions of these companies.

Methodology: the simulation model incorporates factors such as international business networks, tariff barriers, and government support policies, key aspects for the competitiveness of SMEs in global markets.

Results: through computational experiments, the interactions between SMEs and their export environment are modeled, highlighting the importance of business relationships and access to international networks as key determinants of export success. Additionally, institutional intervention emerges as a crucial catalyst, with public policies facilitating the integration of SMEs into global markets.

Conclusions: the study suggests that SMEs with greater access to business networks and robust institutional support gain a significant competitive advantage, achieving better performance in global markets. These findings have implications for the design of public policies and strategies that promote the internationalization of Honduran enterprises.

Keywords: economic competition, experimentation, international trade, small enterprises.

JEL Classification: C63, F14, L25

RESUMEN

Introducción: el estudio analiza el comportamiento exportador de las PYMEs (pequeñas y medianas empresas) en Honduras utilizando un enfoque de simulación multiagente con la plataforma NetLogo. El objetivo principal es comprender cómo las dinámicas internas y externas influyen en las decisiones exportadoras de estas empresas.

Metodología: el modelo de simulación incluye factores como las redes comerciales internacionales, las barreras arancelarias y las políticas de apoyo gubernamental, aspectos cruciales para la competitividad de las PYMES en mercados internacionales.

Resultados: a través de experimentos computacionales, se modelan las interacciones entre las PYMES y su entorno exportador, destacando la importancia de las relaciones comerciales y el acceso a redes internacionales como factores determinantes en el éxito de las exportaciones. Además, la intervención institucional se muestra como un catalizador clave, con políticas públicas que facilitan la integración de las PYMES en mercados internacionales.

Conclusiones: el estudio sugiere que las PYMES que cuentan con un mayor acceso a redes comerciales y un apoyo institucional robusto tienen una ventaja competitiva significativa, logrando un mejor desempeño en los mercados globales. Estos hallazgos poseen implicaciones para el apoyo en el planteamiento de políticas públicas, de estrategias que promuevan la internacionalización de las empresas hondureñas.

Palabras clave: comercio internacional, competencia económica, experimento, pequeña empresa.

Clasificación JEL: C63, F14, L25

Received: 14-11-2024 Revised: 17-02-2025 Accepted: 24-04-2025 Published: 31-07-2025

Editor:

Alfredo

Javier Pérez Gamboa ![]()

1Universidad Nacional Autónoma de Honduras. Comayagua, Honduras.

Cite as: Domínguez-Fernández, M. y Martínez, G. (2025). Simulación multiagente para analizar el comportamiento exportador de las PYMES: un modelo basado en NetLogo. Región Científica, 4(2), 2025497. https://doi.org/10.58763/rc2025497

INTRODUCCIÓN

Globalization has profoundly transformed the dynamics of international trade, creating simultaneous opportunities and challenges for small and medium-sized enterprises (SMEs) in developing economies such as Honduras. Although these productive units represent a significant percentage of employment and national economic activity, their participation in international markets remains limited due to structural and competitive factors (Gkypali et al., 2021). SMEs face critical barriers related to access to finance, lack of knowledge of foreign markets, and lack of effective commercial networks (Dorasamy & Kikasu, 2024).

In this context, understanding how SMEs can enhance their export capacity through computational models is essential (Ghafoorpoor Yazdi et al., 2023). Agent-based simulations are emerging as an innovative methodology for analyzing these processes, as they facilitate controlled experimentation with complex variables that influence export behavior (Antelmi et al., 2022).

This methodological approach becomes even more relevant when considering that exports are a crucial component of economic growth in Honduras, where SMEs play a vital role (Urban et al., 2023). Data from the SICA statistical report confirm that MSMEs contribute substantially to regional export volume (Olivares et al., 2020), emphasizing the need to analyze the factors that condition their international capabilities.

The specific challenges faced by these companies, such as credit constraints and limitations on production scale, require analytical approaches that go beyond traditional methods. Previous studies consistently identify insufficient market intelligence and financial barriers as key obstacles (Kazantsev et al., 2022; McKee et al., 2023). From the authors' perspective, multi-agent simulations offer a robust framework for examining these dynamics, as they allow for the modeling of systemic interactions between economic agents under variable conditions.

For this research, the NetLogo programming environment was adopted, as it is a tool specialized in modeling complex phenomena using autonomous agents (Philippi et al., 2020). This approach facilitated the construction of a model that simulates the strategic interactions between Honduran SMEs and their export environment, to predict behaviors and evaluate hypothetical scenarios. The results provide valuable insights for designing effective support policies and optimizing internationalization strategies in emerging economies.

METHODOLOGY

Multiagent model design

This study implemented NetLogo software to develop an agent-based simulation model that captures the export behavior of Honduran SMEs. The design incorporates key parameters that influence internationalization decisions, structured into three interconnected dimensions: 1) business attributes (size, productive capacity, access to finance), 2) market conditions (transportation costs, tariffs), and 3) institutional environments (government policies, business networks) (Mendy et al., 2020; Martins et al., 2023). Each agent represents an SME with autonomous decision rules derived from quantifiable variables (Table 1).

|

Table 1. Netlogo SME symbology. |

||

|

Description |

Symbol |

Function |

|

Green houses |

|

SME |

|

Yellow houses |

|

International market/distributors |

|

Faces |

|

Competitors |

|

Patch |

|

Transport |

|

Patch |

|

Raw materials |

|

Person |

|

Skills |

|

Person |

|

Creativity |

|

Wheel |

|

Technology |

|

Truck |

|

Raw materials |

|

Arrows |

|

Communication |

Source: own elaboration.

Basic foundations of the multiagent approach

Agent-based models (ABMs) are validated computational tools for analyzing complex economic phenomena (Axtell & Farmer, 2025). In this sense, their analytical power lies in simulating microeconomic interactions that generate emerging patterns at the macro level (Cincotti et al., 2022). In the approach taken, SMEs operate as autonomous entities whose decisions are based on: access to market information, availability of financial resources, presence of trade barriers, and quality of their inter-company networks (Karami et al., 2023; Xu et al., 2022). NetLogo provides the technical environment for this purpose by allowing the modeling of adaptive systems using programmable agents (Flache & De Matos Fernandes, 2021).

Implementation and analytical capabilities

The model's architecture simulates dynamic scenarios where agents interact with international markets and regulatory frameworks. This flexibility allows us to:

· Assess the impact of specific policies (trade agreements, subsidies, tariff reductions) on export rates (Gress & Kalafsky, 2022; Susanty et al., 2023).

· Quantify how internal constraints (credit limits, production scalability) inhibit international expansion (Martins et al., 2023).

· Identify emerging patterns in business cooperation networks that facilitate market access (Yuana et al., 2021).

Simulations generate time projections that link individual decisions to aggregate trends, thus providing a virtual laboratory for policy testing.

RESULTS AND DISCUSSION

The results reveal that dense and diversified commercial networks are a determining factor in the export performance of Honduran SMEs. Companies embedded in these relational ecosystems show greater capacity for growth in international markets, as they have access to strategic information and decisive commercial contacts (Bai et al., 2021; Caputo et al., 2022). In contrast, SMEs with limited networks or operational isolation face persistent difficulties in adapting to global dynamics, a situation that reinforces recent findings on the centrality of relational capital (Chaudhuri et al., 2024; Gkypali et al., 2021).

At the same time, institutional support emerges as a critical lever. Simulations confirm that training programs, export subsidies, and mediation in international networks substantially increase the probability of export success, in line with research highlighting the role of government as a structural facilitator (Ong et al., 2022; Fredrich et al., 2022). This effect is enhanced when policies are coordinated with the reduction of tariff barriers, as systematic tax relief increases the commercial viability of SMEs according to patterns observed in free trade agreements (Smallbone et al., 2022).

However, structural constraints remain that require priority attention. Insufficient productive capacity and restricted access to international markets continue to limit the global competitiveness of these firms. These constraints explain most of the cases of export withdrawal identified in the simulations, underscoring the need for multisectoral interventions to overcome these bottlenecks.

Growth and failure of SMEs

Internationalization theories provide the interpretative framework for the SME typology identified in the model. Four fundamental categories are distinguished:

The first type adopts an incremental approach aligned with the Uppsala model, where companies prioritize the accumulation of knowledge and experience in international markets before scaling up their commitment by establishing distribution centers or production facilities. These characteristics contrast with the second type, which operates according to the principles of international entrepreneurship theory, characterized by the aggressive pursuit of global opportunities and accelerated value creation.

A third group bases its strategy on the formation of collaborative networks to capture export orders, relying critically on relationships with trading partners for their international performance. Finally, the fourth type integrates business and social dimensions through horizontal networks with other SMEs. Each business unit develops a dual threshold of perceived wealth and accumulated experience that determines its capacity for internationalization in specific regions, variables that differ substantially according to organizational nature. This heterogeneity explains why SMEs of the first type show greater risk aversion and strategic conservatism in their international expansion processes.

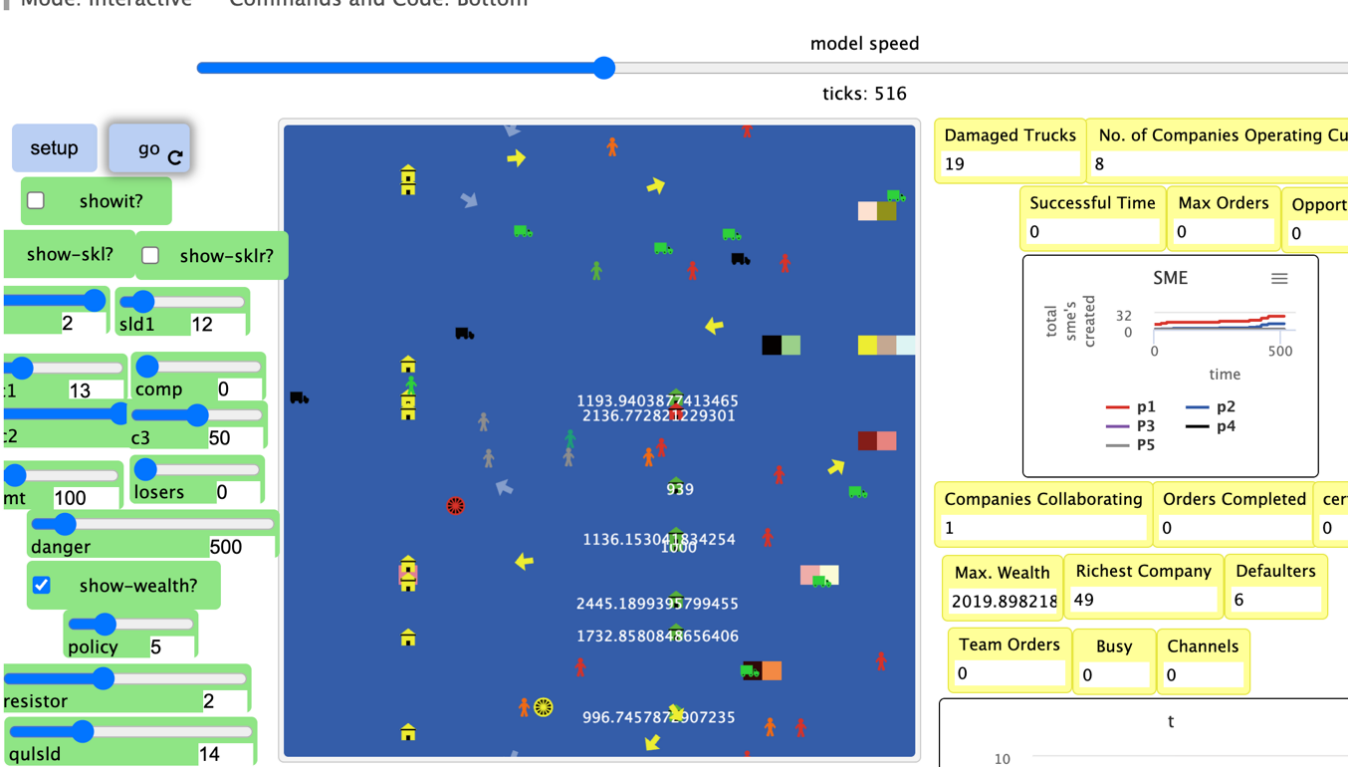

The NetLogo simulation shown is an example of an ABM for analyzing the internationalization of small and medium-sized enterprises (SMEs) in a country (Figure 1). This type of simulation allows modeling and observing emerging behavior in an environment where multiple agents interact under specific rules and conditions.

|

Figure 1. Simulation 1—NetLogo |

|

|

Source: own elaboration

Simulation analysis

Initial configuration and parameters

The model has a series of adjustable parameters (such as sld1, comp, danger, policy, among others) that allow different aspects of the simulation to be controlled by the researcher. These parameters are critical for establishing the initial conditions of the environment in which SMEs operate. For example, the danger parameter could be related to international market risks, while policy could represent government policies that affect the ease of exporting.

Agents and environment

The agents in the simulation represent different actors in the internationalization ecosystem, such as companies (represented by different icons), transport trucks, and possibly other trade intermediaries. The environment in which these agents operate includes infrastructure elements (such as yellow houses) and obstacles (possibly damaged trucks). Each agent follows specific rules that determine its behavior, such as the decision to collaborate with other companies, complete orders, or manage resources.

Emerging dynamics

As the simulation progresses (indicated by the “ticks”), we observe how interactions between agents produce emerging dynamics, such as the creation of small and medium-sized enterprises (SMEs created), the number of damaged trucks, and collaboration between companies (Companies Collaborating). The SME graph on the right shows the evolution over time of companies created at different levels (p1, p2, etc.), reflecting the success or failure of the policies implemented in the simulation.

Key indicators

Indicators such as Max. Wealth, Richest Company, and Orders Completed are critical for evaluating the success of internationalization. An increase in maximum wealth (Max. Wealth) or the number of completed orders suggests that SMEs are succeeding in their international expansion. The number of defaulters (companies that do not fulfill their commitments) is also an important indicator, as a high number could suggest problems in risk management or in the ability of companies to adapt to international markets (Figure 2).

|

Figure 2. Internationalization of SMEs in a country |

|

|

Source: own elaboration

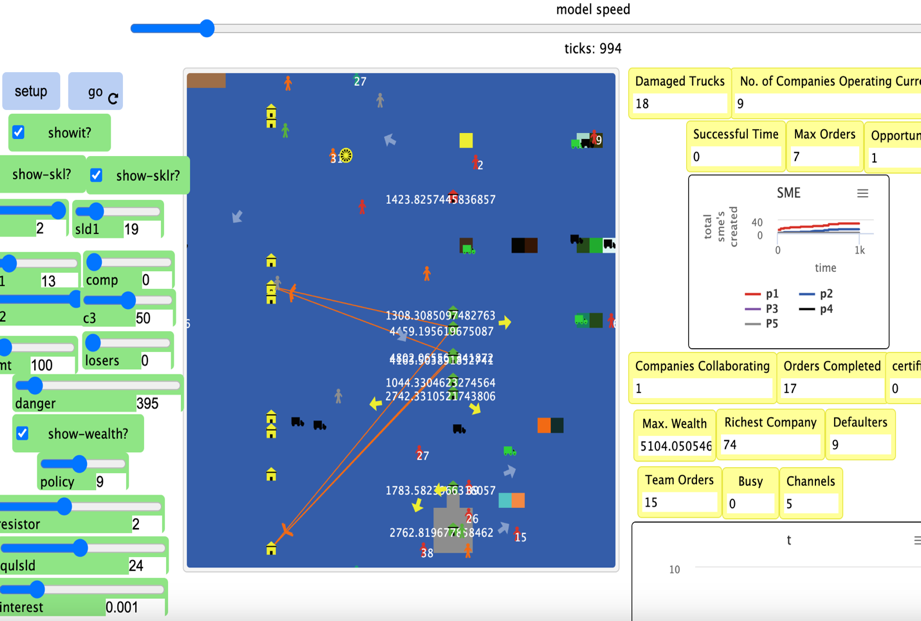

To validate the model, a series of virtual experiments was conducted using agent configurations that reflect fundamental characteristics of Honduran SMEs (Figure 3). These configurations include variables such as company size, production capacity, export experience, and access to commercial networks. Additionally, external factors such as government policies, export tariffs, and international market conditions were included by the authors following the recommendation of the literature (Weerawardena et al., 2020).

|

Figure 3. Example of simulated scenario – 1. |

|

|

Source: own elaboration

The simulated scenarios reveal consistent patterns regarding the determinants of SME internationalization. First, direct government support, particularly through export subsidies and specialized training programs, was found to correlate with significant improvements in export performance compared to companies without such benefits (Felzensztein et al., 2022). Complementarily, the density of international trade networks emerges as a critical variable for access to new markets, confirming recent studies on relational architectures in emerging economies (Johanson & Oliveira, 2024).

On the other hand, trade barriers, both tariff and non-tariff, are a key restrictive factor. Simulations show that high levels of these barriers severely limit the expansion capacity of SMEs, reinforcing previous research on the need to reduce them through international agreements (Yang et al., 2023). This finding underscores the value of simulation-based approaches for designing strategies tailored to specific contexts, such as Honduras (Cho et al., 2023).

CONCLUSIONS

This study confirms that agent-based simulations offer a robust methodology for analyzing international trade dynamics in emerging economies, particularly in the case of Honduran SMEs. The results highlight two determining factors: 1) the density of trade networks as a catalyst for export opportunities, and 2) the multiplier effect of targeted government policies. These findings justify the design of public interventions aimed at strengthening both components to increase international competitiveness.

The research corroborates the strategic value of computational models in economic policy by providing a controlled environment for evaluating alternative scenarios prior to implementation. The experiments demonstrate that the synergistic combination of three measures—strengthening business networks, unlocking financing, and reducing tariff barriers—maximizes the export capacity of SMEs and generates positive externalities for sustainable economic development.

As a future direction, we propose expanding the model by incorporating additional variables: exchange rate volatility, global value chains, and patterns of technological innovation. The continued advancement of multi-agent simulation techniques will facilitate the exploration of emerging complexities in the international competitiveness of Central American economies.

REFERENCES

Antelmi, A., Cordasco, G., D’Ambrosio, G., De Vinco, D., & Spagnuolo, C. (2022). Experimenting with Agent-Based Model Simulation Tools. Applied Sciences, 13(1), 13. https://doi.org/10.3390/app13010013

Axtell, R. L., & Farmer, J. D. (2025). Agent-Based Modeling in Economics and Finance: Past, Present, and Future. Journal of Economic Literature, 63(1), 197–287. https://doi.org/10.1257/jel.20221319

Bai, W., Johanson, M., Oliveira, L., & Ratajczak-Mrozek, M. (2021). The role of business and social networks in the effectual internationalization: Insights from emerging market SMEs. Journal of Business Research, 129, 96–109. https://doi.org/10.1016/j.jbusres.2021.02.042

Caputo, F., Fiano, F., Riso, T., Romano, M., & Maalaoui, A. (2022). Digital platforms and international performance of Italian SMEs: an exploitation-based overview. International Marketing Review, 39(3), 568–585. https://doi.org/10.1108/IMR-02-2021-0102

Chaudhuri, R., Vrontis, D., & Chatterjee, S. (2024). External environment and internal dynamics of “born global”: strategic and operational firm performance. Management Decision, 62(1), 274–300. https://doi.org/10.1108/MD-02-2023-0168

Cho, H. J., Jin, B. E., & Shin, D. C. (2023). Do contingencies matter between organizational capabilities and SME export performance? Review of International Business and Strategy, 33(4), 605–626. https://doi.org/10.1108/RIBS-12-2021-0163

Cincotti, S., Raberto, M., & Teglio, A. (2022). Why do we need agent-based macroeconomics? Review of Evolutionary Political Economy, 3(1), 5–29. https://doi.org/10.1007/s43253-022-00071-w

Dorasamy, N., & Kikasu, E. T. (2024). SMEs’ Information Infrastructure and Access to Finance. En SMEs Perspective in Africa (pp. 121–166). Springer Nature Switzerland. https://doi.org/10.1007/978-3-031-69103-4_7

Felzensztein, C., Saridakis, G., Idris, B., & Elizondo, G. P. (2022). Do economic freedom, business experience, and firm size affect internationalization speed? Evidence from small firms in Chile, Colombia, and Peru. Journal of International Entrepreneurship, 20(1), 115–156. https://doi.org/10.1007/s10843-021-00303-w

Flache, A., & De Matos Fernandes, C. A. (2021). Agent-based computational models. En Research Handbook on Analytical Sociology (pp. 453–473). Edward Elgar Publishing. https://doi.org/10.4337/9781789906851.00033

Fredrich, V., Gudergan, S., & Bouncken, R. B. (2022). Dynamic Capabilities, Internationalization and Growth of Small- and Medium-Sized Enterprises: The Roles of Research and Development Intensity and Collaborative Intensity. Management International Review, 62(4), 611–642. https://doi.org/10.1007/s11575-022-00480-3

Ghafoorpoor Yazdi, P., Azizi, A., & Hashemipour, M. (2023). Agent-Based Control System for SMEs—Industry 4.0 Adoption with Lean Six Sigma Framework. En Emerging Trends in Mechatronics (pp. 1–102). Springer Nature Singapore. https://doi.org/10.1007/978-981-16-7775-5_1

Gkypali, A., Love, J. H., & Roper, S. (2021). Export status and SME productivity: Learning-to-export versus learning-by-exporting. Journal of Business Research, 128, 486–498. https://doi.org/10.1016/j.jbusres.2021.02.026

Gress, D. R., & Kalafsky, R. V. (2022). Staffing Considerations and International Trade Fairs for Korean SME Exporters and Innovators. Asian Journal of Business Research, 12(1), 21–38. https://doi.org/10.14707/ajbr.220118

Johanson, M., & Oliveira, L. (2024). The Performance of Decision-Making Strategies in SME Internationalization: The Role of Host Market’s Institutional Development. Management International Review, 64(2), 303–335. https://doi.org/10.1007/s11575-024-00534-8

Karami, M., Wooliscroft, B., & McNeill, L. (2023). Effectual networking capability and SME performance in international B2B markets. Journal of Business & Industrial Marketing, 38(12), 2655–2672. https://doi.org/10.1108/jbim-01-2022-0020

Kazantsev, N., Pishchulov, G., Mehandjiev, N., Sampaio, P., & Zolkiewski, J. (2022). Investigating barriers to demand-driven SME collaboration in low-volume high-variability manufacturing. Supply Chain Management: An International Journal, 27(2), 265–282. https://doi.org/10.1108/scm-10-2021-0486

Martins, R., Farinha, L., & Ferreira, J. J. (2023). SMEs internationalisation process: from success to insolvency, from rebirth to re-internationalisationProceso de internacionalización de las PYME: del éxito a la insolvencia, del renacimiento a la reinternacionalizaciónProcesso de internacionalização das PME: do sucesso à insolvência, do renascimento à re-internacionalização. Management Research, 21(4), 419–439. https://doi.org/10.1108/MRJIAM-09-2022-1344

McKee, S., Sands, S., Pallant, J. I., & Cohen, J. (2023). The evolving direct-to-consumer retail model: A review and research agenda. International Journal of Consumer Studies, 47(6), 2816–2842. https://doi.org/10.1111/ijcs.12972

Mendy, J., Rahman, M., & Bal, P. M. (2020). Using the “best-fit” approach to investigate the effects of politico-economic and social barriers on SMEs’ internationalization in an emerging country context: Implications and future directions. Thunderbird International Business Review, 62(2), 199–211. https://doi.org/10.1002/tie.22119

Olivares, J. V, Saiz, C., Torró, L., & Zabalza, J. (2020). The internationalisation of family smes in the valencian region: The growing role played by Latin America, 1980-2018. Journal of Evolutionary Studies in Business, 5(2), 115–149. https://doi.org/10.1344/jesb2020.2.j078

Ong, X., Freeman, S., Goxe, F., Guercini, S., & Cooper, B. (2022). Outsidership, network positions and cooperation among internationalizing SMEs: An industry evolutionary perspective. International Business Review, 31(3). https://doi.org/10.1016/j.ibusrev.2021.101970

Philippi, C., Bobek, V., Horvat, T., Maček, A., & Justinek, G. (2020). Internationalisation of an Austrian SME with a sales agent to Mexico and the USA in the automotive sector. International Journal of Globalisation and Small Business, 11(1), 39–64. https://doi.org/10.1504/IJGSB.2020.105582

Smallbone, D., Saridakis, G., & Abubakar, Y. A. (2022). Internationalisation as a stimulus for SME innovation in developing economies: Comparing SMEs in factor-driven and efficiency-driven economies. Journal of Business Research, 144, 1305–1319. https://doi.org/10.1016/j.jbusres.2022.01.045

Susanty, A., Puspitasari, N. B., & Fachreza, A. (2023). Measuring the performance of SMEs during the pandemic situation using system dynamic. Kybernetes, 52(7), 2538–2567. https://doi.org/10.1108/k-09-2022-1206

Urban, W., Krot, K., & Tomaszuk, A. (2023). A cross-national study of internationalisation barriers with reference to SME value chain. Equilibrium. Quarterly Journal of Economics and Economic Policy, 18(2), 523–549. https://doi.org/10.24136/eq.2023.016

Weerawardena, J., Salunke, S., Knight, G., Mort, G. S., & Liesch, P. W. (2020). The learning subsystem interplay in service innovation in born global service firm internationalization. Industrial Marketing Management, 89, 181–195. https://doi.org/10.1016/j.indmarman.2019.05.012

Xu, S., He, J., Morrison, A. M., De Domenici, M., & Wang, Y. (2022). Entrepreneurial networks, effectuation and business model innovation of startups: The moderating role of environmental dynamism. Creativity and Innovation Management, 31(3), 460–478. https://doi.org/10.1111/caim.12514

Yuana, R., Prasetio, E. A., Syarief, R., Arkeman, Y., & Suroso, A. I. (2021). System Dynamic and Simulation of Business Model Innovation in Digital Companies: An Open Innovation Approach. Journal of Open Innovation: Technology, Market, and Complexity, 7(4), 219. https://doi.org/10.3390/joitmc7040219

FINANCING

None.

DECLARATION OF CONFLICT OF INTEREST

None.

AUTHOR CONTRIBUTION

Conceptualization: Marlene Sarahi Dominguez-Fernandez and Geovina Martinez.

Data curation: Marlene Sarahi Dominguez-Fernandez and Geovina Martinez.

Formal analysis: Marlene Sarahi Dominguez-Fernandez and Geovina Martinez.

Research: Marlene Sarahi Dominguez-Fernández and Geovina Martínez.

Methodology: Marlene Sarahi Dominguez-Fernández and Geovina Martínez.

Project management: Marlene Sarahi Dominguez-Fernández and Geovina Martínez.

Software: Marlene Sarahi Dominguez-Fernández and Geovina Martínez.

Supervision: Marlene Sarahi Dominguez-Fernández and Geovina Martínez.

Validation: Marlene Sarahi Dominguez-Fernández and Geovina Martínez.

Visualization: Marlene Sarahi Dominguez-Fernández and Geovina Martínez

Writing – original draft: Marlene Sarahi Dominguez-Fernández and Geovina Martínez.

Writing – review and editing: Marlene Sarahi Dominguez-Fernández and Geovina Martínez.