Scientific and Technological Research Article

Real Options and their application in renewable energy projects. State-of-the-art review

Opciones Reales y su aplicación en proyectos de energía renovable. Revisión de estado del arte

Benjamín Murgas Téllez1 ![]() *, Alvin Arturo Henao-Pérez2

*, Alvin Arturo Henao-Pérez2 ![]() *, Luceny Guzmán Acuña2

*, Luceny Guzmán Acuña2 ![]() *

*

ABSTRACT

The use of renewable energy sources, such as wind, solar, among others, has been growing, especially in recent years. The main objective of this study was to conduct a literature review on the real options approach for assessing the feasibility of investing in energy production and its derivatives. Thirty publications on the mentioned topic were analyzed using the Mendeley Reference Manager bibliographic software and categorized into seven groups according to their purpose: 1) Evaluation of renewable energy projects or investments, 2) Evaluation of non-renewable energy projects or investments, 3) Evaluation of energy auctions, portfolios, and investments in the energy market, 4) Evaluation of renewable energy technologies, 5) Evaluation of the impact of regulatory policies on renewable energy projects, 6) Evaluation of the transition to renewable energy generation, and 7) Evaluation of the design, size, and location of wind farms. Nine types of options were identified: 1) Waiting, 2) Delaying, 3) Anticipating, 4) Expanding, 5) Exercising, 6) Rejecting, 7) Abandoning, 8) Expanding, and 9) Switching. Additionally, the techniques and models applied to evaluate the options and simulate the twenty-nine uncertainties, grouped into eight categories, considered in the research were examined. In the future, there is a need to increase studies using the real options approach to evaluate renewable energy projects under uncertainties, applying new evaluation techniques that allow for the valuation and establishment of flexible strategies.

Keywords: renewable energy, uncertainty, investment, real options, simulation.

JEL Classification: Q42; O13; C19

RESUMEN

El uso de fuentes de energía renovables, como la energía eólica, solar, entre otras, viene en crecimiento, especialmente los últimos años. El objetivo principal del presente estudio consistió en una revisión de literatura sobre enfoque de opciones reales para la evaluación de la viabilidad de invertir en la producción de energías y sus derivados. Se analizaron treinta publicaciones con la temática mencionada, contenidas en el gestor bibliográfico Mendeley Reference Manager, que fueron categorizadas de acuerdo a su propósito en siete grupos: 1) Evaluación del proyecto o inversión de generación de energía renovable, 2) Evaluación del proyecto o inversión de generación de energía no renovable, 3) Evaluación de subastas de energía, carteras e inversiones en el mercado de energía, 4) Evaluación de tecnologías de energía renovable, 5) Evaluación del impacto de la políticas de regulación en proyectos de energía renovable, 6) Evaluación de la transición a generación de energía renovable y 7) Evaluación del diseño, tamaño y ubicación de parques eólicos. Se identificaron nueve tipos de opciones: 1) Esperar, 2) Retrasar, 3) Anticipar, 4) Ampliar, 5) Ejercer, 6) Rechazar, 7) Abandonar, 8) Expandir y 9) Conmutar. Además, se las auscultaron las técnicas y modelos aplicados para evaluar la opción y simular las veintinueve incertidumbres, agrupadas en ocho categorías, consideradas en las investigaciones. En el futuro, se requiere aumentar los estudios con enfoque de opciones reales para evaluar proyectos de energía renovable, bajo incertidumbres, aplicando nuevas técnicas de evaluación, que permita valorar y establecer estrategias flexibles.

Palabras clave: energía renovable, incertidumbre, inversión, opciones reales, simulación.

Clasificación JEL: Q42; O13; C19

Received: 10-11-2022 Revised: 12-12-2022 Accepted: 15-12-2022 Published: 13-01-2023

Editor:

Carlos Alberto Gómez Cano

![]()

1Universidad de La Guajira. Riohacha, Colombia.

2Universidad del Norte. Barranquilla, Colombia.

Cite as: Murgas, B., Henao-Pérez, A. y Guzmán, L. (2023). Opciones Reales y su aplicación en proyectos de energía renovable. Revisión de estado del arte. Región Científica, 2(1), 202349. https://doi.org/10.58763/rc202349

INTRODUCTION

Around 80% of the energy demand used on the planet is produced by fossil fuel sources, emanating two-thirds of global CO2 emissions. In order to address this situation and maintain a sustainable future for the planet, some global strategies were raised, such as the 2030 Agenda, adopted by the United Nations General Assembly in September 2015, which established a global goal concerning sustainable energy (Mentis et al., 2017) and the Paris Agreement (2015) that included as a goal to limit global warming to 1.5 ° C (Lehne, 2019).

According to the 2019 report of the International Energy Agency (IEA), it is estimated that by 2050, global energy consumption will increase by 46.9%, reaching a generation of 911 billion BTU compared to the 620 billion produced in 2018. This indicates that if clean energy sources do not appear, a greater demand for fossil fuels would be generated, increasing the level of carbon dioxide (CO2) emissions, affecting global warming levels, and putting the survival of the entire world population at risk (Harjanne & Korhonen, 2019).

This need demands the participation of renewable energy sources in the configuration of the energy matrix of the future (Kordmahaleh et al., 2017; Deutch, 2017; Burke & Stephens, 2018). According to the report for the first half of 2022, the World Wind Energy Association - WWEA, states that the world installed 28.9 gigawatts during the first half of 2022, which represents a 13% increase over the same period of 2021, where 27.6 gigawatts were added. This brought global installed capacity in June 2022 to 874 gigawatts. Globally installed wind capacity is expected to reach more than 955 gigawatts by the end of 2022 and will cross the 1 million megawatt threshold by mid-2023.

In the case of Colombia, large investments in energy generation are projected; according to the project registry as of November 30, 2022 (UPME, 2022), there are 1678 projects presented, distributed according to generation source: 29 biomass, 65 wind, one geothermal, 510 hydraulic, 953 solar and 120 thermal. This article reviews the literature on the real options approach to evaluate the managerial flexibility generated by uncertainties in renewable energy investment.

Real Options Literature Review

The option is a security that grants the right to buy or sell an asset under previously established conditions within a specific period (Black & Scholes, 1973). Real options can be considered a new approach to evaluating and managing investment projects that incorporate elements of traditional evaluation methods, allowing flexible decisions to be made under uncertainty (Trigeorgis, 1996). A real option is the right, without obligations, to postpone, abandon, or adjust a project in response to influences caused by uncertainties (Dixit & Pindyck, 1994). The real options approach makes an expansion of the Net Present Value - NPV, taking into account the flexibility generated by the effect of uncertainty, as observed in the following equation (Santos et al., 2014):

𝑉𝑃𝑁𝑒𝑥𝑝𝑎𝑛𝑑i𝑑𝑜 = 𝑉𝑃𝑁𝑡𝑟𝑎𝑑i𝑐i𝑜𝑛𝑎𝑙 𝑜 𝑒𝑠𝑡á𝑡i𝑐𝑜 + 𝑉𝑎𝑙𝑜𝑟f𝑙𝑒𝑥i𝑏i𝑙i𝑑𝑎𝑑.

(Formula in its original Spanish version)

The use of real options has relevance for the evaluation of investments in power generation, starting from the deregulation of the power system and the presence of competitive electricity markets, which causes great uncertainty, in addition to the high initial costs of investments in these technologies and the irreversibility of the same (Kitzing et al., 2016; Henao et al., 2018; Gazheli & Bergh, 2018; Murgas et al., 2021).

Types of real options

Authors such as Trigeorgis (1993), Copeland and Antikarov (2001), and Gazheli and Bergh (2018) agree in affirming that in the planning of a project, the decision to invest depends on certain real conditions that determine the instant in which it is taken, as described below:

Postponement or deferral option: It is relevant when there is the possibility of not investing now and waiting for conditions to improve or uncertainty to be overcome before doing so. This option has had certain applications in the energy sector, being used to evaluate investments in wind energy (Lee & Shih, 2011), thermal (Zambujal-Oliveira, 2013), biomass (Pindyck, 1984), hydroelectric (Martinez et al., 2013).

Staged construction time option: used in evaluating projects in their construction or commissioning at some stage where no profits are generated. The investment can be undone at any stage if market conditions are unfavorable. Each stage becomes an option or a necessary expense to move to the next stage; it has been applied in investment for nuclear power generation (Bednyagin & Gnansounou, 2011) and wind power (Méndez et al., 2009).

Altering the operating scale option or expanding the contract, shutting down, and restarting: This is applied to evaluate investments in projects where their scope or operating time must be expanded or reduced according to the viability conditions caused by market changes. This option was applied by Maya et al. (2012) when they considered the option of expanding a wind power generation plant by 50%.

Abandonment options are used to evaluate the decision to discontinue the project by selling it, liquidating it, or changing its use when market conditions are unfavorable. When canceling the project, reselling the capital equipment is possible, thus recovering part of the investment. This option has yet to be widely applied in the energy sector. However, it was used by Siddiqui et al. (2007) to decide whether to abandon a renewable energy research and development project.

Change option: This is applied when the company's raison d'être is to be modified. This indicates, for example, that there is the flexibility to reorient the product line to maintain the company's survival if market conditions so require. The switching option has been used to evaluate investment projects in hydroelectric power plants (Hedman & Sheblé, 2006) and wind power generation (Yu et al., 2006).

Cultivation option: This occurs when the aim is to strengthen in advance to take advantage of the opportunities envisioned in the future. In the renewable energy sector, the continuous deregulation of the market generates expectations of accelerated expansion for this type of energy so that this option can be applied.

METHODS

For the development of this research, the existing publications in the Mendeley Reference Manager on real options for the evaluation of renewable energy under uncertainty from 2019 to 2022 were used as analysis literature. Thirty publications with this theme were found. The selected articles were analyzed from the perspective of the research approach, the technique or model used for its evaluation and modeling, the uncertainty evaluated, and the type of real option, becoming the input to generate the results and discussion.

RESULTS

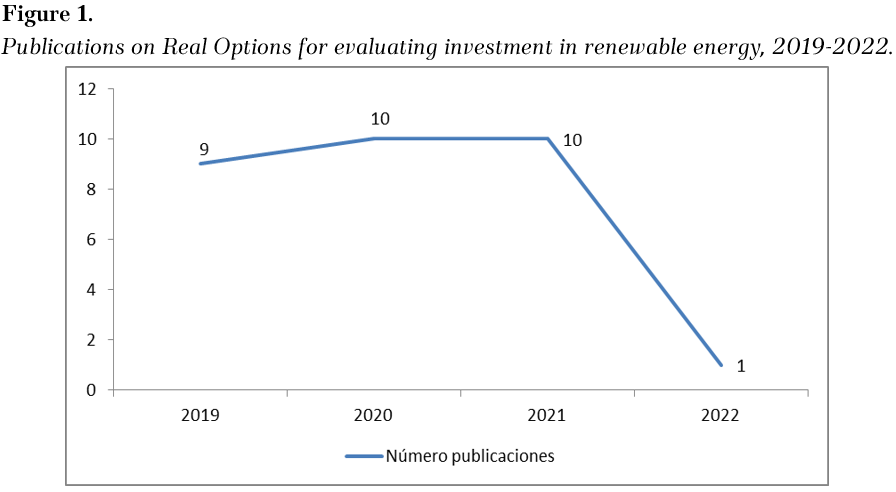

Figure 1 shows the distribution of the thirty publications on real options for evaluating renewable energy investments during the period from 2019 to 2022. It can be seen that in 2019, 2020 and 2021 there were practically the same number of publications, 9 (30%), 10 (33.3%) and 10 (33.3%), respectively, while in 2022 there was a large decrease with only 1 (3.3%) article published.

Source: Own elaboration.

Note: the figure appears in its original language.

Purpose of real options approach studies applied in the evaluation of renewable energy systems and the techniques or models used.

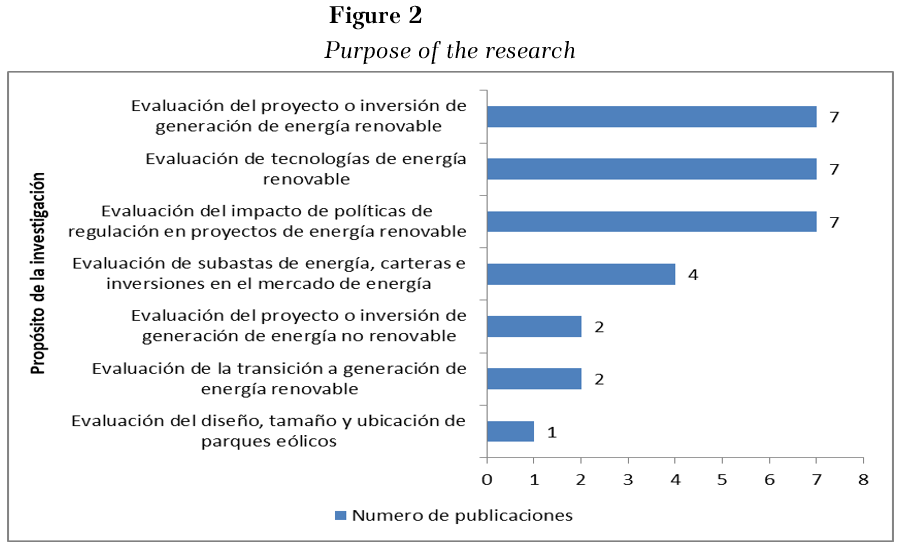

The thirty articles relevant to the research's object were analyzed to identify the purposes of their application, the methods or techniques used for evaluation and simulation, the uncertainties considered, and the real existing options. Several trends were found in the purposes of the studies, which were grouped into seven categories: (1) Renewable energy generation project or investment evaluation, (2) Non-renewable energy generation project or investment evaluation, (3) Evaluation of energy auctions, portfolios and investments in the energy market, (4) Evaluation of renewable energy technologies, (5) Evaluation of the impact of regulatory policies on renewable energy projects, (6) Evaluation of transition to renewable energy generation and (7) Evaluation of the design, size, and location of wind farms, which is shown in table 1.

|

Table 1. Investigations according to the purpose of the application within the framework of the real options approach and the techniques or models applied. |

||

|

Approach |

Author |

Technique or model applied |

|

Evaluation of the project or renewable energy generation project or investment

|

Ofori et al. (2021) |

Binomial trees and Monte Carlo simulation |

|

Nunes et al. (2021) |

Modified net present value |

|

|

Assereto y Byrne (2021) |

Least square Monte Carlo |

|

|

Pringles et al. (2020) |

Stochastic simulation - Dynamic programming |

|

|

Locatelli et al. (2020) |

Scenario optimization - Discounted cash flow - Discounted cash flow |

|

|

Di Bari (2020) |

Extended net present value (ENPV) - Binomial Tree |

|

|

Penizzotto et al. (2019) |

Stochastic Simulation - Linear Regression and Dynamic Programming |

|

|

|

Yang et al. (2020) |

Mathematical model-Brownian motion |

|

Fan et al. (2020) |

Geometric (GBM) |

|

|

Non-renewable power generation project/investment evaluation

|

Zhu et al. (2021) |

Trinomial tree |

|

Isaza et al. (2021) |

Preference game - Least square Monte Carlo |

|

|

Delapedra-Silva et al. (2021) |

least square |

|

|

Ríos et al. (2019) |

Discounted cash flows - Simulation |

|

|

Evaluation of energy auctions, portfolios and energy market investments |

Biggins et al. (2022) |

Monte Carlo |

|

Najafi y Talebi (2021) |

Discounted Cash Flows - Simulation |

|

|

Ma et al. (2021) |

Monte Carlo |

|

|

Agaton & Karl (2019) |

Stochastic dynamic market - system dynamics simulation |

|

|

Kim et al. (2020) |

Enhanced cash flow |

|

|

Moon y Lee (2019) |

Least square Monte Carlo |

|

|

Liu et al. (2019) |

Net present value |

|

|

Policy impact assessment of regulation in renewable energy projects

|

Das Gupta (2021) |

Learning curve |

|

Liu y Ronn (2020) |

Binomial tree - multinomial Monte Carlo simulation with Longstaff-Schwartz |

|

|

Balibrea-Iniesta (2020) |

Extended net present value (NPV) Binomial tree |

|

|

Guo y Zhang (2020) |

Value-value optimization Overall sensitivity analysis |

|

|

Chen et al. (2019) |

Evolutionary game - Real options |

|

|

Chen et al. (2019b) |

Compound options - Least square Monte Carlo - Markov chain |

|

|

Guo et al. (2019) |

Binomial tree |

|

|

Assessment of the transition to renewable energy generation

|

Hörnlein, (2019) |

Two-dimensional stochastic |

|

Zhang et al. (2019) |

Optimal investment decision

|

|

|

Wind farm design, size and location assessment |

Castellini et al. (2021) |

Optimization

|

Source: Own elaboration.

Figure 2 shows that the purposes of the study, Evaluation of renewable energy generation project or investment, Evaluation of renewable energy technologies, and Evaluation of the impact of regulatory policies on renewable energy projects, have the highest number of studies, with seven each, representing a share of 23.3%, respectively.

Source: Own elaboration based on Murgas et al. (2021).

Note: the figure appears in its original language.

Type of real options applied in the evaluation of renewable energy systems.

In relation to the type of option studied by the researchers, nine were identified: 1) Wait, 2) Delay, 3) Anticipate, 4) Expand, 5) Exercise, 6) Reject, 7) Abandon, 8) Expand and 9) Commute, which are listed in Table 2.

|

Type of Option |

|||||||||||||

|

Authors - years |

Wait for |

Delay |

Anticipate |

Enlarge |

Exercise |

Reject |

Leave |

Expand |

Switch |

||||

|

Biggins et al. (2022) |

✓ |

|

|

|

|

|

|

|

|

||||

|

Ofori et al. (2021) |

|

✓ |

|

|

|

|

|

|

|

||||

|

Nunes et al. (2021) |

✓ |

|

|

|

|

|

|

|

✓ |

||||

|

Das Gupta (2021) |

|

|

|

✓ |

|

|

|

|

|

||||

|

Najafi y Talebi (2021) |

|

✓ |

|

|

|

|

|

|

|

||||

|

Assereto y Byrne (2021) |

|

✓ |

|

|

|

|

|

|

|

||||

|

Zhu et al. (2021) |

|

|

|

|

|

|

|

|

|

||||

|

Isaza et al. (2021 |

|

✓ |

|

|

|

|

|

|

|

||||

|

Castellini et al. (2021) |

|

✓ |

|

|

|

|

|

|

|

||||

|

Delapedra-Silva et al. (2021) |

|

✓ |

✓ |

|

|

|

|

|

|

||||

|

Ma et al. (2021) |

|

|

|

|

|

|

|

|

|

||||

|

Pringles et al. (2020) |

|

✓ |

|

|

|

|

|

|

|

||||

|

Agaton y Karl (2019) |

✓ |

✓ |

|

|

|

|

|

|

|

||||

|

Locatelli et al. (2020) |

✓ |

|

|

|

✓ |

✓ |

|

|

|

||||

|

Yang et al. (2020) |

|

|

|

|

|

|

|

|

|

||||

|

Fan et al. (2020) |

✓ |

|

|

|

|

✓ |

|

|

|

||||

|

Liu y Ronn (2020) |

|

|

|

|

✓ |

|

|

|

|

||||

|

Di Bari (2020) |

|

✓ |

|

|

|

|

|

|

|

||||

|

Balibrea-Iniesta (2020) |

|

|

|

|

|

|

✓ |

|

|

||||

|

Guo y Zhang (2020) |

|

|

|

|

|

|

|

✓ |

|

||||

|

Kim et al. (2020) |

|

|

|

|

|

|

|

✓ |

|

||||

|

Penizzotto et al. (2019) |

|

✓ |

|

|

|

|

|

|

|

||||

|

Guo et al. (2019) |

✓ |

|

|

|

|

|

|

|

|

||||

|

Chen et al. (2019) |

✓ |

|

|

|

|

|

|

|

|

||||

|

Hörnlein (2019) |

|

|

|

|

|

|

|

|

|

||||

|

Zhang et al. (2019) |

|

|

|

|

|

|

|

|

|

||||

|

Moon & Lee (2019) |

✓ |

|

|

|

|

|

|

|

|

||||

|

Ríos et al. (2019) |

|

✓ |

|

|

|

|

|

|

|

||||

|

Chen et al. (2019) |

✓ |

|

|

|

|

|

|

|

|

||||

|

Liu et al. (2019) |

✓ |

|

|

|

|

|

|

|

|

||||

|

Total |

10 |

11 |

1 |

1 |

2 |

2 |

1 |

2 |

1 |

||||

Source: Own elaboration.

According to Table 2, the most evaluated options in the studies analyzed were the option to delay with 11 (36.7%) and wait with 10 (33.3%). Furthermore, it is observed that, in some cases, more than one option was considered, as is the case of Locatelli et al. (2020), who evaluated the options of waiting, exercising or rejecting and Delapedra-Silva et al. (2021), who considered two options, delaying and anticipating.

Types of uncertainties evaluated in publications with a real options approach analyzed

Uncertainty is implicit in events when the possible outcomes are unknown, making quantifying their probability of occurrence impossible. About projects, uncertainty increases over time, affecting their viability. Uncertainty management has always been critical for investors and decision-makers (Attoh-Okine & Ayyub, 2005). In the energy sector, including renewable energy, decision-making is almost always influenced by uncertainty in the data (Conejo et al., 2010).

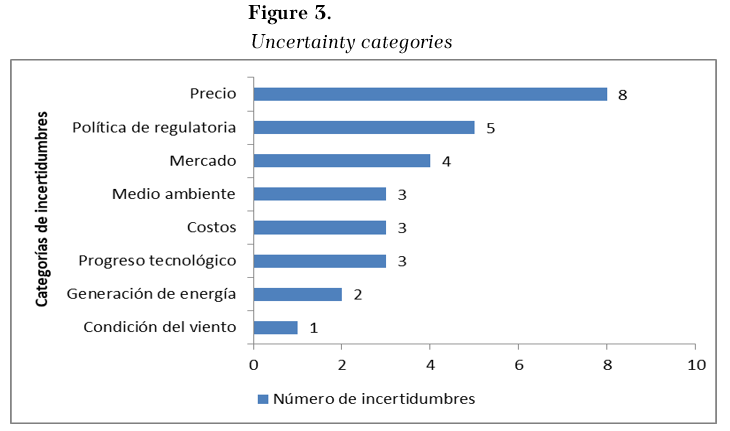

In the thirty publications analyzed, with a real options approach, 29 types of uncertainties were identified, which were categorized into eight groups: 1) Power generation, 2) Environment, 3) Prices, 4) Costs, 5) Regulatory policies, 6) Market, 7) Wind conditions and 8) Technological progress, as shown in Table 3.

|

Table 3 Tipos de incertidumbres exploradas en la investigación con un enfoque de opciones reales. |

|

|

1. Power generation |

5. Regulatory Policies |

|

1.1. Electrolyzer performance 1.2. Energy efficiency

2. Environment 2.1. Geographical position 2.2. Solar irradiation 2.3. Climatic conditions

3. Prices 3.1. hydrogen 3.2. coal 3.3. electricity 3.4. carbon emission allowances 3.5. fossil energy3.6. gas 3.7. oil 3.8. supply (bidding)

4. Costs 4.1. Capital investment 4.2. Fossil fuels 4.3. Energy storage |

5.1. Regulatory environment Feed-in tariffs 5.3. Subsidies 5.4. Timing of energy markets 5.5. Preferential taxes

6. Market 6.1. Economic factors 6.2. Evolution of demand Risk-adjusted index 6.4. Maturity of the option

7. Wind conditions 7.1. Wind speed 8. Technological progress 8.1. Technological factors 8.2. Technological progress 8.3. Learning rate |

Source: Own elaboration based on Murgas et al. (2021).

1. Power generation includes uncertainties affecting power production, such as electrolyzer performance and energy yield.

2. The environment considers the uncertainties in the environmental conditions necessary for developing projects, such as geographical position, solar irradiation, and environmental conditions.

3. Price concentrates on the uncertainties generated by price fluctuations in the market in response to demand and supply behavior, including, among others, the price of hydrogen, electricity, coal, and carbon emission rights. The price of electricity is the most frequent source of uncertainty in the studies analyzed, with 8 (26.6%).

4. Costs contemplate the uncertainties caused by the behavior of costs on the profitability of the investment, such as capital investment costs, fossil fuel costs, or energy storage costs.

5. Regulatory policies include uncertainties caused by changes in legal aspects and incentive policies of the energy sector, including the regulatory environment, feed-in tariffs, subsidy schemes, energy market terms, and preferential taxes.

6. The market considers the sources of uncertainties other than prices and costs that affect the behavior of the energy market, such as economic factors, the evolution of demand, risk-adjusted index, and option expiration.

7. Wind conditions contemplate the uncertainties caused by the variability of wind characteristics in wind power generation, such as wind speed.

8. Technological progress is integrated by the uncertainties caused during the research and development (R&D) process for energy generation; among these are the technological factors, technological advances, and learning rate.

Figure 3 shows the eight categories described above and their respective frequency levels in the analyzed publications. It can be seen that prices are the category with the highest number of uncertainties evaluated, with 8 (27.6%), followed by regulatory policy and market with 5 (17.2%) and 4 (13.8%), respectively.

Source: Own elaboration based on Murgas et al. (2021).

Note: the figure appears in its original language.

DISCUSSION

Based on the information contained in Tables 1, 2, and 3, the following is an articulated description of the research purposes, the techniques or models used, the uncertainties, and the types of options evaluated in each of the publications:

Project or investment evaluation of renewable energy generation, mainly wind and solar, includes research to optimally evaluate investments from the power generation perspective or the financial and economic viability of projects for renewable energy production. With this purpose are the studies conducted by Ofori et al. (2021), who applied binomial trees and Monte Carlo simulation, evaluating uncertainties the economic factors and technological factors, contemplated the option to delay; Nunes et al. (2021), applied the modified net present value and analyzed the option to wait; Assereto and Byrne (2021), used least square Monte Carlo, evaluating the price of electricity as uncertainty and evaluated the option to delay.

Pringles et al. (2020) combined stochastic simulation with dynamic programming and took technological factors, electricity price, and capital investment as uncertainties and valued the option to delay; Locatelli et al. (2020) applied scenario optimization and discounted cash flow, considering three options, wait, exercise and reject; Di Bari (2020), used extended net present value (ENPV) combined with the binomial tree as models and considered geographical position, weather conditions and subsidies as uncertainty and analyzed the option to delay; Penizzotto et al. (2019), relied on three models: stochastic simulation, linear regression, and dynamic programming, evaluating technological factors, electricity price and Capital investment as uncertainty and assessed the option to delay.

The Evaluation of the non-renewable energy generation project or investment includes research to assess the feasibility of projects using non-renewable energy sources (coal, gas). Among these are Yang et al. (2020), who applied a mathematical model complemented with Geometric Brownian motion (GBM), taking as uncertainty the electricity price; Fan et al. (2020), who made the valuation using a trinomial tree, considering feed-in tariffs as uncertainty and assessed the wait-and-reject option.

The Evaluation of energy auctions, portfolios, and investments in the energy market seeks to propose optimal schemes to measure the risks immersed in the private and liberalized markets and to evaluate investment decisions through energy auctions that enable the implementation of renewable energy projects. With this approach, the studies conducted by Zhu et al. (2021) applied Preference Game models, least square Monte Carlo and evaluated uncertainty of the offer price (bidding); Isaza et al. (2021) used discounted cash flows, Monte Carlo simulation as models and considered the uncertainty of capital investment, valued the option of delaying.

Delapedra-Silva et al. (2021) applied discounted cash flows Monte Carlo simulation and took the price of electricity as an uncertain factor, with the options of anticipating or delaying as an alternative; Ríos et al. (2019) used a stochastic dynamic model complemented with the simulation of system dynamics, taking as an uncertain factor the terms of the energy markets and took into account the option of delaying.

The Evaluation of renewable energy technologies grouped studies that seek to support optimally, through research and development (R&D), the decision to invest in a renewable energy technology or the adoption of hybrid systems that combine several technologies, such as wind, solar and photovoltaic energies, wind and thermal energies, solar energy with hydrogen, among others. Studies were identified by Biggins et al. (2022), who evaluated using the improved cash flow, considering uncertainties the performance of the electrolyzer, the price of hydrogen, and the wind speed, evaluated the option to delay; Najafi and Talebi (2021), applied least square Monte Carlo, evaluating as uncertain factors the price of electricity, the capital investment, the risk-adjusted index and the time to maturity of the option and studied the option to delay.

In line with the above, Ma et al. (2021) used a theoretical analysis model combined with a canonical real option and took the regulatory environment as uncertainty; Agaton & Karl (2019) used dynamic programming, Monte Carlo simulation, and Geometric Brownian motion(GBM) as evaluation models and considered a capital investment as uncertainty, studied the options of waiting and delaying; Kim et al. (2020), evaluated by trinomial tree taking fossil energy and gas price as uncertainty, analyzed the option of expanding; Moon & Lee (2019), evaluated by binomial lattice model, considering oil price as an uncertain factor and studied the option of waiting; Liu et al. (2019), made use of net present value as evaluation model, took energy storage cost as uncertainty and evaluated the option of waiting.

The Evaluation of the impact of regulatory policies on renewable energy projects seeks to assess the flexibility associated with the uncertainty caused by the expectation of changes in energy policy, support schemes such as feed-in tariffs and subsidies, regulatory frameworks, trade in renewable energy certificates, and changes in tariff rates, among others. Included in this approach are studies by Das Gupta (2021), who applied a learning curve model, evaluating coal price uncertainty and considered the option of scaling up; Liu and Ronn (2020) applied binomial tree models and Longstaff-Schwartz multinomial Monte Carlo simulation, evaluating subsidies as uncertainty and analyzed the option to exercise; and Balibrea-Iniesta (2020) used the extended net present value (APNPV), the binomial tree, considered solar irradiation as an uncertain factor and considered abandoning as an option.

Consequently, Guo et al. (2019) applied a value-value optimization model supplemented with a global sensitivity analysis, performed the Evaluation of energy yield as uncertainty, and studied the option to expand; Guo et al. (2020) applied the binomial tree taking electricity price as uncertain factor and contemplated the option to wait; Chen et al. (2019), combined an Evolutionary Game model with the real options approach, evaluating electricity price as uncertainty and assessed the option to wait; Chen et al. (2019b), applied the composite options with least square Monte Carlo and Markov Chain, with electricity price, carbon emission rights, preferential taxes and subsidies being the uncertain factors and looked at the possibility of waiting.

The Renewable Energy Generation Transition Assessment seeks to evaluate optimal investment decisions amid uncertainty in the low-carbon transition to renewable energy. These studies include Hörnlein (2019), who evaluated using a two-dimensional stochastic model, considering electricity and gas prices as uncertain factors; Zhang et al. (2019), who used an optimal investment decision technique evaluating electricity price, carbon allowances, capital investment, and fossil fuel costs as uncertainties.

Finally, the Evaluation of the design, size, and location of wind farm projects to enable optimal investment includes the study developed by Castellini et al. (2021), which applies an optimization model and evaluates as uncertain factors, the price of electricity, the regulatory environment, the evolution of demand and technological advances, evaluating the option to delay.

CONCLUSIONS

In this research, an exhaustive analysis was made of the real options approach to evaluating investments in renewable energy generation projects. One of the main advantages of the real option, when evaluating flexibility, is the possibility of having a variety of alternatives to make the necessary adjustments that the taker requires to counteract the effects of uncertainty. In total, 30 articles were analyzed, whose trend shows very stable during the years 2019, 2020 and 2021, where there were 9 (30%), 10 (33.3%) and 10 (33.3%) publications, respectively, with a drastic decrease in the year 2022, with only 1 (3.3%) article, as shown in Figure 1.

The selected publications were analyzed according to their purpose, grouping them into seven categories: 1) Evaluation of renewable energy generation projects or investment, 2) Evaluation of non-renewable energy generation projects or investment, 3) Evaluation of energy auctions, portfolios and investments in the energy market, 4) Evaluation of renewable energy technologies, 5) Evaluation of the impact of regulatory policies on renewable energy projects, 6) Evaluation of the transition to renewable energy generation and 7) Evaluation of the design, size and location of wind farms, identifying nine types of real options contemplated: 1) Wait, 2) Delay, 3) Anticipate, 4) Expand, 5) Exercise, 6) Reject, 7) Abandon, 8) Expand and 9) Switch. The options most considered and evaluated by the researchers were the option to delay with 11(36.7%) and wait with 10(33.3%).

About the techniques or models applied for the evaluation of real options and simulation of uncertainty, a wide variety of random and non-random techniques or models were used, including dynamic programming, binomial and trinomial trees, least squares Monte Carlo, cash flow, extended net present value (ENPV), Monte Carlo simulation and geometric Brownian motion, among others.

Twenty-nine sources of uncertainty were identified and grouped into eight categories: 1. Energy generation, 2. The price of electricity stands out as the source of uncertainty with the highest participation, considered by the researchers in eight articles.

As the use of renewable energy sources is the main alternative to counteract the high level of CO2 emissions generated by fossil fuels and thus meet the objectives of the 2030 Agenda and the Paris Agreement, established in 2015, it is necessary to increase the level of research in future investment in renewable energy projects, under uncertainties, applying the real options approach, with new evaluation techniques, which allow assessing and establishing flexible strategies.

REFERENCES

Agaton, C. y Karl, H. (2019). A real options approach to renewable electricity generation in the Philippines. Energy, Sustainability and Society, 8(1), 1–9. https://doi.org/10.1186/s13705-017-0143-y

Assereto, M. y Byrne, J. (2021). No real option for solar in Ireland: A real option valuation of utility scale solar investment in Ireland. Renewable and Sustainable Energy Reviews, 143, 110892. https://doi.org/10.1016/j.rser.2021.110892

Attoh-Okine, N. y Ayyub, B. (2005). Applied research in uncertainty modeling and analysis. Springer.

Balibrea-Iniesta, J. (2020). Economic analysis of renewable energy regulation in France: A case study for photovoltaic plants based on real options. Energies, 13(11), 27-60. https://doi.org/10.3390/en13112760

Bednyagin, D. y Gnansounou, E. (2011). Real options valuation of fusion energy R&D programme. Energy Policy, 39(1), 116–130. https://doi.org/10.1016/j.enpol.2010.09.019

Biggins, F., Kataria, M., Roberts, D., y Brown, D. (2022). Green hydrogen investments: Investigating the option to wait. Energy, 241, 122842. https://doi.org/10.1016/j.energy.2021.122842

Black, F. y Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81(3), 637–654. https://doi.org/10.1086/260062

Burke, M. y Stephens, J. (2018). Energy Research & Social Science Political power and renewable energy futures : A critical review. Energy Research & Social Science, 35, 78–93. https://doi.org/10.1016/j.erss.2017.10.018

Castellini, M., Menoncin, F., Moretto, M. y Vergalli, S. (2021). Photovoltaic Smart Grids in the prosumers investment decisions: a real option model. Journal of Economic Dynamics and Control, 126, 103988. https://doi.org/10.1016/j.jedc.2020.103988

Chen, S., Zhang, Q., Li, H., Mclellan, B., Zhang, T. y Tan, Z. (2019). Investment decision on shallow geothermal heating & cooling based on compound options model: A case study of China. Applied Energy, 254, 113655. https://doi.org/10.1016/j.apenergy.2019.113655

Chen, W., Zeng, Y. y Xu, C. (2019). Energy storage subsidy estimation for microgrid: A real option game- theoretic approach. Applied Energy, 239, 373–382. https://doi.org/10.1016/j.apenergy.2019.01.232

Conejo, A., Carrión, M. y Morales, J. (2010). Decision making under uncertainty in electricity markets (Vol. 1). Springer.

Copeland, T. y Antikarov, V. (2001). Real options (Issue BOOK). Texere New York.

Das Gupta, S. (2021). Using real options to value capacity additions and investment expenditures in renewable energies in India. Energy Policy, 148, 111916. https://doi.org/10.1016/j.enpol.2020.111916

Delapedra-Silva, V., Ferreira, P., Cunha, J. y Kimura, H. (2021). Economic evaluation of wind power projects in a mix of free and regulated market environments in brazil. Energies, 14(11), 3325. https://doi.org/10.3390/en14113325

Deutch, J. (2017). Decoupling Economic Growth and Carbon Emissions. Joule, 1(1), 3–5. https://doi.org/10.1016/j.joule.2017.08.011

Di Bari, A. (2020). A real options approach to valuate solar energy investment with public authority incentives: The Italian case. Energies, 13(6), 4181. https://doi.org/10.3390/en13164181

Dixit, R. y Pindyck, R. (1994). Investment under uncertainty. Princeton university press.

Fan, J., Wei, S., Zhang, X. y Yang, L. (2020). A comparison of the regional investment benefits of CCS retrofitting of coal-fired power plants and renewable power generation projects in China. International Journal of Greenhouse Gas Control, 92, 102858. https://doi.org/10.1016/j.ijggc.2019.102858

Gazheli, A. y Bergh, J. (2018). Real options analysis of investment in solar vs. wind energy: Diversification strategies under uncertain prices and costs. Renewable and Sustainable Energy Reviews, 82, 2693–2704. https://doi.org/10.1016/j.rser.2017.09.096

Guo, K. y Zhang, L. (2020). Guarantee optimization in energy performance contracting with real option analysis. Journal of Cleaner Production, 258, 120908. https://doi.org/10.1016/j.jclepro.2020.120908

Guo, K., Zhang, L., y Wang, T. (2019). Optimal scheme in energy performance contracting under uncertainty: A real option perspective. Journal of Cleaner Production, 231, 240–253. https://doi.org/10.1016/j.jclepro.2019.05.218

Harjanne, A. y Korhonen, J. (2019). Abandoning the concept of renewable energy. Energy Policy, 127, 330–340. https://doi.org/10.1016/j.enpol.2018.12.029

Hedman, K. y Sheblé, G.(2006). Comparing hedging methods for wind power: Using pumped storage hydro units vs. options purchasing. 2006 International Conference on Probabilistic Methods Applied to Power Systems, 1–6.

Henao, A., Sauma, E. y Gonzalez, A. (2018). Impact of introducing flexibility in the Colombian transmission expansion planning. Energy, 157, 131–140. https://doi.org/https://doi.org/10.1016/j.energy.2018.05.143

Hörnlein, L. (2019). The value of gas-fired power plants in markets with high shares of renewable energy: A real options application. Energy Economics, 81, 1078–1098. https://doi.org/10.1016/j.eneco.2019.04.013

Isaza, F., Arredondo-Orozco, C. y Marenco-Maldonado, G. (2021). Photovoltaic power purchase agreement valuation under real options approach. Renewable Energy Focus, 36, 96–107. https://doi.org/10.1016/j.ref.2020.12.006

Kim, K., Lee, D. y An, D. (2020). Real option valuation of the R&D investment in renewable energy considering the effects of the carbon emission trading market: A Korean case. Energies, 13(3), 622. https://doi.org/10.3390/en13030622

Kitzing, L., Juul, N., Drud, M., y Krogh, T. (2016). A real options approach to analyse wind energy investments under different support schemes. Applied Energy, 188, 83–96. https://doi.org/10.1016/j.apenergy.2016.11.104

Kordmahaleh, A., Naghashzadegan, M., Javaherdeh, K. y Khoshgoftar, M. (2017). Design of a 25 MWe Solar Thermal Power Plant in Iran with Using Parabolic Trough Collectors and a Two-Tank Molten Salt Storage System. International Journal of

Photoenergy, 2017, 4210184. https://doi.org/10.1155/2017/4210184

Lee, S., y Shih, L. (2011). Enhancing renewable and sustainable energy development based on an options-based policy evaluation framework: case study of wind energy technology in Taiwan. Renewable and Sustainable Energy Reviews, 15(5), 2185–2198. https://doi.org/10.1016/j.rser.2011.01.011

Lehne, K. (2019). Informe especial: Emisiones de gases de efecto invernadero en la UE: Se notifican correctamente, pero es necesario tener un mayor conocimiento de las futuras reducciones. https://www.eca.europa.eu/es/publications?did=51834

Liu, X. y Ronn, E. (2020). Using the binomial model for the valuation of real options in computing optimal subsidies for Chinese renewable energy investments. Energy Economics, 87, 104692. https://doi.org/10.1016/j.eneco.2020.104692

Liu, Y., Zheng, R., Chen, S. y Yuan,

J. (2019). The economy of wind-integrated-energy-storage projects in China’s

upcoming power market: A real options approach. Resources Policy, 63,

101434.

https://doi.org/10.1016/j.resourpol.2019.101434

Locatelli, G., Mancini, M. y Lotti, G. (2020). A simple-to-implement real options method for the energy sector. Energy, 197, 117226. https://doi.org/10.1016/j.energy.2020.117226

Ma, R., Cai, H., Ji, Q. y Zhai, P. (2021). The impact of feed-in tariff degression on R&D investment in renewable energy: The case of the solar PV industry. Energy Policy, 151, 112209. https://doi.org/10.1016/j.enpol.2021.112209

Martínez, E., Mutale, J. y Rivas-Dávalos, F. (2013). Real options theory applied to electricity generation projects: A review. Renewable and Sustainable Energy Reviews, 19, 573–581. https://doi.org/10.1016/j.rser.2012.11.059

Maya, C., Hernández, J. y Gallego, Ó. (2012). La valoración de proyectos de energía eólica en Colombia bajo el enfoque de opciones reales. Cuadernos de Administración, 25(44), 193-231.

Méndez, M., Goyanes, A. y Lamothe, P. (2009). Real Options Valuation of a Wind Farm. February. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2708351

Mentis, D., Howells, M., Rogner, H., Korkovelos, A. y Arderne, C. (2017). Lighting the World : the first application of an open source , spatial electrification tool (OnSSET) on Sub-Saharan Africa Lighting the World : the first application of an open source, spatial electrification tool (OnSSET) on Sub-Saharan Africa. Environmental Research Letters, 12(8), 085003. https://doi.org/10.1088/1748-9326/aa7b29

Moon, S. y Lee, D. (2019). An optimal electric vehicle investment model for consumers using total cost of ownership: A real option approach. Renewable Energy, 253, 113494. https://doi.org/10.1016/j.apenergy.2019.113494

Murgas, B., Henao, A. y Guzmán, L. (2021). Evaluation of Investments in Wind Energy Projects, under Uncertainty. State of the Art Review. Applied Sciences, 11(21), 10213.https://doi.org/10.3390/app112110213

Najafi, P. y Talebi, S. (2021). Using real options model based on Monte-Carlo Least-Squares for economic appraisal of flexibility for electricity generation with VVER-1000 in developing countries. Sustainable Energy Technologies and Assessments, 47, 101508. https://doi.org/10.1016/j.seta.2021.101508

Nunes, L., Lima, M., Davison, M. y Leite, A. (2021). Switch and defer option in renewable energy projects: Evidences from Brazil. Energy, 231, 120972. https://doi.org/10.1016/j.energy.2021.120972

Ofori, C., Bokpin, G., Aboagye, A. y Afful-Dadzie, A. (2021). A real options approach to investment timing decisions in utility-scale renewable energy in Ghana. Energy, 235, 121366. https://doi.org/10.1016/j.energy.2021.121366

Penizzotto, F., Pringles, R., y Olsina, F. (2019). Real options valuation of photovoltaic power investments in existing buildings. Renewable and Sustainable Energy Reviews, 114, 109308. https://doi.org/10.1016/j.rser.2019.109308

Pindyck, R. (1984). Uncertainty in the theory of renewable resource markets. The Review of Economic Studies, 51(2), 289–303. https://doi.org/10.2307/2297693

Pringles, R., Olsina, F. y Penizzotto, F. (2020). Valuation of defer and relocation options in photovoltaic generation investments by a stochastic simulation-based method. Renewable Energy, 151, 846–864. https://doi.org/10.1016/j.renene.2019.11.082

Ríos, D., Blanco, G., y Olsina, F. (2019). Integrating Real Options Analysis with long-term electricity market models. Energy Economics, 80, 188–205. https://doi.org/10.1016/j.eneco.2018.12.023

Santos, L., Soares, I., Mendes, C. y Ferreira, P. (2014). Real options versus traditional methods to assess renewable energy projects. Renewable Energy, 68, 588–594. https://doi.org/10.1016/j.renene.2014.01.038

Siddiqui, A., Marnay, C. y Wiser, R. (2007). Real options valuation of US federal renewable energy research, development, demonstration, and deployment. Energy Policy, 35(1), 265–279. https://doi.org/10.1016/j.enpol.2005.11.019

Trigeorgis, L. (1993). Real options and interactions with financial flexibility. Financial Management, 22(3), 202–224. https://doi.org/10.2307/3665939

Trigeorgis, L. (1996). Real options: Managerial flexibility and strategy in resource allocation. MIT press.

Unidad de Planeación Minero Energética – UPME. (2022). Informe de Registro de Proyectos de Generación Inscripción según requisitos de las Resoluciones UPME No. 0520, No. 0638 de 2007 y No. 0143. 0520. https://www1.upme.gov.co/Paginas/Registro.aspx

Yang, Z., Gao, C. y Zhao, M. (2020). The Optimal Investment Strategy of P2G Based on Real Option Theory. IEEE Access, 8, 127156–127166. https://doi.org/10.1109/ACCESS.2019.2910259

Yu, W., Sheblé, G., Lopes, J. y Matos, M. (2006). Valuation of switchable tariff for wind energy. Electric Power Systems Research, 76(5), 382–388. https://doi.org/10.1016/j.epsr.2005.09.004

Zambujal-Oliveira, J. (2013). Investments in combined cycle natural gas-fired systems: A real options analysis. International Journal of Electrical Power & Energy Systems, 49, 1–7. https://doi.org/10.1016/j.ijepes.2012.11.015

Zhang, M., Wang, Q., Zhou, D. y Ding, H. (2019). Evaluating uncertain investment decisions in low-carbon transition toward renewable energy. Applied Energy, 240, 1049–1060. https://doi.org/10.1016/j.apenergy.2019.01.205

Zhu, L., Li, L., y Su, B. (2021). The price-bidding strategy for investors in a renewable auction: An option games–based study. Energy Economics, 100, 105331. https://doi.org/10.1016/j.eneco.2021.105331

FINANCING

No external financing.

DECLARATION OF CONFLICT OF INTEREST

The authors declare that they have no conflicts of interest.

ACKNOWLEDGMENTS (ORIGINAL SPANISH VERSION)

Los autores agradecen a la Universidad de la Guajira y a la Universidad del Norte, por el tiempo permitido para el desarrollo de la investigación.

AUTHORSHIP CONTRIBUTION

Conceptualization: Benjamín Murgas Téllez, Alvin Arturo Henao-Pérez and Luceny Guzmán Acuña.

Research: Benjamín Murgas Téllez, Alvin Arturo Henao-Pérez and Luceny Guzmán Acuña.

Methodology: Benjamín Murgas Téllez, Alvin Arturo Henao-Pérez and Luceny Guzmán Acuña.

Writing - original draft: Benjamín Murgas Téllez, Alvin Arturo Henao-Pérez and Luceny Guzmán Acuña.

Writing - revision and editing: Benjamín Murgas Téllez, Alvin Arturo Henao-Pérez and Luceny Guzmán Acuña.