doi: 10.58763/rc2024340

Scientific and Technological Research

Social security and pension trends. A bibliometric study

Tendencias de las pensiones en la seguridad social. Un estudio bibliométrico

Milton Antonio Fonseca Velásquez1 ![]() *

*

ABSTRACT

This article presents a bibliometric analysis of trends in pension studies in the field of social security, using Zipf’s law, Lotka’s law and the h-index. The research focused on identifying productivity and citation patterns and determining the main research themes and trends. Through term frequency analysis, it was observed that the words “pensions,” “social security,” and “sustainability” are predominant, confirming Zipf’s law. Lotka’s law was validated by finding that a small group of authors is responsible for most of the publications, indicating a concentration in scientific production. The h-index calculation showed that the most prolific authors are also the most cited, reflecting their influence in the field. Thematic trends reveal a shift from implementing pension systems towards sustainability and reforms for regime changes. Furthermore, the geographical distribution highlighted a high concentration in developed countries with increasing international collaborations. These findings provide a comprehensive overview of research dynamics and offer recommendations for future research and policies in social security.

Keywords: pension, retirement, social policy and welfare, social security.

JEL Classification: G23, H55, J32

RESUMEN

Este artículo presenta un análisis bibliométrico de las tendencias en los estudios sobre las pensiones en el campo de la seguridad social, utilizando la ley de Zipf, la ley de Lotka y el índice h. La investigación se centró en identificar patrones de productividad y citación, así como en determinar las principales temáticas y tendencias de investigación. A través del análisis de la frecuencia de términos, se observó que los términos “pensiones”, “seguridad social” y “sostenibilidad” son predominantes, confirmando la ley de Zipf. Por su parte, la ley de Lotka se validó al encontrar que un pequeño grupo de autores es responsable de la mayoría de las publicaciones, indicando una concentración en la producción científica. El cálculo del índice h mostró que los autores más prolíficos también son los más citados, reflejando su influencia en el campo. Las tendencias temáticas revelan un cambio desde la implementación de sistemas de pensiones hacia la sostenibilidad y las reformas para los cambios de regímenes. Además, la distribución geográfica destacó una alta concentración en países desarrollados con crecientes colaboraciones internacionales. Estos hallazgos proporcionan una visión integral de las dinámicas de investigación y ofrecen recomendaciones para futuras investigaciones y políticas en la seguridad social.

Palabras clave: jubilación, pensión, política y bienestar social, seguridad social.

Clasificación JEL: G23, H55, J32

Received: 11-02-2024 Revised: 18-05-2024 Accepted: 15-06-2024 Published: 01-07-2024

Editor:

Carlos Alberto Gómez Cano ![]()

1Universidad Nacional Autónoma de Honduras. Tegucigalpa, Honduras.

Cite as: Fonseca, M. (2024). Tendencias de las pensiones en la seguridad social. Un estudio bibliométrico. Región Científica, 3(2), 2024340. https://doi.org/10.58763/rc2024340

INTRODUCTION

Regarding pension trends, the importance of retirement as a financial and social category has been demonstrated, as it is a process that regulates people's transition from professional jobs to bridge jobs and out of the labor force (Clark & Newhouse, 2021). In this sense, pensions are one of the most frequently available forms of savings and wealth accumulation as income and support mechanisms for reducing poverty in old age (Ghafoori et al., 2021; Valls Martínez et al., 2021).

Regarding its modalities, in different countries, it comes from the social security sector, either through personal accounts that can be privately managed by companies or by a public institution (Bernal & Olivera, 2020; Yeh et al., 2020). In the first case, pension arrangements are typically managed as company plans, which are a contractual component under the umbrella of benefits offered to workers and can be classified as defined contributions or benefits (Zhao & Sutcliffe, 2021). Individual accounts also appear in the private sector, which are created as savings accounts by individuals and whose management is entrusted to a non-state banking institution. In the second case, state-run forms of pension management can arise primarily based on two crucial categories: defined contributions and defined benefits. These two forms of pension formulation and their relationship with labor and social security portfolios are politically and geographically determined, so they can vary from one social system to another.

This sociopolitical nature highlights the importance of understanding the different factors involved in pension payments, the policymakers by region, and the main differentiated responses to population aging (Kessler, 2021). This last factor is crucial, as population aging is a global trend that puts pressure on pension systems. This has resulted in financial challenges for pension systems, which must find sustainable ways to fund benefits and adapt institutions to balance the needs of aging populations with the resources needed to support the social security system (Berstein & Morales, 2021; Dong & Zheng, 2020; Knapp & Lee, 2023; Josa-Fombellida & Navas, 2020).

According to studies on various reforms worldwide, demographic trends related to aging increase pressure on the fiscal sustainability of public pension systems in most industrialized countries (Alvarez et al., 2021; Bravo et al., 2021; Ramos-Herrera & Sosvilla-Rivero, 2020; Sanchez-Romero et al., 2020). Furthermore, ensuring the long-term sustainability of the social security system is not inherently a financial problem; rather, its solution would make sense from a transdisciplinary perspective that considers biological, social, psychological, and spiritual-identity aspects of the contexts where the pension system will be implemented (Arulsamy & Delaney, 2022; Mostert et al., 2022; Pilipiec et al., 2021; Wang & Zheng, 2021).

Thus, theoretical and practical development of public policies, participatory governance initiatives, and the establishment and consolidation of partnerships between key actors from various sectors (industry, business, health, education) and the departments responsible for social security are required (Bao et al., 2021; Wahab et al., 2023). However, consumer responses can be difficult for decision-makers, policymakers, and other aforementioned actors to anticipate, ensuring that assessments address the most pressing factors and that policy measures contribute to the well-being of pensioners, both within the system itself (Kang et al., 2022; Pak, 2020).

Among the most visible alternatives is the European Union's position, where several member states have raised their retirement ages in recent decades or are in the process of gradually doing so (Hinrichs, 2021). This strategy reflects the need to establish tight correlations between retirement age and increasing life expectancy, ensuring that people contribute for a longer period before receiving benefits (Khandan, 2024).

Another approach to strengthening social security and alleviating the stress generated by the aforementioned social problems has been the transition to defined-contribution systems, where pension benefits depend on contributions made and investment performance. This strategy shifts risk from governments and employers to individuals or private entities but also facilitates better design of retirement plans by establishing greater clarity regarding the amount to be received after leaving the active labor market (Li & Cowton, 2023). Other benefits for individuals include portability, which promotes financial and educational responsibility, as well as the ability to make informed decisions over different time periods.

Likewise, the literature highlights the impact of financial education as a growing field and the importance of integrating ICTs into financial management (Hoffmann & Plotkina, 2020; Sarker & Datta, 2022). In the current context, it is vital to help people make informed decisions about their savings and pension plans. Hence, governments and institutions are investing in financial education programs to improve individuals' understanding of the importance of both processes (Alessie et al., 2013; Panos & Wilson, 2020; Sundarasen et al., 2023; Tang et al., 2021; Tomar et al., 2021). In this sense, the development of Fintech has facilitated social and financial inclusion, improved fiscal transparency in account management, and fostered a more pleasant and personalized financial management experience, in contrast to old beliefs related to the savings system (Al Suwaidi & Mertzanis, 2024; Billari et al., 2023; Nguyen, 2022; Zhang & Fan, 2024).

Finally, it should be noted that an important objective of retirement age reforms, in addition to tax savings, is to increase the labor supply of people traditionally considered eligible for retirement (Andersen et al., 2021; Santis, 2020; Soosaar et al., 2021). The labor market's ability to absorb the additional labor supply has important consequences for benefit substitution and affects the overall social security budget (Zhu, 2021). Consequently, employment outcomes also impact the social costs of these reforms through the poverty risk of people not eligible for pension benefits.

In response to the problematization presented, the study's main objective was to conduct a bibliometric review of pension trends as a component of the social security system worldwide in Latin America and Central America. This bibliometric literature review focused on identifying the main trends in productivity indicators and the structure of the field of knowledge. To this end, the theoretical foundations were addressed, and the results were compared with a qualitative analysis embedded in the main design.

Social security

As previously mentioned, population aging has brought increased attention to frequently discussed policy issues related to the management of retirement programs (Feng et al., 2020). In this regard, while some countries have adopted policies aimed at making the retirement age more flexible to adapt to the changing current context and life expectancy, others continue to maintain a uniform retirement age across the population or are in the process of implementing retirement policy reforms. Consequently, one of the most important economic decisions older adults must make is when to claim their Social Security retirement benefits.

While optimal claiming ages vary depending on individual preferences, mortality risk, and economic and health circumstances, there is broad agreement that some people claim too early, resulting in permanently reduced monthly payments (Maurer & Mitchell, 2021). The traditional approach to addressing this problem is to provide people with more information through educational materials about the implications of the timing of their claiming decision. According to various studies, the impact of providing more information or training in various policy areas, including education, financial planning, and tax and welfare policy, is considerable (Maurer & Mitchell, 2021).

Pensions

Pension systems are based on the same principle of income reduction during working years and provide retirement benefits in old age (Koomen & Wicht, 2022). An important example of this management approach is the three pillars of the European system, composed of the public pension, (mandatory) occupational pensions, and individual private pensions (Nagore & van Soest, 2022).

The first pillar consists of a financing scheme supported by a pay-as-you-go system (Nagore & Van Soest, 2022). All residents aged 15 to 65 are eligible for the pension system after reaching a certain threshold, which accrues 2% of the full public pension benefit each year. The second pillar of retirement aims to help workers maintain their standard of living after retirement (Nagore & van Soest, 2022). These occupational pensions are mandatory for most employees, and some independent professionals, and their management is fully annualized and organized at the company or sector level.

Finally, the third pillar corresponds to the private scheme, which is voluntary and offers some tax advantages to individuals who accumulate a limited occupational pension. This type of pension primarily benefits the self-employed and a small group of workers without retirement pensions (Nagore & van Soest, 2022).

On the other hand, an overlapping generation analysis shows that equity-funded pensions increase net holdings of external assets. With a multi-pillar system with an equity-funded portion representing 18% of pensions, the Austrian current account balance would be 1 percentage point of gross domestic product (GDP) higher than that of pure pay-as-you-go pensions over 20 years. By comparison, the Austrian current account surplus averages 1.8 percent of GDP (Davoine, 2021).

METHODOLOGY

Definition of the topic and objectives

This article provides a diagnosis of the trends in pension research in the field of social security based on a bibliographic review of a homogeneous database of 672 scientific articles corresponding to the scientific production between 1956 and 2023. The documents were extracted from the Web of Science database, with the aim of determining research trends and identifying the most influential authors, journals, institutions, and countries, as well as the main thematic areas and collaboration networks.

Search for information and criteria for data extraction

The search was based on the need to retrieve documents related to the field, so terms related to social security and pensions were used, such as: "social security," "pensions," and "retirement benefits." A simple formula was used to achieve the greatest possible dispersion in the results and expand the findings in terms of lines and trends. Finally, the formula was represented as follows: TS=("social security" OR pensions OR "retirement benefits") AND PY=(1956-2023). The criteria used to operationalize the search were the following:

· Titles, abstracts, and keywords.

· Specific time period (1956–2023).

· Document types (research articles, reviews, book chapters, and books).

The data were exported to VOSviewer software, where the following fields were analyzed: titles, authors, affiliations, abstracts, keywords, cited references, years of publication, and journals. This allowed us to explore the number of publications per year, the most productive authors and their co-authorship relationships, and the countries with the highest number of publications.

In addition, a citation analysis was performed based on the most cited articles and authors, a keyword analysis was performed to determine the most frequent keywords and the thematic evolution over time, and a thematic network analysis was performed to identify thematic clusters and map the field. As an additional resource, data, and representations provided by the Lens database (lens.org) were consulted by replicating the search strategy and filtering for articles on the Web of Science.

Analysis and interpretation

Once the data were extracted and processed, the findings were analyzed based on Zipf's law, Lotka's law, and the h-index. Zipf's law analysis allowed us to observe the frequency distribution of terms in the titles, abstracts, and keywords to assess whether it followed the expected distribution, where the most frequent term appears approximately twice as often as the second most frequent term, three times as often as the third most frequent term, and continues with an ascending pattern. In this way, we sought to interpret the relevance and consistency of the most frequent terms in the field of study.

For its part, Lotka's law analysis allowed us to evaluate the productivity of authors based on the number of publications per author, in order to verify the distribution of author productivity that follows this law. This allowed us to assess the concentration of productivity in a few authors compared to a more uniform distribution.

Finally, the h-index was calculated to determine the number of citations per author based on the maximum number h, such that each author has at least h publications with at least h citations each. This procedure allowed for comparing the h-index of different authors and analyzing their correlation with productivity and citation frequency.

These procedures allowed for the interpretation and discussion of the results based on research trends, specifically how research in social security and pensions has evolved; the identification of the most influential papers, authors, and journals in the field; as well as areas of focus and potential gaps in the literature.

RESULTS AND DISCUSSION

The main findings are presented below by indicator. A rigorous comparison of these results with those obtained from the literature review, the Lens database, and the interpretation is also provided.

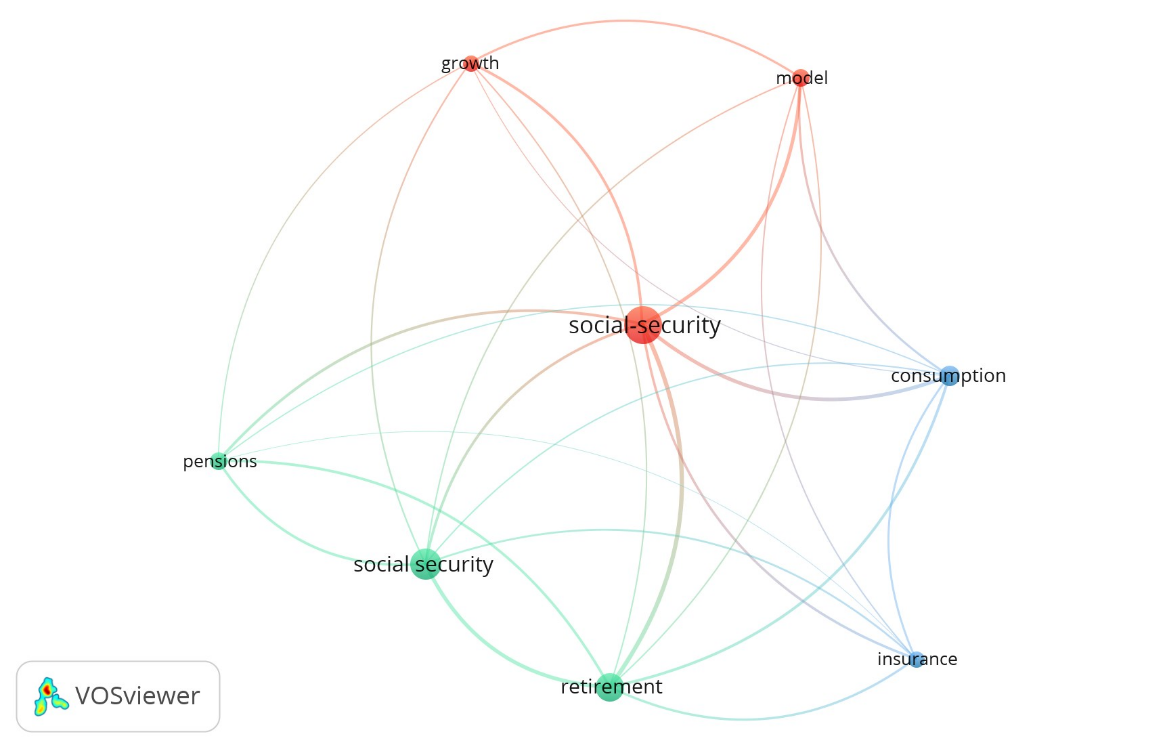

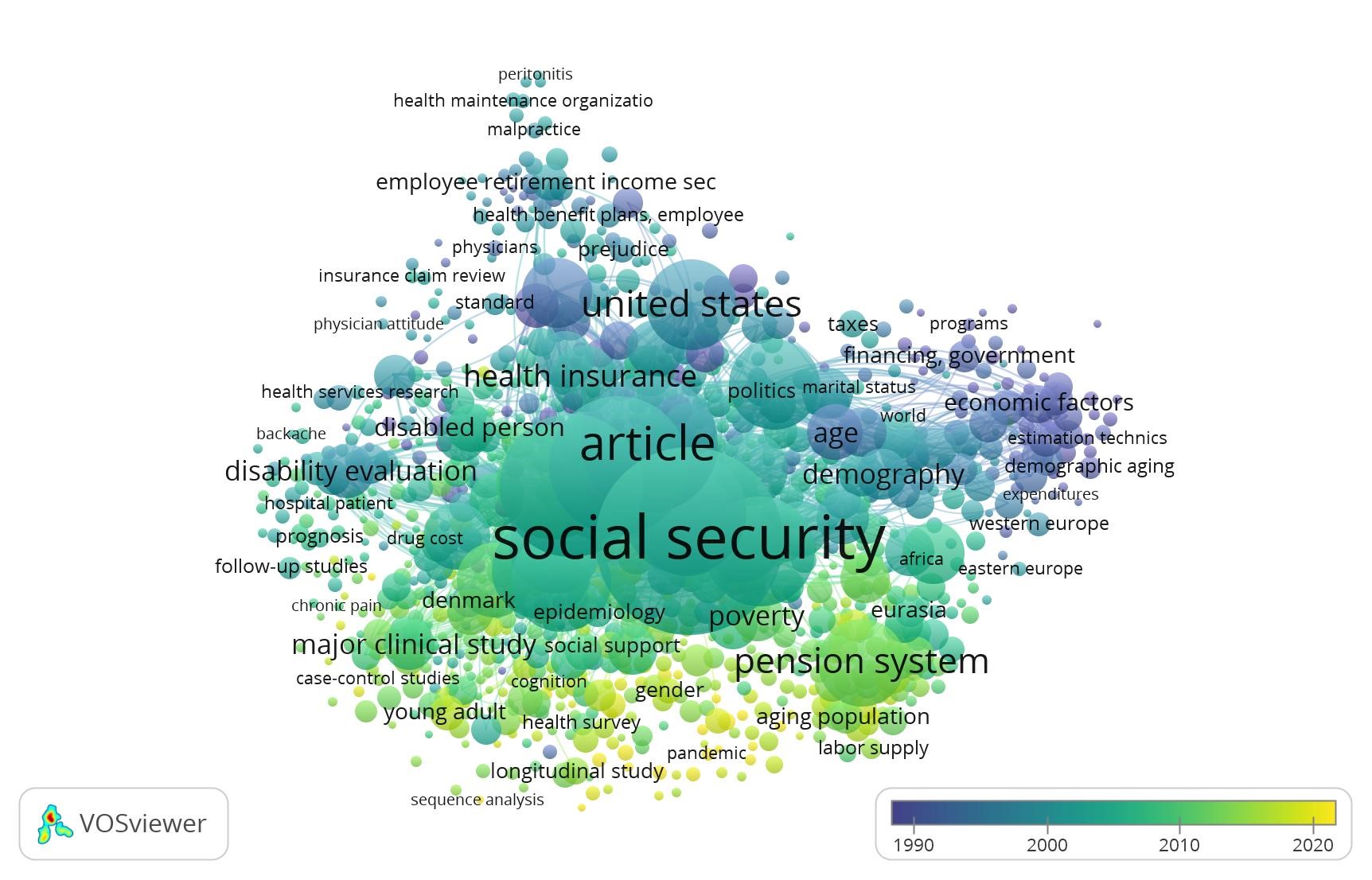

Most cited words

As shown in table 1, a search for keywords or terms was performed in the database using VOSviewer software, selecting 23 occurrences per keyword. 1,173 words were found with 8 thresholds. The keywords are listed in figure 1.

|

Keywords |

|||

|

No. |

Keywords |

Occurrence |

Total Link Strength |

|

1 |

Social Security |

216 |

187 |

|

2 |

Retirement |

74 |

95 |

|

3 |

Consumption |

39 |

61 |

|

4 |

Models |

31 |

50 |

|

5 |

Pensions |

29 |

44 |

|

6 |

Insurance |

27 |

41 |

|

7 |

Growth |

24 |

36 |

Source: own elaboration

|

Figure 1. Keywords |

|

|

Source: own elaboration using VOSviewer

This analysis is crucial because it allows us to understand how study motivations are perceived behind the research. To delve deeper into these trends, three unit-by-unit analyses were run in VOSviewer to explore term clusters. In addition, an analysis of the evolution of the most cited works over time was conducted with the aid of the data.

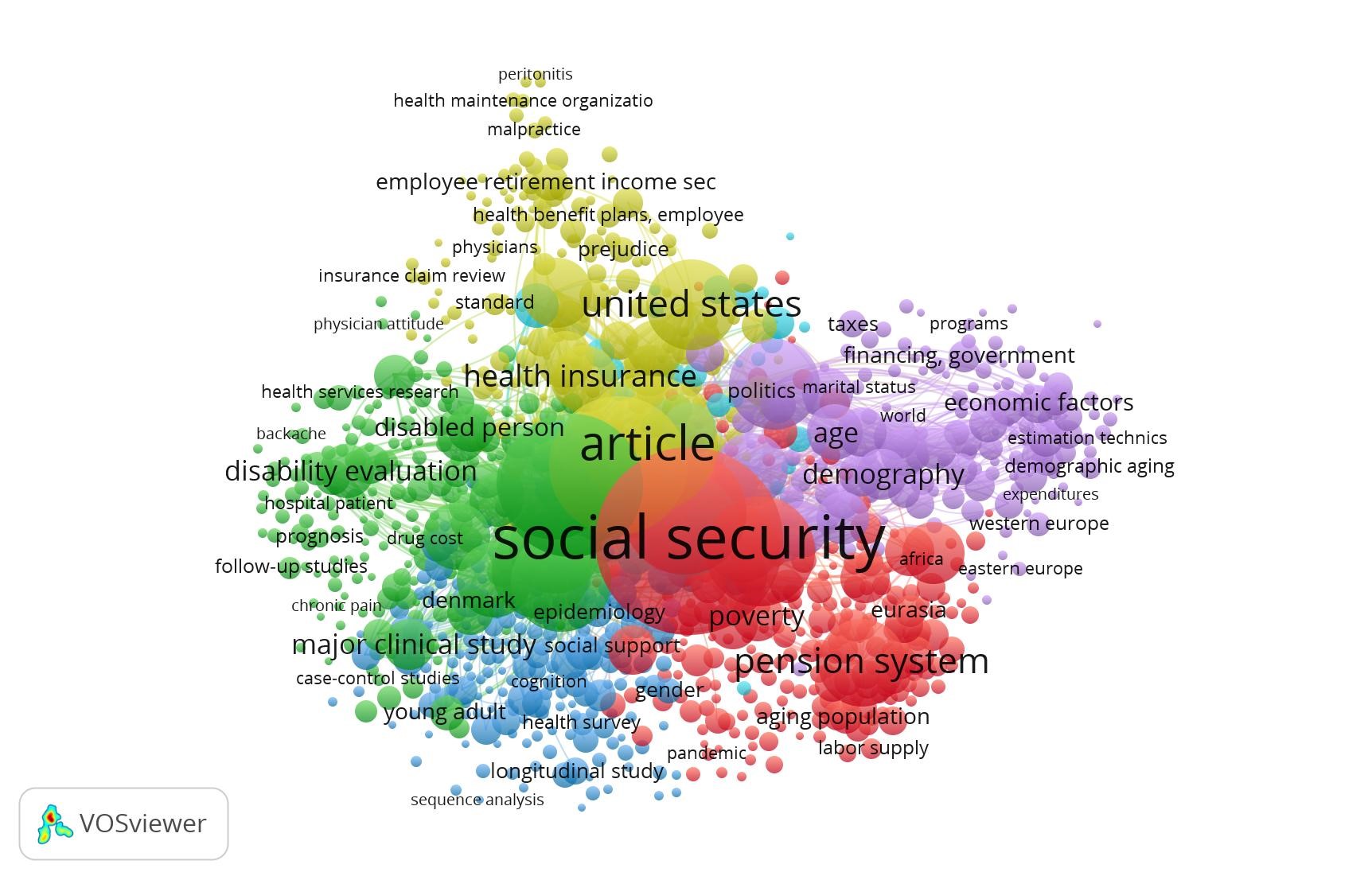

First, the analysis of all keywords revealed five moderately defined clusters where the centrality trend was dominated by social security. Furthermore, a tendency was observed to mention geographic areas and countries of study. Regarding keywords specific to the field, the following stood out: economic factors, estimation techniques, population aging, taxes, policies, and expenditures (purple cluster); social security, aging population, poverty, and labor supply (red cluster); young adult, longitudinal study, gender, social study, and cognition (blue cluster); chronic pain, prognosis, patient, follow-up study, disabled person, and health service (green cluster); benefit plans, retirement, insurance claims, secure income and bad practices (olive cluster).

|

Figure 2. Analysis of all keywords |

|

|

Source: own elaboration using VOSviewer

As can be seen in the analysis of all the keywords, well-defined interests are feasible to address according to the different areas (figure 3). Consequently, an analysis of the main areas of study was performed through a heat map created in the Lens database, which showed three fundamental areas: economics, medicine, and political science; together, they can be seen represented in the keyword analysis.

|

Figure 3. Heat map by areas |

|

|

Source: own elaboration using Lens database

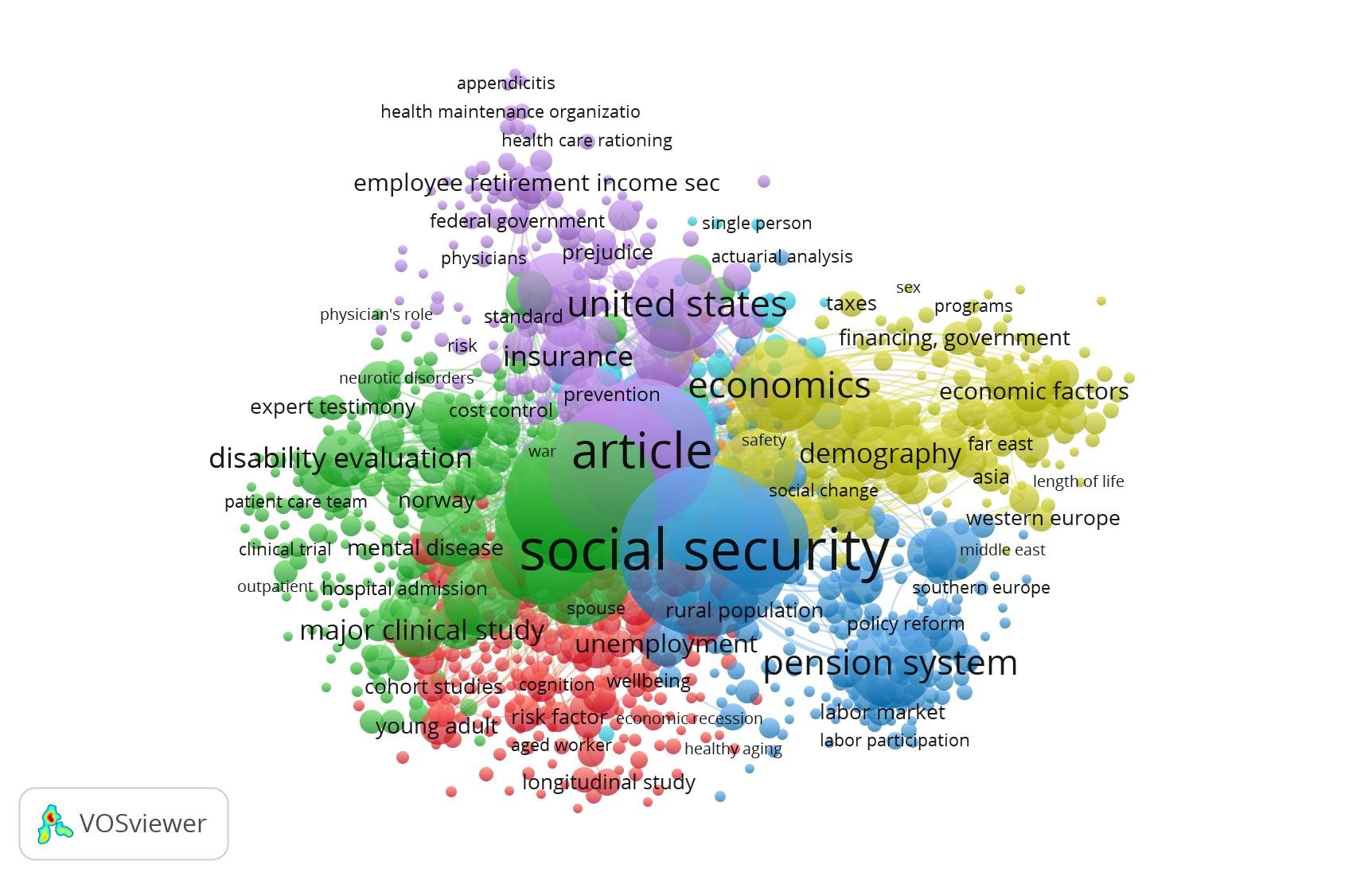

To contrast this result, an analysis of the "index keyword" unit yielded similar results, although the disciplinary divisions are clear and difficult to establish (figure 4). This result reinforces the need for transdisciplinary and interdisciplinary approaches to issues related to social security and pensions; an aspect confirmed by the analysis of the keywords proposed by the authors (figure 5).

|

Figure 4. Analysis of keywords according to the indexer |

|

|

Source: own elaboration using VOSviewer

|

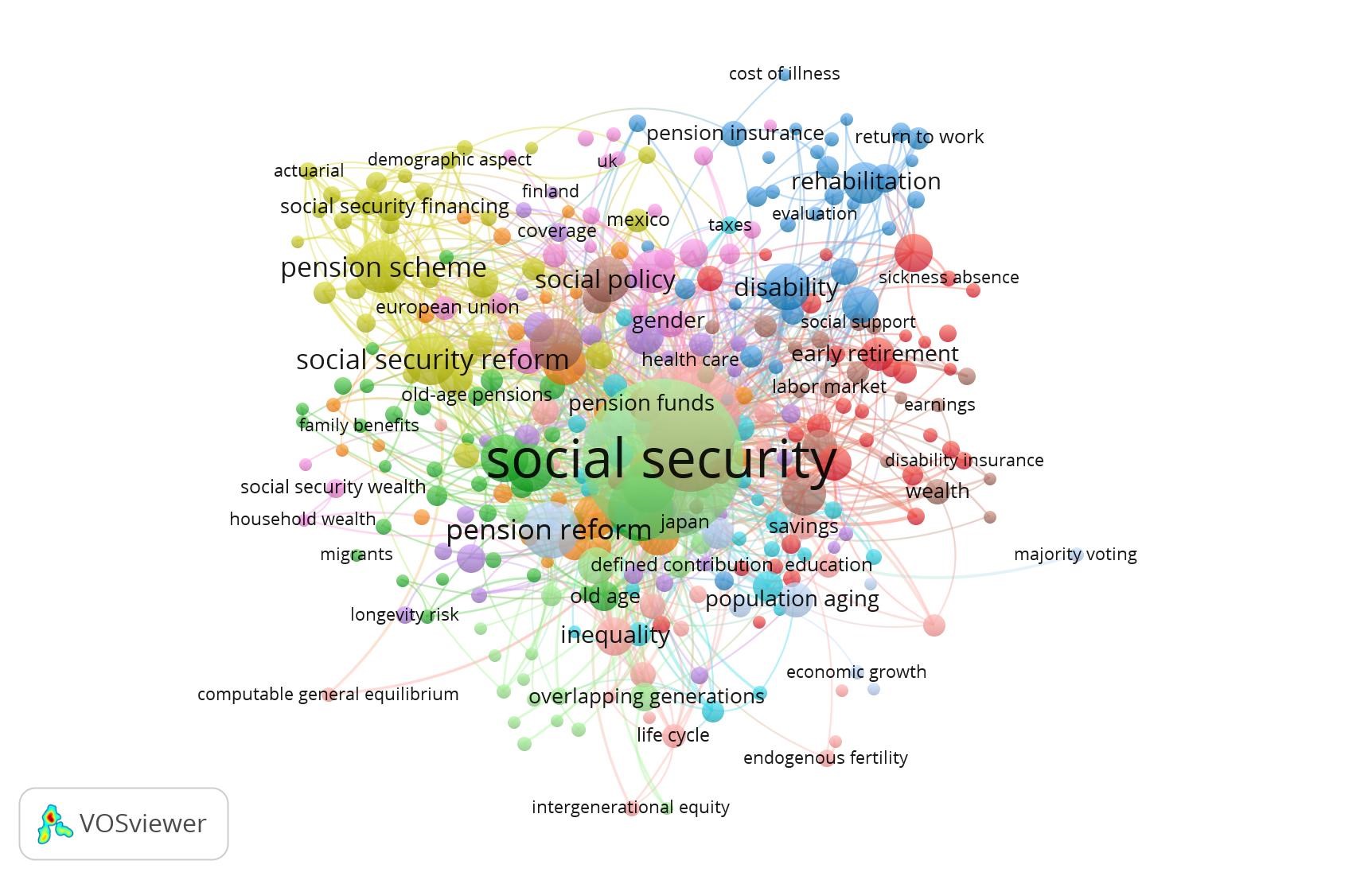

Figure 5. Analysis of keywords according to the authors |

|

|

Source: own elaboration using VOSviewer

Most cited articles

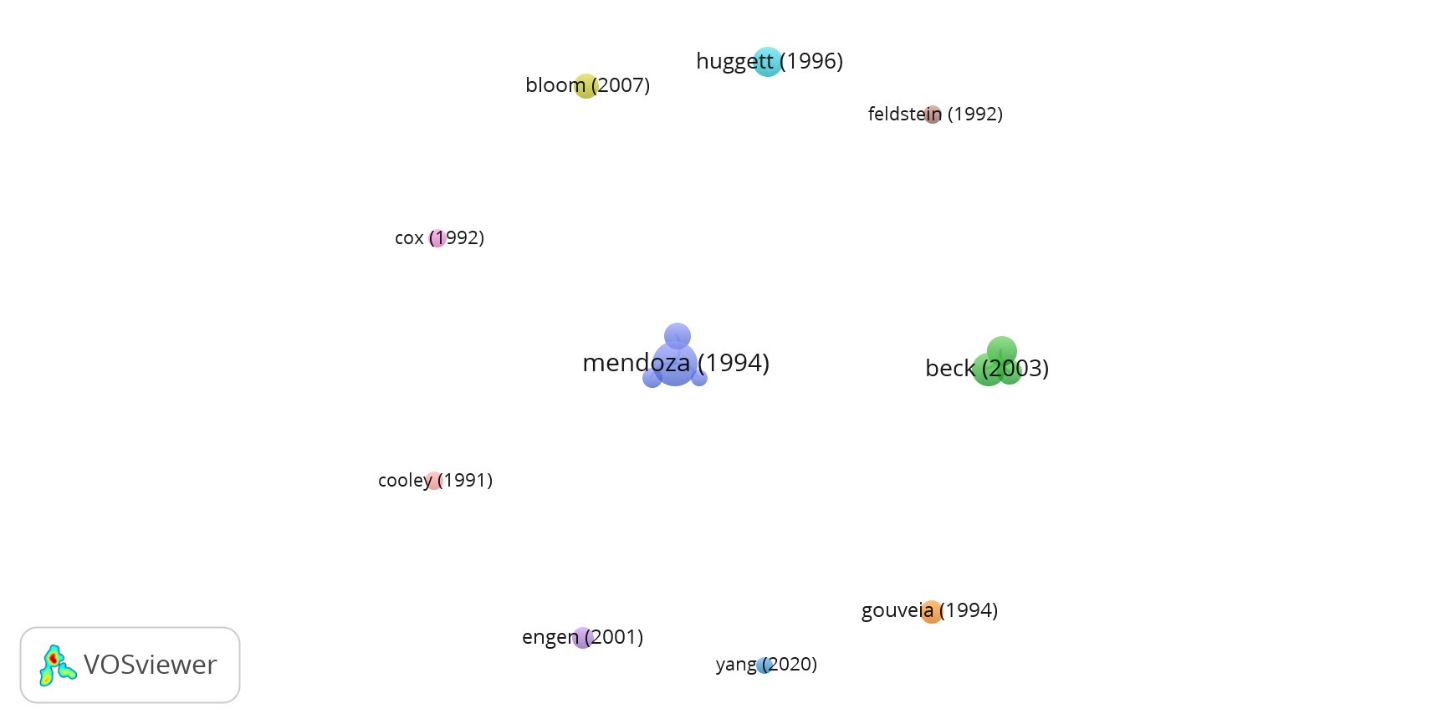

Regarding the extraction of the most cited articles, a minimum of 60 citations per document was selected. This search yielded 15 documents, as detailed below in table 2.

|

Table 2. Most cited articles |

|||

|

No. |

Document |

Citations |

Links |

|

1 |

Mendoza (1994) |

447 |

3 |

|

2 |

Beck (2003) |

246 |

2 |

|

3 |

Browne (1993) |

204 |

2 |

|

4 |

Huggett (1996) |

194 |

0 |

|

5 |

Mcgrattan (1994) |

166 |

0 |

|

6 |

Bloom (2007) |

145 |

0 |

|

7 |

Li (2007) |

133 |

0 |

|

8 |

Gouveia (1994) |

129 |

0 |

|

9 |

Engen (2001) |

112 |

0 |

|

10 |

Goome (2007) |

86 |

0 |

|

11 |

Cooley (1991) |

83 |

0 |

|

12 |

Cox (1992) |

78 |

0 |

|

13 |

Feldstein (1992) |

73 |

0 |

|

14 |

Attanasio (2007) |

64 |

0 |

|

15 |

Yang (2020) |

60 |

0 |

Source: Own elaboration

The analysis of the most cited articles shows a significant bias toward articles published before 2005 (figure 6). This result is crucial because it indicates that they constitute the basis for subsequent studies, but also because it highlights the need to update the most influential texts, especially in light of the impact of COVID-19 and current economic trends.

|

Figure 6. Most cited articles |

|

|

Source: own elaboration using VOSviewer

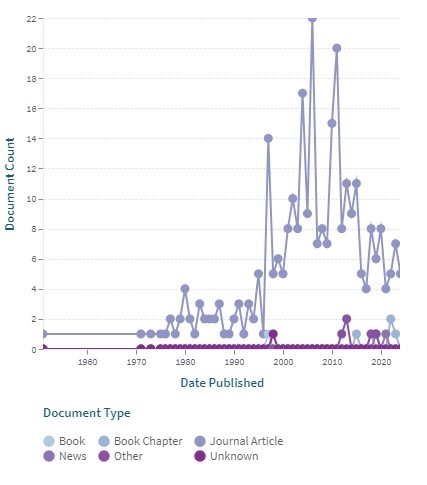

This result, however, did not match the metric shown by the Lens database, which showed greater clustering in the years following the aforementioned brand (2005), as well as a higher average number of citations (figure 7). It was precisely in this year that the most cited article was published, entitled "Customer relationship dynamics: Service quality and customer loyalty in the context of varying levels of customer expertise and switching costs", with 446 citations recorded by the database.

|

Figure 7. Evolution of the main academic works according to citations |

|

|

Source: own elaboration using Lens database

Most prolific authors

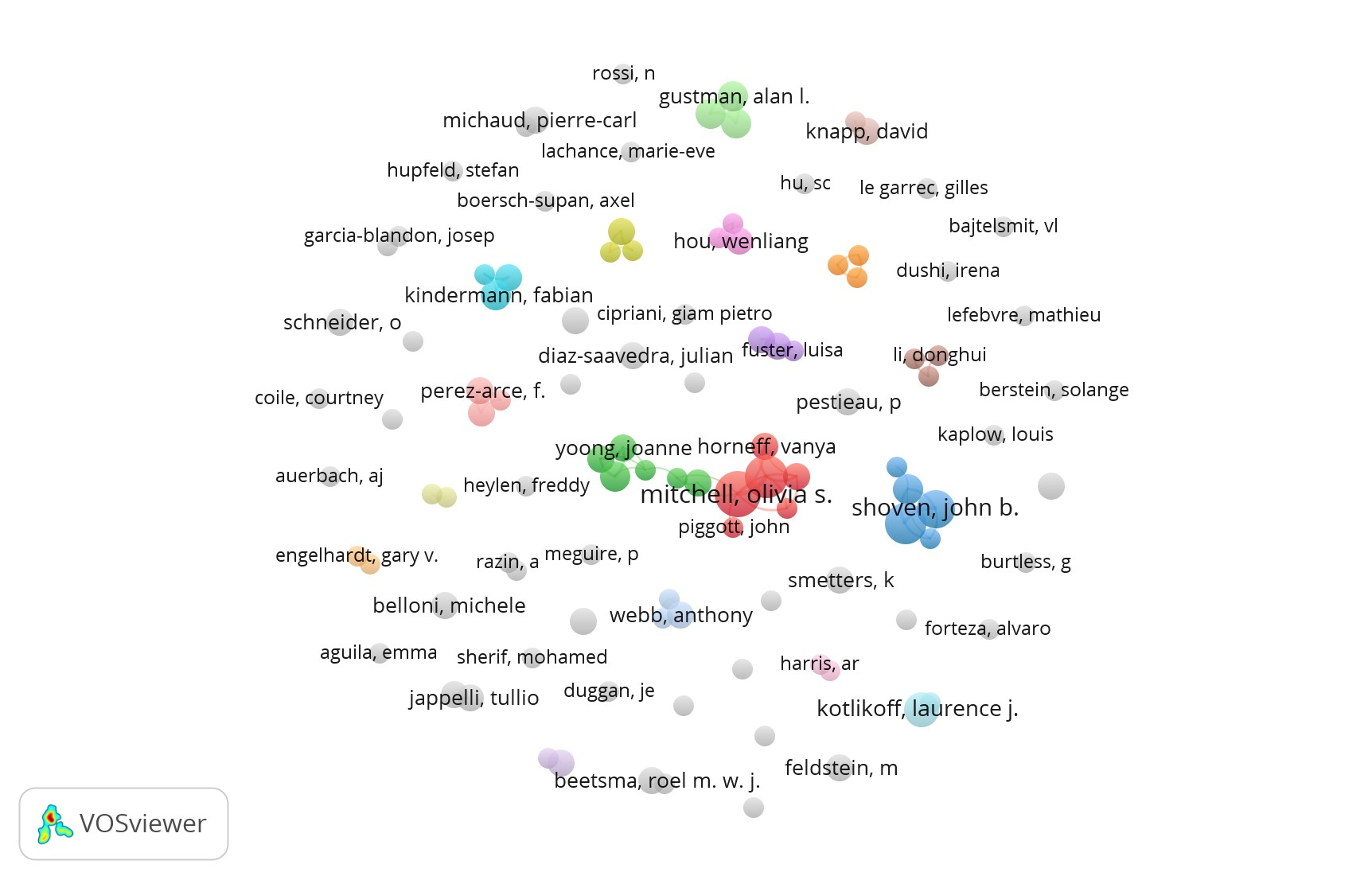

Table 3 shows a co-authorship analysis based on the most prolific authors within the analyzed database. In this regard, 844 authors were found, and a minimum of 5 documents per author were selected. This showed that the most prolific authors were: Mitchell, Olivia S., with 9 published documents; followed by Maurer, Raimond, with 8 published articles; Slavov, Sita Nataraj, with 7 published articles; Shoven, John B., with 6 published articles; and finally, Kotlikoff, Laurence J., with 5 published articles. As can be seen in figure 8, during the period studied, the most prolific authors tended to be disconnected, so it is not possible to speak of an invisible college.

|

Table 3. Most prolific authors 1 |

||||

|

No. |

Authors |

Documents |

Citations |

Total Link Strength |

|

1 |

Mitchell, Olivia S. |

9 |

145 |

7 |

|

2 |

Maurer, Raimond |

8 |

94 |

7 |

|

3 |

Slavov, sita nataraj |

7 |

61 |

6 |

|

4 |

Shoven, John b. |

6 |

61 |

6 |

|

5 |

Kotlikoff, laurence j. |

5 |

71 |

0 |

Source: own elaboration

|

Most prolific authors 2 |

|

|

Source: own elaboration using VOSviewer

Scientific production by country

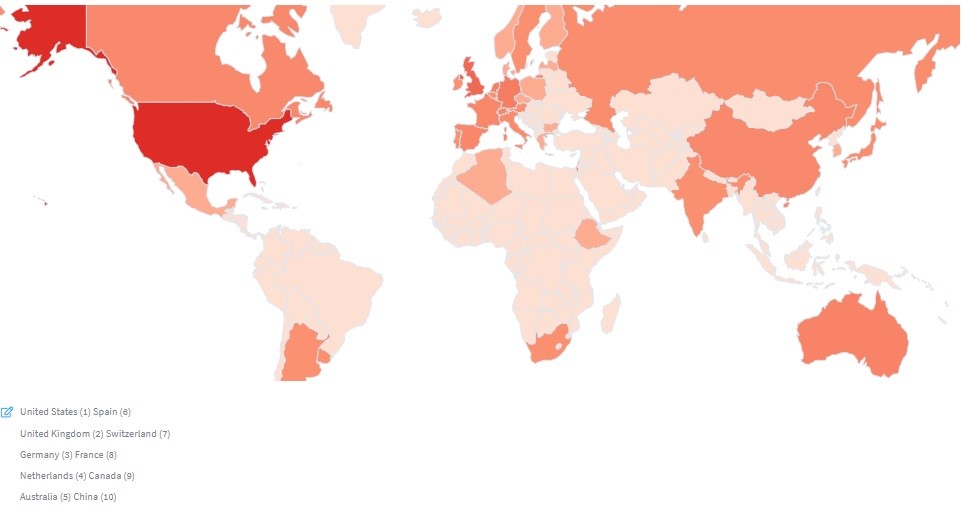

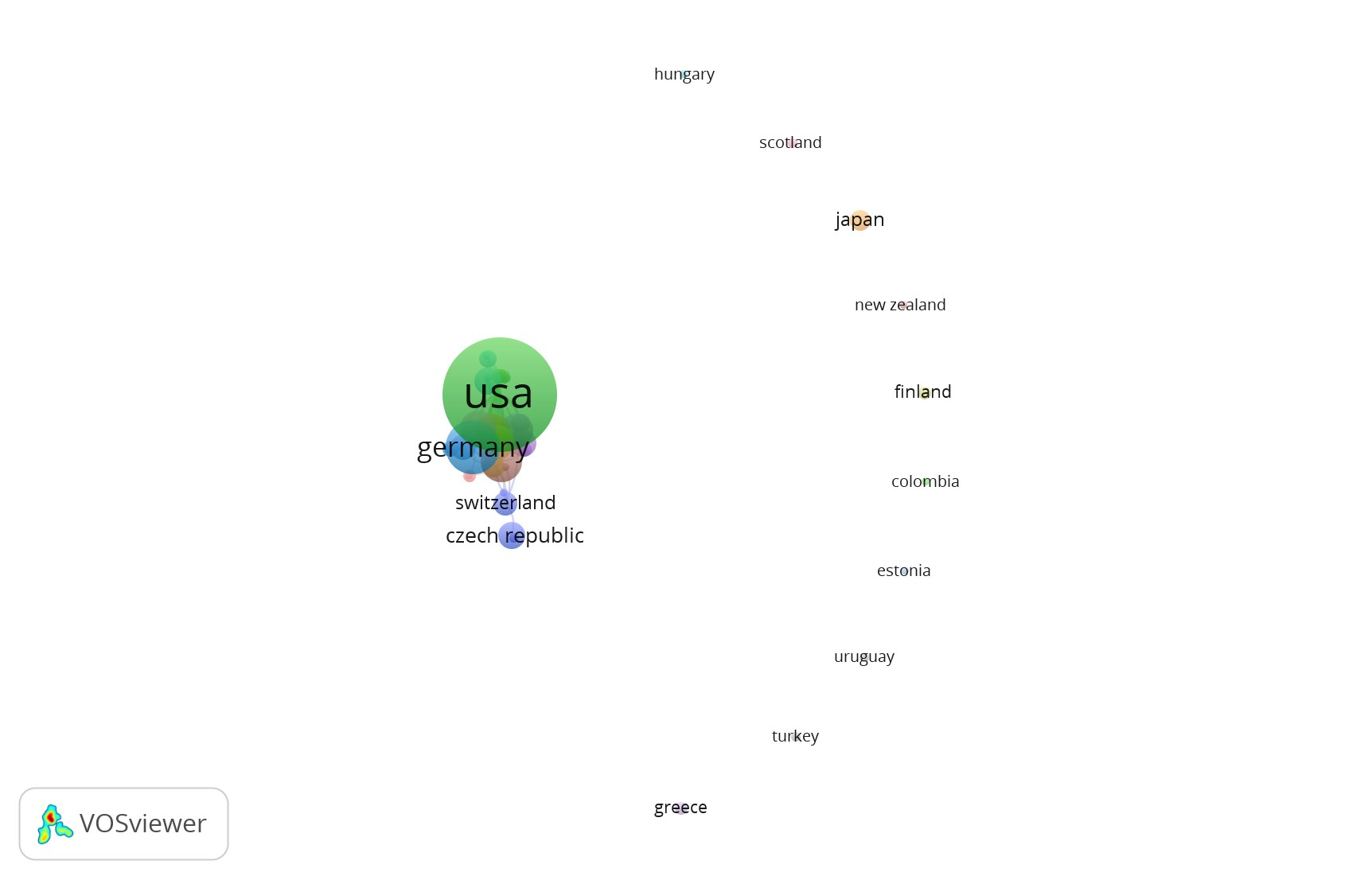

Regarding the geographical distribution of scientific production, it was found distributed across 51 countries, with the United States leading the way, with 219 articles, representing 40.04%. The next six countries accounted for 29.62%, and the remainder, equivalent to 30.35%, was distributed across 44 countries.

|

Table 4. Geographical presentation of scientific production (26 countries) |

|||||

|

No. |

Country |

Documents |

Citations |

Total Link Strength |

Percentage |

|

1 |

USA |

219 |

3677 |

51 |

40.04 |

|

2 |

Germany |

50 |

350 |

25 |

9.14 |

|

3 |

England |

29 |

364 |

25 |

5.30 |

|

4 |

Spain |

23 |

152 |

13 |

4.20 |

|

5 |

Italy |

21 |

195 |

13 |

3.84 |

|

6 |

France |

20 |

111 |

10 |

3.66 |

|

7 |

Peoples R China |

19 |

219 |

16 |

3.47 |

|

8 |

Australia |

13 |

187 |

9 |

2.38 |

|

9 |

Canada |

13 |

247 |

10 |

2.38 |

|

10 |

Czech Republic |

13 |

37 |

4 |

2.38 |

|

11 |

Netherlands |

11 |

96 |

8 |

2.01 |

|

12 |

Switzerland |

10 |

60 |

5 |

1.83 |

|

13 |

Belgium |

9 |

84 |

5 |

1.65 |

|

14 |

Sweden |

9 |

168 |

15 |

1.65 |

|

15 |

Japan |

8 |

28 |

0 |

1.46 |

|

16 |

Taiwan |

7 |

41 |

3 |

1.28 |

|

17 |

Norway |

6 |

102 |

4 |

1.10 |

|

18 |

Singapore |

6 |

21 |

5 |

1.10 |

|

19 |

Austria |

5 |

7 |

3 |

0.91 |

|

20 |

Chile |

4 |

7 |

1 |

0.73 |

|

21 |

Israel |

4 |

473 |

5 |

0.73 |

|

22 |

South Korea |

4 |

11 |

3 |

0.73 |

|

23 |

Finland |

3 |

20 |

0 |

0.55 |

|

24 |

Greece |

3 |

11 |

0 |

0.55 |

|

25 |

Poland |

3 |

7 |

3 |

0.55 |

|

26 |

Portugal |

3 |

55 |

3 |

0.55 |

Source: own elaboration

This result was consistent with those shown by the Lens database, where the top three countries in productivity were the United States, the United Kingdom, and Germany, respectively. It is also interesting that the Netherlands and the People's Republic of China occupy different ranks, both appearing lower in the ranking (figure 9).

|

Figure 9. Most active countries according to the Lens database |

|

|

Source: own elaboration using Lens database

|

Table 5. Geographical presentation of scientific production (25 countries) |

|||||

|

No. |

Country |

Documents |

Citations |

Total Link Strength |

Percentage |

|

27 |

Croatia |

2 |

2 |

1 |

0.37 |

|

28 |

India |

2 |

40 |

3 |

0.37 |

|

29 |

Scotland |

2 |

25 |

0 |

0.37 |

|

30 |

Slovakia |

2 |

22 |

1 |

0.37 |

|

31 |

Tunisia |

2 |

22 |

1 |

0.37 |

|

32 |

Turkey |

2 |

2 |

0 |

0.37 |

|

33 |

Uruguay |

2 |

22 |

0 |

0.37 |

|

34 |

Argentina |

1 |

36 |

3 |

0.18 |

|

35 |

Armenia |

1 |

0 |

2 |

0.18 |

|

36 |

Colombia |

1 |

40 |

0 |

0.18 |

|

37 |

Estonia |

1 |

1 |

0 |

0.18 |

|

38 |

Fiji |

1 |

7 |

3 |

0.18 |

|

39 |

Hungary |

1 |

1 |

0 |

0.18 |

|

40 |

Ireland |

1 |

44 |

1 |

0.18 |

|

41 |

Luxembourg |

1 |

8 |

2 |

0.18 |

|

42 |

Malaysia |

1 |

0 |

1 |

0.18 |

|

43 |

Mexico |

1 |

48 |

2 |

0.18 |

|

44 |

New Zealand |

1 |

9 |

0 |

0.18 |

|

45 |

North ireland |

1 |

145 |

1 |

0.18 |

|

46 |

Peru |

1 |

4 |

1 |

0.18 |

|

47 |

Russia |

1 |

0 |

2 |

0.18 |

|

48 |

Thailand |

1 |

0 |

1 |

0.18 |

|

49 |

U Arab Emirates |

1 |

0 |

2 |

0.18 |

|

50 |

Ukraine |

1 |

0 |

1 |

0.18 |

|

51 |

Wales |

1 |

3 |

1 |

0.18 |

Source: own elaboration

Similar to what was shown in the previous figure, the analysis of the distribution of scientific output showed a tendency toward disconnection (figure 10). This result may be influenced by the long period studied and the recent influence of academic social networks, the rise of scientific publications, and the socialization of scientific communication through social media.

|

Figure 10. Scientific production by country |

|

|

Source: own elaboration using VOSviewer

Analysis and interpretation

The analysis of word frequencies in the titles, abstracts, and keywords of the selected articles revealed that terms such as "pensions," "social security," "reform," "sustainability," and "pension system" were the most frequent. The word "social security" was the most common, followed by "pensions." It is worth noting that, as this is such a diverse field, the keywords respond to disciplinary matrices but also to general terms; hence, Zipf's law explains the predominance of these terms over others already analyzed in figures 4 and 5.

Consequently, it can be noted that the high frequency of these terms suggests that pension studies in the field of social security are primarily focused on the reform of pension systems and their fiscal sustainability, a finding consistent with the literature review and analysis of the international context (Ebbinghaus, 2021; Fornero & lo Prete, 2023). Thus, the word frequency distribution confirms the applicability of Zipf's law in this context, indicating a concentration of research on a few key topics, but with consideration of an increasing expansion and different hierarchies according to other disciplines that occupy these categories to point out specific research problems or interests.

On the other hand, the analysis of author productivity showed that a small group of researchers has published a large number of articles on the topic, while most authors have contributed one or two. It also highlights that collaborative networks, conditioned by the study's temporality, are small and unrelated, so studies with shorter and more recent time frames could shed greater light on author productivity. In the future, it is necessary to delve deeper into highly productive authors and update the time frame, as even in the Lens database, a significant preponderance was not observed (Owusu et al., 2023). These results may suggest that the law is not fulfilled for the field, as no authors with significant influence on the direction and focus of research in this area were found.

Along these same lines, the analysis showed that after calculating the h-index, the most prolific authors also do not tend to have the highest h-indexes. These were observed in authors who have published fewer articles, although these are highly cited, on key topics such as pension sustainability and pension system reforms.

By observing the evolution of the most frequent terms over time, it was identified that, in the early years, research focused on the “implementation of pension systems”. In more recent years, studies have shifted toward the "sustainability" and "reforms" of pension systems. Furthermore, the analysis of keywords over time showed a greater tendency to reflect social issues and different fields of study, while in the early years, studies showed a marked shift toward economics.

These trends, as previously discussed, indicate an evolution in the focus of research, possibly in response to emerging challenges in the field of social security. The shift toward sustainability and reform reflects current concerns about the long-term viability of pension systems, marked, as indicated by the keywords, by gender, savings and financial literacy in early adulthood, labor supply, and various lines associated with disability or illness (figure 11).

|

Figure 11. Temporal evolution of keywords |

|

|

Source: own elaboration using VOSviewer

Regarding geographical distribution, the study showed a high concentration of publications in developed countries, with international collaborations increasing over time, albeit slowly. Co-authorship networks revealed that certain countries and authors act as central nodes in these networks, but they lack the strength or visibility of other fields, with strong invisible colleges and exchange networks. These results must be analyzed from a temporal perspective, which, while favoring a better understanding of the evolution of pensions within social security, does not contribute to a detailed exploration of the most current trends. The geographical concentration suggests that studies on social security pensions are predominantly carried out in countries with well-established pension systems and significant demographic challenges.

Finally, the following set of recommendations were reached after integrating the data. These lines were contrasted in more relevant and updated literature, which reinforces the importance of promoting future studies (Angelici et al., 2022; Haan et al., 2020; Mees, 2020; Sánchez-Romero et al., 2024).

1. Fostering International Collaboration. Promote collaboration between researchers from different countries to more effectively address global challenges in social security. These collaborations could foster the implementation of mixed alternatives, the exchange of experiences, and support for legislators and policymakers in developing countries.

2. Focus on Sustainability. Given the growing concern about their long-term viability, continue research on the sustainability of pension systems. These studies could facilitate a better understanding of the transition from defined-benefit systems to mixed proposals and the creation of new pension regimes that favor the ultimate goal of ensuring an adequate standard of living after retirement.

3. Diversification of Topics. Broaden the research focus to include emerging and underrepresented topics in the field of social security. Likewise, new review studies are hoped to be conducted due to the predominance of empirical articles and the need to uncover hidden trends and conduct meta-analyses.

4. Support for Emerging Researchers. Encourage and support new researchers to diversify perspectives and approaches in pension research. This is a fundamental challenge, not only in developing countries where pension systems are underrepresented in mainstream literature but also internationally.

CONCLUSIONS

The bibliometric analysis revealed a significant evolution in research on social security pensions, highlighting, among other things, an increase in academic production and its corresponding citations over the last two decades. However, studies with short, well-defined time frames are needed to delve deeper into trends and build bridges between lines of research.

It can also be concluded that the predominant themes have varied, from approaches focused on legal, economic, and introductory aspects to financial sustainability, structural reforms, and social issues. These latter categories tend to appear in the most recent studies, with an emphasis on equity and social inclusion. Furthermore, geographical diversification of research was observed, with a growing participation from developing countries, reflecting a global concern for pension systems despite the almost nonexistent appearance of Latin American and Central American studies.

The results also indicated increased international collaboration between researchers and institutions. However, it must be concluded that co-authorship networks have not expanded sufficiently to facilitate the exchange of knowledge and methodologies and, consequently, the enrichment of the field of study. In this sense, it can be stated that collaboration would allow pension challenges to be addressed from multidisciplinary perspectives, integrating economic, demographic, and social approaches. Therefore, governmental and non-governmental support is needed to finance related projects.

Finally, it is argued that flexible and mixed pension systems provide financial security, adaptation to economic conditions, savings promotion, accountability, portability, and risk mitigation. However, these systems must be accompanied by adequate financial education and regulation to ensure that individuals make informed decisions and that the system operates efficiently and equitably.

REFERENCES

Alessie, R., Angelini, V., y van Santen, P. (2013). Pension wealth and household savings in Europe: Evidence from SHARELIFE. European Economic Review, 63, 308–328. https://doi.org/10.1016/j.euroecorev.2013.04.009

AlSuwaidi, R., y Mertzanis, C. (2024). Financial literacy and FinTech market growth around the world. International Review of Financial Analysis, 95, 103481. https://doi.org/10.1016/j.irfa.2024.103481

Alvarez, J.-A., Kallestrup-Lamb, M., y Kjærgaard, S. (2021). Linking retirement age to life expectancy does not lessen the demographic implications of unequal lifespans. Insurance: Mathematics and Economics, 99, 363–375. https://doi.org/10.1016/j.insmatheco.2021.04.010

Andersen, A., Markussen, S., y Røed, K. (2021). Pension reform and the efficiency-equity trade-off: Impacts of removing an early retirement subsidy. Labour Economics, 72, 102050. https://doi.org/10.1016/j.labeco.2021.102050

Angelici, M., del Boca, D., Oggero, N., ... y Villosio, C. (2022). Pension information and women’s awareness. The Journal of the Economics of Ageing, 23, 100396. https://doi.org/10.1016/j.jeoa.2022.100396

Arulsamy, K., y Delaney, L. (2022). The impact of automatic enrolment on the mental health gap in pension participation: Evidence from the UK. Journal of Health Economics, 86, 102673. https://doi.org/10.1016/j.jhealeco.2022.102673

Bao, H., Han, L., Wu, H., y Zeng, X. (2021). What affects the “house-for-pension” scheme consumption behavior of land-lost farmers in China? Habitat International, 116, 102415. https://doi.org/10.1016/j.habitatint.2021.102415

Bernal, N., y Olivera, J. (2020). Choice of pension man agement fees and effects on pension wealth. Journal of Economic Behavior & Organization, 176, 539–568. https://doi.org/10.1016/j.jebo.2020.03.036

Berstein, S., y Morales, M. (2021). The role of a longevity insurance for defined contribution pension systems. Insurance: Mathematics and Economics, 99, 233–240. https://doi.org/10.1016/j.insmatheco.2021.03.020

Billari, F., Favero, C., y Saita, F. (2023). Online financial and demographic education for workers: Experimental evidence from an Italian Pension Fund. Journal of Banking & Finance, 151, 106849. https://doi.org/10.1016/j.jbankfin.2023.106849

Bravo, J., Ayuso, M., Holzmann, R., y Palmer, E. (2021). Addressing the life expectancy gap in pension policy. Insurance: Mathematics and Economics, 99, 200–221. https://doi.org/10.1016/j.insmatheco.2021.03.025

Davoine, T. (2021). The long run influence of pension systems on the current account. Journal of Pension Economics and Finance, 20(1), 67–101. https://doi.org/10.1017/S1474747219000258

Dong, Y., y Zheng, H. (2020). Optimal investment with S-shaped utility and trading and Value at Risk constraints: An application to defined contribution pension plan. European Journal of Operational Research, 281(2), 341–356. https://doi.org/10.1016/j.ejor.2019.08.034

Ebbinghaus, B. (2021). Inequalities and poverty risks in old age across Europe: The double‐edged income effect of pension systems. Social Policy & Administration, 55(3), 440–455. https://doi.org/10.1111/spol.12683

Feng, Z., Lien, J., y Zheng, J. (2020). Flexible or mandatory retirement? Welfare implications of retirement policies for a population with heterogeneous health conditions. International Review of Economics & Finance, 69, 1032–1055. https://doi.org/10.1016/j.iref.2018.12.011

Fornero, E., y lo Prete, A. (2023). Financial education: From better personal finance to improved citizenship. Journal of Financial Literacy and Wellbeing, 1(1), 12–27. https://doi.org/10.1017/flw.2023.7

Ghafoori, E., Ip, E., y Kabátek, J. (2021). The impacts of a large-scale financial education intervention on retirement saving behaviors and portfolio allocation: Evidence from pension fund data. Journal of Banking & Finance, 130, 106195. https://doi.org/10.1016/j.jbankfin.2021.106195

Haan, P., Kemptner, D., y Lüthen, H. (2020). The rising longevity gap by lifetime earnings – Distributional implications for the pension system. The Journal of the Economics of Ageing, 17, 100199. https://doi.org/10.1016/j.jeoa.2019.100199

Hinrichs, K. (2021). Recent pension reforms in Europe: More challenges, new directions. An overview. Social Policy & Administration, 55(3), 409–422. https://doi.org/10.1111/spol.12712

Hoffmann, A., y Plotkina, D. (2020). Why and when does financial information affect retirement planning intentions and which consumers are more likely to act on them? Journal of Business Research, 117, 411–431. https://doi.org/10.1016/j.jbusres.2020.06.023

Josa-Fombellida, R., y Navas, J. (2020). Time consistent pension funding in a defined benefit pension plan with non-constant discounting. Insurance: Mathematics and Economics, 94, 142–153. https://doi.org/10.1016/j.insmatheco.2020.07.007

Kang, J., Park, S., y Ahn, S. (2022). The effect of social pension on consumption among older adults in Korea. The Journal of the Economics of Ageing, 22, 100364. https://doi.org/10.1016/j.jeoa.2021.100364

Kessler, A. (2021). New Solutions to an Age-Old Problem: Innovative Strategies for Managing Pension and Longevity Risk. North American Actuarial Journal, 25(sup1), S7–S24. https://doi.org/10.1080/10920277.2019.1672566

Khandan, A. (2024). Old-Age Labor Exit Rates and the Impact of Social Security Programs in Iran. The Journal of Retirement, 11(3), 20–39. https://doi.org/10.3905/jor.2023.1.144

Knapp, D., y Lee, J. (2023). Introduction to special issue on institutional influences on retirement, health and well-being. Journal of Pension Economics and Finance, 22(2), 161–166. https://doi.org/10.1017/S1474747221000408

Koomen, M., y Wicht, L. (2022). Pension systems and the current account: An empirical exploration. Journal of International Money and Finance, 120, 102520. https://doi.org/10.1016/j.jimonfin.2021.102520

Li, Z., y Cowton, C. (2023). Defined benefit pension de-risking strategy: Determinants of pension buy-ins. Accounting Forum, 47(1), 123–145. https://doi.org/10.1080/01559982.2021.2024011

Maurer, R., y Mitchell, O. (2021). Older peoples’ willingness to delay social security claiming. Journal of Pension Economics and Finance, 20(3), 410–425. https://doi.org/10.1017/S1474747219000404

Mees, B. (2020). Risk shifting and the decline of defined benefit pension schemes in Australia. Accounting History Review, 30(1), 69–87. https://doi.org/10.1080/21552851.2020.1711527

Mostert, C., Mackay, D., Awiti, A., Kumar, M., y Merali, Z. (2022). Does social pension buy improved mental health and mortality outcomes for senior citizens? Evidence from South Africa’s 2008 pension reform. Preventive Medicine Reports, 30, 102026. https://doi.org/10.1016/j.pmedr.2022.102026

Nagore, A., y Van Soest, A. (2022). How does an allowance for a non-working younger partner affect the retirement behaviour of couples? Journal of Pension Economics and Finance, 21(4), 582–612. https://doi.org/10.1017/S1474747221000299

Nguyen, T. (2022). Does Financial Knowledge Matter in Using Fintech Services? Evidence from an Emerging Economy. Sustainability, 14(9), 5083. https://doi.org/10.3390/su14095083

Owusu, G., Onumah, R., y Essel-Donkor, A. (2023). Pensions and retirement systems research: A retrospective assessment from 1910 to 2022 using bibliometric analysis. Journal of Economic Studies. https://doi.org/10.1108/JES-04-2023-0212

Pak, T.-Y. (2020). Social protection for happiness? The impact of social pension reform on subjective well-being of the Korean elderly. Journal of Policy Modeling, 42(2), 349–366. https://doi.org/10.1016/j.jpolmod.2019.12.001

Panos, G., y Wilson, J. (2020). Financial literacy and responsible finance in the FinTech era: Capabilities and challenges. The European Journal of Finance, 26(4–5), 297–301. https://doi.org/10.1080/1351847X.2020.1717569

Pilipiec, P., Groot, W., y Pavlova, M. (2021). The Effect of an Increase of the Retirement Age on the Health, Well-Being, and Labor Force Participation of Older Workers: A Systematic Literature Review. Journal of Population Ageing, 14(2), 271–315. https://doi.org/10.1007/s12062-020-09280-9

Ramos-Herrera, M., y Sosvilla-Rivero, S. (2020). Fiscal Sustainability in Aging Societies: Evidence from Euro Area Countries. Sustainability, 12(24), 10276. https://doi.org/10.3390/su122410276

Sanchez-Romero, M., Lee, R., y Prskawetz, A. (2020). Redistributive effects of different pension systems when longevity varies by socioeconomic status. The Journal of the Economics of Ageing, 17, 100259. https://doi.org/10.1016/j.jeoa.2020.100259

Sánchez-Romero, M., Schuster, P., y Prskawetz, A. (2024). Redistributive effects of pension reforms: Who are the winners and losers? Journal of Pension Economics and Finance, 23(2), 294–320. https://doi.org/10.1017/S147474722300015X

Santis, S. (2020). The Demographic and Economic Determinants of Financial Sustainability: An Analysis of Italian Local Governments. Sustainability, 12(18), 7599. https://doi.org/10.3390/su12187599

Sarker, I., y Datta, B. (2022). Re-designing the pension business processes for achieving technology-driven reforms through blockchain adoption: A proposed architecture. Technological Forecasting and Social Change, 174, 121059. https://doi.org/10.1016/j.techfore.2021.121059

Soosaar, O., Puur, A., y Leppik, L. (2021). Does raising the pension age prolong working life? Evidence from pension age reform in Estonia. Journal of Pension Economics and Finance, 20(2), 317–335. https://doi.org/10.1017/S1474747220000244

Sundarasen, S., Rajagopalan, U., Kanapathy, M., y Kamaludin, K. (2023). Women’s financial literacy: A bibliometric study on current research and future directions. Heliyon, 9(12), e21379. https://doi.org/10.1016/j.heliyon.2023.e21379

Tang, L., Sun, S., y Yang, W. (2021). Investments in human capital: The evidence from China’s new rural pension scheme. Research in International Business and Finance, 55, 101345. https://doi.org/10.1016/j.ribaf.2020.101345

Tomar, S., Kent, H., Kumar, S., y Hoffmann, A. (2021). Psychological determinants of retirement financial planning behavior. Journal of Business Research, 133, 432–449. https://doi.org/10.1016/j.jbusres.2021.05.007

Valls, M., Santos-Jaén, J., Amin, F., y Martín-Cervantes, P. (2021). Pensions, Ageing and Social Security Research: Literature Review and Global Trends. Mathematics, 9(24), 3258. https://doi.org/10.3390/math9243258

Wahab, M., Khan, M., Siddique, M., y Hasan, F. (2023). Investigating pension choice factors among the faculty of public sector universities in Pakistan. International Journal of Emerging Markets. https://doi.org/10.1108/IJOEM-08-2022-1212

Wang, F., y Zheng, H. (2021). Do Public Pensions Improve Mental Wellbeing? Evidence from the New Rural Society Pension Insurance Program. International Journal of Environmental Research and Public Health, 18(5), 2391. https://doi.org/10.3390/ijerph18052391

Yeh, C.-Y., Cheng, H., y Shi, S.-J. (2020). Public–private pension mixes in East Asia: Institutional diversity and policy implications for old-age security. Ageing and Society, 40(3), 604–625. https://doi.org/10.1017/S0144686X18001137

Zhang, Y., y Fan, L. (2024). The nexus of financial education, literacy and mobile fintech: Unraveling pathways to financial well-being. International Journal of Bank Marketing. https://doi.org/10.1108/IJBM-09-2023-0531

Zhao, Z., y Sutcliffe, C. (2021). What determines the asset allocation of defined benefit pension funds? Applied Economics, 53(36), 4178–4191. https://doi.org/10.1080/00036846.2021.1897512

Zhu, R. (2021). Retirement and voluntary work provision: Evidence from the Australian Age Pension reform. Journal of Economic Behavior & Organization, 190, 674–690. https://doi.org/10.1016/j.jebo.2021.08.011

FINANCING

None.

CONFLICT OF INTEREST STATEMENT

None.

AUTHORSHIP CONTRIBUTION

Conceptualization: Milton Antonio Fonseca Velásquez.

Data curation: Milton Antonio Fonseca Velásquez.

Formal analysis: Milton Antonio Fonseca Velásquez.

Research: Milton Antonio Fonseca Velásquez.

Methodology: Milton Antonio Fonseca Velásquez.

Project management: Milton Antonio Fonseca Velásquez.

Software: Milton Antonio Fonseca Velásquez.

Writing - original draft: Milton Antonio Fonseca Velásquez.

Writing - proofreading and editing: Milton Antonio Fonseca Velásquez.