doi: 10.58763/rc2024335

Scientific and Technological Research

Artificial Intelligence in banking services. A bibliometric review

Inteligencia Artificial en los servicios bancarios. Una revisión bibliométrica

Sergio Gerardo Padilla Hernández1 ![]() *

*

ABSTRACT

This article presents a comprehensive bibliometric review of 2,916 articles on artificial intelligence (AI) in banking services, extracted from Web of Science and analyzed with VOSviewer. Scientific production in this field has experienced exponential growth since 2016, with the United States leading the research, followed by European countries such as England and France. International collaboration is evident, highlighting the global nature of banking AI research. There is a significant focus on improving credit risk, with an emphasis on applying AI to provide clear explanations and improve the accuracy of risk assessments. The trend towards personalization and improving the user experience is evident, especially on mobile platforms. However, the discussion of various studies highlights critical challenges, such as biases and vulnerabilities to cyberattacks. The absence of evidence of scientific production in Central America highlights a significant opportunity to foster research in this region. This bibliometric analysis provides a solid foundation for understanding current trends and challenges in the application of AI in banking services, underlining the importance of addressing key issues to advance in this ever-evolving strategic field effectively.

Keywords: artificial intelligence, bank, employees, intelligence.

JEL classification: E5, G21, O32

RESUMEN

Este artículo presenta una exhaustiva revisión bibliométrica de 2916 artículos sobre inteligencia artificial en servicios bancarios, extraídos de Web of Science y analizados con VOSviewer. La producción científica en este campo ha experimentado un crecimiento exponencial desde 2016, con Estados Unidos liderando la investigación, seguido de países europeos como Inglaterra y Francia. La colaboración internacional es evidente, y permiten destacar la naturaleza global de la investigación en IA bancaria. Se observa un enfoque significativo en la mejora del riesgo crediticio, con énfasis en la aplicación de la IA para proporcionar explicaciones claras y mejorar la precisión de las evaluaciones del riesgo. La tendencia hacia la personalización y la mejora de la experiencia del usuario es evidente, especialmente en plataformas móviles. Sin embargo, la discusión de diversos estudios destaca desafíos críticos, como sesgos y vulnerabilidades a ataques informáticos. La ausencia de evidencia de producción científica en Centroamérica resalta una oportunidad significativa para fomentar la investigación en esta región. Este análisis bibliométrico proporciona una base sólida para comprender las tendencias actuales y los desafíos en la aplicación de la IA en servicios bancarios, subrayando la importancia de abordar problemas clave para avanzar de manera efectiva en este campo estratégico en evolución.

Palabras clave: banco, empleado, inteligencia, inteligencia artificial.

Clasificación JEL: E5, G21, O32

Received: 18-02-2024 Revised: 27-05-2024 Accepted: 15-06-2024 Published: 01-07-2024

Editor:

Carlos Alberto Gómez Cano ![]()

1Universidad Nacional Autónoma de Honduras. Comayagua, Honduras.

Cite as: Padilla, S. (2024). Inteligencia Artificial en los servicios bancarios. Una revisión bibliométrica. Región Científica, 3(2), 2024335. https://doi.org/10.58763/rc2024335

INTRODUCTION

According to Fernández (2019), in his analytical article for the Bank of Spain's economic bulletin, the integration of artificial intelligence (AI) into banking services has experienced an exponential increase over the last ten years. Although AI integration has been a process with more than 50 years of sustained evolution, it is uneven as a field, as its growth has been exponential in recent times.

In this sense, AI represents a transformative potential for the banking industry, developing at an unprecedented pace and generating a conceptual revolution. From process automation to improving customer experience, AI-powered applications play a crucial role in modernizing banking systems. Among other benefits, this introduction has enabled the development of numerous banking services. Due to the banking industry's important role in market intermediation, the academic literature focuses on evaluating various financial aspects of banks (Al-Ababneh et al., 2022; Doumpos et al., 2023).

This does not mean that the inclusion of other technological advances has not strengthened the sector, but the use of AI is gaining greater prominence in the financial industry, offering innovative solutions that improve operational efficiency, service personalization, and transaction security. For example, recent scientific and social debates on the use, growth, and challenges posed by language models such as ChatGPT (OpenAI) or Bard (Google) have been projected toward the banking sector, primarily in continuous customer service (Rajendran et al., 2024). These tools demonstrate that, while they offer banking institutions other benefits such as process automation, identity verification, and fraud detection, they can also contribute to the development of innovative ideas, the creation of specialized tasks, and other aids that streamline work in the sector (Mohamad et al., 2021; Valverde et al., 2023; Vargas, 2021).

In the United States, studies have been conducted on the requirements for introducing AI, seeking to transform companies' customer services. An important precedent is the work of Huang and Rust (2018), who argue that AI radically transforms traditional concepts of customer service and internal operations management. Therefore, even in its earliest stages, AI was presented as a phenomenon that not only represented a technological advancement but also posed a series of critical challenges and questions for the sector.

AI-powered technologies, such as chatbots, virtual assistants, and personalized recommendation systems, are increasingly being used to provide more efficient and personalized service to customers (Bhattacharya & Sinha, 2022; Noreen et al., 2023; Umamaheswari & Valarmathi, 2023). These technologies help companies automate routine tasks, reduce response times, and provide 24/7 support to customers (Adamopoulou & Moussiades, 2020). Furthermore, AI can help companies analyze customer data and gain behavioral insights, providing a clearer picture of key customer trends. This extracted and processed data contributes to better design of products and services provided by banking institutions (Rahman et al., 2023).

Regarding AI applied to banking services, Manser et al. (2021) conducted a study aimed at investigating value perceptions in the use of AI-based mobile banking applications (AIMBs). The study was based on a conceptual model that identified five key antecedents that influence AIMB evaluation. Among the elements collected, mention is made of the comparison between non-AI-based services as a baseline, the advantages and benefits offered by different service configurations, the analysis of cybersecurity and data protection features, and customer interaction with AI services. The results indicated that the introduction of AI in mobile banking platforms changes the configuration of service delivery and the role of the customer in value co-creation (Manser et al., 2021).

This study suggests that banks should focus on developing AI systems that can predict customer needs and provide personalized services to improve the experience, a fact supported by other research (Misischia et al., 2022). Additionally, this background recommends that banks invest in mobile banking platforms to provide customers with convenient and accessible banking services, which can translate into better financial outcomes for individuals and organizations (Breeden, 2021).

However, in the current evolving landscape of the banking sector, it is essential to conduct an in-depth analysis of emerging trends, identify future challenges, and explore the impact of AI in this area (Abele & D'Onofrio, 2020; Gomes et al., 2022). Therefore, thorough reviews are needed to provide a holistic understanding of AI's current and emerging impact in the financial sector, paving the way for the development of robust strategies (Alonso & Carbó, 2022; Zhang & Lu, 2021). Likewise, studies on the conscious adoption of emerging technologies in their relationship with society and humans are necessary (Korteling et al., 2021; Ruiz-Real et al., 2020; Zarifis & Cheng, 2022).

Focusing on these crucial questions will establish a solid foundation that will not only address current challenges but also outline a clear path for future research. This forward-looking approach will serve as a guide for the continued and effective integration of AI into banking services. It also seeks to foster equitable and sustainable development in this key sector of the economy, ensuring that technological progress translates into tangible and equitable benefits for all stakeholders.

This strategic analysis stands as an essential pillar for building a more advanced, efficient, and, above all, ethical financial landscape. Based on the above, the main objective of this article was to conduct a comprehensive bibliometric review of the application of AI in banking services. The objective was to thoroughly analyze and understand how AI has impacted and continues to transform processes, efficiency, and customer experience in the banking sector worldwide, with a special focus on the Americas and its geographic regions.

Similarly, the article aimed to analyze existing academic production related to the implementation of AI in banking services through a bibliometric review to identify emerging trends, challenges, and opportunities present in the scientific literature on this topic. This analysis aims to provide a comprehensive and up-to-date view of the state of knowledge at the intersection of AI and banking services, thus contributing to the understanding of the current and future dynamics of this technology in the financial industry.

METHODOLOGY

The primary purpose of this research is to conduct a comprehensive bibliometric review of scientific production on AI in the Web of Science, specifically in the area of its application in banking services. The aim was to highlight current trends and challenges in the field, employing bibliometric analysis methods such as keyword co-occurrence analysis, Lotka's Law, Zipf's Law, and the Hirsch Index. This predominantly quantitative and intrinsically rigorous methodological approach allowed for a thorough exploration of the dynamics and configurations that characterize scientific production in this field to significantly contribute to the existing body of knowledge in the discipline (Acevedo-Duque et al., 2020; Acevedo-Duque et al., 2022).

The search formula was comprehensively designed to cover terms associated with using, introducing, and analyzing AI benefits in the banking sector. This was defined as follows: TS = (artificial NEAR/0 intelligence), Refined By: Web of Science Index: Social Sciences Citation Index (SSCI) or Science Citation Index Expanded (SCI-EXPANDED). Research Areas: Business Economics. This Web of Science search equation combines keywords and refinements to find specific articles in the field of AI with a focus on the areas of Social Sciences and Business Economics. It is explained as follows:

TS: A term that refers to searching the title and abstract of the article. In this case, we searched for articles that contained the terms “artificial” and “intelligence” in the title and/or abstract.

NEAR/0: This is a proximity operator; it indicates that the terms should be close to each other, and “/0” specifies that there should be no other terms between them. Therefore, “artificial intelligence NEAR/0” searched for cases where the words “artificial” and “intelligence” appear together in the text, with no other words between them.

Refined By: Web of Science Index, Social Sciences Citation Index (SSCI), or Science Citation Index Expanded (SCI-EXPANDED) refers to searching to include only articles indexed in the Social Sciences Citation Index or the Science Citation Index Expanded. These are indexes that cover specific areas of research in the social sciences and natural sciences, respectively. Research Areas and Business Economics: This further refinement limits the search to articles that fall within the “Business Economics” research area, reflecting the search focus on AI-related studies in the context of economics and business.

According to the literature, a rigorously designed, implemented, and triangulated bibliometric analysis constitutes a critical foundation for the development of knowledge fields, as well as encouraging innovation and empowering scholars to advance their studies and collaborations (Brown et al., 2020; Donthu et al., 2021; Sánchez et al., 2024). The following is a list of the contribution indicators considered for this study:

1. Obtain a comprehensive overview.

2. Identify knowledge gaps.

3. Derive novel research ideas.

4. Position its expected contributions to the field.

These works also mention that, despite its advantages, bibliometric analysis remains relatively new in business research, and its implementation does not fully leverage its potential (Donthu et al., 2021). However, the authors emphasize that this occurs when bibliometric studies are based on a limited set of data and bibliometric techniques and provide only a fragmented understanding of the field under study through performance analyses without scientific mapping or other similar limited procedures.

RESULTS AND DISCUSSION

Bibliometric review

The initial results showed that several studies are currently analyzing this phenomenon, as well as its application in different types of services. Regarding the sample size, a database of 2,916 articles on AI was analyzed. According to the defined search equation and its analysis using the VOSviewer tool, 58 of them are related to banking services. Therefore, they were reviewed in depth to provide an overview of the trends and challenges of AI in banking services. State of the art and advances in the field were identified, and the main findings are highlighted through a bibliometric study and comparison with other precedents with similar rationale and methodological approaches (Manta et al., 2024; Osei et al., 2023).

This decision also required considering the growing relevance and prevalence of bibliometrics, evidenced by the high number of publications, as well as the limitations and weaknesses generated by their overuse as a methodological resource (García-Villar & García-Santos, 2021; Mokhnacheva & Tsvetkova, 2020; Sánchez et al., 2024). Currently, there is no doubt about the importance and advantages of documentary databases (de Granda-Orive et al., 2013). However, it is undeniable that bibliometrics allows for quantitative, qualitative, and mixed analyses of scientific productivity, as well as the measurement of research activity through various metrics (Cao & Shao, 2020; Pranckutė, 2021; Sánchez et al., 2024).

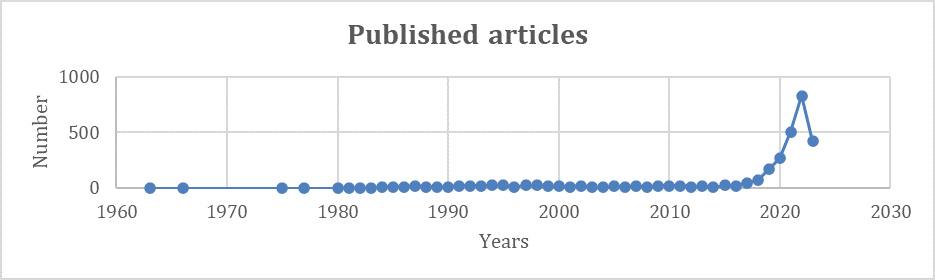

The bibliometric review of trends and challenges related to AI in banking services revealed that publications on this topic date back to 1963 and end at the extraction date set for 2023. However, from 1963, when barely a single article was published, until 2015, scientific production on this topic was minimal or nonexistent, according to the results of the WoS database. During these 40 years, publications represented 19.72%, while since 2016, research has shown exponential growth, demonstrating the growing interest in this phenomenon. Figure 1 shows the exponential growth in the number of articles published on AI since 1963; thus, the number of published articles has quadrupled in the last 10 years and is expected to continue growing in the coming years.

|

Figure 1. Scientific production per year |

|

|

Source: own elaboration

According to Cai et al. (2021), this is because the concept of AI is not particularly novel; with incipient explorations in the middle of the last century, it has gained in popularity and development due to the exponential growth in the volume and importance of digital data and virtual environments, the expansion of databases, and the improvement of extraction and advanced processing algorithms. Likewise, the lowering of the cost of the technological components (hardware and software) that support it has promoted its integration into economics in general (Milana and Ashta, 2021).

Scientific productivity

The country with the highest scientific production in the analyzed period was the United States, with 880 co-authored documents, followed by England and China, with 410 and 397 articles, respectively. In Latin America, Brazil is the country with the highest number of articles, with a total of 30 documents, followed by Colombia, Chile, and Argentina, with 9, 8, and 6 publications, respectively. There are countless measures for analyzing performance; the most notable are the number of publications and citations per year or per research component, where publication is an indicator of productivity, while citation is a measure of impact and influence (Donthu et al., 2020). Other measures, such as citation per publication and the h-index, combine citations and publications to measure the performance of research components (Donthu et al., 2021).

A thorough analysis of the database created revealed the absence of scientific production linked to the AI variable in the Central American region. This omission presents a significant discrepancy, especially when considering the growing trend and globally relevant challenges associated with this topic. This gap in scientific production in AI in the region suggests a valuable opportunity to boost research and encourage Central America's participation in this strategic field. This observation underscores the need to promote initiatives that stimulate AI research within the region, thus providing the opportunity to contribute to global advances in this area.

Thus, table 1 shows that Europe is the continent with the highest number of publications, with 1,700 articles. This is due to the long history of AI research in Europe, as well as the investment in this field by European governments and companies. In terms of citations, Europe is also the continent with the highest number, with 36,108 citations. This indicates that AI research in Europe is of high quality and is being recognized by the international scientific community.

|

Table 1. Co-authored publications by continent |

||

|

Continent |

Publications |

Citation |

|

Africa |

60 |

1212 |

|

America |

1086 |

29003 |

|

Asia |

1077 |

18397 |

|

Europe |

1700 |

36108 |

|

Oceania |

240 |

5658 |

In second place is America, with 1 086 publications and 29 003 citations. The Americas have a large number of researchers working in AI, but it was clear that the United States led this effort during the period studied. Thirdly, Asia has 1 077 publications and 18 397 citations, a continent experiencing rapid growth in AI research led by countries such as China, Japan, and South Korea. In fourth place is Oceania, with 240 publications and 5 658 citations; it also has a small community of researchers working in AI, but its research is of high quality. Overall, the table of co-authorship in AI publications shows that research in the field is growing worldwide. Europe, the Americas, and Asia are the continents leading this effort.

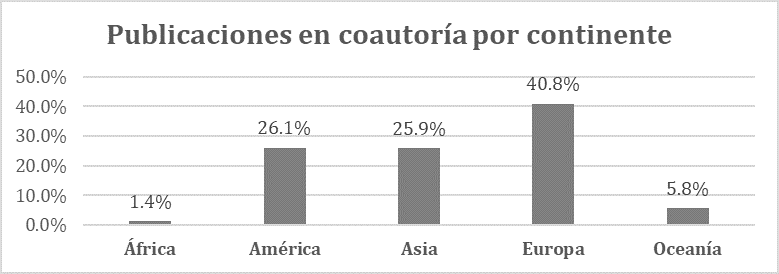

Figure 2 shows the percentage of co-authored publications by continent. This graph shows that Europe has the highest percentage of co-authored publications, at 40.8%. This is followed by the Americas with 26.1%, Asia with 25.9%, Africa with 1.4%, and finally Oceania with 5.8%. This graph shows that AI research is increasingly collaborative. Researchers around the world are working together to advance this field.

|

Figure 2. Productivity worldwide |

|

|

Source: own elaboration

Note: the figure appears in its original language

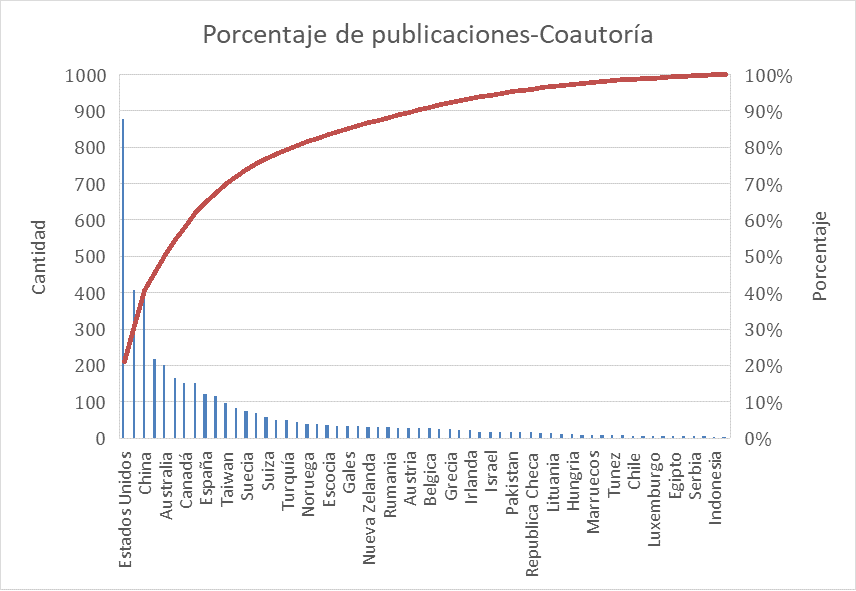

Figure 3 shows the percentage of publications in which authors are affiliated with research institutions in a given country. In this case, the graph shows that the United States has the highest percentage of co-authored publications, at 21.1%. It is followed by the United Kingdom, at 9.8%; China, at 9.5%; France, at 6.2%; and Japan, at 5.3%.

This result demonstrates that AI research is increasingly concentrated in a small number of countries. It is relevant to note that the fact that the United States has the highest percentage of co-authored publications indicates that the country is a global leader in AI research. China also has a relatively high percentage of co-authored publications, indicating that the country is experiencing rapid growth in AI research. Likewise, the United Kingdom, Germany, and Japan also have a relatively high percentage of co-authored publications; this indicates that these countries are also important players in AI research.

|

Figure 3. Productivity by country |

|

|

Source: own elaboration

Note: the figure appears in its original language

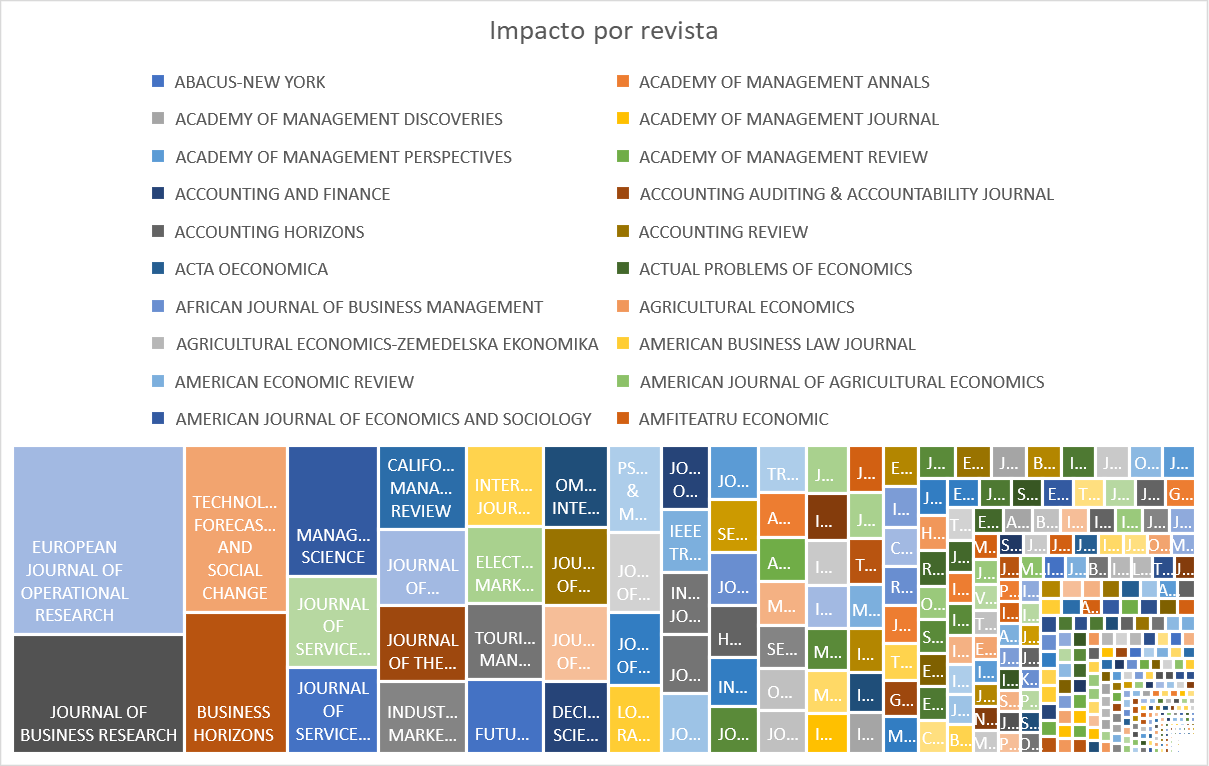

The figure above shows the total publications by source in the Web of Science database in the field of AI research. It also shows that the number of articles published in the field of AI research has steadily increased over the study period. The graph shows that the distribution of the number of articles published by journal is uneven; the most important journals publish a large number of articles, while the less important journals publish a smaller number of articles.

The most important journals in terms of the number of articles published are:

· European Journal of Operational Research.

· Journal of Business Research.

· IEEE Transactions on Engineering Management.

· Technological Forecasting and Social Change.

· Futures.

These journals publish a large number of articles because they are classified as high-impact, meaning their articles are frequently cited by other researchers.

|

Figure 4. Scientific productivity by journal |

|

|

Source: own elaboration

Note: the figure appears in its original language

Figure 5 shows the impact of scientific journals in the field of AI research, measured by the number of times their articles have been cited. The graph shows that the most influential scientific journals in the field of AI research are:

· European Journal of Operational Research (EJOR).

· Technological Forecasting and Social Change (TFSC).

· Journal of Business Research (JBR).

· IEEE Transactions on Engineering Management (IEEE TEM).

· Futures.

These journals receive a high number of citations, meaning their articles are of high quality and recognized by the international scientific community. Figure 5 also shows that English-language scientific journals are the most influential in the field of AI research; this is due to the fact that most AI researchers publish their work in English in an effort to expand their potential readership.

The fact that EJOR is the most influential journal in the field of research demonstrates that AI research is closely related to operations research; this is due to the increasing use of AI in operations applications, such as production planning, supply chain management, and decision-making.

On the other hand, the fact that TFSC is the second most influential journal in the field of research confirms that research on the topic is closely related to research on technology and society. This is because the topic has a significant impact on society, and research has focused on understanding and managing this impact. JBR is the third most influential journal in the field of research, with a trend closely related to business research, and this is due to the increasing use of AI in business applications such as marketing, customer service, and risk management.

|

Figure 5. Impact per journal |

|

|

Source: own elaboration

Note: the figure appears in its original language

Bibliometric indicators

The database, which includes 2.916 AI-related articles, was subjected to a bibliometric analysis using the VOSviewer tool; this yielded several key indicators. Three specific indicators were analyzed in-depth: Lotka, Zipf, and h-index.

Lotka's Law

This law establishes the relationship between authors and articles published in a field of knowledge during a defined time period. Its distribution is represented as a negative relationship, as a smaller number of authors account for the highest productivity rates (Sahu & Jena, 2022; Su et al., 2019). In the case of the AI database, concurrent patterns were identified for a total of 7,310 authors, where a marked asymmetry in scientific production was observed. This index reflects that a relatively small group of authors, approximately 1.18% of the total (86 authors), contributes most significantly to producing articles on AI.

The presence of active authors who contribute significantly, along with a large number of authors who contribute less frequently, follows the characteristic distribution of Lotka's law. This phenomenon highlights the existence of opinion leaders and experts in the AI scientific community. They are active authors who can be crucial in guiding and directing research, potentially highlighting areas of greater interest and relevance.

This indicator also underscores the need to encourage the participation of emerging projects and less visible authors in academic networks. This analysis provides a solid basis for decision-making regarding editorial policies, seeking to promote the diversity of contributors and thus strengthen the breadth and richness of knowledge in the field of AI. In short, the Lotka index not only sheds light on the structure of author production but also offers valuable insights for the effective management and promotion of research in this dynamic field.

|

Figure 6. Application of Lotka's law |

|

|

Source: Own elaboration

Zipf's Law

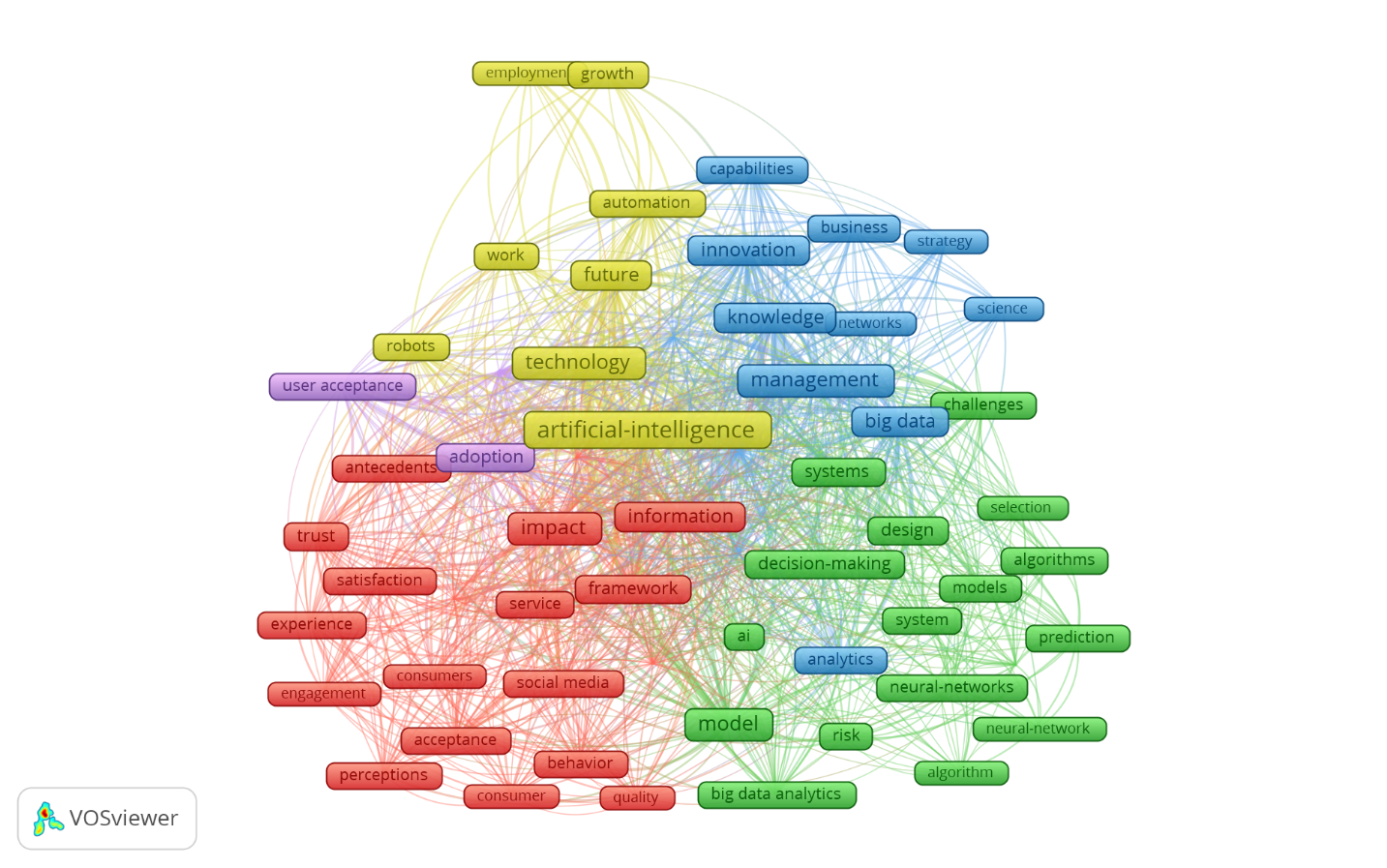

It describes the behavior of the most relevant words according to their frequency of occurrence and relevance within a given area of knowledge (Corral & Serra, 2020). Analysis of the postulates included in Zipf's Law revealed a striking distribution pattern in the frequency of top keywords (KWPs). When applying this law to these keywords, it was observed that a particular group of terms occurs recurrently, while a wide variety of keywords are used less frequently.

Of a total of 3,635 top keywords identified, approximately 1.65% of these (60 KWPs) are located at the top of the distribution, reflecting a high frequency of use, while another 37 occurrences, constituting 1.02%, are distributed at the tail of the distribution. This pattern is characteristic of phenomena observed in various scientific disciplines and contexts. In the field of AI, the recurrent presence of certain keywords indicates dominant areas or concepts in research; their identification is crucial for understanding emerging trends and directions in the field.

The analysis of the law for this study provides a clear view of the concentration of key terms and their relationship to frequency of use. In this sense, it can guide search and information filtering strategies for researchers interested in specific topics within the vast domain of AI; it also suggests opportunities to delve into less-explored areas, offering valuable insights for planning future research (as shown below).

|

Figure 7. Application of Zipf's law |

|

|

Source: own elaboration

h-index

Finally, the h-index analysis was used to study the relationship between productivity and the impact of authors' contributions (Bihari et al., 2023). This study obtained an h-index of 98, meaning that 98 documents in the database have received at least 98 citations each. This indicator measures the influence and quality of research in the field and period studied. Since this index is based on the number of citations received by an article, this result suggests that the 98 documents are especially influential in the scientific community.

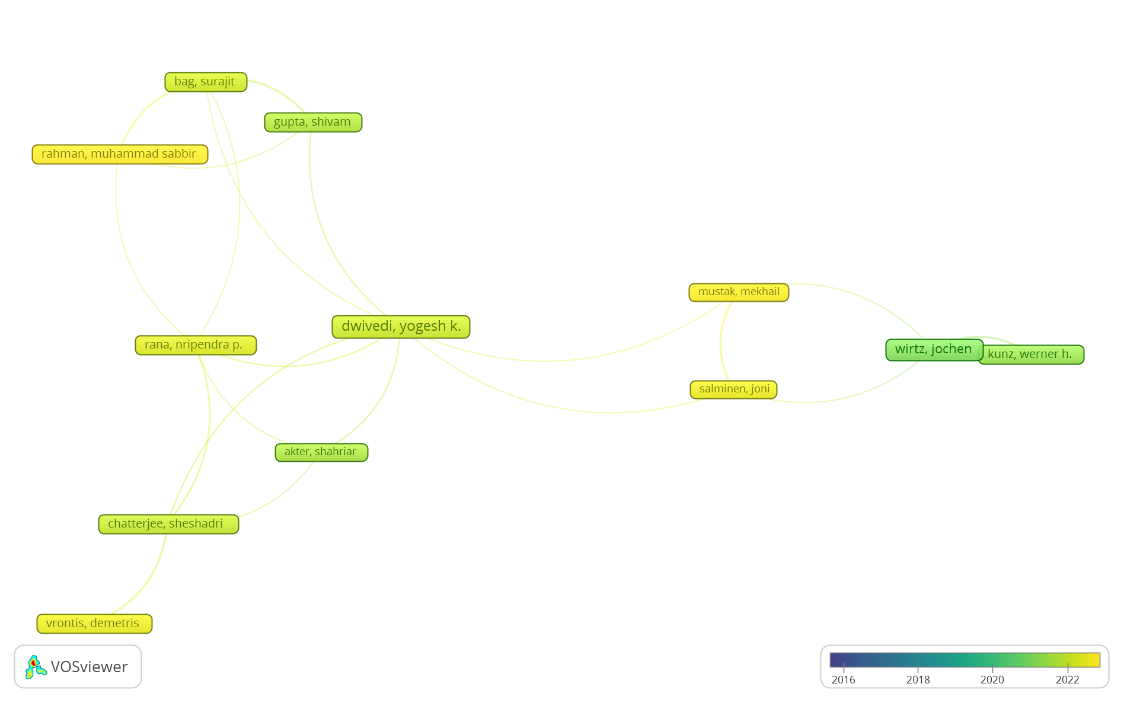

Integrated analysis

A thorough analysis of the AI database, focusing on co-authorship according to Lotka's law, Zipf's law, and the h-index, offers revealing insights that merit in-depth discussion in the context of previous research and potential future directions. For example, the high level of co-authorship, evidenced by the 7,310 authors, highlights the collaborative nature of AI research. This phenomenon is consistent with the contemporary trend toward interdisciplinary teams and collaborative projects; while such collaboration fosters a diversity of ideas and approaches, it also presents coordination challenges. Future research could explore how the dynamics of these teams influence the quality and originality of research.

Furthermore, applying Zipf's law to KWPs revealed the prevalence of a small set of key terms in AI. This finding is consistent with the centrality of certain topics in the field; however, the analysis also highlights significant room for discovery in the tail of the distribution. This opens the door to more in-depth research on less frequent terms, which could lead to the identification of emerging areas and innovative concepts.

Considering the h-index of 98 documents, this finding underscores the relevance and impact of the research in the database. It is crucial to consider the relationship between quality and quantity, as a research area may generate a large volume of documents, but their real impact lies in how much they influence future research. This analysis raises the question: How can the quality and dissemination of knowledge in AI be improved? These results align with previous studies that report extensive collaboration, topic concentration, and the importance of sustainable impact in AI research (Manta et al., 2024; Osei et al., 2023). Consistency with past research reinforces the validity and relevance of the findings.

Implications and future directions

The implications of this analysis go beyond the mere understanding of bibliometric patterns. It is hoped that the results obtained will contribute to designing and evaluating strategies to strengthen collaboration, highlight less-explored areas, and emphasize quality over quantity in scientific production. For future research, we propose investigating the dynamics of collaboration, exploring the evolution of KWPs, and delving deeper into the real impact of research.

To contribute to this aspiration, the following discussion aims to provide a comprehensive framework for interpreting the results and guiding future research in the dynamic and essential field of AI. First, we start from the ideas of Bussmann et al. (2021), who investigated the use of AI to improve the explanation of machine learning models in credit risk management. These authors found that AI can help provide clearer and more concise explanations of the results of machine learning models, which can be useful for banks that need to make informed decisions about whom to lend money to (Bussmann et al., 2021).

For their part, Chen et al. (2022) investigated the use of AI to enhance selective learning in credit risk. Their results reinforce the notion that AI can help more effectively identify and utilize relevant data for credit risk prediction, which can lead to improved accuracy of risk assessments (Chen et al., 2022). Similarly, Sadok et al. (2022) investigated the use of operational AI techniques to assess bank performance and found that such intelligence can help banks improve the efficiency and effectiveness of their operations, which can lead to improved financial results (Sadok et al., 2022). For their part, Northey et al. (2022) investigated the impact of AI in banking on consumer belief in financial advice. They found that AI can have a positive impact on consumer belief in financial advice, but they also found that it is important for consumers to understand the limits of AI (Northey et al., 2022).

Alonso Robisco and Carbó Martínez (2022) investigated the performance measurement of risk-adjusted machine learning algorithms in predicting default. They found that AI can help improve the accuracy of default predictions but also that it is important to consider its limits. For example, AI can be biased by the data on which it is trained. This means it may be more likely to predict default in certain groups of people, even if there is no actual difference in their default risk. Furthermore, AI can be vulnerable to cyberattacks, which can be used to manipulate credit risk assessments, leading to financial losses for banks and borrowers (Alonso Robisco & Carbó Martínez, 2022).

Königstorfer and Thalmann (2020) examine the use of AI in commercial banks in their research. The authors argue that AI has the potential to revolutionize banking by automating tasks, improving decision accuracy, and providing a better understanding of customer behavior. This research is a good introduction to the use of AI in commercial banks. The article identifies the potential benefits of AI, as well as the challenges posed by its implementation. The article also provides a research agenda for the future (Königstorfer & Thalmann, 2020).

Other studies reviewed focused on investigating the role of AI in the future of work. These studies argue that AI has the potential to automate a wide range of tasks currently performed by humans, but they also suggest that AI will create new jobs due to its constant evolution and the need for oversight (Benbya et al., 2020; Ng et al., 2021). For example, a well-developed and increasingly important area of research includes research on the use of AI in customer service. Studies support that AI can help companies personalize financial products and services by analyzing customer data to offer personalized recommendations and products tailored to individual needs (Wang et al., 2022; Xu et al., 2020). Another line of increasing relevance refers to using various AI methods to predict bank failure. These studies suggest that AI can help improve the accuracy of bank failure predictions and support informed decision-making on managing their risks (Jabeur et al., 2021; Mhlanga, 2021).

CONCLUSIONS

The detailed bibliometric review provided in-depth insight into this key research area's trends, challenges, and opportunities. The results suggest that scientific production in AI applied to banking services has experienced exponential growth since 2016. This emphasizes the increased interest and importance of this field of research over the last decade. The United States leads the scientific production, closely followed by European countries such as England and France.

Furthermore, the high level of co-authorship and international collaboration between countries reflects the global and collaborative nature of research in the field. This synergy contributes to generating more robust and comprehensive knowledge; recent research has shown a considerable focus on applying AI to improve credit risk management. This emphasis suggests the importance of AI in critical decisions for financial institutions. Furthermore, the trend toward personalization, highlighted by KWPs, reflects a significant interest in improving the user experience on mobile banking platforms. AI is positioned as a key tool for offering more engaging and satisfying services.

Several studies point to the need to address critical challenges, such as biases, vulnerabilities to cyberattacks, and the importance of transparency in the use of AI in financial services. The lack of evidence of scientific production on AI in the Central American region highlights a significant opportunity to foster research and participation in this strategic field. These studies consolidate the current state of AI research in banking services and point to avenues for future research. The intersection of bibliometric findings with specific research underscores the coherence and relevance of the results, providing a solid foundation for the continued development of this evolving field.

REFERENCES

Abele, D., y D’Onofrio, S. (2020). Artificial Intelligence – The Big Picture. En Cognitive Computing (pp. 31–65). Springer Fachmedien Wiesbaden. https://doi.org/10.1007/978-3-658-27941-7_2

Acevedo-Duque, Á., Llanos-Herrera, G., García-Salirrosas, E., ... y Sánchez, L. (2022). Scientometric Analysis of Hiking Tourism and Its Relevance for Wellbeing and Knowledge Management. International Journal of Environmental Research and Public Health, 19(14), 8534. https://doi.org/10.3390/ijerph19148534

Acevedo-Duque, Á., Vega-Muñoz, A., y Salazar-Sepúlveda, G. (2020). Analysis of Hospitality, Leisure, and Tourism Studies in Chile. Sustainability, 12(18), 7238. https://doi.org/10.3390/su12187238

Adamopoulou, E., y Moussiades, L. (2020). Chatbots: History, technology, and applications. Machine Learning with Applications, 2, 100006. https://doi.org/10.1016/j.mlwa.2020.100006

Al-Ababneh, H., Borisova, V., Zakharzhevska, A., Tkachenko, P., y Andrusiak, N. (2022). Performance of Artificial Intelligence Technologies in Banking Institutions. WSEAS TRANSACTIONS ON BUSINESS AND ECONOMICS, 20, 307–317. https://doi.org/10.37394/23207.2023.20.29

Alonso, A., y Carbó, J. (2022). Measuring the model risk-adjusted performance of machine learning algorithms in credit default prediction. Financial Innovation, 8(1), 70. https://doi.org/10.1186/s40854-022-00366-1

Alonso-Robisco, A., y Carbó, J. (2022). Inteligencia artificial y finanzas: Una alianza estratégica. Documentos Ocasionales/Banco de España, 2222. https://repositorio.bde.es/handle/123456789/23434

Benbya, H., Davenport, T., y Pachidi, S. (2020). Artificial Intelligence in Organizations: Current State and Future Opportunities. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3741983

Bhattacharya, C., y Sinha, M. (2022). The Role of Artificial Intelligence in Banking for Leveraging Customer Experience. Australasian Business, Accounting and Finance Journal, 16(5), 89–105. https://doi.org/10.14453/aabfj.v16i5.07

Bihari, A., Tripathi, S., y Deepak, A. (2023). A review on h-index and its alternative indices. Journal of Information Science, 49(3), 624–665. https://doi.org/10.1177/01655515211014478

Breeden, J. (2021). A survey of machine learning in credit risk. The Journal of Credit Risk. https://doi.org/10.21314/JCR.2021.008

Brown, T., Park, A., y Pitt, L. (2020). A 60-Year Bibliographic Review Of the Journal of Advertising Research: Perspectives on Trends in Authorship, Influences, and Research Impact. Journal of Advertising Research, 60(4), 353–360. https://doi.org/10.2501/JAR-2020-028

Bussmann, N., Giudici, P., Marinelli, D., y Papenbrock, J. (2021). Explainable Machine Learning in Credit Risk Management. Computational Economics, 57(1), 203–216. https://doi.org/10.1007/s10614-020-10042-0

Cai, Z.-X., Liu, L., Chen, B., y Wang, Y. (2021). Artificial Intelligence: From Beginning to Date. WORLD SCIENTIFIC. https://doi.org/10.1142/11921

Cao, D., y Shao, S. (2020). Towards Complexity and Dynamics: A Bibliometric-Qualitative Review of Network Research in Construction. Complexity, 2020, 1–19. https://doi.org/10.1155/2020/8812466

Chen, D., Ye, W., y Ye, J. (2022). Interpretable Selective Learning in Credit Risk. Research in international business and finance, 1–17.

Corral, Á., y Serra, I. (2020). The Brevity Law as a Scaling Law, and a Possible Origin of Zipf’s Law for Word Frequencies. Entropy, 22(2), 224. https://doi.org/10.3390/e22020224

de Granda-Orive, J., Alonso-Arroyo, A., García-Río, F., … y Aleixandre-Benavent, R. (2013). Certain advantages of Scopus compare with Web of Science in a bibliometric analysis related to smoking | Ciertas ventajas de scopus sobre web of science en un análisis bibliométrico sobre tabaquismo. Revista Espanola de Documentacion Cientifica, 36(2), 1–9. https://doi.org/10.3989/redc.2013.2.941

Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., y Lim, W. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. https://doi.org/10.1016/j.jbusres.2021.04.070

Donthu, N., Kumar, S., y Pattnaik, D. (2020). Forty-five years of Journal of Business Research: A bibliometric analysis. Journal of Business Research, 109, 1–14. https://doi.org/10.1016/j.jbusres.2019.10.039

Doumpos, M., Zopounidis, C., Gounopoulos, D., Platanakis, E., y Zhang, W. (2023). Operational research and artificial intelligence methods in banking. European Journal of Operational Research, 306(1), 1–16. https://doi.org/10.1016/j.ejor.2022.04.027

Fernández, A. (2019). Inteligencia artificial en los servicios financieros. Boletín Económico/Banco de España, 2/2019. https://core.ac.uk/download/pdf/322617455.pdf

García-Villar, C., y García-Santos, J. (2021). Bibliometric indicators to evaluate scientific activity. Radiología, 63(3), 228–235. https://doi.org/10.1016/j.rxeng.2021.01.002

Gomes, P., Verçosa, L., Melo, F., ... y Bezerra, B. (2022). Artificial Intelligence-Based Methods for Business Processes: A Systematic Literature Review. Applied Sciences, 12(5), 2314. https://doi.org/10.3390/app12052314

Huang, M.-H., y Rust, R. (2018). Artificial Intelligence in Service. Journal of Service Research, 21(2), 155–172. https://doi.org/10.1177/1094670517752459

Jabeur, S., Gharib, C., Mefteh-Wali, S., y Arfi, W. (2021). CatBoost model and artificial intelligence techniques for corporate failure prediction. Technological Forecasting and Social Change, 166, 120658. https://doi.org/10.1016/j.techfore.2021.120658

Königstorfer, F., y Thalmann, S. (2020). Applications of Artificial Intelligence in commercial banks – A research agenda for behavioral finance. Journal of Behavioral and Experimental Finance, 27, 100352. https://doi.org/10.1016/j.jbef.2020.100352

Korteling, J., van De Boer-Visschedijk, G., Blankendaal, R., Boonekamp, R., y Eikelboom, A. (2021). Human- versus Artificial Intelligence. Frontiers in Artificial Intelligence, 4, 622364. https://doi.org/10.3389/frai.2021.622364

Manser, E., Peltier, J., y Barger, V. (2021). Enhancing the value co-creation process: Artificial intelligence and mobile banking service platforms. Journal of Research in Interactive Marketing, 15(1), 68–85. https://doi.org/10.1108/JRIM-10-2020-0214

Manta, A., Bădîrcea, R., Doran, N., … y Popescu, J. (2024). Industry 4.0 Transformation: Analysing the Impact of Artificial Intelligence on the Banking Sector through Bibliometric Trends. Electronics, 13(9), 1693. https://doi.org/10.3390/electronics13091693

Mhlanga, D. (2021). Financial Inclusion in Emerging Economies: The Application of Machine Learning and Artificial Intelligence in Credit Risk Assessment. International Journal of Financial Studies, 9(3), 39. https://doi.org/10.3390/ijfs9030039

Milana, C., y Ashta, A. (2021). Artificial intelligence techniques in finance and financial markets: A survey of the literature. Strategic Change, 30(3), 189–209. https://doi.org/10.1002/jsc.2403

Misischia, C., Poecze, F., y Strauss, C. (2022). Chatbots in customer service: Their relevance and impact on service quality. Procedia Computer Science, 201, 421–428. https://doi.org/10.1016/j.procs.2022.03.055

Mohamad, S., Salim, N., y Jambli, M. (2021). Service chatbots: A systematic review. Expert Systems with Applications, 184, 115461. https://doi.org/10.1016/j.eswa.2021.115461

Mokhnacheva, Y., y Tsvetkova, V. (2020). Development of Bibliometrics as a Scientific Field. Scientific and Technical Information Processing, 47(3), 158–163. https://doi.org/10.3103/S014768822003003X

Ng, D., Leung, J., Chu, S., y Qiao, M. (2021). Conceptualizing AI literacy: An exploratory review. Computers and Education: Artificial Intelligence, 2, 100041. https://doi.org/10.1016/j.caeai.2021.100041

Noreen, U., Shafique, A., Ahmed, Z., y Ashfaq, M. (2023). Banking 4.0: Artificial Intelligence (AI) in Banking Industry & Consumer’s Perspective. Sustainability, 15(4), 3682. https://doi.org/10.3390/su15043682

Northey, G., Hunter, V., Mulcahy, R., Choong, K., y Mehmet, M. (2022). Man vs machine: How artificial intelligence in banking influences consumer belief in financial advice. International Journal of Bank Marketing, 40(6), 1182-1199. https://doi.org/10.1108/IJBM-09-2021-0439

Osei, L., Cherkasova, Y., y Oware, K. (2023). Unlocking the full potential of digital transformation in banking: A bibliometric review and emerging trend. Future Business Journal, 9(1), 30. https://doi.org/10.1186/s43093-023-00207-2

Pranckutė, R. (2021). Web of Science (WoS) and Scopus: The Titans of Bibliographic Information in Today’s Academic World. Publications, 9(1), 12. https://doi.org/10.3390/publications9010012

Rahman, M., Ming, T., Baigh, T., y Sarker, M. (2023). Adoption of artificial intelligence in banking services: An empirical analysis. International Journal of Emerging Markets, 18(10), 4270–4300. https://doi.org/10.1108/IJOEM-06-2020-0724

Rajendran, R., Priya T., y Chitrarasu, K. (2024). Natural Language Processing (NLP) in Chatbot Design: NLP’s Impact on Chatbot Architecture. En Advances in Computational Intelligence and Robotics (pp. 102–113). IGI Global. https://doi.org/10.4018/979-8-3693-1830-0.ch006

Ruiz-Real, J., Uribe-Toril, J., Torres, J., y de Pablo, J. (2020). ARTIFICIAL INTELLIGENCE IN BUSINESS AND ECONOMICS RESEARCH: TRENDS AND FUTURE. Journal of Business Economics and Management, 22(1), 98–117. https://doi.org/10.3846/jbem.2020.13641

Sadok, H., Sakka, F., y El Maknouzi, M. (2022). Artificial intelligence and bank credit analysis: A review. Cogent Economics & Finance, 10(1), 2023262. https://doi.org/10.1080/23322039.2021.2023262

Sahu, A., y Jena, P. (2022). Lotka’s law and author productivity pattern of research in law discipline. Collection and Curation, 41(2), 62–73. https://doi.org/10.1108/CC-04-2021-0012

Sánchez, V., Pérez, A., y Gómez, C. (2024). Trends and evolution of Scientometric and Bibliometric research in the SCOPUS database. Bibliotecas, Anales de Investigacion, 20(1). http://revistas.bnjm.sld.cu/index.php/BAI/article/view/834

Su, Y.-S., Lin, C.-L., Chen, S.-Y., y Lai, C.-F. (2019). Bibliometric study of social network analysis literature. Library Hi Tech, 38(2), 420–433. https://doi.org/10.1108/LHT-01-2019-0028

Umamaheswari, S., y Valarmathi, A. (2023). Role of artificial intelligence in the banking sector. Journal of Survey in Fisheries Sciences, 10(4S), 2841–2849. https://doi.org/10.17762/sfs.v10i4S.1722

Valverde, S., Solas, P., y Fernández, F. (2023). Algunas reflexiones sobre la inteligencia artificial en el sector bancario. Cuadernos de Información económica, 295, 35–40.

Vargas, A https://doi.org/10.15381/idata.v24i2.20351. (2021). La banca digital: Innovación tecnológica en la inclusión financiera en el Perú. Industrial Data, 24(2), 99-120. https://doi.org/10.15381/idata.v24i2.20351

Wang, X., Lin, X., y Shao, B. (2022). How does artificial intelligence create business agility? Evidence from chatbots. International Journal of Information Management, 66, 102535. https://doi.org/10.1016/j.ijinfomgt.2022.102535

Xu, Y., Shieh, C.-H., Van Esch, P., & Ling, I.-L. (2020). AI Customer Service: Task Complexity, Problem-Solving Ability, and Usage Intention. Australasian Marketing Journal, 28(4), 189–199. https://doi.org/10.1016/j.ausmj.2020.03.005

Zarifis, A., y Cheng, X. (2022). A model of trust in Fintech and trust in Insurtech: How Artificial Intelligence and the context influence it. Journal of Behavioral and Experimental Finance, 36, 100739. https://doi.org/10.1016/j.jbef.2022.100739

Zhang, C., y Lu, Y. (2021). Study on artificial intelligence: The state of the art and future prospects. Journal of Industrial Information Integration, 23, 100224. https://doi.org/10.1016/j.jii.2021.100224

FINANCING

None.

CONFLICT OF INTEREST STATEMENT

None.

AUTHORSHIP CONTRIBUTION

Conceptualization: Sergio Gerardo Padilla Hernández.

Data curation: Sergio Gerardo Padilla Hernández.

Formal analysis: Sergio Gerardo Padilla Hernández.

Fund acquisition: Sergio Gerardo Padilla Hernández.

Research: Sergio Gerardo Padilla Hernández.

Methodology: Sergio Gerardo Padilla Hernández.

Project management: Sergio Gerardo Padilla Hernández.

Resources: Sergio Gerardo Padilla Hernández.

Software: Sergio Gerardo Padilla Hernández.

Supervision: Sergio Gerardo Padilla Hernández.

Validation: Sergio Gerardo Padilla Hernández.

Visualization: Sergio Gerardo Padilla Hernández.

Writing - original draft: Sergio Gerardo Padilla Hernández.

Writing - proofreading and editing: Sergio Gerardo Padilla Hernández.