doi: 10.58763/rc2024311

Scientific and Technological Research Article

Transformations and impacts of financial innovation and the rise of Fintech in Mexico

Transformaciones e impactos de la innovación financiera y el auge de las Fintech en México

Aurora Ramón de la Cruz1 ![]() *, Aida Dinorah García

Álvarez1

*, Aida Dinorah García

Álvarez1 ![]() *, Heidi Gabriela Estrada Calix1

*, Heidi Gabriela Estrada Calix1 ![]() *

*

ABSTRACT

Companies require large amounts of capital for the development of their operations; in this scenario, financial planning provides companies with funds to help them in their day-to-day tasks. In this endeavor, a set of technologies have been developed to support financial decision-making. The objective of this research is to analyze the transformations and impact of financial innovation and the rise of Fintech in Mexico. Quantitative research was developed, based on a retrospective and descriptive study, with a bibliometric approach in the databases Google academic, Scielo, Scopus, Dialnet and Redalyc during the period from 1998 to 2024, without language restriction. It offers a look at Mexico’s financial system and its evolution, focusing on the public and non-governmental organizations involved. It also shows the purpose of the system, which is to follow the management methods of banks, stock exchanges and credit institutions, and to manage through supervisory, inspection and management bodies. The economic and social impact of Fintech at the national level was analyzed based on traditional economic sectors. This research establishes a financial system composed of organizational structures, legal systems, agencies and inspection bodies that administer, control and manage public funds and money.

Keywords: currency, financial market, financial system, financial technology.

JEL Classification: B22, D52

RESUMEN

Las empresas requieren grandes cantidades de capital para el desarrollo de sus operaciones; en este escenario, la planificación financiera dota a las empresas de fondos que les ayuden en sus tareas del día a día. Bajo este empeño se han desarrollado un conjunto de tecnologías en apoyo a la toma de decisiones financieras. El objetivo de esta investigación es analizar las transformaciones y el impacto de la innovación financiera y el auge de las Fintech en México. Se desarrolló una investigación de tipo cuantitativo, a partir de un estudio retrospectivo y descriptivo; con un enfoque bibliométrico en las bases de datos Google académico, Scielo, Scopus, Dialnet y Redalyc; durante el período de 1998 a 2024; sin restricción idiomática. Se ofrece una mirada al sistema financiero de México y su evolución, enfocada en el público y las organizaciones no gubernamentales involucradas. Asimismo, muestra el propósito del sistema, que es seguir los métodos de gestión de los bancos, bolsas de valores e instituciones de crédito, y gestionar a través de organismos de supervisión, inspección y gestión. Se analizó el impacto económico y social de las Fintech a nivel nacional, con base en sectores económicos tradicionales. Este trabajo establece un sistema financiero compuesto por estructuras organizativas, sistemas legales, agencias y organismos de inspección que administran, controlan y administran los fondos y dinero públicos.

Palabras clave: moneda, mercado financiero, sistema financiero, tecnología financiera.

Clasificación JEL: B22, D52

Received: 20-03-2024 Revised: 11-06-2024 Accepted 15-06-2024 Published: 01-07-2024

Editor:

Carlos Alberto Gómez Cano ![]()

1Universidad Juárez Autónoma de Tabasco. Tabasco, México.

Cite as: Ramon, A., García, A. y Estrada, H. (2024). Transformaciones e impactos de la innovación financiera y el auge de las Fintech en México. Región Científica, 3(2), 2024311. https://doi.org/10.58763/rc2024311

INTRODUCTION

Businesses require large amounts of capital for daily operations (Renaud & Kumral, 2021) because the organization cannot complete the production and distribution of its products and services, resulting in reduced cash and unexpected events (Chung et al., 2017), which is known as the losses a company faces when it goes bankrupt (Afif, 2024; Imani & Ardi, 2024). In this scenario, financial planning provides businesses with funds to help them with their day-to-day tasks (McKinnon & Salapatas, 2024), perhaps in the short or long term, attracting resources from people looking for ways to save money (Gutura & Chisasa, 2024; Shiha & El-Adaway, 2024).

The history of the Mexican economy is closely linked to the history of finance and credit (Gómez, 2009). According to the author, the first financial syndicate in Mexico was created in 1975: the Monte de Piedad Ánimas. The syndicate was the manager of the National Monte de Piedad, and its first tasks were to lend money and maintain confidentiality, fairness, and protection. According to Villegas (2002), the National Savings Bank of Monte de Piedad was founded in 1849, and in 1897, the Law of Large Savings Banks was passed, which established restrictions on banks, banknote sales, and branch openings. Credit institutions are classified here: Supply Banks (commercial), Real Estate Banks (long-term loans), and Reconstruction Banks (intermediate loans).

Again, according to Gómez (2009), Articles 28 and 123 of the Constitution were revised in 1990 to increase the private sector's and society's participation in financial capital. The "Financial Institutions Law" and the "Financial Institutions Management Law" were enacted. The first stipulates that banks and loans can only be issued by credit cooperatives, which can be several banks or development banks (Chavez, 2023); the maximum proportion of foreign investment allowed is 30%. The second law, on the other hand, allowed the creation of financial institutions, which is why it is considered the pronouncement that initiated the creation of international banks in Mexico (Posso, 2016). Furthermore, savings and loan societies, known as "savings banks," were authorized in 1991. In 1993, limited liability companies (Sofoles) emerged, receiving exclusive rights from the Bank of Mexico. This year's Foreign Investment Law allows specific categories of banks to introduce foreign currencies (Sanchez, 2020).

The financial system guarantees a fair distribution of resources between lenders and borrowers (Aliaga, 2010). A sound financial system requires good and solvent consumers (Győri & Benedek, 2022), sound and fair markets (Bindseil & Fotia, 2021), and a legal system that properly determines the rights and responsibilities of shareholders (Gharaibeh, 2024; Z. Liu et al., 2024). In order to promote the healthy development of the financial system and protect the interests of all, Banco de México conducts inspections of all established institutions, promotes changes in existing laws, and enacts laws in accordance with the law (Dussauge & Aguilar, 2021).

In this endeavor, a set of technologies has been developed to support financial decision-making and technological finance, emerging from the combination of financial services and information technologies (Bancomext, 2018). However, more recently, Fintechs have undergone dramatic changes, with new commercial companies focusing on improving financial services and making them more efficient (Leon & Medina, 2022) while simultaneously changing the types of services the industry has been providing for centuries. Thus, it is necessary to create a clear idea of how to understand money (García, 2020) and to understand how to introduce Fintech companies into Mexican legislation. Addressing the unknowns and difficulties in establishing safety and security standards (Calderón et al., 2024).

Throughout history, many things have been used as currency (Tcherneva & Cruz-Hidalgo, 2020). Metals such as gold and silver are widely used because they are safe to maintain and easy to transport (Sanchez, 2019); gold and silver are also highly valuable because they can be used as jewelry (Aranda Huete, 2015). Today, it is often used for things without real value, such as coins. Currency that does not earn interest is called fiat currency. People accept money because they believe they can do other things with it (Santana, 2011).

The speed of technological change has greatly affected the global economy (Kravchuk et al., 2024). Most devices are connected to the internet, and everyone uses digital devices to perform daily tasks. Authors López et al. (2017) mention that Fintech business families are the result of many factors, including technological development and social conditions such as speed and security. One of the most common problems is that they do not accept the current financial system, which does not adapt to the needs of the people around them (Shkolnyk et al., 2021). The global economy, the emergence of digital banking, open government or open banking, and the growing diversity of organizations in the so-called collaborative economy have all had their impact (Linares, 2023); meanwhile, in the field of Fintech, the technical foundation is unavoidable (Al-Debei et al., 2024).

Seen under the previously described arguments, the objective of this research is to analyze the transformations and impact of financial innovation and the rise of Fintech in Mexico. This study provides an analysis of the Mexican economy and Fintech implementation

METHODOLOGY

Qualitative research was developed (Almeida et al., 2024) with the purpose of describing the Mexican financial system and the changes that have occurred over time, which includes the new measures introduced by the recent Fintech legislation. The bibliographic review was carried out in the databases Google Scholar, Scielo, Scopus, Dialnet, and Redalyc (de la Cruz et al., 2022), without language restriction, from 1998 to 2024. The thematic descriptors used were: "financial innovation", "Financial System", "Mexican economy", "financial technologies", "Fintech", "Mexico", "impacts" and "transformations", and their combinations with the help of the Boolean indicators AND and OR. To eliminate duplicates, all downloaded files were integrated into the EndNote bibliographic manager.

For the selection and analysis of the analysis sample, the following criteria were taken into account:

1. Identification and classification of areas to be analyzed.

2. Identification of financial information and stakeholders for decision-making.

3. Identification of financial systems and their powers.

4. Monitoring and development of financial technology.

A bibliometric analysis was conducted in the SCOPUS database (https://www.scopus.com/) (Sánchez et al., 2023; Yiming et al., 2024) to identify trends in the development of financial technologies. The search formula was: TITLE-ABS-KEY ([“emergence” OR “development”] AND “financial technology”).

Research trends were studied, an aspect that was complemented with the main contributions, date ranges of research analysis, scientific production by type of document, and areas of knowledge. In addition, a keyword co-occurrence analysis was performed. The indicators were obtained from the SCOPUS database, where .XLSX files were downloaded in Excel format, while the bibliometric map was obtained using Vosviewer software. All this was synthesized in the following research questions:

1. How does the financial system work in Mexico?

2. What laws govern the Mexican financial system?

3. How does it help everyone?

4. What are the laws and benefits of Fintech?

RESULTS AND DISCUSSION

In 1895, the Bolsa de México S.A. (Mexico Stock Exchange) was inaugurated in Mexico City. It can be said that it originated from the Mexican Gas Company security system in 1880. By 1925, there were 25 banks, 3 credit banks, 7 alternative banks, and a stock exchange. Beginning in 1931, the Bank of Mexico was the only bank providing banking services, managing funds, and acting as a central bank. Furthermore, general laws on ownership and credit litigation were enacted to encourage the use of credit instruments as monetary payments (Gómez, 2009).

According to Villegas (2002), in 1975, the Mexican economic system operated in two ways: authorities and groups (table 1).

|

Table 1. Ways in which the Mexican economic system operated in 1975 |

|

|

Way of operating |

Description |

|

Authority |

The Ministry of Finance and Credit Unions (SHCP) is the highest authority, acting through the Undersecretariat of Public Credit and the Bank of Mexico, S.A. The Undersecretariat of Public Credit administers and supervises the entire financial system, and the Bank of Mexico is the main bank that manages and controls the credit and investment system. The National Banking and Insurance Commission regulates the credit and insurance industry, and the State Securities Commission regulates market activities. |

|

Institutional groups |

Households and Financial Organizations and Financial Assistants established by the government to meet the credit needs of groups important to the national economy, other than private banks. These financial institutions include investment banks, savings banks, finance companies, mortgage companies, and trust companies. |

Credit cooperatives can be classified as one or more of the following: warehouses, clearing houses, stock exchanges, and credit unions. “Banks grew rapidly, and although legally they were independent institutions, in practice they formed a financial group with large amounts of capital” (Gómez, 2009). According to Villegas (2002), in 1976, bank independence ended, and many of them obtained federal government licenses to deposit funds, currency, and wire transfers. In addition to other services provided by law, the legal foundations were also laid for the gradual consolidation of banks and credit unions so that by 1982, there were only 36 banks; the largest at the time were Bancomer, Banamex, Serfin, Banobras, Banco Mexicano Somex, and Multibanco Comemex.

The same author states that the bank was created in 1982, at the end of President José López Portillo's six-year term, and the following year, the Public Services Management Law was enacted (Villegas, 2002). Subsequently, in 1984, the National Credit Cooperative was divided into a Financial Group and a Development Financial Group. According to the General Law on Financial Aid Organizations and Activities, securities organizations are excluded since credit organizations and stock exchanges can act as credit institutions. The Securities Market Law regulates the incorporation of foreign investment companies and their authorization as institutions to administer pensions and retirement benefits. The Investment Company Law divides them into three categories: general funds, fixed-income funds, and venture capital funds (Montiel, 1998).

Financial system

The financial system consists of all the institutions, markets, and instruments that carry out economic activities, promote savings, and their efficient utilization (Saltos et al., 2016). It ensures that what drives real activity in the production and consumption economy comes from people who have additional income in times of need and helps share the burden. In addition to Herrera (2008), Wang et al. (2024) assert that the government has implemented a set of rules, regulations, and laws that improve the ownership of those who lend money through financial institutions they have approved to make a profit by entering the country.

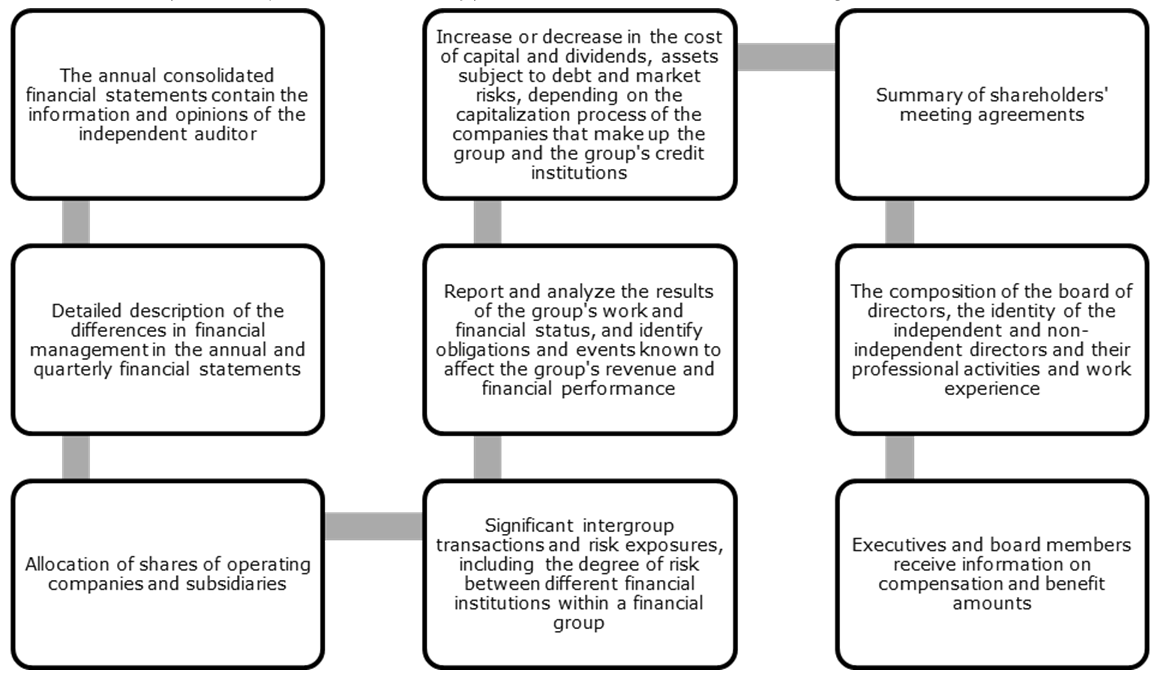

As Gómez (2009) mentions, the existence of the financial system is based on economic vulnerabilities, especially the problem of unknown information amidst economic conditions. Therefore, a financial system cannot exist in a country where information costs (such as evaluating a company's reputation) and transaction costs (such as entering into contracts) are zero. In this regard: "Since 1995, following the severe economic crisis, foreign and banking policies have increased as foreign banks have acquired control of the Mexican financial system from the national bank" (Gómez, 2009). In April 2005, at the request of the Ministry of Finance and Public Accounts (SCP), the following information was published online and in the Official Gazette of the Federation in order to increase the transparency of the Mexican economy and optimize its operations.

|

Figure 1. Financial or corporate information that supports stakeholder decision-making |

|

|

Among the executives and board members who receive information on compensation and benefit amounts are Ministry of Finance and Credit (SHCP), Bank of Mexico (BANXICO), National Council for the Protection of Users of Financial Services (CONDUSEF), Bank, Non-bank financial intermediation sectors, Retail Market Department, Issuance Department and Insurance Department and Savings Department (Hernández-Anastacio & Rodesma-Montero, 2015).

Systems: financial institutions and their faculties

In order for financial institutions to operate in accordance with the needs and rights of users and the laws that govern them, there are financial authorities or institutions that supervise them. According to CONDUSEF (2018), these are the financial authorities located in the country: the Ministry of Finance (SHCP), the Bank of Mexico (Banxico), the National Banking and Securities Commission (CNBV), the National Retirement System Commission (CONSAR), the National Insurance and Bonding Commission (CNSF), the National Commission for the Protection and Defense of Financial Institutions and Service Users (CONDUSEF), and the Bank Protection Institute (IPAB).

The importance of authorities in the Mexican financial system has already been mentioned (Herrera, 2008), as they administer and control the activities of financial institutions for the benefit of investors. The Ministry of Finance and Public Treasury (SHCP) is responsible for taxes with the approval of the House of Representatives and the Senate, and the government uses the funds raised to build schools, hospitals, roads, etc. Furthermore, this authority is determined by the Federal Law on the Organization of Public Administration and represents the highest authority in the country's economy, whose activities are carried out by the activities of other organizations. Likewise, the author shows that in the financial field, they have the following faculties (Herrera, 2008):

· Encourage the President of the Republic to implement the federal government's financial and monetary policies.

· Issue and obtain licenses for the composition, management, and administration of the following organizations: large banking institutions, insurance companies, mutual insurance companies, confirming agencies, credit unions, home transfers, advanced functions and other options, and Smart Home (in the market).

· Issuance and finalization of the approval of laws and services for establishing stock exchange institutions, including the approval of projects resulting in the merger of two or more institutions and the establishment of national categories. Representative offices of financial institutions abroad.

· Issue and obtain legal and operating licenses for financial groups, as well as accept the inclusion of new companies in a financial group or the spin-off of one of its members, including two or more groups of those, two or more entities belonging to the same group, and the liquidation of that financial group.

· Appointment of the presidents of the Banking and State Commission (CNBV), the National Insurance and Guarantees Commission (CNSF), the National Retirement Savings System Commission (CONSAR), and the National User Protection Commission (CONDUSEF). In accordance with applicable law, the president shall be informed of the decisions and opinions of the Board of Directors.

|

Table 2 Faculties or responsibilities of financial systems |

|

|

System |

Faculty or responsibility |

|

Bank of Mexico (BANXICO) |

Provide wealth and national currency. It relies on the stability of the currency's purchasing power. |

|

National Banking and Securities Commission (CNBV) |

Approve and supervise institutions such as banks, savings banks, and cooperatives to fully utilize public services and ensure the proper distribution of funds. |

|

National Council of Retirement Savings Systems (CONSAR) |

Manage funds in employees' post-retirement savings accounts, and ensure businesses are properly invested for growth and the provision of adequate services. |

|

National Insurance and Guarantees Commission (CNSF) |

Approve and supervise insurance policies to promote those that enable individuals and businesses to avoid the financial consequences of accidents, illnesses, natural disasters, or natural disasters. |

|

National Commission for the Protection and Defense of Financial Services Users (CONDUSEF) |

Provide public financial education, develop products and tools to assist, advise and guide users of financial services, and respond to public complaints against financial institutions. |

|

Bank Deposit Protection Institute (IPAB) |

Protecting money deposited in banks through deposit insurance. This insurance is a way forward if the bank experiences financial problems. |

Source: own elaboration based on Herrera (2008) and CONDUSEF (2018)

The emergence and development of financial technology

Financial technology has been around for 150 years, adds Bancomext (2018), when Edward Callahan invented the teletypewriter, an early electronic method for transmitting stock prices by telephone. As an innovative company, products or services can be sold through the vigorous use of information and communication technologies, with business risks growing and stabilizing over time (Fernández, 2021).

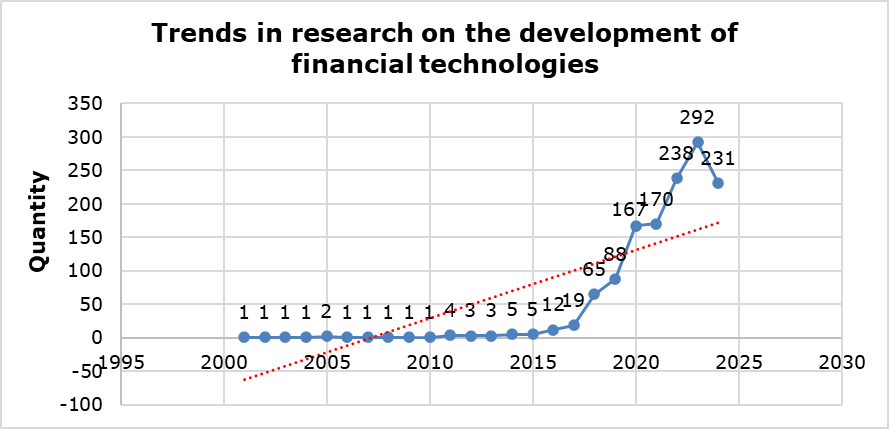

Figure 2 shows the trend in research related to the emergence and development of financial technologies. From 2001 to 2017, the trend was stable, with an average range of 1 to 4 publications. From 2018 onward, the trend was positive and increasing, with a peak of 292 research papers in 2023. However, by 2024, there were already 231 documents, so production for that year is expected to exceed the previous year. Research articles in the areas of economics, econometrics, and finance predominated.

|

Figure 2. Trends in research on the development of financial technologies |

|

|

Source: own elaboration

A financial technology (Fintech) or fintech company is a company that uses technology as a means to provide financial products and services. These companies are known for collaborating to create solutions to financial and other non-traditional problems, resulting in the following business model.

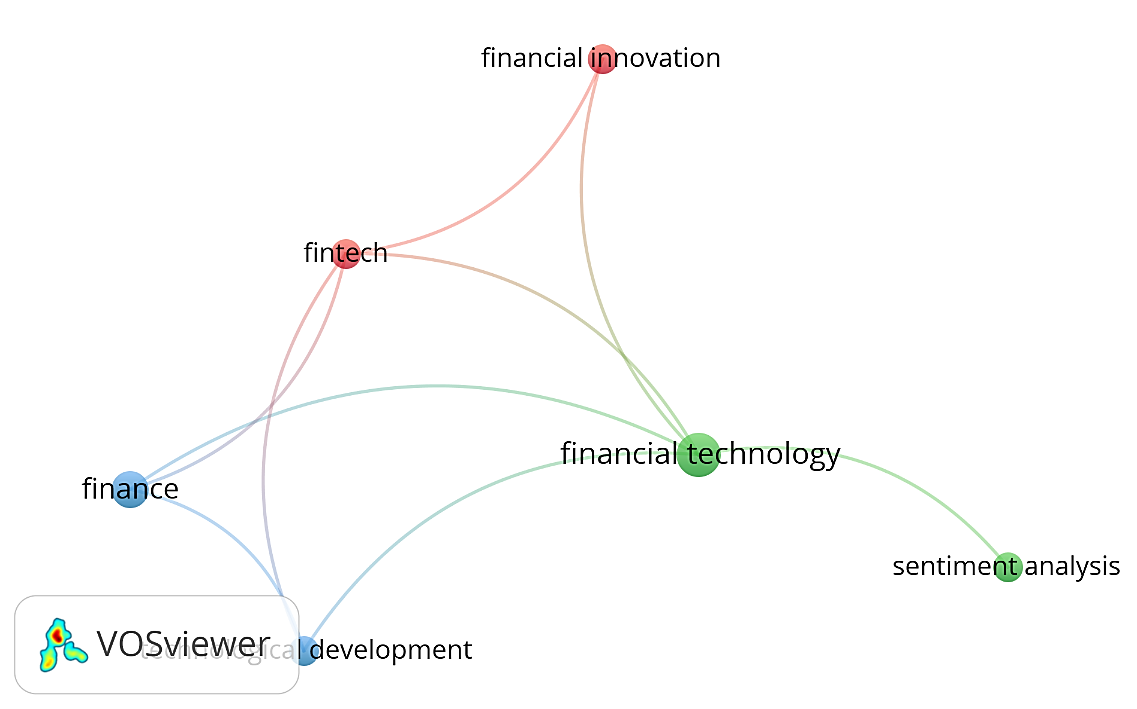

A co-occurrence analysis was performed on keywords with a co-occurrence level greater than or equal to two (Figure 3), where three clusters were identified: the first focused on financial innovation and the emergence of fintech (Aryan et al., 2024; Q. Liu et al., 2024; Rahadian et al., 2024); the second focused on financial technologies and sentiment analysis (Biju et al., 2024; Miranti et al., 2024), while the third focused on finance and technology development (Wan et al., 2024; Wu, 2024).

|

Figure 3. Word co-occurrence analysis (n≥2) |

|

|

Source: own elaboration

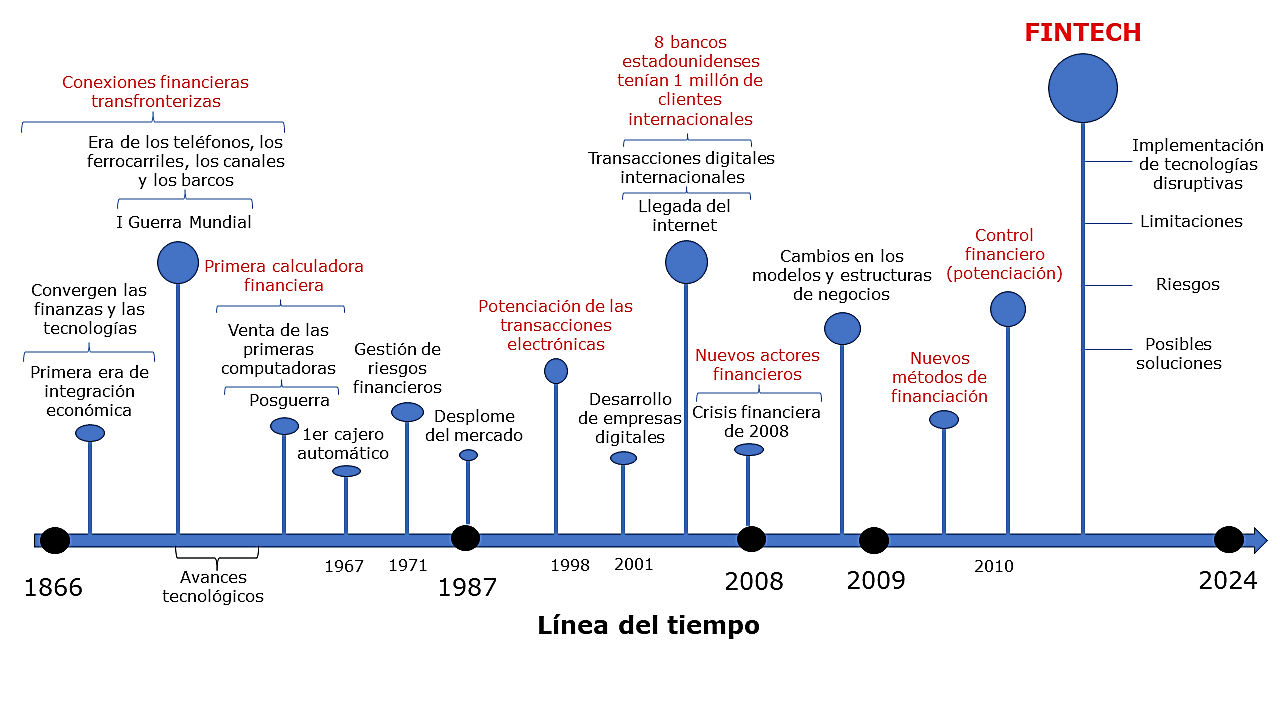

Figure 4 shows the emergence and evolution of Fintech as a financial technology; the analysis was segmented into three main periods: from 1866 to 1987, from 1988 to 2008, and from 2009 to the present. The first period was marked by the first era of economic integration, which lasted until the First World War, which boosted the rise of cross-border connections with the era of telephones, railways, canals, and ships (Bancomext, 2018). After the postwar period, technological advances began, and the first computers were sold, such as the International Business Machines Corporation (IBM) (García, 2020), which also created the first financial calculator. As many banks replaced paper documents with computers and began to manage risk, research articles in the areas of Economics, Econometrics, and Finance predominated.

|

Figure 4. Emergence and evolution of Fintech |

|

|

Source: own elaboration

Note: the figure appears in its original language

The second period marked a new era in the management of financial transaction problems and their integration with technology, with the stock market crash, where companies relied on electronic transactions between financial institutions, financial market participants, and consumers. In this other scenario, the creation of financial companies was boosted due to their practical impact on financial services. With the arrival of the internet, by 2001, eight US banks had 1 million international clients; this factor enabled the digitalization of banks, reflecting the investments made by these institutions to improve technology and, furthermore, replace legacy systems with a better understanding of the digital world (Bancomext, 2018).

The third period shows how the financial crisis boosted financial technologies' applications, leading to Fintech's creation. The financial crisis had two main consequences that affected public opinion and people's finances. The first is related to the idea that banks failed, and the second is that when the financial crisis became a social problem, many bank and financial system employees lost their jobs, which meant they were not prepared to understand financial markets and to take advantage of and drive the development of Fintech. Therefore, business models and structures have had to change, and new financing methods have been introduced, which is consistent with the lack of financial controls. This new proposal has five limitations (Bancomext, 2018):

1. Money is money: it focuses on alternative sources of financing, especially peer-to-peer lending.

2. Activities and Risk Management: these are investments in information technology made by financial institutions, which—especially since 2008—have developed monitoring systems to address major issues when they arise.

3. Payments and Infrastructure: online payments and mobile transactions are key for Fintech companies and are driving new ecosystems.

4. Data and Fund Security: as financial companies maintain their digital focus, they are vulnerable to cybercrime and espionage, which becomes a political issue.

5. Customer Contraction: this will continue to be a key investment target for Fintech companies. For developing countries, technology financing is another way to improve the economy.

CONCLUSIONS

The government's economic activities and other functions are carried out through the executive branch of administration and management. This work establishes a financial system composed of organizational structures, legal systems, agencies, and inspection bodies that administer, control, and manage public funds and monies.

The Mexican financial system is made up of financial institutions, subsidiaries, agencies, and authorities responsible for managing, directing, regulating, supervising, and verifying financial affairs. The competent authorities for the regulation and control of financial services are the Bank of Mexico, the Ministry of Finance and Public Finance (through its executive branch), and the National Commission for the Protection and Protection of Users of Financial Services Banks; in short, these are the authorities that regulate financial services, the national banking and securities commissions, insurance, and the financial and retirement systems.

Legal and technological changes have also reshaped the Mexican economy. Fintechs have thus become a major innovative competitor, affecting consumer confidence in traditional financial services. These changes demonstrate the urgent need for reform and adequate regulation to ensure the stability and control of the financial system. Therefore, it is recommended that financial technology oversight be strengthened to ensure competition and security for all stakeholders. Cultural institutions are also encouraged to strengthen cooperation with financial technology and use technology to improve financial services. It should be noted that financial education and consumer protection are key to maintaining financial confidence.

REFERENCES

Afif, M. (2024). Examining the usability of mobile applications among undergraduate students using SUS and data mining techniques. International Journal of Data and Network Science, 8(3), 1801-1814. https://doi.org/10.5267/j.ijdns.2024.2.008

Al-Debei, M., Hujran, O., y Al-Adwan, A. (2024). Net valence analysis of iris recognition technology-based FinTech. Financial Innovation, 10(1), Article 59. https://doi.org/10.1186/s40854-023-00509-y

Aliaga, Y. (2010). Variables financieras y el impacto en la tasa de interés pasiva del sistema bancario boliviano. [Tesis de grado]. Universidad Mayor de San Andrés. La Paz, Bolivia. https://repositorio.umsa.bo/bitstream/handle/123456789/28755/PG-302.pdf?sequence=1&isAllowed=y

Almeida, D., Naidon, A., Martins, F., … y Rangel, R. (2024). Trajectory and professional practice of the graduates of the residency program in obstetric nursing: qualitative study. Acta Scientiarum - Health Sciences, 46(1), Article e64893. https://doi.org/10.4025/actascihealthsci.v46i1.64893

Aranda, A. (2015). La joya histórica como objeto de arte. Problemas de conservación. Ge-conservacion(8), 154-160. https://dialnet.unirioja.es/servlet/articulo?codigo=5278323

Aryan, L., Alsharif, A., Alquqa, E., … y Al-Hawary, S. (2024). How digital financial literacy impacts financial behavior in Jordanian millennial generation. International Journal of Data and Network Science, 8(1), 117-124. https://doi.org/10.5267/j.ijdns.2023.10.011

Bancomext, B. (2018). Fintech en el mundo: La revolución digital de las finanzas ha llegado a México. México.

Biju, H., Mukthar, K., Dhia, A., … y Singh, J. (2024). A bibliometric analysis of financial technology: unveiling the landscape of a rapidly evolving field. Discover Sustainability, 5(1), Article 72. https://doi.org/10.1007/s43621-024-00256-9

Bindseil, U., y Fotia, A. (2021). Economic Accounts and Financial Systems. In Introduction to Central Banking (pp. 1-9). Springer. https://link.springer.com/chapter/10.1007/978-3-030-70884-9_1

Calderón, M., Cordero, D., y Rivera, J. (2024). Desarrollo de competencias en seguridad de la información y protección de datos en el comercio electrónico. Revista Conrado, 20(99), 249-259. https://conrado.ucf.edu.cu/index.php/conrado/article/view/3807

Chavez, J. (2023). Análisis de la aceptación de la Banca Digital en las Pymes de la ciudad de Guayaquil. [Tesis de grado]. Universidad Politécnica Salesina. https://dspace.ups.edu.ec/bitstream/123456789/26478/1/UPS-GT004844.pdf

Chung, M., Hsieh, M., y Chi, Y. (2017). Computation of operational risk for financial institutions. Romanian Journal of Economic Forecasting, 20(3), 77-87. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85032385454&partnerID=40&md5=844f9a6b4016cdc53a9b70f564170b6a

CONDUSEF, C. (2018). El Sistema Financiero Mexicano. Guia 3, 17. https://www.condusef.gob.mx/documentos/302248_Guia_3_.pdf

de La Cruz, P., Poquis, E., Valle, R., Castañeda, M., y Sánchez, K. (2022). Aprendizaje basado en retos en la educación superior: Una revisión bibliográfica. Horizontes Revista de Investigación en Ciencias de la Educación, 6(25), 1409-1421. http://www.scielo.org.bo/pdf/hrce/v6n25/a7-1409-1421.pdf

Dussauge, M., y Aguilar, M. (2021). Populismo, retrocesos democráticos y administraciones públicas: la experiencia de México durante la primera mitad del gobierno de Andrés Manuel López Obrador. Estado, gobierno, gestión pública: Revista Chilena de Administración Pública(36), 135-186. https://revistaeggp.uchile.cl/index.php/REGP/article/view/66054

Fernández, H. (2021). Economiatic. https://economiatic.com/startups/early-stage/que-es-una-startup/

García, D. (2020). Las FinTech: Desafios Jurídicos en la Reinvencion del Sistema Financiero en México [Tesis de grado]. Universidad Juárez Autónoma de Tabasco. https://ri.ujat.mx/bitstream/20.500.12107/3359/1/TESIS%20DANIEL%20GARC%c3%8dA%20GALLEGOS.pdf

Gharaibeh, Z. (2024). Legal Support for Sustainable Development in Middle East. International Journal of Sustainable Development and Planning, 19(4), 1439-1446. https://doi.org/10.18280/ijsdp.190421

Gómez, T. (2009). Sistema financiero y crecimiento economico en México. Analisis econometrico 1975 - 2005.

Gutura, R., y Chisasa, J. (2024). The relationship between financial literacy and retirement planning among informal sector workers in Randburg, South Africa. Folia Oeconomica Stetinensia, 24(1), 56-74. https://doi.org/10.2478/foli-2024-0004

Győri, Z., y Benedek, B. (2022). Stakeholders and opportunities of debt settlement as a values-based banking activity in Hungary. Social Responsibility Journal, 18(7), 1361-1377. https://doi.org/10.1108/SRJ-04-2020-0134

Hernández, C., y Rodesma, M. (2015). Análisis comparativo de la Normativa prudencial entre Costa Rica y México-Reglamentos y normas de las principales autoridades financieras presentes en cada país-La Comisión Nacional Bancaria y de Valores, CNBV y la Superintendencia General de Entidades Financieras, SUGEF [Tesis de grado]. Tecnológico de Costa Rica. https://repositoriotec.tec.ac.cr/bitstream/handle/2238/6649/analisis_comparativo_normativa_prudencial_costa_rica_mexico_reglamentos.pdf?sequence=1&isAllowed=y

Herrera Mejía, R. (2008). La importancia de los mercados financieros y opciones financieras en México [Tesis de grado]. Universidad Autónoma de Hidalgo. http://dgsa.uaeh.edu.mx:8080/jspui/bitstream/231104/459/1/La%20importancia%20de%20los%20mercados%20financieros.pdf

Herrera, M. (2008). La importancia de los mercados financieros y opciones financieras en México. Hidalgo, México.

Imani, R., y Ardi, M. (2024). Integrity management system risk modeling in transmission pipelines natural gas, energi mega persada (EMP) Bentu Ltd. AIP Conference Proceedings,

Kravchuk, D., Khrapatyi, S., Fedirko, O., Berezovska, N., y Budzyn, V. (2024). The Influence of Investments in Science and Technology on the Innovative Development of the Global Economic System. Economic Affairs (New Delhi), 69, 95-106. https://doi.org/10.46852/0424-2513.1.2024.12

Leon, L., y Medina, R. (2022). Payment Fintech: acceptance analysis based on TAM model. Universidad Ciencia y Tecnología, 26(113), 92-102. https://uctunexpo.autanabooks.com/index.php/uct/article/view/575

Linares, E. (2023). Open banking: intercambio de información transaccional entre instituciones de tecnología financiera [Trabajo de grado]. Universidad Externado de Colombia

Liu, Q., Chan, K., y Chimhundu, R. (2024). Fintech research: systematic mapping, classification, and future directions. Financial Innovation, 10(1), Article 24. https://doi.org/10.1186/s40854-023-00524-z

Liu, Z., He, S., Men, W., y Sun, H. (2024). Impact of climate risk on financial stability: Cross-country evidence. International Review of Financial Analysis, 92, Article 103096. https://doi.org/10.1016/j.irfa.2024.103096

López, J., Langthaler, J., Fabian, M., y Mayorga, J. (2017). Una Perspectiva General de Fintech: Sus Beneficios y Riesgos. Asociación de Supervisores Bancarios de las Américas. https://bit.ly/2U7OJDA

McKinnon, A., y Salapatas, K. (2024). Beyond the theory: Adaptive workforce planning approaches that are business-led. In Strategic Workforce Planning: Best Practices and Emerging Directions (pp. 241-259). https://doi.org/10.1093/oso/9780197759745.003.0012

Miranti, R., Siregar, S., y Willyana, A. (2024). How does inclusion of digital finance, financial technology, and digital literacy unlock the regional economy across districts in Sumatra? A spatial heterogeneity and sentiment analysis. GeoJournal, 89(4), Article 136. https://doi.org/10.1007/s10708-024-11110-w

Montiel, G. (1998). Las sociedades de inversión. Carta Económica Regional, 58, 42-44. https://dialnet.unirioja.es/servlet/articulo?codigo=7951610

Posso, R. (2016). Historia de la creación de la banca central latinoamericana-El pretérito es la base de un presente prominente. Tendencias, 17(2), 166-187. https://doi.org/10.22267/rtend.161702.9

Rahadian, D., Firli, A., Dinçer, H., … y Ecer, F. (2024). A hybrid neuro fuzzy decision-making approach to the participants of derivatives market for fintech investors in emerging economies. Financial Innovation, 10(1), Article 37. https://doi.org/10.1186/s40854-023-00563-6

Renaud, M., y Kumral, M. (2021). Out of the Comfort Zone: Quantifying Country Risk for Foreign Mining Project Investment Feasibilities. Mining, Metallurgy and Exploration, 38(6), 2323-2335. https://doi.org/10.1007/s42461-021-00495-8

Saltos, J., Mayorga, M., y Ruso, F. (2016). La economía popular y solidaria:: un estudio exploratorio del sistema en Ecuador con enfoque de control y fiscalización. Cofin Habana, 10(2), 55-75. http://scielo.sld.cu/pdf/cofin/v10n2/cofin03216.pdf

Sanchez, A. (2020). La Inversión Extranjera en México y en China, Análisis Comparativo del Marco Jurídico. Journals Press, 20(3), 43-60. https://journalspress.com/LJRS_Volume20/967_La-inversion-Extranjera-en-Mexico-y-en-China-Analisis-Comparativo-del-Marco-Jur%C3%ADdico.pdf

Sánchez, A. (2019). Situación del dinero efectivo en España: alternativas y sociedades cashless [Tesis de Grado]. Universitas Miguel Hernández. https://dspace.umh.es/bitstream/11000/8243/1/TFG-Sanchez%20S%c3%a1nchez,%20Alberto.pdf

Sánchez, Y., Pérez, A., Hernández, A., … y Rodríguez Torres, E. (2023). Cultura hospitalaria y responsabilidad social: un estudio mixto de las principales líneas para su desarrollo. Salud, Ciencia y Tecnología-Serie de Conferencias, 2, 451-451. https://doi.org/10.56294/sctconf2023451

Santana, M. (2011). Recrear el dinero en una economía solidaria. Polis. Revista Latinoamericana(29). https://journals.openedition.org/polis/2005

Shiha, A., y El-Adaway, I. (2024). Forecasting Construction Material Prices Using Macroeconomic Indicators of Trading Partners. Journal of Management in Engineering, 40(5), Article 04024036. https://doi.org/10.1061/JMENEA.MEENG-6106

Shkolnyk, I., Kozmenko, S., Kozmenko, O., Orlov, V., y Shukairi, F. (2021). Modeling of the financial system? s stability on the example of Ukraine. Equilibrium. Quarterly Journal of Economics and Economic Policy, 16(2), 377-411. https://www.ceeol.com/search/article-detail?id=975692

Tcherneva, P., y Cruz-Hidalgo, E. (2020). Dinero, poder y regímenes monetarios: por qué la naturaleza del dinero sí importa. Revista de Economía Crítica(29), 1-15. https://revistaeconomiacritica.org/index.php/rec/article/view/246

Villegas, H. (2002). Sistema Financiero en México. Mc Graw Hill.

Wan, J., Ma, W., y Mao, C. (2024). Navigating economic and legal compliance in digital resource management: Technological Pathways to sustainability with digital government. Resources Policy, 95, Article 105110. https://doi.org/10.1016/j.resourpol.2024.105110

Wang, L., Sha, Y., Ding, L., y Zhao, Z. (2024). Risk mitigation strategies in urban investment bonds: Insights from local government implicit debt governance. Structural Change and Economic Dynamics, 70, 607-618. https://doi.org/10.1016/j.strueco.2024.05.015

Wu, J. (2024). Role of green finance and carbon accounting in achieving sustainability. Humanities and Social Sciences Communications, 11(1), Article 128. https://doi.org/10.1057/s41599-023-02492-2

Yiming, S., Xinming, Y., Liqun, C., y Aining, L. (2024). Bibliometric analysis of vertigo-related histopathology, vestibular rehabilitation, physical rehabilitation, and Chinese and Western medical treatments. Chinese Journal of Tissue Engineering Research, 28(34), 5500-5507. https://doi.org/10.12307/2024.839

FINANCING

The authors did not receive funding for the development of this research.

CONFLICT OF INTEREST STATEMENT

The authors declare that there is no conflict of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Data curation: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Formal analysis: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Acquisition of funds: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Investigation: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Methodology: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Project management: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Resources: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Software: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Supervision: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Validation: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Visualizatioón: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Writing - original draft: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.

Writing - proofreading and editing: Aurora Ramón de la Cruz, Aida Dinorah García Álvarez and Heidi Gabriela Estrada Calix.