Scientific and Technological Research Article

Potential of nearshoring for Mexico's economic development

Potencialidad del nearshoring para el desarrollo económico de México

Alejandra Fernández Hernández1 ![]() *, Ernesto

Bravo Benítez2

*, Ernesto

Bravo Benítez2 ![]() *

*

ABSTRACT

The article focuses on analyzing the potential of "nearshoring," that is, outsourcing services and production to nearby countries, to strengthen the Mexican economy. Through a descriptive and qualitative methodology, the theoretical-methodological aspects related to the variants of nearshoring and the advantages offered by state participation in the economy are examined. The study highlights the growing global trend towards foreign direct investment. It underlines how Mexico has benefited from relocation to geographically close areas, driven by factors such as its proximity to the United States, the T-MEC, and key logistical connections, such as the transisthmian train linking the Pacific Ocean with the Gulf of Mexico. It is also noted that national and international indebtedness processes have led Mexico into a virtuous circle, requiring the authorities to focus strategically on identifying and meeting the logistics needs of foreign companies and the population itself.

Keywords: global value chains, public debt, regional economy, economic evaluation, finance and trade, outsourcing.

JEL Classification: H61; J10; F10

RESUMEN

El artículo se centra en analizar el potencial del "nearshoring", es decir, la externalización de servicios y producción a países cercanos, para el fortalecimiento de la economía mexicana. A través de una metodología descriptiva y cualitativa, se examinan los aspectos teórico-metodológicos relacionados con las variantes de relocalización y las ventajas que ofrece la participación estatal en la economía. El estudio destaca la creciente tendencia mundial hacia la inversión extranjera directa y subraya cómo México se ha beneficiado de la relocalización a zonas geográficamente cercanas, impulsada por factores como su proximidad a Estados Unidos, el T-MEC y las conexiones logísticas clave, como el tren transístmico que une el Océano Pacífico con el Golfo de México. Asimismo, se señala que los procesos de endeudamiento tanto nacional como internacional han llevado a México a un círculo virtuoso, lo que ha requerido de las autoridades un enfoque estratégico en identificar y atender las necesidades logísticas de empresas extranjeras y de la propia población.

Palabras clave: cadenas globales de valor, deuda pública, económica regional, evaluación económica, finanzas y comercio, tercerización.

Clasificación JEL: H61; J10; F10

Received: 04-17-2023 Revised: 22-05-2023 Accepted: 15-06-2023 Published: 04-07-2023

Editor: Carlos

Alberto Gómez Cano ![]()

1Universidad Politécnica del Estado de Morelos. Morelos, México.

2Universidad Nacional Autónoma de México. Ciudad de México, México.

Cite as: Fernández, A. y Bravo, E. (2023). Potencialidad del nearshoring para el desarrollo económico de México. Región Científica, 2(2), 2023105. https://doi.org/10.58763/rc2023105

INTRODUCTION

The efficient production and marketing of goods and services between countries at the international level was explained until before the arrival of globalization on the basis of the Bertin-Ohlin model (Akinrinade and Ogen, 2008), based on the endowment of productive factors but contextualized in the model of competitive advantages put forward in the early 19th century by Ricardo (1993), which was preceded in the late 18th century by the productive criterion of Smith's absolute advantages (2015); in this sense, with the arrival of the globalization process that began to take shape in the 1970s, the paradigm that actually governs the processes of productive specialization and commercial positioning among countries is based on Michael Porter's model of competitive advantages and its corollary based on systemic advantages, highlighting in particular the contribution that governments make in terms of providing productive and social infrastructure (Benavides et al, 2004; Esser et al., 1996; Ortega and Segovia, 2017).

Globalization has given rise to corporate offshoring, known as "offshoring" (Lian et al., 2023). It is essential to distinguish this concept from outsourcing. While offshoring refers to the geographic relocation of specific business operations, outsourcing describes the practice of delegating services, tasks, and operations to third parties (Karamemis et al., 2023; Kovach et al., 2023; Wang et al., 2023). The latter started to gain popularity in the 1970s, 1980s, and 1990s, mainly in low and medium-value-added activities (Bauzá, 2021).

An offshore company is a multinational organization of a productive, financial or investment fund type that chooses a place to locate its fiscal domicile without producing there and in which they benefit from asset protection, confidentiality, and tax advantages (Hessevik, 2022; Leite & Garibaldi, 2021). Thus, there is an ad-hoc typology to contextualize offshoring processes, giving rise to variants that are a function of aspects related to ownership (Fessel, 2023), distance, and production processes, giving way to modalities such as the following:

· Ownership: This is related to the transfer by the company of the productive factors (capital, labor, and entrepreneurial skills) to those regions where it intends to produce a good or service; the other modality related to this topic involves subcontracting an external company to participate in part of the production of the good or service.

· Distance: It has to do with sending to distant territories (offshoring) where there are certain advantages to be exploited in favor of the company, while the other modality is nearshoring (reshoring), which implies transferring part of the production to regions that are not so distant, such as neighboring countries.

· Processes: services are provided abroad as a better way of getting closer to customers; production processes are sent to factories abroad; sales is when external sales services are contracted in order to open new markets; and lastly, there is research and development, which is nothing more than the offshoring of activities that add value to the service or product.

In this sense, the COVID-19 crisis triggered unexpected global economic processes such as supply crisis (Aljuneidi et al., 2023; Babu & Yadav, 2023; Fan et al., 2023) and runaway inflation (Aharon et al., 2023; Grigoli & Pugacheva, 2023; Nascimento & Matheus, 2023), which together have slowed the growth of the hegemonic economies and with this the global economy, which has motivated multinational companies and governments to take various measures to try to get out of this economic impasse (Sánchez et al., 2021). In the case of transnational companies based in China, they have had to relocate their production (Liu & Yu, 2022; Xie et al., 2023; Zhang et al., 2020), while in the case of most governments, they had to implement a combination of economic policy measures in the fiscal, monetary and exchange rate areas to boost the economy, but also to control the inflationary and exchange rate devaluation pressures that manifested themselves on a global scale at the end of 2021 and throughout 2022.

The scenario above has resulted in the exit of many Western companies from China, relocating their production to countries that have specific characteristics, among which the Mexican nation stands out, which has the Mexico, United States, and Canada Treaty (T-MEC) (Leal & Dabat, 2019; Roumasset & Wada, 2013). In addition to a unique geostrategic position since its territory connects Central and South America with the North American side, and through the Isthmus of Tehuantepec to the Gulf of Mexico with the Pacific Ocean in this sense, the federal government has implemented various measures in areas related to infrastructure for production through the enabling of industrial parks, facilitation of procedures to bring together many of the companies coming from the United States, Canada, Europe and Japan, and even companies of Chinese origin.

Therefore, the current international situation favors the Mexican nation, but this is a process with apparent obscurities since it demands a meticulous protocol with how public policy is conducted because bottlenecks and diplomatic pressures may arise and even lead to trade blockades in the case of North America, there are specific clauses in the framework of the T-MEC (Gómez & Ruiz, 2021), in the sense that the nations that comprise it are prevented from establishing close trade ties with countries with a non-capitalist economic orientation. Thus, this research aims to analyze the potential of nearshoring for Mexico's economic development.

METHODS

Descriptive and qualitative research was carried out to address the theoretical-methodological aspects based on the modalities in which the variants involved in relocation and the systemic competitive advantages that involve the participation of the State in the economy can be presented. The Mexican nation was used as the unit of analysis to evaluate the potential of nearshoring in the country's economic development. Following the protocols of Bravo and Santos (2017) and Céspedes and Martínez (2016), theoretical and empirical methods were used, as described below:

Theoretical methods

The historical-logical method was applied to determine the benefits of "near outsourcing" based on historical analysis, which allowed contextualizing the issue of business offshoring and the existence of governmental institutions that aim to strengthen the processes of economic growth and development. On the other hand, analysis-synthesis was used to study the different aspects of offshoring, including advantages and disadvantages, stylized facts, and elements related to foreign direct investment. Finally, the inductive-deductive method was used to evaluate the results of the research variables.

Empirical methods

The literature review was used to study relocation and its potentialities for Mexico's economic development, the study of characteristic elements that allowed characterizing the variable from the country's reality and its influence on debt and public finances. Among the primary methodological, theoretical references is welfare economics (Piguo, 2017), the latter in the context of the Cambridge school (table 1), where such criticism is nuanced, becoming entirely in favor of government intervention with the arrival of Keynesianism and post-Keynesianism (Lovoie & Seccareccia, 2022).

|

Table 1. Theoretical references of contemporary public sector economics |

||||||

|

Keynesian Macroeconomics (POS, NEO, NUE)* and its neoclassical and Marxist critique

|

Public economy

|

R. Musgrave, L. Johansen, J. Stiglitz |

Public finance |

|||

|

Welfare economics |

||||||

|

Public choice - collective action |

||||||

|

Cost - benefit and cost - efficiency |

||||||

|

New public economics |

E. Phelps (neoclassical school) |

Company Market Government |

Neocuant-Monet Spect. Rac. Ofertismo |

NMC** NSN*** EA**** |

||

|

Development economics |

New development economics or new economic geography Structuralism, Neo-Structuralism and Post-Structuralism Institute of New Economic Structuralism of Peking Universities. |

|||||

|

Institutionalism |

Historical: T. Veblen, K. Polanyi, J.K. Galbraith Contemporary: D. Asemoglu, J.A. Robinson Neoinstitutionalism: R. Coase, D. North, M. Aoki, J. March, J. Olsen |

|||||

|

Political economy |

Marxism and neo-Marxism: James O. Connor (Fiscal Sociol. Connor (Fiscal Sociol.), Nicos P. Post-Marxist: Perry A., Erick H., J. Habermas (Neolib. Vs. Welfare Edo.) |

|||||

|

Pragmatic approach |

Pikkety (Progressive Taxation) (Neoc.-Institut. And Marxism) |

|||||

|

French school of public finance |

Tax Keynesianism |

Sociology, Culture and Psychology |

||||

|

Economic evolutionism |

Institutional contexts |

J. Schumpeter, Dosi G. Freeman C. y Fabiani S. |

||||

Where: * POS: Post-Keynesian, NEO: New Keynesian and NUE: New New Keynesian.

** New Classical Macroeconomics. *** New Neoclassical Synthesis.

**** Austrian School.

Source: Own elaboration.

RESULTS

Industrial development in substitution of imports reached its peak after the Mexican Revolution. This element marked a more dynamic macroeconomic strategy, abandoned in the early 1980s due to the foreign debt crisis and replaced by the Economic Opening Strategy (EAE) with Mexico's entry into the then General Agreement on Tariffs and Trade (GATT), now the World Trade Organization (WTO), today the World Trade Organization (WTO), and more formally with the entry into force in 1994 of the Free Trade Agreement (FTA) and its subsequent renegotiation in 2018 under the concept of Mexico, United States, Canada Agreement (T-MEC).

There are also free trade agreements that Mexico has with multiple countries, in particular, the Free Trade Agreement with the European Union (EUFTA) in force since 2000, as well as the Continuity of Trade Agreement with the United Kingdom (UKFTA), signed between both nations in 2020 (Ministry of Economy, 2020), In addition to other Asian nations with which we have close trade ties, such as Japan, with which we have an Economic Partnership Agreement (2004), and South Korea, which is currently negotiating an FTA with Mexico (SE-2022), not to mention China, which has been a member of the World Trade Organization (WTO) since 2001 and is currently seeking to position itself productively with its companies in Mexico.

The process of economic liberalization that the Mexican economy has undergone in recent years was linked to the irruption of the globalization phenomenon and the subsequent formation of global value chains (González-Ramírez et al., 2020; Raimondi et al., 2023; Rohit, 2023), transforming its productive profile in the industrial-manufacturing and services sectors. However, the results in terms of growth and economic development were not as expected by the sectors of Mexican society, leading its citizens to vote in 2018 for a government with an ideological profile different from the neoliberal one and with a transitionist management program, which had to face one of the most aggressive pandemics ever experienced by humanity with its unfortunate health and economic effects in areas related to production (nearshoring and onshoring), trade (logistics crisis), and inflation affecting the international price system.

In this sense, the Mexican government has been characterized since it came to power by promoting changes in primary and secondary laws of an economic-social nature, also adapting the administrative framework that sustains it, but having as a foundation the constitutional articles that confer to the Mexican State a guiding condition of economic development, that is, the so-called economic chapter integrated by constitutional articles 25, 26, 27 and 28, and where some of them could even be reformed to return the Mexican State its condition of the promoter of economic development, 26, 27 and 28, some of which could even be reformed to return the Mexican State its condition as a promoter of economic development, all of which could be aided with the help of other constitutional articles that could well contribute to the strengthening of neo-interventionism in the post-pandemic stage, under a format of open promotion of systemic competitive advantages of an institutional nature (Bravo, 2022).

Stylized facts of the offshoring process

The economic effects of the offshoring process have been studied from the international perspective as well as from the national and local levels in scenarios that concern industrial production, employment, investments (national and foreign), foreign trade, and taxation; however, their scope has not been related to the phenomena of nearshoring and onshoring, since these are just beginning to be studied precisely because of the economic effects generated by the COVIOD-19 pandemic (World Economic Forum, 2023). The offshoring and outsourcing phenomena have advantages and disadvantages, which are evaluated when companies decide to engage in them (Table 2).

|

Table 2. Advantages and disadvantages of offshoring and outsourcing phenomena |

|

|

Advantages |

Disadvantages |

|

Lower costs by outsourcing different company processes. |

Less control in the execution of processes by delegating part of the work to an external company. |

|

Reduces the workload by outsourcing certain processes to a third party. |

If specialization is not necessary, it may generate unnecessary additional costs. |

|

Allows company projects to be carried out with specialized personnel without the need to invest in their training. |

Requires training and resources for its first implementation. |

|

Allows a better workflow by linking people within the same time zone. |

It may take time for the company's employees to adapt to the nearshoring team. |

Source: Own elaboration.

Thus, in terms of advantages, companies decide to enter because it makes them more productive and competitive and allows them to access international markets. The same applies to the governmental side regarding efficiency and savings in public policy resources. Bauzá (2021) also identifies benefits concerning savings, personnel and tax relief, image improvement, greater leverage, economic development, emergency management, cost clarification, and incentives to improve public productivity.

Likewise, and about the economic disadvantages generated by business relocation processes, there are the effects on the population and the regions that are abandoned when it is decided to move to other latitudes, transferring their productive activities there, in addition to problems related to mobility costs, the quality of manufactured goods, as well as the high turnover of personnel employed in production.

Foreign direct investment and offshoring

One way to quantitatively know the phenomenon of offshoring and its variants is through foreign direct investment (FDI) flows, whose behavior worldwide is monitored by the United Nations Conference on Trade and Development (UNCTAD, 2022), which stipulates that such flow grew by 7% going from 1. 41 trillion dollars (bdd) in 2018 to 1.5 bdd in 2019, falling, on the occasion of the irruption of COVID-19, by 35% in the year of 2020, to grow again in 2021 by 64% in 1.58 bdd thus recovering the levels prior to 2020. However, the projections of this indicator for 2022 foresee a stagnation of this indicator due to the slowdown of the world economy in 2022, extending this scenario to 2023.

The above scenario shows a more complex result during this period in the case of developing economies, to whose regions less than 50% of total world FDI flowed in 2019, falling by 8% in 2020 to 643 billion dollars, a figure much lower than the 58% drop recorded by developed economies and economies in transition; this result transformed the correlation of this indicator since it implied that during this year these nations received two-thirds of world FDI. However, this trend was reversed for 2021 since such flows to developed nations grew by 134% while the growth for developing economies stood at 837,000 million dollars, i.e., a growth of 30%, implying that these regions received only 50% of the world total this time.

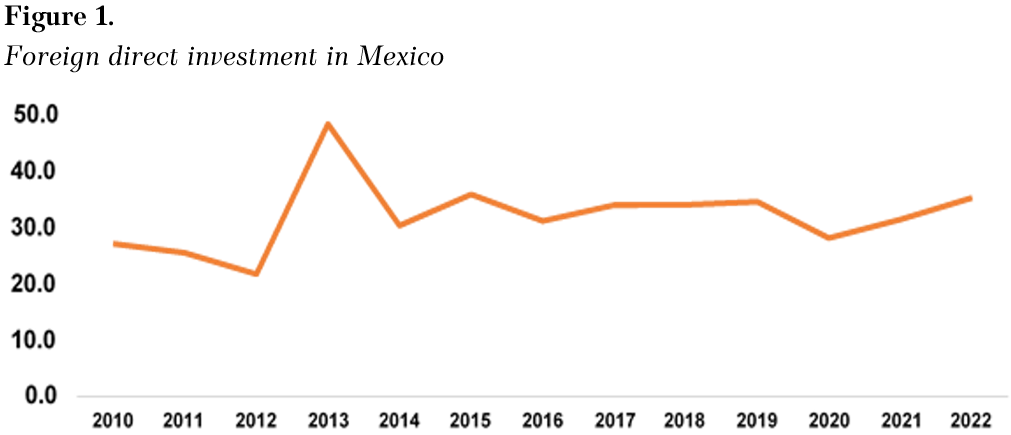

Regarding Latin American countries, UNCTAD reports that in 2018, its member nations received resources for 184,287 million dollars; in 2019, they were 160,721 million dollars. In the year of the 2020 pandemic, these fell to 102,000 million dollars, while in 2021, they rose again to 134,000 million dollars, implying a growth of 56%; of these resources to Mexico corresponded in 2018 a total of 34. One mmdd, in 2019 they were 34.6 mmdd, while in the challenging year of 2020, such resources fell to 28.2 mmdd, growing again in 2021 to 31.5 mdd, growing again in 2022 due to nearshoring effects to 35.3 mm (Figure 1), in addition to the fact that by 2023 these resources are expected to be close to 40 mm.

The process of recovery of FDI in the Mexican economy can be observed from 2020 onwards, but this is merely the result of productive rearrangements to make value chains more efficient since they have been affected by the health problems caused by the pandemic, the confrontation on the European front between Russia and Ukraine and the Asian front between China and Hong Kong, as well as the logistic-inflationary problems derived from the economic recovery based on the transcendent fiscal-monetary impulses of the hegemonic and developing nations (World Bank, 2021).

Note: Figures are expressed in billions of dollars.

Source: Own elaboration based on Secretaría de Economía.

In this sense, nearshoring has specifically benefited the Mexican economy by receiving in recent months increasing volumes of investments as a result of the complex geopolitical and geoeconomic matrix in which developed and emerging nations are currently moving, in such a way that according to the nearshoring potential index it was positioned in 2020 in 15th place out of 40 nations considered, the first place being occupied by Vietnam (Garrido, 2022). The aforementioned has translated for Mexico into investments seeking to relocate from Canada, China, Korea, Japan, and, of course, the United States, which between February 2022 and January 2023 amounted to 19 109 million dollars located in the industrial-manufacturing sector specifically in the automotive sector, driving the growth in demand for industrial parks in the state capitals of Nuevo Leon, which concentrates 50% of this type of investment, Chihuahua, Coahuila, San Luis Potosi, Guanajuato, as well as Mexico City and its metropolitan area.

CONCLUSIONS

The post-pandemic international economic landscape has become more intricate because of the repercussions of the supply and inflation crisis and geopolitical tensions in regions such as the Middle East, Central Europe, and Southeast Asia. Nevertheless, Mexico is emerging as an attractive nearshoring destination. This preference is based on its strategic geographic location, proximity to the United States, the backing of the T-MEC, and effective management of public finances during the COVID-19 pandemic. This trend is reflected in the increase in foreign direct investment (FDI) and the growing demand for industrial parks in the north, Baja, and Mexico City. However, the southern and southeastern regions still need to show this dynamism. This situation could change with the operation of the transisthmian train and the industrial zones planned along its route.

Federal authorities must work closely with state and municipal governments to enhance and maintain the flow of FDI. This synergy should simplify procedures, strengthen host regions' physical and social infrastructure, and improve public safety. Achieving this will not only ensure that the economic benefits outweigh the disadvantages. However, it will also position Mexico on a path of accelerated development, consolidating it as one of the most dynamic and attractive destinations for global investment.

For the sustainable advancement of Mexico's economic development, future research must focus on the detailed examination of domestic and international best practices. By identifying and adapting these successful practices to the Mexican context, a clear and efficient roadmap for strategic implementation can be drawn. This adaptation will not only facilitate the execution of the initiatives but also maximize their positive impact on the country's economic growth.

REFERENCES

Aharon, D., Aziz, M. y Nor, S. (2023). Cross-country study of the linkages between COVID-19, oil prices, and inflation in the G7 countries. Finance Research Letters, 57, 104172. https://doi.org/https://doi.org/10.1016/j.frl.2023.104172

Akinrinade, S. y Ogen, O. (2008). Globalization and de-industrialization: South-South neo-liberalism and the collapse of the Nigerian textile industry. The Global South, 2(2), 159-170. https://doi.org/10.2979/gso.2008.2.2.159

Aljuneidi, T., Bhat, S. y Boulaksil, Y. (2023). A comprehensive systematic review of the literature on the impact of the COVID-19 pandemic on supply chains. Supply Chain Analytics, 3, 100025. https://doi.org/https://doi.org/10.1016/j.sca.2023.100025

Babu, H. y Yadav, S. (2023). A supply chain risk assessment index for small and medium enterprises in post COVID-19 era. Supply Chain Analytics, 3, 100023. https://doi.org/https://doi.org/10.1016/j.sca.2023.100023

Banco Mundial. (2021). Crecimiento en tiempos de crisis https://envivo.bancomundial.org/crecimiento-economico-en-tiempos-de-crisis/

Bauzá, H. (2021). “Outsourcing” y “Offshoring”: Beneficios Y Contras. Revista Empresarial Inter Metro, XV(1), 52-76. http://ceajournal.metro.inter.edu/spring21/bauzahugo1501.pdf

Benavides, S., Parada, A. y Muñoz, J. (2004). El enfoque de competitividad sistémica como estrategia para el mejoramiento del entorno empresarial. Economía y Sociedad, 24, 119–137.

Bravo, E. (2022). Senderos de la recuperación pospandémica: política monetaria, inestabilidad financiera y desarrollo económico. En Estabilizadores pospandémicos y oportunidades de las políticas fiscal y monetaria en México. Ed. IIEc, México.

Bravo, P. y Santos, K. (2017). Propuesta para el diseño de una guía didáctica en la disciplina Bioquímica. Educación Médica, 18(1), 49-55. https://doi.org/https://doi.org/10.1016/j.edumed.2016.06.011

Céspedes, G. y Martínez, J. (2016). Un análisis de la seguridad y salud en el trabajo en el sistema empresarial cubano. Revista Latinoamericana de Derecho Social, 22, 1-46. https://doi.org/https://doi.org/10.1016/j.rlds.2016.03.001

Conferencia de las Naciones Unidas sobre Comercio y Desarrollo – UNCTAD. (2022). Informe sobre el comercio y el desarrollo. ONU: Nueva York.

Esser, K., Hillebrand, W., Messner, D. y Mayer, J. (1996). Systemic Competitiveness: New governance patterns for industrial development. Ed. Frank Cass. Inglaterra.

Fan, D., Lin, Y., Fu, X., Yeung, A. y Shi, X. (2023). Supply chain disruption recovery in the evolving crisis—Evidence from the early COVID-19 outbreak in China. Transportation Research Part E: Logistics and Transportation Review, 176, 103202. https://doi.org/https://doi.org/10.1016/j.tre.2023.103202

Fessel, P. (2023). El archivo como laboratorio: el Fondo Gerardo Gandini de la Biblioteca Nacional de Argentina. Estudios Indiana, 14. https://publications.iai.spk-berlin.de/servlets/MCRFileNodeServlet/iai_derivate_00000164/Estudios-Indiana-14.pdf#page=161

Garrido, C. (2022). México en la fábrica de América del Norte y el nearshoring. Ed. ONU-CEPAL, Chile. https://www.cepal.org/es/publicaciones/48056-mexico-la-fabrica-america-norte-nearshoring

Gómez, R. y Ruiz, P. (2021). Efectos potenciales de los cambios en el T-MEC respecto al TLCAN sobre la economía mexicana. Norteamérica, 16(2), 347-373. https://doi.org/10.22201/cisan.24487228e.2021.2.518

González-Ramírez, M., Santoyo-Cortés, V., Arana-Coronado, J. y Muñoz-Rodríguez, M. (2020). The insertion of Mexico into the global value chain of berries. World Development Perspectives, 20, 100240. https://doi.org/https://doi.org/10.1016/j.wdp.2020.100240

Grigoli, F. y Pugacheva, E. (2023). COVID-19 inflation weights in the UK and Germany. Journal of Macroeconomics, 103543. https://doi.org/https://doi.org/10.1016/j.jmacro.2023.103543

Hessevik, A. (2022). Green shipping networks as drivers of decarbonization in offshore shipping companies. Maritime Transport Research, 3, 100053. https://doi.org/https://doi.org/10.1016/j.martra.2022.100053

Karamemis, G., Zhang, J. y Chen, Y. (2023). Consignment and turnkey sourcing and outsourcing analysis for a three-player supply chain in various power dynamics. European Journal of Operational Research, 311(1), 125-138. https://doi.org/https://doi.org/10.1016/j.ejor.2023.04.035

Kovach, J., Swink, M. y Rodríguez, M. (2023). A novel measure of firm-level production outsourcing. International Journal of Production Economics, 263, 108940. https://doi.org/https://doi.org/10.1016/j.ijpe.2023.108940

Leal, P. y Dabat, A. (2019). La reconfiguración de la relación México-Estados Unidos en el contexto del T-MEC. Economía UNAM, 16(48), 98-120. https://doi.org/10.22201/fe.24488143e.2019.48.491

Leite, D. y Garibaldi, A. (2021). The impact of human factors on pilots’ safety behavior in offshore aviation companies: A brazilian case. Safety Science, 140, 105272. https://doi.org/https://doi.org/10.1016/j.ssci.2021.105272

Lian, J., Xiao, T., Liu, D., Ye, F. y Xiong, D. (2023). The offshore prefabrication and semi-wet towing of a bucket foundation for offshore wind turbines. Ocean Engineering, 285, 115354. https://doi.org/https://doi.org/10.1016/j.oceaneng.2023.115354

Liu, X. y Yu, S. (2022). Anthropogenic metal loads in nearshore sediment along the coast of China mainland interacting with provincial socioeconomics in the period 1980–2020. Science of The Total Environment, 839, 156286. https://doi.org/https://doi.org/10.1016/j.scitotenv.2022.156286

Lovoie, M. y Seccareccia, M. (2022). La economía poskeynesiana, ¿un pensamiento heterodoxo desconocido? Análisis, 15(42), 1-37. www.olafinanciera.unam.mx/newweb/42/pdfs/PDF42/LavoieSeccarecciaOlafinanciera42.pdf

Nascimento, P. y Matheus, J. (2023). Inflation, perception of economic uncertainty and COVID-19: Evidence from Central Bank communication. Central Bank Review, 23(1), 100108. https://doi.org/https://doi.org/10.1016/j.cbrev.2023.100108

Ortega, M. y Segovia, M. (2017). Ventajas del análisis sistémico aplicado a los espacios locales. Cinta de moebio, (58), 13-25. http://dx.doi.org/10.4067/S0717-554X2017000100013

Piguo, A. (2017). La Economía del bienestar. Ed. Aranzadi.

Raimondi, V., Piriu, A., Swinnen, J. y Olper, A. (2023). Impact of global value chains on tariffs and non-tariff measures in agriculture and food. Food Policy, 118, 102469. https://doi.org/https://doi.org/10.1016/j.foodpol.2023.102469

Ricardo, D. (1993). Principios de economía política y tributación. Ed. FCE - Colombia.

Rohit, K. (2023). Global value chains and structural transformation: Evidence from the developing world. Structural Change and Economic Dynamics, 66, 285-299. https://doi.org/https://doi.org/10.1016/j.strueco.2023.05.006

Roumasset, J. y Wada, C. (2013). Economics of Groundwater. In J. F. Shogren (Ed.), Encyclopedia of Energy, Natural Resource, and Environmental Economics (pp. 10-21). Elsevier. https://doi.org/https://doi.org/10.1016/B978-0-12-375067-9.00157-1

Sánchez, Y., Pérez, J., Sangroni, N., Cruz, C. y Medina, Y. (2021). Retos actuales de la logística y la cadena de suministro. Ingeniería Industrial, XLII (1), 1-12. https://rii.cujae.edu.cu/index.php/revistaind/article/download/1079/992

Secretaría de Economía. (2020). Inversión en México y sus aliados comerciales. https://www.gob.mx/se/prensa/revisado/09/02/2023

Smith, A. (2015). Investigación sobre la naturaleza y causas de la riqueza de las naciones. Ed. FCE - México.

Wang, C., Yang, C. y Zhang, T. (2023). Order planning with an outsourcing strategy for a make-to-order/make-to-stock production system using particle swarm optimization with a self-adaptive genetic operator. Computers & Industrial Engineering, 182, 109420. https://doi.org/https://doi.org/10.1016/j.cie.2023.109420

World Economic Forum. (2023). Nearshoring: la solución actual para el comercio exterior. https://www.thomsonreutersmexico.com/es-mx/soluciones-de-comercio-exterior/blog-comercio-exterior/nearshoring-la-solucion-actual-para-el-comercio-exteior/

Xie, H., Lyu, J., Bao, Y., Yu, Y., Li, Y., Zheng, X. y He, X. (2023). Spatial and temporal variation of nearshore significant wave height in the Three Gorges Reservoir, China. Ecological Indicators, 151, 110343. https://doi.org/https://doi.org/10.1016/j.ecolind.2023.110343

Zhang, X., Qi, M., Chen, L., Wu, T., Zhang, W., Wang, X. y Tong, Y. (2020). Recent change in nutrient discharge from municipal wastewater in China's coastal cities and implication for nutrient balance in the nearshore waters. Estuarine, Coastal and Shelf Science, 242, 106856. https://doi.org/https://doi.org/10.1016/j.ecss.2020.106856

FINANCING

No external financing.

CONFLICT OF INTEREST STATEMENT

None.

ACKNOWLEDGMENTS

None.

AUTHORSHIP CONTRIBUTION

Conceptualization: Alejandra Fernández Hernández, Ernesto Bravo Benítez.

Formal analysis: Alejandra Fernández Hernández, Ernesto Bravo Benítez.

Research: Alejandra Fernández Hernández, Ernesto Bravo Benítez.

Methodology: Alejandra Fernández Hernández, Ernesto Bravo Benítez.

Writing - original draft: Alejandra Fernández Hernández, Ernesto Bravo Benítez.

Writing - revision and editing: Alejandra Fernández Hernández, Ernesto Bravo Benítez.